It’s not just kids. I showed mine to my 23 yo niece, 21 yo niece and 20 yo nephew at Christmas. It was the coolest thing. My wife came out and asked why everyone was laughing hysterically (fart mode).had an unreal experience that I think speaks to the most underrated thing about Tesla: brand value.

was parked waiting for something and three kids (oldest was maybe 12, youngest like 6) walked by. oldest one backtracked realized it was a Tesla and literally couldn't stop pointing and yelled out to his brothers who were similarly amazed. Tesla's brand value is insane. no one reacts like that to seeing a Benz or BMW, especially not kids.

You could make an equivalent car that could be just as good but if it's not a Tesla its not getting that "OMFG" from those kids.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Antares Nebula

Active Member

I want to believe. I need to believe.So I think if the judge had any inclination to rule against Elon, she'd have insisted on an evidentiary hearing and asked him. I find it hard to imagine any scenario in which she'd rule against Elon without taking his "intent" into account.

"Intent" in this case is argued by the parties under the topic of "willfulness" and "diligence".

Here are the 4 rounds of motion, answer, reply and sur-reply and their handling of the 'willfulness' and 'diligence' arguments for anyone who wants to double check my assumptions and conclusions:

Motion by the SEC:

Motion for Order to Show Cause – #18 in United States Securities and Exchange Commission v. Musk (S.D.N.Y., 1:18-cv-08865) – CourtListener.comAnswer by Team Elon:

The SEC argues that the court can just find Elon in contempt without examining willfulness (intent):

"Significantly, a violation need not be willful in order to find contempt. Donovan v. Sovereign Sec. Ltd., 726 F.2d 55, 59 (2d Cir. 1984)."

"A violation of a court order need not be willful in order to find contempt. Donovan, 726 F.2d at 59."

Response to Order to Show Cause – #27 in United States Securities and Exchange Commission v. Musk (S.D.N.Y., 1:18-cv-08865) – CourtListener.comReply by the SEC:

Team Elon lines up half a dozen citations in a powerful showing of case law that totally eviscerates the SEC's willfulness argument:

"In assessing a party’s diligence, courts in this District generally require a showing of intent, sometimes amounting to willfulness, before a party will be held in contempt. Jeri-Jo Knitwear, Inc. v. Club Italia, Inc., 94 F. Supp. 2d 457, 459 (S.D.N.Y. 2000) (“I can not, however, conclude on the total record before me that defendants’ conduct is of that flouting willfulness to have earned the denomination ‘contemnor.’”); Wojnarowicz v. Am. Family Ass’n, 772 F. Supp. 201, 202 (S.D.N.Y. 1991) (“While the Court is troubled by the mailings and the potential damage that may come to plaintiff therefrom, it finds no ‘willfulness’ on the part of defendants and concludes that the mailings were mistakes from which no malevolence may be presumed.”)."If the court accepts Team Elon's arguments and case law citations then to find Elon in contempt of violating the settlement at minimum 'lack of diligence' has to be shown.

"Moreover, Musk consulted with Tesla’s Disclosure Counsel after posting the 7:15 tweet. Id. ¶ 12. Out of an abundance of caution, Musk posted another tweet at 11:41 p.m. ET. Id. This is precisely the kind of diligence that one would expect from someone who is endeavoring to comply with the Order, and it is certainly not the type of “willful flouting” of judicial authority that is often required to justify a contempt finding. See Robert Half, Inc. v. Romac Int’l, Inc., 101 F. Supp. 2d 223, 225 (S.D.N.Y. 2000) (holding that an “inadvertent” violation “is not such a willful flouting of the court’s authority so as to warrant a finding of contempt”); Wojnarowicz, 772 F. Supp. at 202 (refusing to find party in contempt upon a party’s first time violation of a court order that could reasonably have been a mistake); Matrix Essentials v. Quality King Distribs., Inc., 346 F. Supp. 2d 384, 393 (E.D.N.Y. - 17 - 5491445Case 1:18-cv-08865-AJN Document 27 Filed 03/11/19 Page 24 of 33 2004) (refusing to hold party in contempt without further factual development about whether the “violations were de minimus, inadvertent and/or promptly cured”)."

Reply to Response to Motion – #30 in United States Securities and Exchange Commission v. Musk (S.D.N.Y., 1:18-cv-08865) – CourtListener.comSur-reply by Team Elon:

Silence on "willfulness", the SEC's argument abandons "Donovan v. Sovereign Sec. Ltd.". (!)

The reason: they cited the wrong case law IMHO, and Elon's team cited the correct one that requires intent, generally at least on the level of "lack of diligence".

So instead of just withdrawing their motion the SEC instead just changes their legal argument and now claims that Elon was "not diligent" in a handful of other tweets:

"Musk made no diligent or good faith effort to comply with the pre-approval provision of the Court’s order."The SEC's argument rests on mischaracterizing the other tweets, which as @KarenRei pointed it out as well were innocuous. Importantly the SEC doesn't even attempt to claim that these tweets contained material information.

"While Musk professes to take seriously his obligations to comply with the Court’s order and the Tesla Policy, his actions speak much more loudly: he has not diligently sought to comply with either."

By going this way the SEC effectively concedes the point:

Reply to Response to Motion – #33 in United States Securities and Exchange Commission v. Musk (S.D.N.Y., 1:18-cv-08865) – CourtListener.com

"The SEC also fails to show that Musk has not diligently attempted to comply with the Order. The SEC now points to other tweets (rather than the 60 Minutes interview) that it suggests possibly also should have been pre-approved. These tweets, which include statements denying untrue rumors and repeating well-known safety information, prove Musk’s point. Since the Order was entered, Musk has not tweeted material information regarding Tesla. It is because he has been complying with the Order, not defying it, that these tweets have not required pre-approval."Total K.O. for the SEC. Checkmate. The SEC got fragged and Team Elon wins the Superbowl.

The only way the SEC could have developed their accusation of lack of diligence was by perhaps cross-examining Elon Musk - but they didn't request it as it's a double edged sword: with Elon present the judge might actually witness it first hand how diligent Elon is about pretty much everything, and how wacky and petty the SEC's position really is in the general scheme of things ...

The judge did not request Elon to be present either - which pretty much closes the door on willfulness and diligence, IMHO.

So to me, at this point, the main open question is the extent of the SEC's loss: will they lose just on materialness, or also on constitutional grounds?

(Anyway, keep in mind that I'm a Tesla fan who is not a lawyer and that I could be wrong about this, and that court proceedings are often unpredictable. Also heads-up to @TNEVol who is a lawyer, who is much more cautious in his assessments of this case and who might disagree with me here.)

You will be voted Grand Nagus of TMC if Musk is cleared!

Fact Checking

Well-Known Member

I'd sell half. But since you only bought 1 and this is a lottery ticket...

@Lycanthrope could sell the 1 contract for EUR ~250 and buy a higher strike price contract for ~125 EUR.

(Or 4 higher price contracts for ~30 EUR each - bigger risk, but also bigger leverage.)

That would realizes 50% of the gains while keeping half of the leveraged options value still alive. (Plus loss on the spread.)

Pezpunk

Active Member

I want to believe. I need to believe.

You will be voted Grand Nagus of TMC if Musk is cleared!

Upvote for DS9 reference.

Antares Nebula

Active Member

Can we bribe the judge with a basket of chocolates (or fruits)?

Artful Dodger

"Neko no me"

S&P500 inclusion. Else, in the limit of your argument, why not just go private?So why continue this bad practice for financial "optics" that no longer matter, when the alternative would actually save money in the long term ???

As a side-note, if Telsa wins in the auto market and in court, could the stock market really not follow?

Cheers!

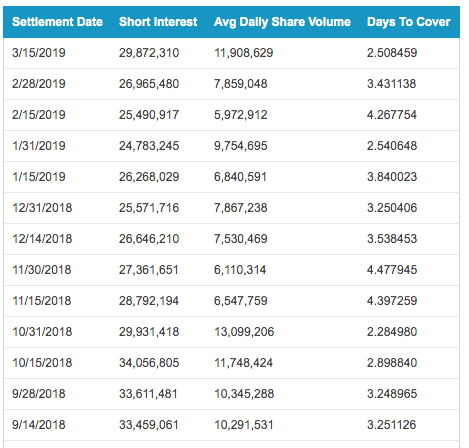

I think this is a recent update to the official short interest numbers.

Krugerrand

Meow

So a new and copied die is made from a digital, rather than a physical master? TIA.

Edit: Am thinking about the remarkable similarity between 3 and Y, as though they applied mathematical transformations to enlarge by 10%. That might make it possible to create new digital die files by applying the same mathematical transformations.

Nowadays, yes CAD. In the good ole days (as little as only 30 years ago) it was from handmade drafts/blueprints.

But no. Y die designs would be entirely new CAD files, not just 3 designs made 10% bigger or some such. Does not work that way. Die designers essentially have to start from scratch. They can incorporate aspects from 3 designs into Y designs where parts of the panels are similar in shaping and to get certain desired results. No body panel for the Y is going to be a copy of a 3 body panel. So these parts are not included in the 70whatever% of same as Model 3.

It’s not just kids. I showed mine to my 23 yo niece, 21 yo niece and 20 yo nephew at Christmas. It was the coolest thing. My wife came out and asked why everyone was laughing hysterically (fart mode).

I know, I've had plenty of people gawk at the car before.

for me tho, this experience was different just because of how young the kids were. it was just pure innocent joy and astonishment at the same time. a totally different feel from when say an adult looks over at the car twice. kinda hard to put in to words actually, but it just felt more special with those kids.

Fact Checking

Well-Known Member

As a side-note, if Telsa wins in the auto market and in court, could the stock market really not follow?

According to the first rule of TSLA price action it could absolutely happen!

As long as both the Wall Street analyst scene and the business media is dominantly bearish and hostile towards Tesla that's a big filter on potential investors and also provides a steady inflow of new shorts. It's a bigger and more stubborn filter I expected it to be.

Eventually there might be a point of no return (to $3xx levels), and a rather significant upwards correction, in a potentially non-linear event, but I don't dare predicting anything to its timing other than it will be in this century, most likely.

Big Blue 1011

Member

Sorry - our replies indeed crossed, and when I saw yours I edited my harsh response - and for the unjustified harshness I apologise! The text you quoted doesn't exist anymore.

Regarding the affidavit, what amazes me is that the SEC didn't drop their motion on reading it.

They might genuinely have missed the fact that Elon not sending half of his tweets is an honest to God attempt at compliance.

Instead they doubled down and increased the volume - further twisting the knife if the shareholder value they are actively butchering.

No worries. I joined this site to better understand the deep connection that Tesla owners seem to have with the company, EM and especially, its products. I'm getting all of that, with a healthy dose of passion to boot. It's all good.

For a variety of reasons, I will not get into specifics regarding my interactions with lawyers for the SEC. All I will say is that some give new meaning to the term "evangelical zeal".

Not all by any means, and I'm not saying the term applies to any of the current participants, since I don't know any of them. But some, for sure.

Artful Dodger

"Neko no me"

True, but a separate issue is whether the BANKS are open on the weekend, or if any weekend transaction will be post-dated to the next business day, which is Mon Apr 1st.FWIW, we already know that some deliveries are done during the weekend: both Saturday and even Sunday.

Anyone?

Causalien

Prime 8 ball Oracle

I know, I've had plenty of people gawk at the car before.

for me tho, this experience was different just because of how young the kids were. it was just pure innocent joy and astonishment at the same time. a totally different feel from when say an adult looks over at the car twice. kinda hard to put in to words actually, but it just felt more special with those kids.

I don't know if this is just by chance or not. I'd pick the remotest part of the parking lot to park when I go grocery shopping and when I get back I'd always get surrounded by cars while the rest of the lot is empty. What kind of tesla effect is this?

Fact Checking

Well-Known Member

Most likely the boards are laid up, populated, soldered, etc in either China or Taiwan (or somewhere else nearby) currently anyways. Almost nobody gets their PCBs made in the USA unless they need overnight turnaround for prototyping, or perhaps it's a DOD or similar contract. Mass production even with shipping is much cheaper from Asia.

This of course doesn't rule out that some components are shipping to Asia from the US (such as the new HW3 processors, which IIRC are being fabbed in Samsung's Austin, TX facility) to supply HW3 board production, but the final board assembly is likely to occur in Asia regardless.

Actually, this is what Pete Bannon, Director of Hardware had to say about it a couple of months ago:

Peter Bannon:

"Hi, this is Pete Bannon. The Hardware 3 design is continuing to move along. Over the last quarter, we've completed qualification of the silicon, qualification of the board. We started the manufacturing line, in qualification of the manufacturing line. We've been validating the provisioning flows in the factory. We built test versions of Model S, X and 3 in the factory to validate all the fit and finish of the parts and all the provisioning flows."

"So we still have a lot of work to do. And the team is doing a great job, and we're still on track to have it ready to go by the end of Q1."

"Hi, this is Pete Bannon. The Hardware 3 design is continuing to move along. Over the last quarter, we've completed qualification of the silicon, qualification of the board. We started the manufacturing line, in qualification of the manufacturing line. We've been validating the provisioning flows in the factory. We built test versions of Model S, X and 3 in the factory to validate all the fit and finish of the parts and all the provisioning flows."

"So we still have a lot of work to do. And the team is doing a great job, and we're still on track to have it ready to go by the end of Q1."

Tesla is making their own boards and I am 95% sure they were talking about Fremont here. And yes, I believe Tesla's boards carry a "made in the USA" sticker somewhere.

Causalien

Prime 8 ball Oracle

@Lycanthrope could sell the 1 contract for EUR ~250 and buy a higher strike price contract for ~125 EUR.

(Or 4 higher price contracts for ~30 EUR each - bigger risk, but also bigger leverage.)

That would realizes 50% of the gains while keeping half of the leveraged options value still alive. (Plus loss on the spread.)

That'd make the lottery ticket even more lottery-y

Antares Nebula

Active Member

Looks like someone in the comments section has pointed out the fraud allegations against Anton Wrongman on his most recent article today:

How Audi's And Jaguar's EVs Outsold Tesla Model S And X In Europe - Tesla, Inc. (NASDAQ:TSLA) | Seeking Alpha

How Audi's And Jaguar's EVs Outsold Tesla Model S And X In Europe - Tesla, Inc. (NASDAQ:TSLA) | Seeking Alpha

Minus the 4 times 20 euro Keytrade transaction costs to go back to cash, the gain is much less impressive.@Lycanthrope could sell the 1 contract for EUR ~250 and buy a higher strike price contract for ~125 EUR.

(Or 4 higher price contracts for ~30 EUR each - bigger risk, but also bigger leverage.)

That would realizes 50% of the gains while keeping half of the leveraged options value still alive. (Plus loss on the spread.)

Fact Checking

Well-Known Member

Yes, die building has a long lead time and it’s expensive.

Just curious, how long would a "copy" of an existing die take, with minimal "tweaks" - weeks or several months? Is there some chokepoint that slows down the process - such as foundry capacity for high quality casts, or availability of CNC machines?

Also, how much extra time would "new" dies take typically - a few months on top, used mostly as human time - or are there material or machine dependencies as well? Very interesting topic!

EVDRVN

Active Member

Okay, lets just put this very simply:

If you go there dressed like a "Tesla Fan", or worse acting like a "Tesla Fan", as though this were some sort of sports game and you're there to cheer for the home team.... most people here will hate you for doing so. For threatening our investments because you want to insert yourself into the middle of important legal proceedings as something other than a passive observer.

I was thinking along similar lines.

Fact Checking

Well-Known Member

True, but a separate issue is whether the BANKS are open on the weekend, or if any weekend transaction will be post-dated to the next business day, which is Mon Apr 1st.

Anyone?

Customer having taken delivery is enough for the sale to count as revenue and profit. Tesla's Q1 ends on midnight March 31 Pacific Time, so even a 1 am delivery on the East Coast would probably count.

Cash inflow might not make it into Q1 but would increase "accounts receivable" and arrive in Q2.

Since cash flow metrics are best viewed while taking accounts receivable, accounts payable, inventory and other cash sources and sinks into account, it's not a problem.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M