Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

I think my eyes will be qqq. Retest 400 this am then strong bounce. This might mean MmD for Tesla and then end up green.Obviously TSLA is poised for big moves come P and D and earnings, but let us not forget everyone already knew the Elon was almost done selling, and that the final announcement begs for a 'sell the news' phenomenon. I am not predicting any real decline, but I would be equally surprised to see a huge move up before confirmation of Tesla's 'yet another record' quarter.

Krugerrand

Meow

Weren’t you?!You were up at 4am?

That was my last tranche, I'm calling this done! Where do I get the Form 4s?

Sure as Sugar, someone's gonna say, "but you can get one more!"

StarFoxisDown!

Well-Known Member

Seems like MM’s finally drew a line in the sand. Quite bold (or arrogant) to think they can hold it just under 1100 with Q4 coming up Monday but maybe they’ll get lucky and the FOMO won’t be that strong

EVDRVN

Active Member

Heard that before

But if your advisor is any good then they should have been recommending leaning heavy into TSLA, no? Anyone can suggest you diversify to spread risk but when there's a smoking rocket on the launch pad is that the right advice?I agree with you that financial planners et. al. prioritize their interests above yours. But I don't think it follows that the all-in approach is universally better. In retrospect, of course that approach has worked best for us TSLA investors - hindsight's always 20/20. But I don't think it's wrong to consider that any force majeure event could, for example, take Elon out of the picture, would impact those all-in people more than those who weren't. How about we agree not to fault those who choose a different risk profile by diversifying.

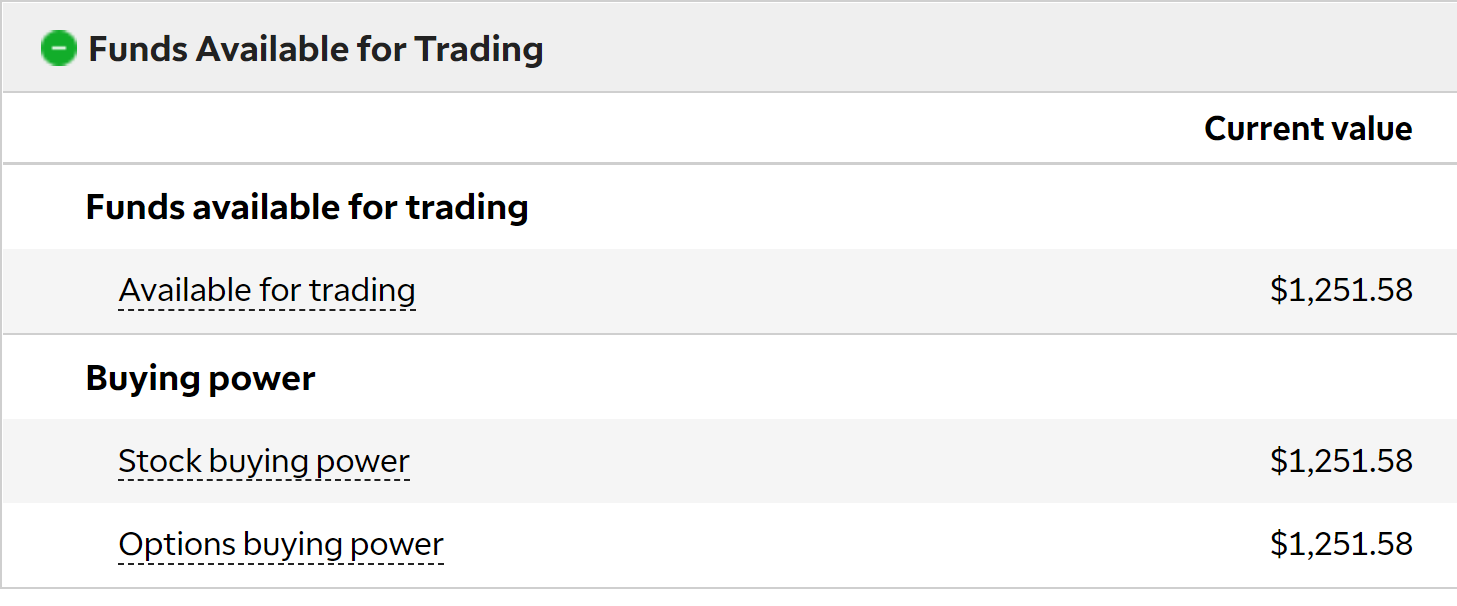

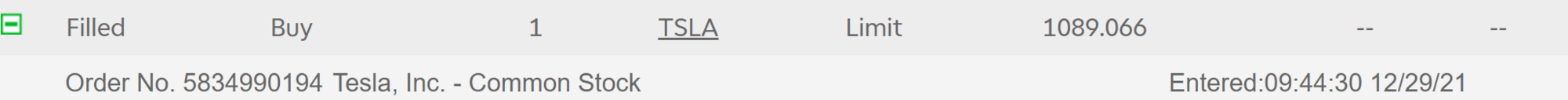

It's official. I'm all in!!!

I just couldn't resist such a good price for the best, most diversified stock in the world! The price does not matter, the future matters.

Cheers!

I just couldn't resist such a good price for the best, most diversified stock in the world! The price does not matter, the future matters.

Cheers!

It's official. I'm all in!!!

I just couldn't resist such a good price for the best, most diversified stock in the world! The price does not matter, the future matters.

Cheers!

View attachment 749512

Yawn

StealthP3D

Well-Known Member

All futures except for Dow in the red.

TSLA a big fat green.

I can virtually see you all smiling with an "I told you so" in your eyes.

Restraining yourselves to no let it come out of your mouth.

Congrats everybody here, even if it's just premarket.

This will work out just fine.

I recommend avoiding the temptation to let the share price dictate how you feel about your investments. While it's true that only the share price can tell you what you could sell your investment for right now, that is only significant if you want to sell your investment right now.

Share prices are spastic and not good indicators of much of anything except for what they are - the current price someone will pay you for your shares. Share prices are best looked at dispassionately and as a point of minor curiosity, not as an important metric of how your long-term investments are performing. Look towards the company's performance for that. The time to start paying attention to the share price is if you think it's fully valued, the company has run out of steam and it's time to exit. I hope I don't see signs like that for many years!

so we bounce from here then, yea?I think my eyes will be qqq. Retest 400 this am then strong bounce. This might mean MmD for Tesla and then end up green.

edit: well QQQ didn't actually hit 400 yet, so..

J

jbcarioca

Guest

Long ago a few colleagues and I were having barroom bets. Two of us were induced to take the test. One of us had securities knowledge from an operations perspective, but zero about sales knowledge. The other had gone to graduate school with us but had exactly zero securities background. They both studied for a single day. They both had passes the first time.You only need a 70% to pass and get your Series 7, and the average a few years ago was that it was taken 3 times with a passing grade in the 70s.

None of us has ever paid any attention at all to opinions of salespeople in the securities world.

Offhand it seems we've all done well finncially.

Last edited by a moderator:

MTL_HABS1909

Active Member

Can we ask Elon to start selling again?

StealthP3D

Well-Known Member

It's official. I'm all in!!!

I just couldn't resist such a good price for the best, most diversified stock in the world! The price does not matter, the future matters.

Cheers!

View attachment 749512

All I can say is I'm glad you don't have a margin account!

This is not my idea of a bounce... just sayin'...so we bounce from here then, yea?

edit: well QQQ didn't actually hit 400 yet, so..

Featsbeyond50

Active Member

Are you sure? Do you still have a house?It's official. I'm all in!!!

I just couldn't resist such a good price for the best, most diversified stock in the world! The price does not matter, the future matters.

Cheers!

View attachment 749512

Somebody broke the trampoline.This is not my idea of a bounce... just sayin'...

Imagine if I did.All I can say is I'm glad you don't have a margin account!

Very confident in Q4 numbers. Darn near all in at this point. Added a couple March 22 $1100s and a few shares. Some more cash will settle by the 31st but hopefully I don't feel tempted to buy more dips.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M