Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Don't forget selling off the preproduction German vehicles. Those have been a substantial drag, haven't they?Random Weekend Insights - Inventory:

Raw Materials have increased from $1.8b to $3.8b in just 4 quarters (see yellow boxes). That's a huge increase. Berlin and Austin can't account for this entire increase. I suspect Tesla has increased it's safety stock at all locations to protect against logistics issues. We recently saw a Wu Wa video of Tesla's offsite materials warehouse in Shanghai. Castings would be included in raw materials as a sub-assembly. Castings move to Work in Progress once they move onto the production line. We could likely see raw materials rise again in Q2.

Work in Progress (WIP) has steadily increased since Q1 2021 (see gray boxes) and this is due to Berlin and Austin and possibly the abrupt manufacturing stoppage in Shanghai from the lockdown in late March. Also important to note: finished vehicles stay in WIP until they have passed quality control. Perhaps some completed vehicles at Berlin and Austin sat in WIP at Q1 2022 awaiting QC sign-off.

Finished Goods peaked in Q1 2019 ($2.2b) driven by Logistics Hell and then again in Q1 2020 ($2b) due to Covid lockdowns (see orange boxes). In Q1 2022 Tesla hit a recent low of $977m. The Q1 2022 number was remarkably low and was helped by the the delivery wave unwind. Finished Goods should increase in Q2 as production exceeded deliveries.

View attachment 829455

ZeApelido

Active Member

Leave a 4 yr old alone in your Tesla for a few minutes and she’ll learn how to play “Ring of Fire” while making fart sounds and drawing.

D

dm28997

Guest

"Why It’s Important: Hoffman went on to say he supports entrepreneurs and investors who work to build a better future for America and the world, like Musk."

markets.businessinsider.com

markets.businessinsider.com

LinkedIn Co-Founder Explains Musk, Trump Beef: Real Life Success Vs. Pretend TV Version

Entrepreneur and investor Reid Hoffman took to Twitter Inc (NYSE: TWTR) to defend Tesla Inc (NASDAQ: TSLA) CEO Elon Musk and call out former President Donald Trump.

petit_bateau

Active Member

If you recall CATL's Shanghai factory appeared to ramp up very quickly, faster than Tesla's utilisation of the LFP cells/packs in Shanghai. We know they also started shipping LFP packs to Fremont. I wonder if a lot of this raw material build can be attributed to Tesla taking everything that CATL could ship, irrespective of whether Tesla had an immediate ability to use it.Random Weekend Insights - Inventory:

Raw Materials have increased from $1.8b to $3.8b in just 4 quarters (see yellow boxes). That's a huge increase. Berlin and Austin can't account for this entire increase. I suspect Tesla has increased it's safety stock at all locations to protect against logistics issues. We recently saw a Wu Wa video of Tesla's offsite materials warehouse in Shanghai. Castings would be included in raw materials as a sub-assembly. Castings move to Work in Progress once they move onto the production line. We could likely see raw materials rise again in Q2.

View attachment 829455

Nice summary of the evidence that Tesla doesn't have a demand problem, and won't during a recession:

forwardcap.substack.com

forwardcap.substack.com

Analyzing Tesla's Demand

How does consumer demand look as we enter a potential recession?

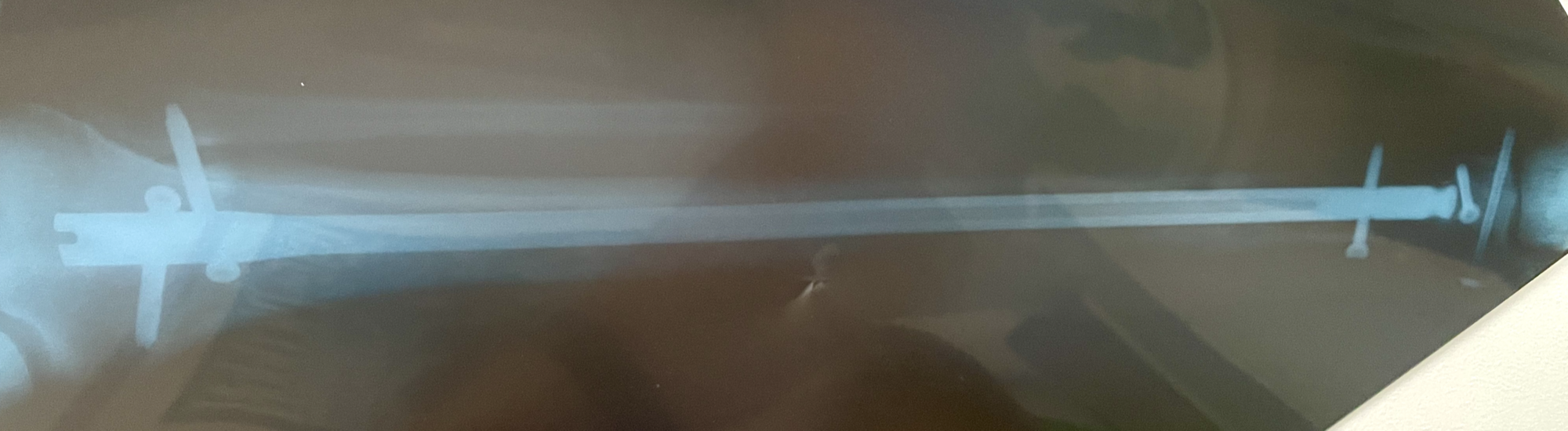

As we're doing orthoporn, I had this inside my lower leg back in 1999 - there's still some screws in there, somewhere...

MC3OZ

Active Member

You mean like this?

The castings inventory at Fremont has been growing lately. At first I wondered it was to establish safety stock in case one of the Giga Presses were to go down for an extended repair. Now I am wondering if it could be backup inventory for Berlin in case a potential energy crisis in Germany surfaces later this year and shuts down Giga Presses there. Are the castings for Model Y in Fremont the same as the castings used in Berlin?

View attachment 829421

I also wonder if the stockpile of castings at Fremont moght be preparation to make Model Y with Front and Rear castings.

Perhaps if Berlin doesn't need the castings.

If it was necessary, it might be better to ship castings from Shanghai to Berlin from a logistics point of view.

jkirkwood001

Active Member

I don't understand why this is a concern (that's what I'm getting from the OP). I appreciate the bottoms-up calculations in the replies, but top-down, Tesla just had to calculate the conservative standard cycle time times the operating hours times the number of Gigapresses to estimate their annual capacity. Gigapresses are a known commodity to Tesla. Do we really think they didn't do the simple math to buy enough capacity for their production targets?Cory Steuben from Munro Live is interviewed. I thought the most interesting bit was where he talked about the GigaPress. For all its advantages, he explains that it is worthless if you can't get the throughput high enough. He says an auto plant typically puts out a car every 45 seconds.

This sounded low to me, but I assume he was taking multiple production lines into account?

So if the GigaPress can't keep up with the production rate then you might as well not use it. In this case, you need it to output a casting every 45 seconds or buy more GigaPresses.

Does anyone here know the rate for Tesla's GigaPress? Does Tesla use one GigaPress per production line?

If I've misunderstood, and this thread is just to show how ahead of the game Tesla is, well,

Last edited:

ThisStockGood

Still cruising my Model S 70 2015

TE chiming in on Q2 earnings. He is bullish.

Edit: typo

Edit: typo

Last edited:

The Accountant

Active Member

TE chiming in on Q3 earnings. He is bullish.

Q2 chart now updated with the Tesla Economist estimate:

FYI, based on this video for MY 2021, 75kW battery this would be ~37 to 40 minutes - to charge from 10% to 90% at 250kWh harger.I don't know about that. Impossible this seems.

Per my graphs, with 'objective function' the best time would be to charge from 10-15% to 60% @ 250kWh charger. Anything above 60% takes increasingly longer as we move towards 100%.

Out of spec reviews:

TheTalkingMule

Distributed Energy Enthusiast

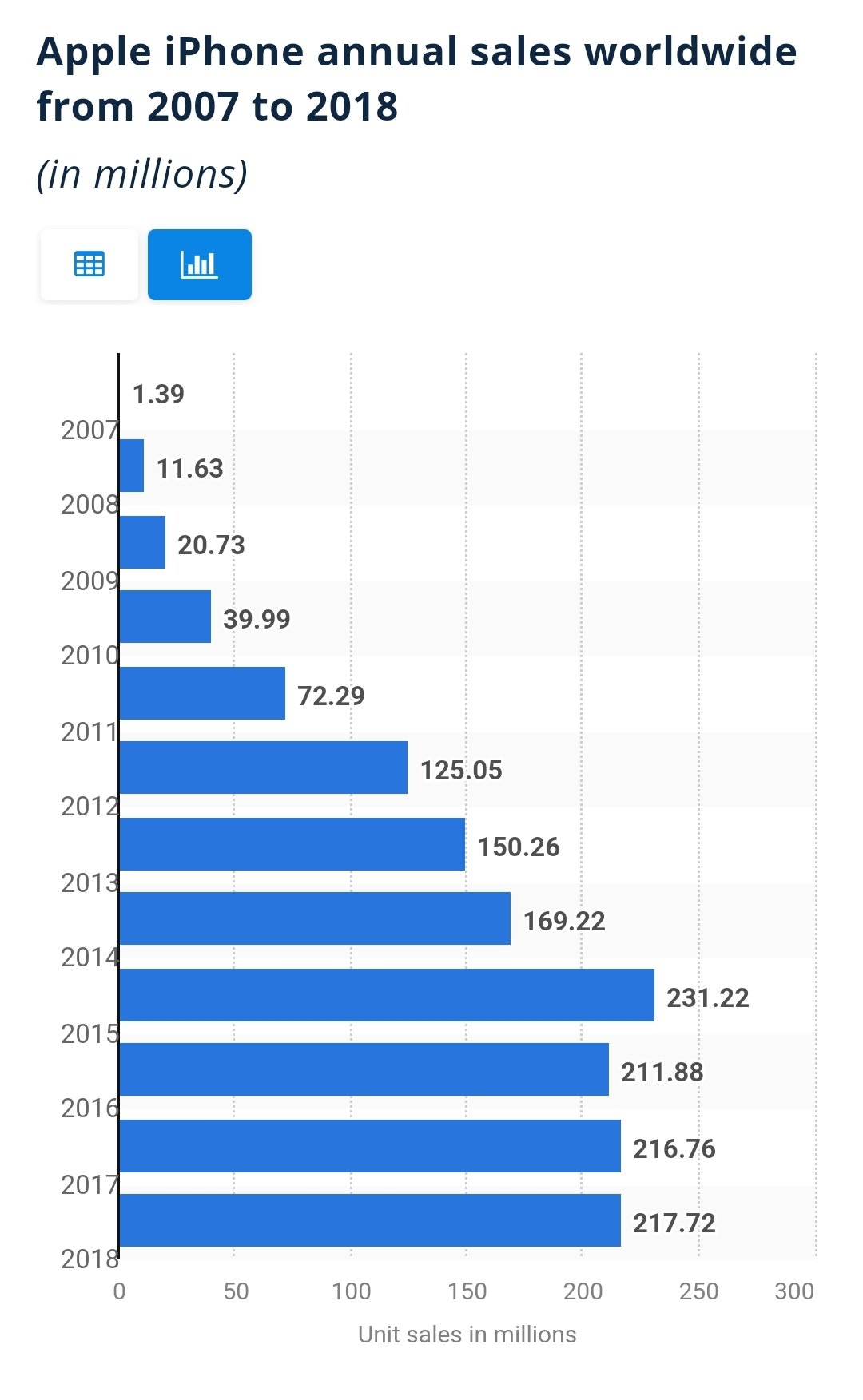

Was just looking at iphone sales. We're so clearly on a similar trajectory, perhaps on about double or triple the time scale.

It's 2010/11 in the iPhone timeline, the idea of owning an EV has just gone somewhat mainstream, but volumes are still limited. People question if there's room for growth and if more than 20% of consumers even want a smartphone.

Tesla will keep it's insane lead another 4 or 5 years, then begin to level off as the android options fill the market gaps. We shall see if that turns into robotaxi time or not.

I don't really care if robotaxi becomes reality. My hope is simply for greater transport efficiency that's also 100% EV so we can turn our focus to the grid.

Long before the S-curve completes for EVs.....we then begin another far larger ascent up the Energy S-curve. That's what I'm interested in.

Lord only knows what it'll even look like. Reshaping the energy system of the entire planet isn't exactly a consumer product. Hopefully we get a really good idea of how much storage is needed globally and there's a quantifiable goldrush to meet that threshold.

Most of this could and IMO likely will happen over the next 15 years. Bananas.

It's 2010/11 in the iPhone timeline, the idea of owning an EV has just gone somewhat mainstream, but volumes are still limited. People question if there's room for growth and if more than 20% of consumers even want a smartphone.

Tesla will keep it's insane lead another 4 or 5 years, then begin to level off as the android options fill the market gaps. We shall see if that turns into robotaxi time or not.

I don't really care if robotaxi becomes reality. My hope is simply for greater transport efficiency that's also 100% EV so we can turn our focus to the grid.

Long before the S-curve completes for EVs.....we then begin another far larger ascent up the Energy S-curve. That's what I'm interested in.

Lord only knows what it'll even look like. Reshaping the energy system of the entire planet isn't exactly a consumer product. Hopefully we get a really good idea of how much storage is needed globally and there's a quantifiable goldrush to meet that threshold.

Most of this could and IMO likely will happen over the next 15 years. Bananas.

B

betstarship

Guest

Wholeheartedly think this is awesome and can think of the same path you're talking about. Then, robots!

Was just looking at iphone sales. We're so clearly on a similar trajectory, perhaps on about double or triple the time scale.

It's 2010/11 in the iPhone timeline, the idea of owning an EV has just gone somewhat mainstream, but volumes are still limited. People question if there's room for growth and if more than 20% of consumers even want a smartphone.

Tesla will keep it's insane lead another 4 or 5 years, then begin to level off as the android options fill the market gaps. We shall see if that turns into robotaxi time or not.

View attachment 829583

I don't really care if robotaxi becomes reality. My hope is simply for greater transport efficiency that's also 100% EV so we can turn our focus to the grid.

Long before the S-curve completes for EVs.....we then begin another far larger ascent up the Energy S-curve. That's what I'm interested in.

Lord only knows what it'll even look like. Reshaping the energy system of the entire planet isn't exactly a consumer product. Hopefully we get a really good idea of how much storage is needed globally and there's a quantifiable goldrush to meet that threshold.

Most of this could and IMO likely will happen over the next 15 years. Bananas.

bkp_duke

Well-Known Member

If we come in remotely close to TE's estimates, I'll be beyond elated.

bkp_duke

Well-Known Member

Yes because that’s not fun when they put in a zipperView attachment 829593

Off-topic, but objectively, I would have not used staples there. I know they are common on the head, but unless the guy was going to grow his hair out, that's going to be a prominent scar. IMHO a wound like that deserves a little more TLC to reduce scaring. I once spent and entire ER shift on a woman's back (pushed through a plate glass window) doing subcuticular stitching because . . . scars matter (I stopped counting after the equivalent of ~400 stitches).

Thekiwi

Active Member

In the age of Covid, Energy shortages & trade wars there is no way to know which of your “available parts“ becomes a “part limited” item, so best to have safety stock of every part.Some may be safety stock, but if production is part limited, buffering the available parts isn't very advantageous.

StarFoxisDown!

Well-Known Member

He’s getting to those numbers by having expectations that the price hikes ove the past 2-3 quarters will start hitting earnings in a big way starting in Q2.

I would remind people, while ASP increased in Q1, I still haven’t seen the impact from those price hikes actually flow into earnings in any meaningful way. Maybe Q2 is the quarter it finally happens

True, but if your other suppliers are meeting your orders and only a few are lacking in the short term, you'll end up with extra stock anyway.In the age of Covid, Energy shortages & trade wars there is no way to know which of your “available parts“ becomes a “part limited” item, so best to have safety stock of every part.

If we come in remotely close to TE's estimates, I'll be beyond elated.

I feel TE's estimate is way too high. James Stephenson's $1.73 is much more realistic in my opinion for Q2.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K