ThisStockGood

Still cruising my Model S 70 2015

Have been preparing for this:

Congrats!

Congrats!

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

I don’t know what that means. Summarize please with one word.Wow, puts exp this friday are going through the roof!

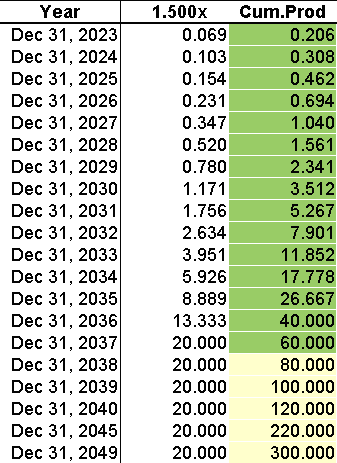

I see. You're going out past 2040 to get to 300 TWh cumulative. The hard thing is getting to 300TWh by 2040.I've previously (over several years now since Battery Day) published a few possible production goal tables. I'll link here to my most recent one (made after the TED2022 interview), and the content myself to wait for "Master Plan Part 3":

Artful Dodger Post #334,587 (Mon, Apr 18, 2022)

Cheers to the Longs!

| Annual | Cumulative | |

2023 | 1 | 1 |

2024 | 2 | 3 |

2025 | 3 | 6 |

2026 | 4 | 10 |

2027 | 5 | 15 |

2028 | 6 | 21 |

2029 | 7 | 28 |

2030 | 8 | 36 |

2031 | 9 | 45 |

2032 | 10 | 55 |

2033 | 11 | 66 |

2034 | 12 | 78 |

2035 | 13 | 91 |

2036 | 14 | 105 |

2037 | 15 | 120 |

2038 | 16 | 136 |

2039 | 17 | 153 |

2040 | 18 | 171 |

2041 | 19 | 190 |

2042 | 20 | 210 |

2043 | 21 | 231 |

2044 | 22 | 253 |

2045 | 23 | 276 |

2046 | 24 | 300 |

2047 | 25 | 325 |

2048 | 26 | 351 |

2049 | 27 | 378 |

2050 | 28 | 406 |

Thank me for having my Tesla Model 3 delivered in March with perpetual FSD.33% gross auto margins is glorious.

Give it a few days. Or weeks. Or months.While this is certainly a beat, I'm curious to see how the market actually reacts. As in tomorrow, when the SP drops because everyone thought a beat should have taken it up. We've all been down this road before. I'm happy they beat as a miss could have resulted in a precipitous Netflix drop, but I'm not convinced the Market is going to respond the way most think it should.

Yes. I guess the FSD take rate made the day even more bullish than I calculated. Thanks Stol LatThank me for having my Tesla Model 3 delivered in March with perpetual FSD.

Super-moneyI don’t know what that means. Summarize please with one word.

Did the changes Biden Administration EPA reinstated already have an effect in regulatory credit sales?

Financial results are amazing, even better than most of the uber-bull estimates ($2.86/share GAAP, 3.22 non-GAAP profit).

Now the question is: can Elon rattle the cages and scare the investors on the call enough despite the results to cause the SP to tank tomorrow ?

Looks very difficult, but Elon is extremely talented, so I would not rule it out yet...

Financial results are amazing, even better than most of the uber-bull estimates ($2.86/share GAAP, 3.22 non-GAAP profit).

Now the question is: can Elon rattle the cages and scare the investors on the call enough despite the results to cause the SP to tank tomorrow ?

Looks very difficult, but Elon is extremely talented, so I would not rule it out yet...