Thank you, that makes senseThat is not the correct timing. Cost of Goods Sold (COGS) travels with the vehicle and does not get recognized until the sale.

So it goes from inventory (tracking item) in Q4 to revenue (income) & COGS (expense) in Q1.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

One more question for you, how do capital expenditures and R&D affect earnings. So surely if I buy a stamping press in Q1 the full amount of that purchase doesn’t count against Q1 earnings right?That is not the correct timing. Cost of Goods Sold (COGS) travels with the vehicle and does not get recognized until the sale.

So it goes from inventory (tracking item) in Q4 to revenue (income) & COGS (expense) in Q1.

At Tesla, R&D is expensed in the quarter it occurs. Capital Equipment (CapEx) can be more nuanced, so I'll leave that to @The AccountantOne more question for you, how do capital expenditures and R&D affect earnings. So surely if I buy a stamping press in Q1 the full amount of that purchase doesn’t count against Q1 earnings right?

The Difference Between an Operating Expense vs. a Capital Expense

J

jbcarioca

Guest

All of us should remember that US GAAP, IFRS (EU plus most countries) and a number of country-specific tax policies make generalizations about GAAP fraught. @The Accountant generally deals with US GAAP. These discrepancies and a large number of really arcane rules about things like capitalization, depreciation, income recognition and, for example, quite bizarre rules on lease accounting for specific industries make areas like fringe benefit treatment (e.g. options vesting) subject to major variations.

Further, Tesla now has most capex associated with new factory and product launch in China and Germany, as well as launch of business in diverse business rules everywhere from Israel to Romania. Many countries have specific rules for imports, power distribution and energy products the Tesla accounting is growing ever more complex.

That does not mean that people like @The Accountant cannot do productive and useful forecasting. He, and others, prove their value every quarter. However, they and most analysts deal mostly with non-GAAP, where the specific policies tend to be quite well documented in admittedly tiny and often-cryptic footnotes. Non-GAAP helps understand the business philosophy as well in ways GAAP cannot.

While spending almost my entire business career in international business I strongly believe that the details of a capital-intensive business sometimes cannot be perfectly reconciled to any specific GAAP. That may be thought heretical. I offer just one category as proof of the reconciliation issue, capital investment accounting. A Chinese real property lease, a German one and a US one are in three entirely different accounting and legal systems. The financing arrangements themselves, including incentives and done in incompatible legal and accounting structures. The notion of recourse, for example, differs in each of the three. Yet another quite arcane (one of my favorite words to describe international business rules) area is the performance rules underlying many of these agreements from Fremont, Buffalo, Shanghai, and Berlin to Panasonic, IDRA, CATL and hundreds of others.

All those issues we mostly ignore, usually with the singular exception of emissions credits. Even that one is fraught because the detailed agreements and not disclosed so we are forced to guess.

In sum, dealing with non-GAAP tends to simplify all those issues. That allows our talented forecasters to make broad generalizations based on disclosures. That can be and will be errors in applying accounting rules, but mostly they will not be material from the perspective of long-term investors.

For active traders understanding how these generalizations may fail can give opportunity to trade on discrepancies. That is an entirely different story, primarily ignoring reality in order to trade on differences that can be described as misrepresentations or outright lies.

Further, Tesla now has most capex associated with new factory and product launch in China and Germany, as well as launch of business in diverse business rules everywhere from Israel to Romania. Many countries have specific rules for imports, power distribution and energy products the Tesla accounting is growing ever more complex.

That does not mean that people like @The Accountant cannot do productive and useful forecasting. He, and others, prove their value every quarter. However, they and most analysts deal mostly with non-GAAP, where the specific policies tend to be quite well documented in admittedly tiny and often-cryptic footnotes. Non-GAAP helps understand the business philosophy as well in ways GAAP cannot.

While spending almost my entire business career in international business I strongly believe that the details of a capital-intensive business sometimes cannot be perfectly reconciled to any specific GAAP. That may be thought heretical. I offer just one category as proof of the reconciliation issue, capital investment accounting. A Chinese real property lease, a German one and a US one are in three entirely different accounting and legal systems. The financing arrangements themselves, including incentives and done in incompatible legal and accounting structures. The notion of recourse, for example, differs in each of the three. Yet another quite arcane (one of my favorite words to describe international business rules) area is the performance rules underlying many of these agreements from Fremont, Buffalo, Shanghai, and Berlin to Panasonic, IDRA, CATL and hundreds of others.

All those issues we mostly ignore, usually with the singular exception of emissions credits. Even that one is fraught because the detailed agreements and not disclosed so we are forced to guess.

In sum, dealing with non-GAAP tends to simplify all those issues. That allows our talented forecasters to make broad generalizations based on disclosures. That can be and will be errors in applying accounting rules, but mostly they will not be material from the perspective of long-term investors.

For active traders understanding how these generalizations may fail can give opportunity to trade on discrepancies. That is an entirely different story, primarily ignoring reality in order to trade on differences that can be described as misrepresentations or outright lies.

The Accountant

Active Member

That's not how the accountig works. The 4,500 more cars delivered in Q1 than produced also had their cost included in Q1.Last quarter was a profit of $438 million. But there were 4500 more cars delivered than built so that was basically 4500 cars that all the expenses were paid in Q4 2020 but all the revenue/profit was booked to Q1.

When these cars were produced in Q4, the cost was held in Inventory (on the balance sheet) and did not get expensed to earnings. When these cars were sold in Q1, the cost moved from Inventory (on the balance sheet) to cost of goods sold (COGS) to the income statement. This follows the Matching Principle of accounting.....that is costs should match the revenues that they relate to.

In Q2 the oppsoite happened. Telsa produced more cars than it delivered. The production cars not delivered are on the Balance Sheet as Inventory and will be released to the income statment in Q3 when they are sold.

Edit: I see that @mongo and others addressed this already.

Last edited:

Yep that makes sense thank you for the info!That's not how the accountig works. The 4,500 more cars delivered in Q1 than produced also had their cost included in Q1.

When these cars were produced in Q4, the cost was held in Inventory (on the balance sheet) and did not get expensed to earnings. When these cars were sold in Q1, the cost moved fro Inventory (on the balance sheet) to cost of goods sold (COGS) to the income statement. This is follows the Matching Principle of accounting.....that is costs shouls match the revenues that they related to.

In Q2 the oppsoite happened. Telsa produced more cars than it delivered. The production cars not delivered are on the Balance Sheet as Inventory and will be released to the income statment in Q3 when they are sold.

Edit: I see that @mongo and others addressed this already.

The Accountant

Active Member

@Radish11At Tesla, R&D is expensed in the quarter it occurs. Capital Equipment (CapEx) can be more nuanced, so I'll leave that to @The Accountant

The Difference Between an Operating Expense vs. a Capital Expense

Yes - something like a Stamping Press goes to the Balance Sheet at Fixed Assets and gets expensed (depreciated) over something like 10 years. So 10% of the cost per year or 2.5% per Qtr. I say 10 years - it needs to be depreciated over its "useful life" - not sure if that is 10 years, 15 years?

Can you elaborate on that a bit? Trying to understand all the accounting rules. (Some like the bitcoin impairment rules make no sense)

Echoing an earlier comment that cars that are unfinished or in inventory do not impact earnings. The costs associated to those vehicles form part of Balance Sheet inventory. In other words, they don’t pass through Income Statement accounts (Cost of Goods Sold) until they are actually sold. The costs associated to these inventory or unfinished items do impact cash flow though. They costs are after all incurred and paid, they just aren’t impacting net income until sale (or writing off of obsolete inventory).

They generally form part of depreciation which may find their way either in R&D (if the asset is part of RD activities) or as part of Costs of Goods Sold (the asset is depreciated against each unit produced from the line(s) that use the asset). So you’re correct that the total cost of a new stamping won’t all hit earnings in a period. The cost is instead spread out over the useful life of the asset, and may be recognized across various accounts depending on the nature of the asset (could be anywhere from R&D, to COGS, to Selling & General & Administrative expenses for more generic assets like buildings).One more question for you, how do capital expenditures and R&D affect earnings. So surely if I buy a stamping press in Q1 the full amount of that purchase doesn’t count against Q1 earnings right?

The Accountant

Active Member

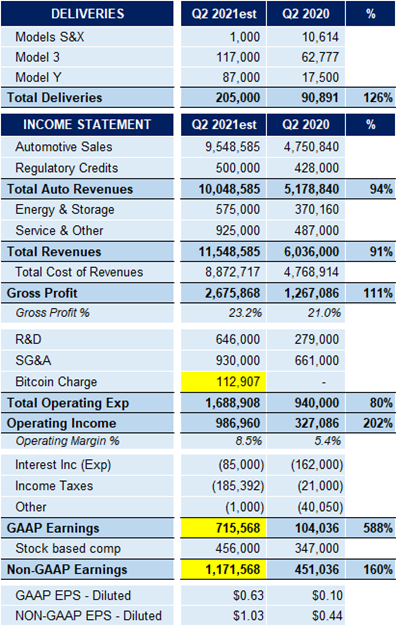

For those interested, I attempted to recontruct Tesla's Bitcoin purchase, sale and impairments in this post:

teslamotorsclub.com

teslamotorsclub.com

Bitcoin - Potential Q2 2021 Impact

Here is my estimate for the Bitcoin Impairment Charge for Q2 2021: Q2 Earnings Outlook with this Impairment:

J

jbcarioca

Guest

@ The Accountant and others regularly discuss what I regard as the single most important accounting rule Tesla employs.

That is the rule governing income recognition on sale of a vehicle. Tesla is alone among automakers, I believe :

"We recognize revenue on automotive sales upon delivery to the customer, which is when the control of a vehicle transfers. Payments are typically received at the point control transfers or in accordance with payment terms customary to the business." Tesla 2020 10K

Contrast this with GM:

"We present both wholesale and total vehicle sales data to assist in the analysis of our revenue and our market share. Wholesale vehicle sales data consists of sales to GM's dealers and distributors as well as sales to the U.S. Government and excludes vehicles sold by our joint ventures. Wholesale vehicle sales data correlates to our revenue recognized from the sale of vehicles, which is the largest component of Automotive net sales and revenue." General Motors 10K 2020

Thus Tesla cannot and does not record sale of surplus vehicles to dealers. GM can and does do that.

A related convention is reporting of inventory "days on hand". While the global practice does vary somewhat, the general convention is that a 60 day inventory on hand is optimal. Due to the typical OEM wholesale practices the manufacturer tends to have cash flow delayed until the vehicle is sold by a dealer. The typical "floor plan" structures vary widely so OEM's can be paid prior to dealer sale when the floor plan is not offered by the OEM. Even when that si the case the OEM tends to be paid at least 30 days after the wholesale revenue has been recognized.

What does that mean? Tesla averages less than two weeks inventory days on hand. When they recognize a sale Tesla has cash. When the typical OEM recognizes a sale they wait at least 30 days to receive cash, usually more.

Tesla not has typical payment terms from suppliers of net 90, net 60 in a few cases.

So, Tesla generates more cash flow as growth advances. Higher growth yields higher cash flow to Tesla, and Tesla alone.

Virtually all other OEM's burn more cash as they grow faster because their business cycle is much longer than is Tesla's.

Thus far the Tesla advantage is only in recognition of sale. Since their sales are direct the conventional wisdom suggest stay would ahem higher inventory and slower cash flow, but that is not so.

Therefore we must also observe another major Tesla advantage, high vertical integration. Not since the original Ford River Rouge plant has a auto OEM had such high vertical integration.

Tesla has a very rapid conversion cycle from raw material to completed vehicle due to an industry leading manufacturing efficiency. They thus are buying raw materials and rapidly converting those to finished goods. They also how small inventories of supplied parts, which do have those long payment cycles.

Because they go from parts and material to a finished vehicle in a cycle of< I am informed, roughly 14 days. On average Tesla delivers completed vehicles, on average, in about 21 days. For the majority of sales it seems they are actually faster than these times.

When we use these conservative numbers we find that Tesla generates cash of an extra 26 days as they grow, and that is using net-60 payment terms.

Elon and others have from time to time said they now must pay suppliers after Tesla has already been paid. The simple example here shows how that happens.

Finally, this also shows why Tesla is anxious to begin producing where the cars are to be sold. People used to think that is mostly about reducing shipping costs, which in part it is. The biggest benefit, though, is in improving cash flow. When shipping vehicles from Fremont and Shanghai to Europe or even distant parts of Noth America or China the shipping times alone eradicate most or all the cash flow advantage, plus the direct shipping costs and or tax costs.

When considering tax issues Tesla built Tilburg. When Tesla builds a factory in Mexico they'll have both NAFTA and Mercosur access duty free. When a 'Model 2' appears the scale economies in Mexico plus cheap shipping will allow them access to the worlds' sixth largest vehicle market without too much bureaucracy. The cash flow consequences will become positive there also because of rapid conversion cycles.

Of course we all know there are FSD subscriptions and paid Supercharger access as well as opening Supercharger access to other brands. All of that will have very positive cash flow consequences also. Further, even if priced favorably to consumers the net Sup[erchargers will defray system costs and potentially generate profits. For context please note that Tesla is already licensed as a power provider in the EU and UK.

Very soon I am confident that our forecasting mavens will begin modeling these factors.

That is the rule governing income recognition on sale of a vehicle. Tesla is alone among automakers, I believe :

"We recognize revenue on automotive sales upon delivery to the customer, which is when the control of a vehicle transfers. Payments are typically received at the point control transfers or in accordance with payment terms customary to the business." Tesla 2020 10K

Contrast this with GM:

"We present both wholesale and total vehicle sales data to assist in the analysis of our revenue and our market share. Wholesale vehicle sales data consists of sales to GM's dealers and distributors as well as sales to the U.S. Government and excludes vehicles sold by our joint ventures. Wholesale vehicle sales data correlates to our revenue recognized from the sale of vehicles, which is the largest component of Automotive net sales and revenue." General Motors 10K 2020

Thus Tesla cannot and does not record sale of surplus vehicles to dealers. GM can and does do that.

A related convention is reporting of inventory "days on hand". While the global practice does vary somewhat, the general convention is that a 60 day inventory on hand is optimal. Due to the typical OEM wholesale practices the manufacturer tends to have cash flow delayed until the vehicle is sold by a dealer. The typical "floor plan" structures vary widely so OEM's can be paid prior to dealer sale when the floor plan is not offered by the OEM. Even when that si the case the OEM tends to be paid at least 30 days after the wholesale revenue has been recognized.

What does that mean? Tesla averages less than two weeks inventory days on hand. When they recognize a sale Tesla has cash. When the typical OEM recognizes a sale they wait at least 30 days to receive cash, usually more.

Tesla not has typical payment terms from suppliers of net 90, net 60 in a few cases.

So, Tesla generates more cash flow as growth advances. Higher growth yields higher cash flow to Tesla, and Tesla alone.

Virtually all other OEM's burn more cash as they grow faster because their business cycle is much longer than is Tesla's.

Thus far the Tesla advantage is only in recognition of sale. Since their sales are direct the conventional wisdom suggest stay would ahem higher inventory and slower cash flow, but that is not so.

Therefore we must also observe another major Tesla advantage, high vertical integration. Not since the original Ford River Rouge plant has a auto OEM had such high vertical integration.

Tesla has a very rapid conversion cycle from raw material to completed vehicle due to an industry leading manufacturing efficiency. They thus are buying raw materials and rapidly converting those to finished goods. They also how small inventories of supplied parts, which do have those long payment cycles.

Because they go from parts and material to a finished vehicle in a cycle of< I am informed, roughly 14 days. On average Tesla delivers completed vehicles, on average, in about 21 days. For the majority of sales it seems they are actually faster than these times.

When we use these conservative numbers we find that Tesla generates cash of an extra 26 days as they grow, and that is using net-60 payment terms.

Elon and others have from time to time said they now must pay suppliers after Tesla has already been paid. The simple example here shows how that happens.

Finally, this also shows why Tesla is anxious to begin producing where the cars are to be sold. People used to think that is mostly about reducing shipping costs, which in part it is. The biggest benefit, though, is in improving cash flow. When shipping vehicles from Fremont and Shanghai to Europe or even distant parts of Noth America or China the shipping times alone eradicate most or all the cash flow advantage, plus the direct shipping costs and or tax costs.

When considering tax issues Tesla built Tilburg. When Tesla builds a factory in Mexico they'll have both NAFTA and Mercosur access duty free. When a 'Model 2' appears the scale economies in Mexico plus cheap shipping will allow them access to the worlds' sixth largest vehicle market without too much bureaucracy. The cash flow consequences will become positive there also because of rapid conversion cycles.

Of course we all know there are FSD subscriptions and paid Supercharger access as well as opening Supercharger access to other brands. All of that will have very positive cash flow consequences also. Further, even if priced favorably to consumers the net Sup[erchargers will defray system costs and potentially generate profits. For context please note that Tesla is already licensed as a power provider in the EU and UK.

Very soon I am confident that our forecasting mavens will begin modeling these factors.

Moreover, Neroden is on the spectrum, like Elon is; he got absolutely fixated on the service issues that he could not see the bigger picture. He thought that it could be the downfall of Tesla. He said many times he was very conservative in his investiments because he needed the many for his many heatlh issues... His obsession to tiny details got him to live off investments and managing millions of dollars. So, yes, he was wrong to sell when he did, but he got also in 2012-2013, and had many other assets. You win some, you lose some. He was absolutely right in timing for FSD, and had the best analysis for the Solarcity deal. He probably still has more money and skills than most here (not all- most). I for one am just a lucky bastard with no clue whatsoever.True but for him it was an issue of principles and integrity not money. He didn't like certain aspects of the company and lost faith in management so he got out. Also we don't know what he did with the proceeds, maybe he went all in Dogecoin

The Accountant

Active Member

Why not Brazil for Latin American sales?When Tesla builds a factory in Mexico

G

goinfraftw

Guest

This is known as a buying opportunity

J

jbcarioca

Guest

We do not know about the GigaPresses but the typical IDRA press today has had about a thirty year useful life. I suspect the GigaPresses will ahem similar lifespans but will have higher maintenance costs. I have no idea about the materials preparation equipment. From recent issues of Global Casting magazine I have gained the impression that the most expensive parts are the most durable ones, thus implying an expected lifetime of decades. However the transfer processes and process control are evolving very rapidly and are likely to be continuously refined.@Radish11

Yes - something like a Stamping Press goes to the Balance Sheet at Fixed Assets and gets expensed (depreciated) over something like 10 years. So 10% of the cost per year or 2.5% per Qtr. I say 10 years - it needs to be depreciated over its "useful life" - not sure if that is 10 years, 15 years?

Global Casting Magazine Issue 4, 2020

Read Global Casting Magazine Issue 4, 2020 by Modern Casting on Issuu and browse thousands of other publications on our platform. Start here!

These are all material costs, even though the final result is very likely to be much, much cheaper, higher quality and higher precision with corresponding major reductions in assembly line complexity. Something on the order of minimum of 39 robots per line should be eliminated, perhaps more.

Thus far we have no disclosed costs for and part of the equipment. Considering what they represent it seems important to understand these much, much better.

If my information is correct it seems probable that total vehicle production costs could drop by 10% or more once these Presses and ancillary processes are made to be reliable. Since novel aluminum alloys are required, novel transport form furnace to press is required and novel die structure and lubricant are also required nothing about this is trivial nor easily replicated.

G

goinfraftw

Guest

This is known as a buying opportunity

The curiosity, for me, is what caused the start of the drop after 1/26...

When you have billions in trade on stock like Tesla, cost of doing business(130K car) is nothing, when firm owns combination of stocks and option, especially on option expiry date motive could be several, you are long term bullish on stock but option you wrote against your stock or in-money call, you want stock to do nothing on expiry day(mission accomplish), they could have written lot of put and they wanted to stock to do nothing(mission accomplish), there is so many possibility when options Call/Put buying/selling comes into play.

J

jbcarioca

Guest

Good question. Brazil has three major problems: lack of skilled workforce, giant bureaucracy and very high taxes. On the other hand we do have a huge market. Since Mexico has a free trade agreement with Mercosur traditional Brazil-centric OEMs like VAG, Fiat Chrysler (excluding the rest f Stellantis) and GM have all been importing Mexican-built models.Why not Brazil for Latin American sales?

Mexico thus far is a much better solution. However, even the infamous Bolsonaro is lusting after Tesla as are quite a wide array of influential people. Raw materials are plentiful including the world's third largest nickel reserves. If negotiating magic can work, the potential is enormous.

Among the first problems are to negotiate major changes in the way BEV's are taxed and to obtain rights to operate Supercharger network as a utility.

All the other problems, including workforce, can be solved. They'll only need to co-locate with the well-developed aircraft industry.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K