So my crystal ball misjudged the enthusiasm a bit. Tough crowd. I heard it's made at Fremont under a tent so it may not be perfectly round and may come with some panel gaps...This is not my idea of a bounce... just sayin'...

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

I have margin and am well into it, at least for another week.Imagine if I did.

For anyone considering portfolio margin, here's what I've noticed since using it.

1. For my portfolio, available margin drops slightly less than 2% for each 1% drop in the SP. My portfolio is roughly 40% more volatile than TSLA, so that makes sense because pm tests my portfolio against -/+15% SP.

2. Ditm spreads use very little margin because their value doesn't change much when SP changes.

3. As expected, speculative calls and spreads have an oversized impact on margin.

All in all, I can't complain because it offers over 2x more borrowing power for my mix. I wish I had more experience with it before the dip, but better late than never.

Nolimits

Member

If there is a will there is a way….

Snagged the dip today too.

Think q4 will be spectacular. Lots of members here posting their “3rd-5th teslas”. Lots of repeat customers.

And Tesla China analyst guy (forgot his exact handle) did post something in twitter to look for a surprise this Friday. Could be nothing but probably something..

Lex Friedmans interview was spectacular too. Got me feeling bullish. Even more than the TP post from the service center.. lol.

Played the margin game again today too and bought some more at $1069.Decided to play the margin game today, after buying some real shares yesterday, bought some margin shares today. Hoping Musk causes one last dip tomorrow so i can buy a little more.

I have to admit, I'm one of the worst for timing the TSLA market. Even called the "contrarian investor" by some. And yet I still managed to make some good coin on TSLA trades because I made it a practice not to sell unless I match it with an older buy that's lower (or I leaned in further like today). This resulted in a very long blackout for me as it dropped from 1200. This strategy has worked for me anyway, each to his/her own. The fact that I can't buy anymore might be a good thing - there's literally no way to screw it up now.

I have very high confidence January will deliver, and green today would not surprise anyone here. TSLA is down a whopping 0.87%. That's the noise level because many are literally afraid of Tesla. I'm not under any illusion that many want it to crash it hard or slow it way down - this disruption is not over. But the motivation to clean up this planet is strong and growing fast. If I'm wrong on this, we all lose out... big time.

So we had our fun with the pokes and laughs, I'm laughing with many of you here, and I don't think anyone is laughing AT me in this room. But if you do, maybe take a look at your own side of the street, cuz mine's pretty clean right now with zero regrets.

Cheers!

I have very high confidence January will deliver, and green today would not surprise anyone here. TSLA is down a whopping 0.87%. That's the noise level because many are literally afraid of Tesla. I'm not under any illusion that many want it to crash it hard or slow it way down - this disruption is not over. But the motivation to clean up this planet is strong and growing fast. If I'm wrong on this, we all lose out... big time.

So we had our fun with the pokes and laughs, I'm laughing with many of you here, and I don't think anyone is laughing AT me in this room. But if you do, maybe take a look at your own side of the street, cuz mine's pretty clean right now with zero regrets.

Cheers!

Phobi

Member

You were up at 4am?

I’m taking full advantage of my holiday break…and pay

Congrats to those that caught the dip this morning!

The day is young.

Yup had mine yesterday and completely blew my mind. Didn't touch the accelerator at all. Had 3 unprotected left with traffic, one being a blinking yellow.Beta 10.8 is pretty solid. I'm having my first intervention free trips now, which is a strange feeling. The one thing I don't like is that now it tries to swing really wide on turns which makes you feel like it's going to do something stupid (it still does stupid things at times). Still playing with it.

I am a little scared of V11. Based on what Elon saying about retraining it may just be a regression but will be better much faster than v10. Don't want to lose 10.8 here..lol.

jeewee3000

Active Member

Might be true, but many more are long Tesla IMO.That's the noise level because many are literally afraid of Tesla.

I received a "2021 recap" newsletter from my Broker a few days ago, containing a list of the most traded stocks on their platform.

Number 1 on the list was - of course - TSLA.

A quick Google search tells me this is true in many countries, including the US.

This tells me many (retail) investors want to be part of the growth story, either for a quick buck or for a longer period of time. TMC members are no longer outliers in that regard.

So yes, some prudent investors might still shy away from Tesla until they have proven to produce millions of cars a year at a healthy profit and FSD is fully functional, but many more are not afraid at all. I don't know if this is bullish or bearish, it's just an observation. It used to be quite different.

I don't .. and i still have a grudge for buying my M3 in cash at the beginning of 2020 instead of financing ... -.-Are you sure? Do you still have a house?

Artful Dodger

"Neko no me"

RI-CO-LA!

www.teslarati.com

www.teslarati.com

Pigs fly at Eleven.

Elon Musk turns CNBC host into a full-on "fanboy:" “If loving him is wrong, I don’t want to be right.”

To state that Elon Musk has critics is an understatement. A look at the online backlash from his sale of Tesla stock and his impending $11 billion tax bill for 2021 would prove it. Due to his personality and style, Musk also tends to rub off mainstream media personalities negatively, as...

Pigs fly at Eleven.

TSLA Pilot

Active Member

May I make a suggestion?Most of us who have been around a while do diversify. That has nothing to do with dealing with the licensed community, [in the US, CFA, FCA, Series 3, 6, 7 or RIA]. Nothing much about any of those licenses actually has anything to do with sound judgement. Anybody who's a decent test-taker can endure most or all of those two and three hours exams and pass them all. They are no more rigorous than a typical standardized test for anything else. Memorization and endurance are the critical skills. Just as a hedge fund typically does not hedge, these people do not typically understand what diversification is.

Diversification only succeeds with assiduous attention to high quality.

TSLA, for example, has enough risks to richly deserve the exceedingly focussed attention to risks that happens in this Forum and a few other places. Bizarrely, FUD also tends to be very precise, just not very accurate. Diversification demands precise and accurate analysis.

Personally I would never put my net worth in a single asset. I try to keep it to only assets I know and understand well enough to know when to sell.

I also try hard to minimize transaction costs. If transaction costs are high, you can be assured that you'll lose sometime.

SMR's YT video on diversification is WELL worth your time to watch . . .

Had I known the content of the video years ago I'd likely have another seven-figures worth of TSLA . . . BUT I foolishly bought the BS of diversification hook, line, and sinker. It kept me in some remarkably poor stocks for far, far too long and the opportunity cost of NOT investing TSLA has been huge.

Let this be a lesson for all investors.

If you would like a bit of schadenfreude, enjoy Gordon being utterly roasted on CNBC. "what is Gordon smoking" and "perhaps you shouldn't be valuing companies at all?"

Late response, I had to check my security cams... yup it's still there along with 3 couches (not including our LOVE seat). So there's some backup anyway.Are you sure? Do you still have a house?

Actually, I haven't heard much about couch harvesting in a while. I suspect they were all cleaned out earlier in the quarter?

I bought both of mine with cash and regret nothing. Financing a car isn't always the best way, especially if like me you might want to modify it in the future. I also just worked out what they cost me as a % of my current TSLA holding and I'm even less bothered now.I don't .. and i still have a grudge for buying my M3 in cash at the beginning of 2020 instead of financing ... -.-

My Model 3s are assets which have been depreciating remarkably slowly. If they were a pile of cash I'd buy more chairs immediately, but I like having some assets I can call my own.

StealthP3D

Well-Known Member

Late response, I had to check my security cams... yup it's still there along with 3 couches (not including our LOVE seat). So there's some backup anyway.

Actually, I haven't heard much about couch harvesting in a while. I suspect they were all cleaned out earlier in the quarter?

I suspect, with COVID, the couches are not getting as many deposits as usual.

mars_or_bust

Member

In Germany, it is hard to differentiate incompetence from corruption....

Today's volume was about 11M several hours ago, and only 12.5M now which is still light. Possibly a last ditch effort by MMs this morning first thing, (or maybe some sell the news). No more shares to short, their couches are also empty - I love it! Quiet before the storm I say, then some FOMO sets in.

All we need now is some sort of surprise news... they have no defense. (But I could be wrong, lol).

All we need now is some sort of surprise news... they have no defense. (But I could be wrong, lol).

petit_bateau

Active Member

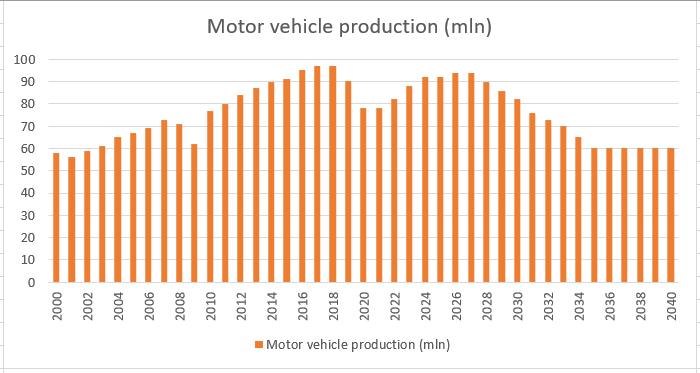

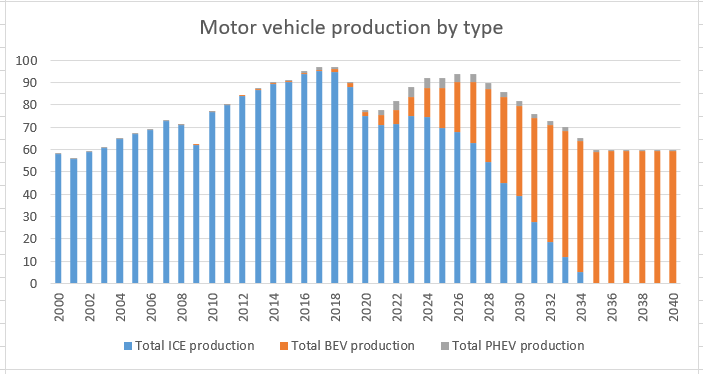

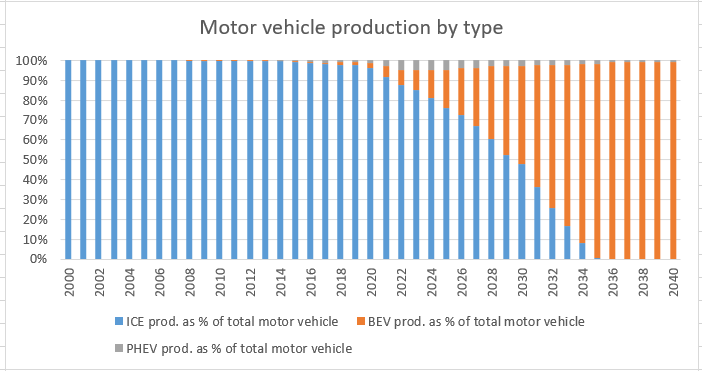

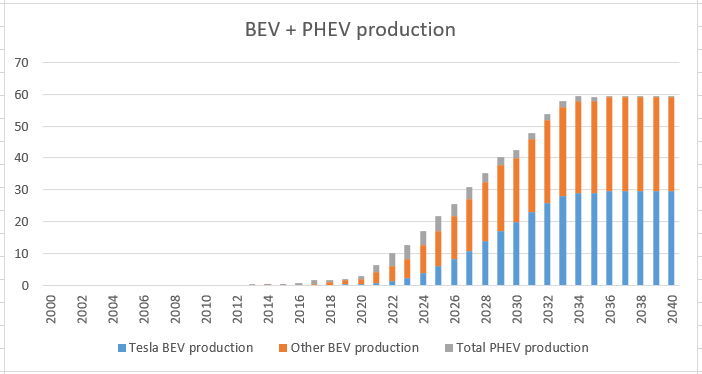

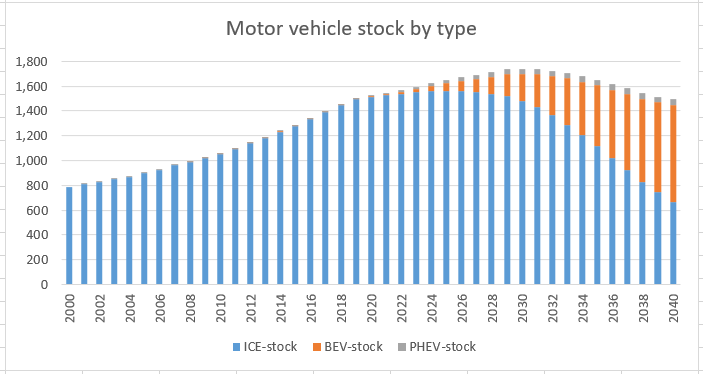

There was some chit chat recently on how long it might take to transition fully from ICE to EV. Since I cleaned up my long term historical data series and future forecasts I thought I could look at that fairly easily, at least for some crude approximations so as to add data to what can otherwise be an unreal discussion.

There are issues around both stocks and flows, i.e. how many vehicles are in existence and how many get built and/or disposed of each year.

For the definition of a vehicle I used the IOICA ones (www.oica.net) which differentiate between light duty vehicles (aka 'passenger') and heavy duty (aka "commercial"). The "passenger" ones of course includes all those 'trucks' the yanks keep bleating about, whereas the heavy duty ones seem to be mostly the large buses and heavy goods vehicles.

For flows there are many series of tota production and with a bit of care one can identify light vs heavy. For lifespan one needs to be careful - most of the studies tend to give a vehicle lifespan in the mid-teens. However as any visitor to a poorer country will see the vehicles there are often well beyond mid teens, and so one needs to account for vehicles being exported out of rich nations to poor nations, and so skewing the data. This study (Lifespans of passenger cars in Europe: empirical modelling of fleet turnover dynamics - European Transport Research Review) looks at that and comes to 18-year lifespans for west Europe and 28-year lifespans for East Europe. As a result I selected a 20-year lifespan for global average forecasting purposes, though inevitably that will mask both national variation and the likelihood of some compression during the latter stages of adoption.

There is talk about how autonomous vehicles may result in fewer vehicles as each vehicle gets more fully utilised. I don't see any significant autonomy hitting the mass-market pre 2030, if only for regulatory reasons. Equally as (hopefully, perhaps) more humans around the planet are able to afford access to vehicles that will tend towards greater numbers of vehicles, though of course the continued penetration of rail solutions will have an effect, at least in some regions. During the transition some ICE-manufacturers will naturally push cheap vehicles into the market in an attempt to survive and that will drive volumes up, but then some of them will go bankrupt before the corresponding EV volumes are fully available, which will complicate matters. Therefore I imposed a long term (2040) production volume of 60 million vehicles/year to account for these various effects, and I sketched in a production profile over the next 20-years that attempts to reflect a bounce-back from Covid and these factors.

As we know Tesla are pushing towards 20m/yr in 2030, and for the last few years Tesla have been approximately 22-23% of BEV-sales (see my previous studies and also EV-sales-blogspot). However Musk is on record as saying he thinks by the time Tesla get to 20m/yr the others will only reach 10m/yr. That does not seem likely to me as non-Tesla BEV production was already 2.5m in 2020, and non-Tesla growth rates have historically also been good. Nonetheless we can see that non-Tesla long-range integrated planning may be less than perfect and so I set up a progression for Tesla from the current 23% towards 50% in 2030. After that there is no good reason for Tesla to stop growing, indeed many reasons that they could and would do so. In this respect we can recall that Ford were once at 60% market share in the inter-War years. Therefore I assumed that Tesla continue to grow to ~30m and that the remainder of the industry match that rate.

For PHEV it seems to me that they are a failed technology and so once the current crop have come to market as a way of spreading the batteries around as thinly as possible, they will diminish to fairly rare use-cases. I suspect they will peak at 4.6m/yr in 2024 at 5% market share.

This gives the following production breakdowns.

or put differently it suggests ICE production would - naturally, and without requiring intervention - cease globally by 2035.

This assumes that Tesla perform on their stated plans, and that by-comparison other companies fail to individually match Tesla and can only (together) hold parity in volume terms with Tesla. If the ~25% market share of Tesla were to remain steady and the other companies somehow are able to match Tesla's growth rate then of course ICE-manufacture would end far earlier. Other combinations are of course possible.

In stock terms this creates the following global outcome, with ICE fully eliminated to all intents by 2050. From an energy perspective they would have become irrelevant earlier as the most mileages are driven by the newer vehicles.

Maybe one day I'll look at the energy and carbon implications of this.

EDIT: Left Hand Axis on most of these charts is of course "millions of vehicles". ICE = internal combusion engine, aka "dino-juice". BEV = battery electric vehicle. PHEV = plug-in-electric/hybrid vehicle. I've ignored fuel cells, hydrogen, etc as being irrelevant.

There are issues around both stocks and flows, i.e. how many vehicles are in existence and how many get built and/or disposed of each year.

For the definition of a vehicle I used the IOICA ones (www.oica.net) which differentiate between light duty vehicles (aka 'passenger') and heavy duty (aka "commercial"). The "passenger" ones of course includes all those 'trucks' the yanks keep bleating about, whereas the heavy duty ones seem to be mostly the large buses and heavy goods vehicles.

For flows there are many series of tota production and with a bit of care one can identify light vs heavy. For lifespan one needs to be careful - most of the studies tend to give a vehicle lifespan in the mid-teens. However as any visitor to a poorer country will see the vehicles there are often well beyond mid teens, and so one needs to account for vehicles being exported out of rich nations to poor nations, and so skewing the data. This study (Lifespans of passenger cars in Europe: empirical modelling of fleet turnover dynamics - European Transport Research Review) looks at that and comes to 18-year lifespans for west Europe and 28-year lifespans for East Europe. As a result I selected a 20-year lifespan for global average forecasting purposes, though inevitably that will mask both national variation and the likelihood of some compression during the latter stages of adoption.

There is talk about how autonomous vehicles may result in fewer vehicles as each vehicle gets more fully utilised. I don't see any significant autonomy hitting the mass-market pre 2030, if only for regulatory reasons. Equally as (hopefully, perhaps) more humans around the planet are able to afford access to vehicles that will tend towards greater numbers of vehicles, though of course the continued penetration of rail solutions will have an effect, at least in some regions. During the transition some ICE-manufacturers will naturally push cheap vehicles into the market in an attempt to survive and that will drive volumes up, but then some of them will go bankrupt before the corresponding EV volumes are fully available, which will complicate matters. Therefore I imposed a long term (2040) production volume of 60 million vehicles/year to account for these various effects, and I sketched in a production profile over the next 20-years that attempts to reflect a bounce-back from Covid and these factors.

As we know Tesla are pushing towards 20m/yr in 2030, and for the last few years Tesla have been approximately 22-23% of BEV-sales (see my previous studies and also EV-sales-blogspot). However Musk is on record as saying he thinks by the time Tesla get to 20m/yr the others will only reach 10m/yr. That does not seem likely to me as non-Tesla BEV production was already 2.5m in 2020, and non-Tesla growth rates have historically also been good. Nonetheless we can see that non-Tesla long-range integrated planning may be less than perfect and so I set up a progression for Tesla from the current 23% towards 50% in 2030. After that there is no good reason for Tesla to stop growing, indeed many reasons that they could and would do so. In this respect we can recall that Ford were once at 60% market share in the inter-War years. Therefore I assumed that Tesla continue to grow to ~30m and that the remainder of the industry match that rate.

For PHEV it seems to me that they are a failed technology and so once the current crop have come to market as a way of spreading the batteries around as thinly as possible, they will diminish to fairly rare use-cases. I suspect they will peak at 4.6m/yr in 2024 at 5% market share.

This gives the following production breakdowns.

or put differently it suggests ICE production would - naturally, and without requiring intervention - cease globally by 2035.

This assumes that Tesla perform on their stated plans, and that by-comparison other companies fail to individually match Tesla and can only (together) hold parity in volume terms with Tesla. If the ~25% market share of Tesla were to remain steady and the other companies somehow are able to match Tesla's growth rate then of course ICE-manufacture would end far earlier. Other combinations are of course possible.

In stock terms this creates the following global outcome, with ICE fully eliminated to all intents by 2050. From an energy perspective they would have become irrelevant earlier as the most mileages are driven by the newer vehicles.

Maybe one day I'll look at the energy and carbon implications of this.

EDIT: Left Hand Axis on most of these charts is of course "millions of vehicles". ICE = internal combusion engine, aka "dino-juice". BEV = battery electric vehicle. PHEV = plug-in-electric/hybrid vehicle. I've ignored fuel cells, hydrogen, etc as being irrelevant.

Last edited:

Elon Musk: SpaceX, Mars, Tesla Autopilot, Self-Driving, Robotics, and AI | Lex Fridman Podcast

What a fantastic interview. Finally got around to listening to all of it. It's a long one and I listened to it in segments when doing other things (cooking, driving, reading TMC etc.). I emplore others to do the same - don't give up on listening to it just because you can't listen to it all in one go. Lex definitely knows how to get the most out of Elon and turn him into a fountain of insight.

Model 3 praised in Australia. I like that they call out the low cost of ownership

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M