Favguy

Member

Oh yes, they get paid very well, by big fossil interests, lol!!I could have sworn you left a 1 off your number but you didn’t. What a complete joke. And those people get paid for these opinions?

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

Oh yes, they get paid very well, by big fossil interests, lol!!I could have sworn you left a 1 off your number but you didn’t. What a complete joke. And those people get paid for these opinions?

Well, that's infinitely more useful than JPM's number.I upgrade my 01/03 price target to $1200

If Tesla pays tax to California using the “single sales factor” method of apportionment, which is likely, then moving the headquarters to Texas doesn’t actually reduce anything on income taxes.He states that they could claim 80% in Q4 and then the remaining 20% in Q1, before having to pay massive taxes going forward. I think this lines up perfectly with Tesla moving their headquarters to Texas in Q4. It will both reduce the amount of tax they will have to pay as well stick it to the politician(s) in California who told him to F off.

There isn't a lot of reason to wait for ER numbers when you beat this big. Everyone knows at this point earnings will be a monster beat too.Do we think the big move will stick this time, or will we see another big run up by retail FOMO, only to get completely tamped down later in the day, like so many excellent P&D reports in the past. It has always seemed like the big boys are reluctant to buy in before they see the ER numbers.

Do we think the big move will stick this time, or will we see another big run up by retail FOMO, only to get completely tamped down later in the day, like so many excellent P&D reports in the past. It has always seemed like the big boys are reluctant to buy in before they see the ER numbers.

That’s not true. I can trade pre-market with TD Ameritrade. I just have to make sure to select extended hours in my order.There isn't a lot of reason to wait for ER numbers when you beat this big. Everyone knows at this point earnings will be a monster beat too.

Also retail can't trade PM, so this big move is entirely big boys right now.

50m in 2030?Tesla tends to get 10X growth in about 5 years. For example. 50k in 2015 -> 500k in 2020. So 5M in 2025?

We are buyers of this sort of industrial equipment and are pleased that we see some nascent attempts to electrify small farm tractors, lawn mowers, chainsaws, and even a skidsteer (Slovakian company).A significant portion of the Industrial energy consumption bucket is for heavy mobile machinery that I was including in a broader definition of transport, and that bumps it up from 24% to higher. I was including basically any self-powered motorized machine on wheels: Forklifts, dump trucks, backhoes, excavators, tractors, bulldozers, asphalt rollers, tree harvesters, pile drivers, rototillers, cherrypickers, etc.

Additionally I think increased efficiency and lower cost of ownership of EVs compared to ICEVs will result in greater quantity of transport miles demanded per capita. I think autonomous driving and Boring Co tunnel networks will multiply this increase even more. (This is for 2035 and beyond).

On the other hand, we will probably want more than 24 hours of storage for the grid.

In any case, energy consumption for all categories is likely to increase as the cost decreases. Supply and Demand 101.

Interesting that the consensus estimates are predicting 30% margins straight through to 2030. That's more bullish that I would expect from the average analyst.Bloomberg consensus deliveries will probably see some change. That 2023 number looks feasible for 2022.

Love the enthusiasm but when Tesla makes 20 million cars a huge percent will be selling for much lower prices than the current 50k or so. Are you considering the tremendous slide in average price when looking at 15k profit/car?Tesla already is the most valuable company on the planet by a massive margin, but the inhabitants of the planet are mostly too clueless to understand this yet.

What Tesla has guided for already implies a $4,000ish valuation just on selling cars, trucks and vans.

By 2030 this could happen (2022 dollars, actual would have inflation):

20 million annual production

$15 k gross profit per car on just the hardware and simple software upgrades, no FSD

$30 B operating expenditures

20% tax

= $200-250 B annual earnings, enough to justify $4,000 share price at about 20x P/E if no further growth expected.

driveteslacanada.ca

driveteslacanada.ca

I hate to see a fellow TMC'er struggle so I'll help you, using a few numbers plucked from thin air.I struggle currently to see the price getting over $4,000 (ignoring inflation adjustment), which to be fair would make it the most valuable company on the planet by a massive margin.

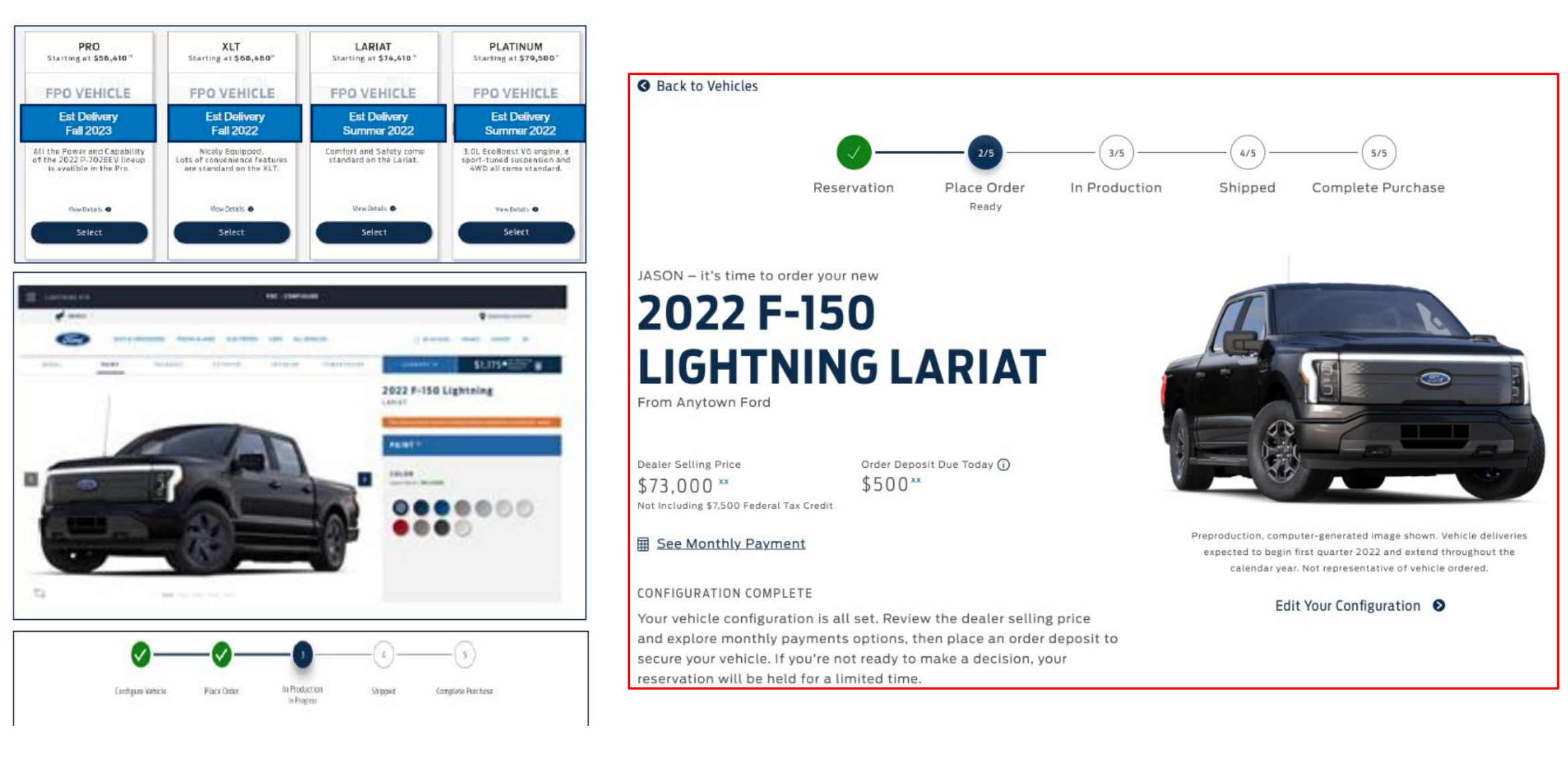

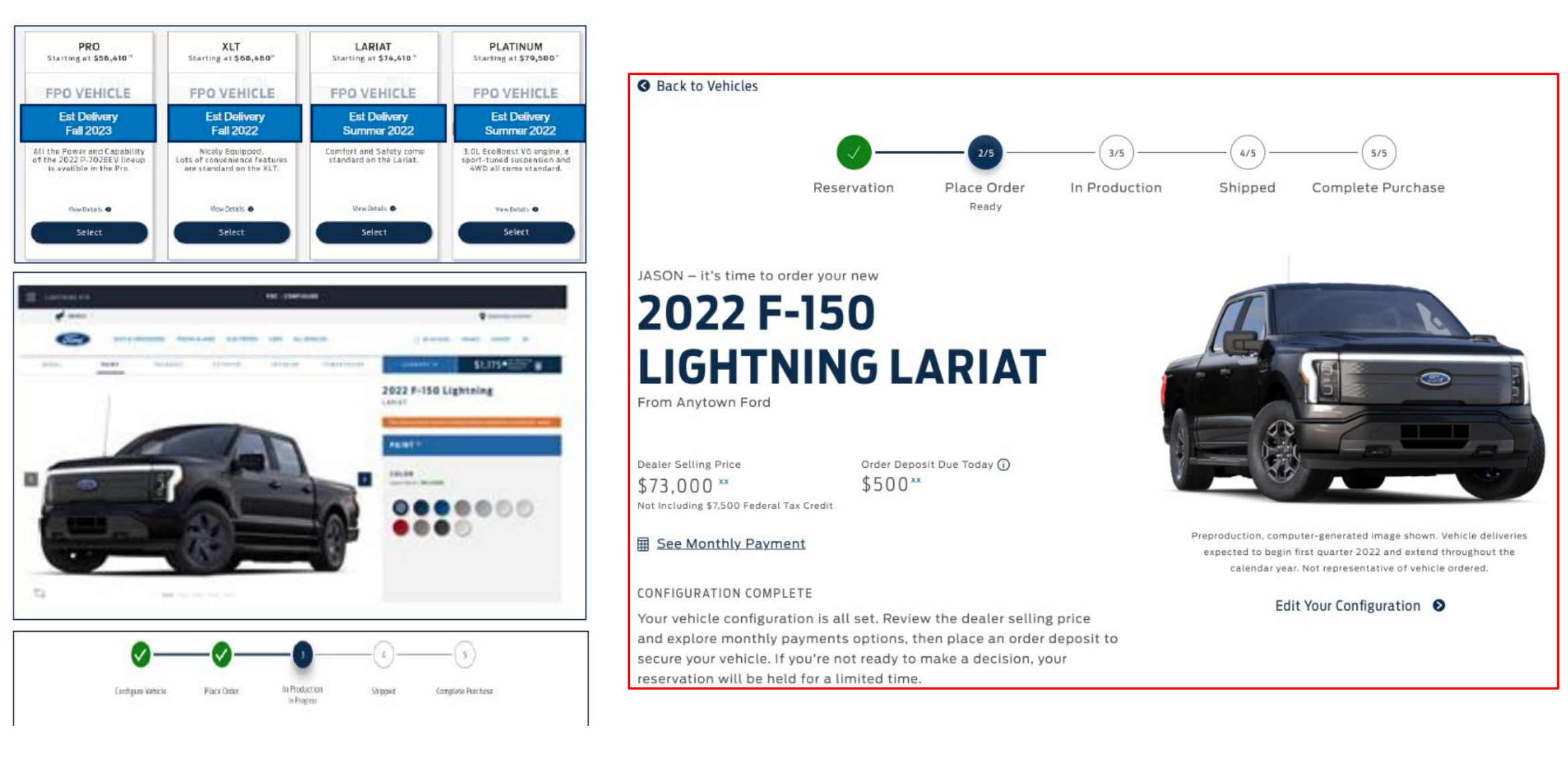

I'm guessing it will be a repeat of the Chevy Bolt, which garnered tons of press attention and awards and "beat the Model 3 to market"Looks like Fordstealershipsdealers won't be getting rich after all:

Leaked Ford dealer playbook reveals F-150 Lightning deliveries delayed to Summer 2022 [Update]

A leaked Ford dealer playbook that is intended to prepare dealerships for the order bank opening for the F-150 Lightning reveals the electric truck may arrive later than planned. UPDATE Jan 3 3:20pm PST: New […]driveteslacanada.ca

Who wants to bet Cybertruck ships more volume in 2022 than E-150? Gonna be close out of the gate.

Cheers!

Tesla already is the most valuable company on the planet by a massive margin, but the inhabitants of the planet are mostly too clueless to understand this yet.

What Tesla has guided for already implies a $4,000ish valuation just on selling cars, trucks and vans.

By 2030 this could happen (2022 dollars, actual would have inflation):

20 million annual production

$15 k gross profit per car on just the hardware and simple software upgrades, no FSD

$30 B operating expenditures

20% tax

= $200-250 B annual earnings, enough to justify $4,000 share price at about 20x P/E if no further growth expected.

... / snip

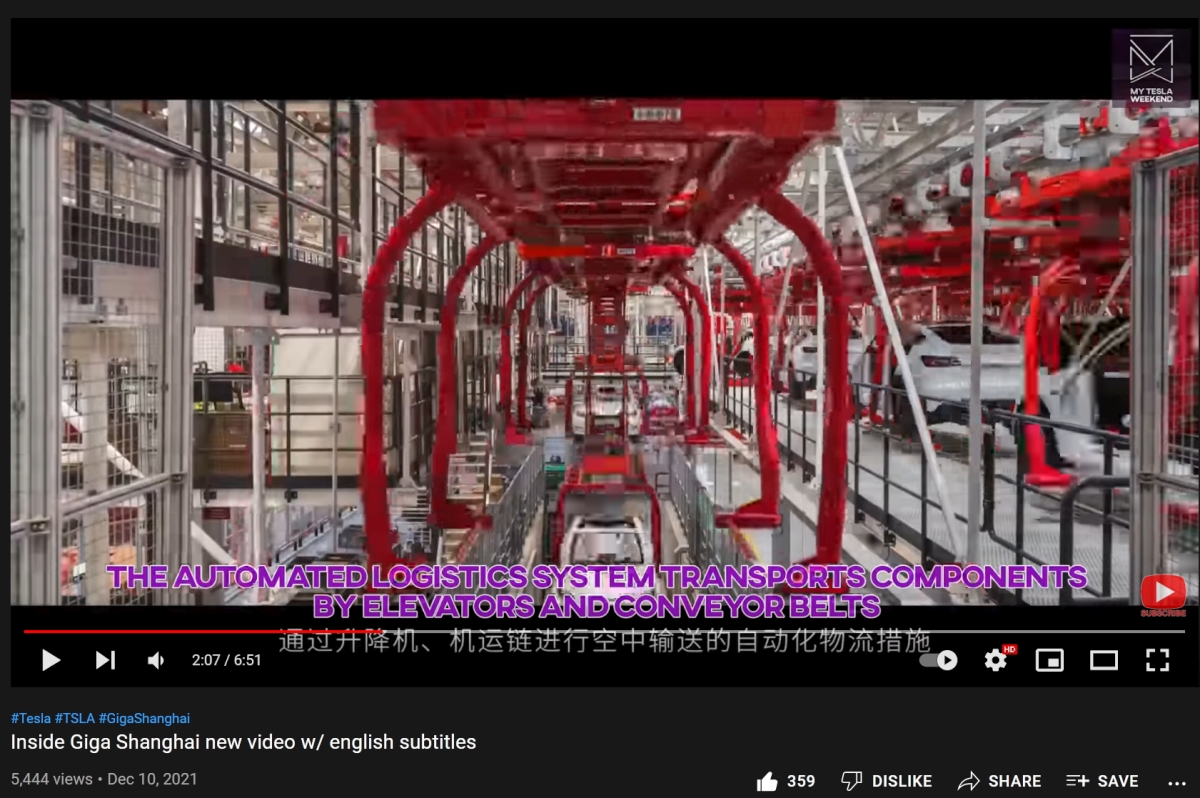

abandon the complicated design of a factory

the four major vehicle processes of stamping, welding, coating, and assembly form a large, single workshop

This greatly shortens the logistics path between each process

This improves operating efficiency

Secondly, the plant's configuration allows full use of vertical space, benefiting from the multi-story design

to maximize space utilization

The automated logistics system transports components by elevators and conveyor belts,

which reduces manual handling. The efficient travel path can be measured in cubic meters.

It can be said that the innovation of the factory itself provides rich soil for manufacturing innovation