I doubt they overpaid. They probably had such a large, multi-year order that they got a discount before the price surge happened.I would love to hear a sidenote at the Shareholder Meeting or some other event where Elon explains how they overpaid a bit for fixed-price multi-year agreements in 2021 to accomodate a possible shortage on material during EV S-curve adoption - just to find out they got an unbelievable stable price during war time on all key materials while other players are struggling with spot prices and high volatility on pricing.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

TheTalkingMule

Distributed Energy Enthusiast

So much for a mega-MMD this morning.

Artful Dodger

"Neko no me"

I forget, are we allowed to say anything at 10:16 ET?

Cheers!

Cheers!

MartinAustin

Active Member

Plus, when you talk to mines, you get it more cheaply than from the commercial commodities markets. Tesla pioneered talking directly to mines, they first mentioned it in 2014 when describing how integratedthe Nevada factory would beI doubt they overpaid. They probably had such a large, multi-year order that they got a discount before the price surge happened.

Gigapress

Trying to be less wrong

Demand matters greatly even when delivery volume is fixed (Inelastic supply).Demand doesn't matter right now. Tesla Q1 sales is mostly dependent on how many chips they can acquire. So the actual number is very hard to guess.

Different vehicle models, versions and configurations vary widely in the gross profit Tesla can get with the available components supply. In the extreme, a Model S Plaid with $12k FSD and all the $1-3k extras for wheels/paint/interior probably earns an order of magnitude more profit than the cheapest Model 3 SR. A growing backlog for all vehicles increases Tesla's power to allocate production as they see fit.

Demand also affects the price Tesla can charge for a given car configuration, because they're effectively auctioning off the cars in a global bidding war. Tesla has been generous in allowing the order backlog to get so long, because this whole time they could've simply raised prices even more to reach a supply-demand equilibrium. (Thought experiment: Raise Model Y price to $90k and see if there's still a backlog). Tesla is a benevolent monopoly.

Currently, FSD and Performance orders are being prioritized and prices for all models have risen an average of 7% since last year. Extremely bullish, all thanks to high demand (edit: and Tesla's competitive dominance).

Additionally, Tesla's fat gross profit margins let them bid more for chip supply, other components, and expedited shipping. Elon said on the earnings call that many suppliers worked nights and weekends to make 2021 happen how it did. Overtime surely was compensated by Tesla somehow, and demand paid for it.

Longer term, this demand still matters because Tesla's investors and suppliers see this position of strength and increase their willingness to risk funding a more aggressive rate of expansion. Those nickel mining firms, chipmakers, aluminum smelters and battery manufacturers see the overwhelming demand and it gives them more confidence to go hard, thus accelerating the sustainable energy transition.

Last edited:

TheTalkingMule

Distributed Energy Enthusiast

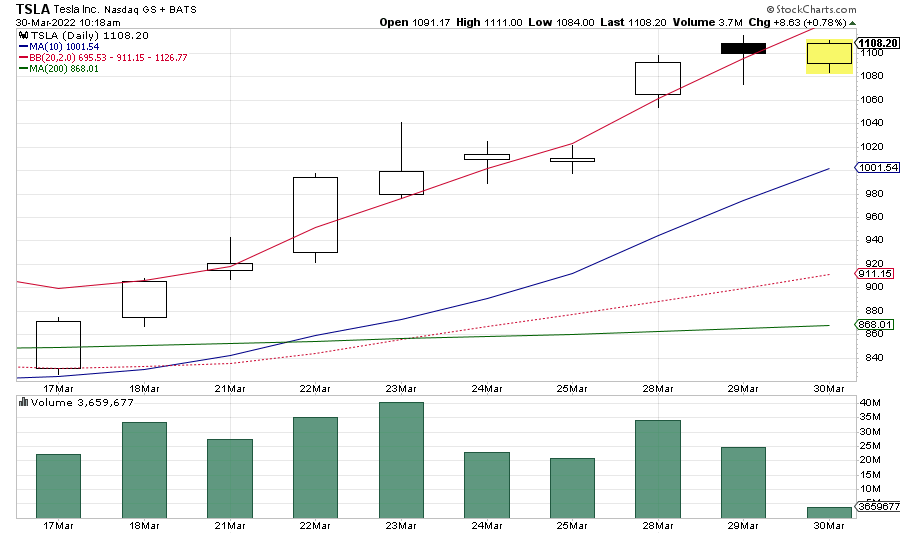

I kinda like having a ceiling of $1111.11

...some thanks to inflation though, no??Demand matters greatly even when delivery volume is fixed....

...Currently, FSD and Performance orders are being prioritized and prices for all models have risen an average of 7% since last year. Extremely bullish, all thanks to high demand.

Longer term, this demand still matters because Tesla's investors and suppliers see this position of strength and increase their willingness to risk funding a more aggressive rate of expansion, thus accelerating the sustainable energy transition.

2daMoon

Mostly Harmless

Yes, you can announce the Blue Light Special has ended.

I have been curious as to why heretofore there haven’t been news regarding Tesla and Vale contracts - and even now, today’s articles refer only to “a secret deal.”

That Vale had been left out - so it has seemed - as a supplier to Tesla…certainly, for its steel alloy needs, Tesla could and properly should depend on its steel suppliers to secure their own raw materials sources, although one can make a good case for assistance from the carmaker in such negotiations.

But for its batteries? This is where I have been puzzled.

Now, we have had snippets over the past years. “We’ve had talks” have come from company officers at least as far back as 2020.

So - I’ll take today’s reports as genuine, and the delays as evidence of giants in their respective fields each having been diligent, hard-headed negotiators.

That Vale had been left out - so it has seemed - as a supplier to Tesla…certainly, for its steel alloy needs, Tesla could and properly should depend on its steel suppliers to secure their own raw materials sources, although one can make a good case for assistance from the carmaker in such negotiations.

But for its batteries? This is where I have been puzzled.

Now, we have had snippets over the past years. “We’ve had talks” have come from company officers at least as far back as 2020.

So - I’ll take today’s reports as genuine, and the delays as evidence of giants in their respective fields each having been diligent, hard-headed negotiators.

Xepa777

Banned

Plenty of times you’d be losing money if you were in tesla too. I was an investor since 2013 and after 6 years I’d DCAing I was down after Q1 2019. So what? Stock price at a given moment isn’t reflective of the company quality.yeah, I got into ABML and then lost money. I'm still holding onto it as I understand it's a long term play, and I hope they succeed, but they don't even have a factory right now, Redwood does. Redwood is actually producing material.

Gigapress

Trying to be less wrong

Tesla's average cost for vehicles has been declining and likely will continue to decline in 2022 with shorter shipping distances, no Model Y EU import tariff, LFP batteries, newer bigger factories etc....some thanks to inflation though, no??

Rob Maurer showed that two weeks ago (jump to 4:20 for relevant section).

More importantly, as a price-setting monopoly (more or less) with short-term supply that can barely be increased, Tesla chooses sale prices and production allocation mostly based on the demand curve and how sensitive quantity is to price, because the length of the waiting list is affected only by factors the customers care about when ordering.

Last edited:

StarFoxisDown!

Well-Known Member

More like thanks to the Biden EV Tax Credit that Tesla was clearly raising prices in anticipation for + inflation, which allowed Tesla not only keep those higher prices, but increase them even more....some thanks to inflation though, no??

The Biden ev tax credit that never was has turned out to be a massive tailwind for Tesla while being a huge negative for the likes of GM, F, etc….

Last edited:

AimStellar

Member

Xepa777

Banned

They do both. One of my classmates works there. Of course they’ll talk about water based part because the smelting has been such bad PR. And if you actually follow the paper trail you will see Nevada had shut down their operations before for not complying and environmental impact of their operations.Have you actually listended to the JB interview? He says they use hydrometallurgical processes as well.

And it’s sort of obvious if you Listen to Jb himself talk about it.

Watch Feelin' hot, hot , hot... | Streamable

Watch "Feelin' hot, hot , hot..." on Streamable.

streamable.com

For good measure…read this and tell me with a straight face they don’t smelt. Public Notice - BSMM - Hazardous Waste Written Determination | NDEP

Have you actually listended to the JB interview? He says they use hydrometallurgical processes as well.

Last edited:

B

betstarship

Guest

Plenty of times you’d be losing money if you were in tesla too. I was an investor since 2013 and after 6 years I’d DCAing I was down after Q1 2019. So what? Stock price at a given moment isn’t reflective of the company quality.

Funny story, I had a few family and friends tell me that, on that run-down in 2019 of TSLA, I'd lose all my money due to investing in TSLA because it was going to zero and to sell.

Some of these folks had Teslas themselves.

BrownOuttaSpec

Active Member

Just wanted to give an update to this. I just checked again and the estimated delivery date has moved back to the original estimate of "June 2022". I wonder if they have that Giga Austin production ramping very smoothly now.Almost the exact same for me, just checked my Model Y ordered end of Oct. It was May/June delivery and now "August 24 - October 19". Edit: 5-seater with no FSD

thesmokingman

Active Member

Ironically the end of 2019 was an ideal entry point to Tesla longterm.Funny story, I had a few family and friends tell me that, on that run-down in 2019 of TSLA, I'd lose all my money due to investing in TSLA because it was going to zero and to sell.

Some of these folks had Teslas themselves.

and forges swords from fallen knives  ... the Unknown Retail Investor

... the Unknown Retail Investor

On 2/22(I day before the recent low), I sold 500 shares and bought mostly 900 jan 24 Calls.

Closed the Calls today, and got myself 900 Shares - 400 more Votes

400 more shares in 1 month

(+ didn't want to get too greedy, didn't want to wait on binary event output )

cheers!!

On 2/22(I day before the recent low), I sold 500 shares and bought mostly 900 jan 24 Calls.

Closed the Calls today, and got myself 900 Shares - 400 more Votes

400 more shares in 1 month

(+ didn't want to get too greedy, didn't want to wait on binary event output )

cheers!!

TheTalkingMule

Distributed Energy Enthusiast

Watching the CNBC/Bloomberg coverage this morning it seems they feel institutional equity holding is way behind the curve 9n big tech. All the biggest players offloaded in anticipation of doom once we approached the March Fed rate raise meeting. Didn't happen.

Now we have Wall Street raising EPS estimates like mad for 2022 and the institutional buyers are left on the wrong side of things.

TSLA earnings are a pretty clear picture for 2022, but not so much outside of forums like this. The average institutional buyer probably looks at Street 2022 and 2023 EPS estimates of 10.6 and 13 and sees a 50/50 chance of hitting the target. Those in the know see that as laughable and are hoping for 18 this year.

What happens when a fat number lands for 1Q in 4 weeks? All the models flip IMO. Maybe it takes 2Q numbers as well, but I think the foundation for a wonderful FOMO surge is already here. The first few are gonna jump next week before things get far far worse.

Now we have Wall Street raising EPS estimates like mad for 2022 and the institutional buyers are left on the wrong side of things.

TSLA earnings are a pretty clear picture for 2022, but not so much outside of forums like this. The average institutional buyer probably looks at Street 2022 and 2023 EPS estimates of 10.6 and 13 and sees a 50/50 chance of hitting the target. Those in the know see that as laughable and are hoping for 18 this year.

What happens when a fat number lands for 1Q in 4 weeks? All the models flip IMO. Maybe it takes 2Q numbers as well, but I think the foundation for a wonderful FOMO surge is already here. The first few are gonna jump next week before things get far far worse.

B

betstarship

Guest

Ironically the end of 2019 was an ideal entry point to Tesla longterm.

I re-capitulated in the six digit range instead.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M