If they'd just increase the range in the Plaid X to over 400 miles I'd finally consider trading in my Sig P90D. The Plaid X was the first update that has tempted me, but for now I will continue to hold my Day 1 CT reservation as the alternative and hope it will fit in my garage. I will pay over $100K for the Quad CT or whatever a 400 mile Plaid X would cost. How many years before they satisfy all the Day 1 CT reservations? Hoping my Sig X holds out until it's available. I love my Sig Red X.Tri-motor is the Plaid powertrain and quad-motor is probably whatever they're going to put in the Roadster. S&X Plaids are priced at $136k and $139k respectively. And the base S&X are $105k and $112k. This is why I think Cybertrucks will sell for $100k+ for a while. S&X also have been around for a while and aren't as flashy and exotic, so they won't even have the novelty factor of the Cybertruck launch. If Cybertruck is going to be "an insane technology bandwagon" then I'm sure it will have the extra technology S&X have and maybe more. Elon is saying he thinks it's Tesla magnum opus. It's also a bigger vehicle with more room, higher road position, more safety, more storage room and more functionality. Many people in North America are willing to pay a lot extra for this kind of convenience and capability.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

That is not unreasonable for delivery next year.My Cybertruck budget is 207 * SP (It was 69* SP but s**it happens). So the SP better start moving if we’re going to hit these 6 figure Cybertruck prices y’all are talking about.

MC3OZ

Active Member

Under my scenario 2170s would go into Semis and probably Powerwalls.What do you think Panasonic will do with their ~40GWh/yr of 2170 capacity at Giga Nevada if Fremont switches to 4680s?

I don't think Fremont will switch. If they do expand production capacity, IMO it'll be for LFP models. For the same reason Tesla hasn't stop the flow of 18650s from Japan, I think Tesla keeps the 2170 production pipeline churning away. When the cell making machinery has reached its age limit, sure, go to the new tech. But by then, supply has to catch up to demand.

Cheers!

The may keep some production of 2170 Model 3/Y and LFP.

Mostly my plan is to free up adequate volumes of 2170s for Semi production.

But I also think they want to use 4680s for all models if/when this is possible.

18650s can also be used for Powerwalls with the right chemistry.

Giga Nevada might also covert to producing 4680s or making 2170s with single crystal cathode supplied by Tesla.

What I am saying here is long lasting batteries with many cycles are a great option for the Semi and Powerwalls.

There are obviously many ways to "feed the cat a nice bowl of cream"* (*yes, I modified that saying because of a particular cat).

We are speculating in slightly different directions, and who knows what they will actually do. My hunch is the ability to rapidly iterate the 4680 product and the production process is all important. So I predict 1-2 Gens of cells, and production equipment every year.

Knightshade

Well-Known Member

Under my scenario 2170s would go into Semis and probably Powerwalls.

Doesn't LFP make massively more sense long-term for stationary storage?

I wish all talk of moody's would include Elons comment.

They truly represent the worst Wallstreet has to offer.

Pay to play trash...the world will be a better place when they are gone.

They truly represent the worst Wallstreet has to offer.

Pay to play trash...the world will be a better place when they are gone.

thesmokingman

Active Member

Yeap, irrelevant much like Consumer Reports, JD Power, the list goes on and on. This Pay To Win scheme needs to die.

dhanson865

Well-Known Member

For all we know the Optimus robot has a form factor preference for smaller cells.What do you think Panasonic will do with their ~40GWh/yr of 2170 capacity at Giga Nevada if Fremont switches to 4680s?

Maybe Optimus can use up 18650 and 2170 cells and let the cars standardise on a single cell (ignoring the iron variants of LFP and LFMP that won't be cylindrical)

Gigapress

Trying to be less wrong

Wow This US Tax Change is Huge

After all the consternation and moaning in the last year about the US government wanting to screw over Tesla while claiming to support sustainable energy, now that the dust has settled what we actually are left with is amazing. I'm stunned the the US government actually passed a law that's this heavily in favor of getting off fossil fuels. I'm estimating $23 billion of impact to Tesla's profit just in the first two years.

The Inflation Reduction Act gives:

Megapack

Tesla says the Lathrop, California plant is going to produce 40 GWh. Let's assume Tesla isn't sandbagging like they are with Shanghai's ">750k" number.

Semi

The Semi would get a $45k subsidy for a 1 MWh battery pack, which is 22.5% of its $200k list price.

Cars

For every car Tesla sells with average battery size of 80 kWh, the subsidy is $3.6k.

Direct Subsidy Total

So Tesla could get in total $1.8B + $3.6B = $5.4B or about $1.50/share in direct subsidy incentives from the US government in 2023.

Consumer $7.5k Credit

That $5.4 billion is in addition to whatever extra revenue Tesla ends up getting due to the $7.5k consumer tax credit, either from more price rises or more customers using some of the savings to buy upgrades like paint, wheels, tow hitch, FSD etc. If half of that, $3.7k, goes to Tesla as increased revenue and Tesla sells 1M cars in the US in '23, then that brings us up to $9.1B or $2.54/share estimated for the government sustainable energy incentives.

Residential Solar + Storage 30% Credit

The IRA also extends the life of the 30% tax credit for home solar, and now it includes storage such as Powerwalls too.

I have to guess more with this one because we don't have good data on this and I haven't looked much into the current state of the solar side. Tesla deployed 100 MW of solar in Q2. If that's at an average price on the order of $2/W and half of Tesla Solar was for residential instead of commercial or utility scale, then that's $100M of residential solar revenue which is about to resume getting a 30% government bonus for the customers, plus the same bonus for all Powerwall sales. As the solar business grows to a multibillion-dollar operation this incentive will partially flow back to Tesla, but it's not as significant as the battery and EV credits.

Stacking It Up

This law is very likely to stay in effect until at least the end of President Biden's 1st term, which is over in January '25. Since Tesla will sell even more in the US in '24 than in '23, that might be more like $4.00/share in benefits from the policy, for a combined total of ~$6.50/share or $23 billion of estimated value just in the first two years. This isn't counting the 30% solar benefit, which would add even more bonus.

For a sense of scale:

What If the Law Lasts Longer?

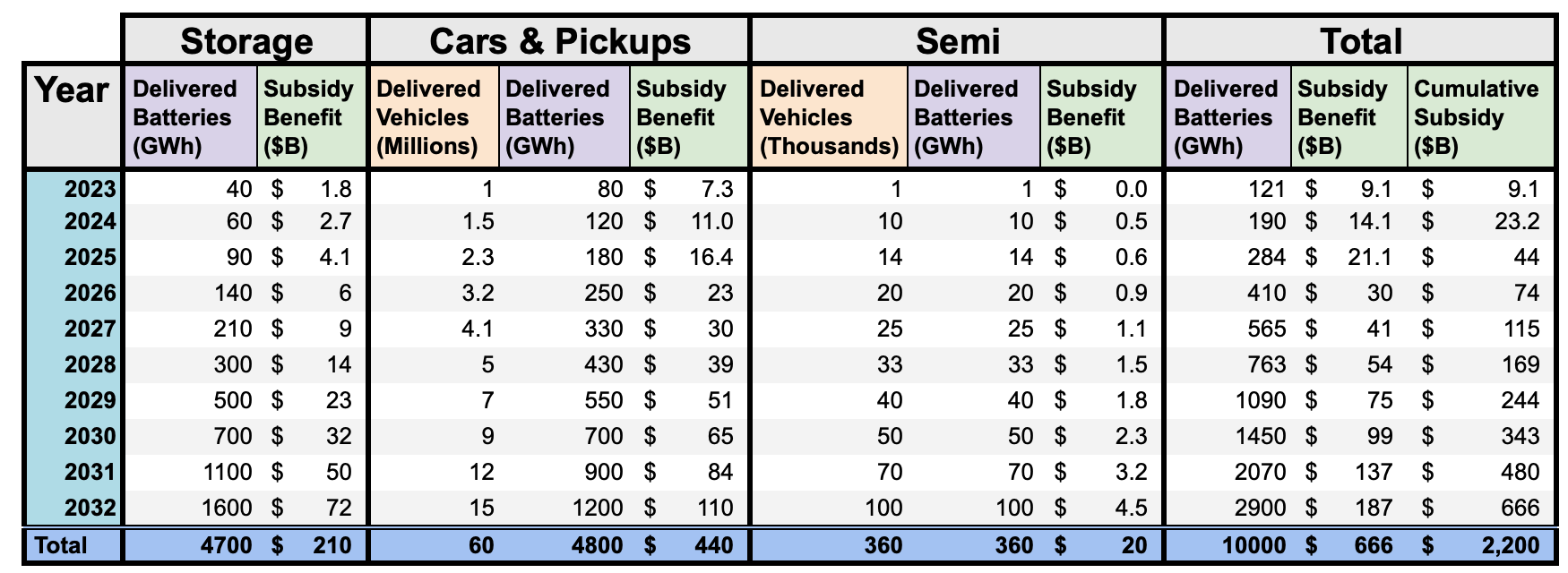

If the law persists any longer than that, then the benefit to Tesla will be enormous. In theory the IRA doesn't have these credits expire until after 2032.

Here's an idea of how crazy this could get if Tesla grows like they say they will and the law stays in place, I estimate they would garner a cumulative total of $670 BILLION in subsidy impact. I seriously doubt this law will last in its current form much past 2025 or 2026 because it will get increasingly hard to justify to voters why Tesla is getting such big handouts, and the total cost will include subsidies for all the hybrids and batteries from other companies that can meet the sourcing requirements.

After all the consternation and moaning in the last year about the US government wanting to screw over Tesla while claiming to support sustainable energy, now that the dust has settled what we actually are left with is amazing. I'm stunned the the US government actually passed a law that's this heavily in favor of getting off fossil fuels. I'm estimating $23 billion of impact to Tesla's profit just in the first two years.

The Inflation Reduction Act gives:

- $45/kWh subsidy to battery cell and pack manufacturers

- $7.5k refundable EV tax credit to people of most normal income levels

- 30% of total cost of residential solar + storage cost in refundable tax credit

Megapack

Tesla says the Lathrop, California plant is going to produce 40 GWh. Let's assume Tesla isn't sandbagging like they are with Shanghai's ">750k" number.

$45 / kWh = $45M / GWh --> 40 GWh gets $1.8B subsidy per year, which is $0.50/share with 3.6B shares outstanding next year.

Semi

The Semi would get a $45k subsidy for a 1 MWh battery pack, which is 22.5% of its $200k list price.

$45M subsidy for every 1k Semis sold in USA.

Cars

For every car Tesla sells with average battery size of 80 kWh, the subsidy is $3.6k.

If the average revenue per car is $60k by next year, that's 6% increase in gross margin for free.

Tesla will sell ~1M cars in America next year, so that's $3.6B, or $1/share, straight to the bottom line.

Direct Subsidy Total

So Tesla could get in total $1.8B + $3.6B = $5.4B or about $1.50/share in direct subsidy incentives from the US government in 2023.

Consumer $7.5k Credit

That $5.4 billion is in addition to whatever extra revenue Tesla ends up getting due to the $7.5k consumer tax credit, either from more price rises or more customers using some of the savings to buy upgrades like paint, wheels, tow hitch, FSD etc. If half of that, $3.7k, goes to Tesla as increased revenue and Tesla sells 1M cars in the US in '23, then that brings us up to $9.1B or $2.54/share estimated for the government sustainable energy incentives.

Residential Solar + Storage 30% Credit

The IRA also extends the life of the 30% tax credit for home solar, and now it includes storage such as Powerwalls too.

I have to guess more with this one because we don't have good data on this and I haven't looked much into the current state of the solar side. Tesla deployed 100 MW of solar in Q2. If that's at an average price on the order of $2/W and half of Tesla Solar was for residential instead of commercial or utility scale, then that's $100M of residential solar revenue which is about to resume getting a 30% government bonus for the customers, plus the same bonus for all Powerwall sales. As the solar business grows to a multibillion-dollar operation this incentive will partially flow back to Tesla, but it's not as significant as the battery and EV credits.

Stacking It Up

This law is very likely to stay in effect until at least the end of President Biden's 1st term, which is over in January '25. Since Tesla will sell even more in the US in '24 than in '23, that might be more like $4.00/share in benefits from the policy, for a combined total of ~$6.50/share or $23 billion of estimated value just in the first two years. This isn't counting the 30% solar benefit, which would add even more bonus.

For a sense of scale:

- Analyst average forecasts according to Marketwatch (link) are for Tesla to earn $5.81/share in '23 and $7.02 in '24.

- Tesla has earned $3.54/share total cumulative net income since turning profitable in 2019.

- The 2024 subsidy estimate is almost as much as annual US federal subsidies for the entire agriculture industry.

What If the Law Lasts Longer?

If the law persists any longer than that, then the benefit to Tesla will be enormous. In theory the IRA doesn't have these credits expire until after 2032.

Here's an idea of how crazy this could get if Tesla grows like they say they will and the law stays in place, I estimate they would garner a cumulative total of $670 BILLION in subsidy impact. I seriously doubt this law will last in its current form much past 2025 or 2026 because it will get increasingly hard to justify to voters why Tesla is getting such big handouts, and the total cost will include subsidies for all the hybrids and batteries from other companies that can meet the sourcing requirements.

| Storage | Cars & Pickups | Semi | Total | ||||||||

| Year | Delivered Batteries (GWh) | Subsidy Benefit ($B) | Delivered Vehicles (Millions) | Delivered Batteries (GWh) | Subsidy Benefit ($B) | Delivered Vehicles (Thousands) | Delivered Batteries (GWh) | Subsidy Benefit ($B) | Delivered Batteries (GWh) | Subsidy Benefit ($B) | Cumulative Subsidy ($B) |

| 2023 | 40 | $ 1.8 | 1 | 80 | $ 7.3 | 1 | 1 | $ 0.0 | 121 | $ 9.1 | $ 9.1 |

| 2024 | 60 | $ 2.7 | 1.5 | 120 | $ 11.0 | 10 | 10 | $ 0.5 | 190 | $ 14.1 | $ 23.2 |

| 2025 | 90 | $ 4.1 | 2.3 | 180 | $ 16.4 | 14 | 14 | $ 0.6 | 284 | $ 21.1 | $ 44 |

| 2026 | 140 | $ 6 | 3.2 | 250 | $ 23 | 20 | 20 | $ 0.9 | 410 | $ 30 | $ 74 |

| 2027 | 210 | $ 9 | 4.1 | 330 | $ 30 | 25 | 25 | $ 1.1 | 565 | $ 41 | $ 115 |

| 2028 | 300 | $ 14 | 5 | 430 | $ 39 | 33 | 33 | $ 1.5 | 763 | $ 54 | $ 169 |

| 2029 | 500 | $ 23 | 7 | 550 | $ 51 | 40 | 40 | $ 1.8 | 1090 | $ 75 | $ 244 |

| 2030 | 700 | $ 32 | 9 | 700 | $ 65 | 50 | 50 | $ 2.3 | 1450 | $ 99 | $ 343 |

| 2031 | 1100 | $ 50 | 12 | 900 | $ 84 | 70 | 70 | $ 3.2 | 2070 | $ 137 | $ 480 |

| 2032 | 1600 | $ 72 | 15 | 1200 | $ 110 | 100 | 100 | $ 4.5 | 2900 | $ 187 | $ 666 |

| Total | 4700 | $ 210 | 60 | 4800 | $ 440 | 360 | 360 | $ 20 | 10000 | $ 666 | $ 2,200 |

Last edited by a moderator:

Artful Dodger

"Neko no me"

For all we know the Optimus robot has a form factor preference for smaller cells.

Maybe Optimus can use up 18650 and 2170 cells and let the cars standardise on a single cell (ignoring the iron variants of LFP and LFMP that won't be cylindrical)

Asta la vista, Moody's...

Cheers to the Te'bots!

ZeApelido

Active Member

Wow This US Tax Change is Huge

After all the consternation and moaning in the last year about the US government wanting to screw over Tesla while claiming to support sustainable energy, now that the dust has settled what we actually are left with is amazing. I'm stunned the the US government actually passed a law that's this heavily in favor of getting off fossil fuels. I'm estimating $23 billion of impact to Tesla's profit just in the first two years.

The Inflation Reduction Act gives:

- $45/kWh subsidy to battery cell and pack manufacturers

- $7.5k refundable EV tax credit to people of most normal income levels

- 30% of total cost of residential solar + storage cost in refundable tax credit

Megapack

Tesla says the Lathrop, California plant is going to produce 40 GWh. Let's assume Tesla isn't sandbagging like they are with Shanghai's ">750k" number.

$45 / kWh = $45M / GWh --> 40 GWh gets $1.8B subsidy per year, which is $0.50/share with 3.6B shares outstanding next year.

Semi

The Semi would get a $45k subsidy for a 1 MWh battery pack, which is 22.5% of its $200k list price.

$45M subsidy for every 1k Semis sold in USA.

Cars

For every car Tesla sells with average battery size of 80 kWh, the subsidy is $3.6k.

If the average revenue per car is $60k by next year, that's 6% increase in gross margin for free.Tesla will sell ~1M cars in America next year, so that's $3.6B, or $1/share, straight to the bottom line.

Direct Subsidy Total

So Tesla could get in total $1.8B + $3.6B = $5.4B or about $1.50/share in direct subsidy incentives from the US government in 2023.

Consumer $7.5k Credit

That $5.4 billion is in addition to whatever extra revenue Tesla ends up getting due to the $7.5k consumer tax credit, either from more price rises or more customers using some of the savings to buy upgrades like paint, wheels, tow hitch, FSD etc. If half of that goes to Tesla as increased revenue and Tesla sells 1M cars in the US in '23, then that's another brings us up to $9.1B or $2.54/share estimated for the government sustainable energy incentives.

Residential Solar + Storage 30% Credit

The IRA also extends the life of the 30% tax credit for home solar, and now it includes storage such as Powerwalls too.

I have to guess more with this one because we don't have good data on this and I haven't looked much into the current state of the solar side. Tesla deployed 100 MW of solar in Q2. If that's at an average price on the order of $2/W and half of Tesla Solar was for residential instead of commercial or utility scale, then that's $100M of residential solar revenue which is about to resume getting a 30% government bonus for the customers, plus the same bonus for all Powerwall sales. As the solar business grows to a multibillion-dollar operation this incentive will partially flow back to Tesla, but it's not as significant as the battery and EV credits.

Stacking It Up

This law is very likely to stay in effect until at least the end of Biden's 1st term, which is over in January '25. Since Tesla will sell even more in the US in '24 than in '23, that might be more like $4.00/share in benefits from the policy, for a combined total of ~$6.50/share or $23 billion of estimated value just in the first two years. This isn't counting the 30% solar benefit, which would add even more bonus.

For a sense of scale:

- Analyst average forecasts according to Marketwatch (link) are for Tesla to earn $5.81/share in '23 and $7.02 in '24.

- Tesla has earned $3.54/share total cumulative net income since turning profitable in 2019.

- The 2024 subsidy estimate is almost as much as annual US federal subsidies for the entire agriculture industry.

What If the Law Lasts Longer?

If the law persists any longer than that, then the benefit to Tesla will be enormous. In theory the IRA doesn't have these credits expire until after 2032.

Here's an idea of how crazy this could get if Tesla grows like they say they will and the law stays in place, I estimate they would garner a cumulative total of $2.2 TRILLION in subsidy impact. I seriously doubt this law will last in its current form much past 2025 or 2026 because it will get increasingly hard to justify to voters why Tesla is getting such big handouts, and the total cost will include subsidies for all the hybrids and batteries from other companies that can meet the sourcing requirements.

View attachment 848477

Storage Cars & Pickups Semi Total Year Delivered Batteries (GWh) Subsidy Benefit ($B) Delivered Vehicles (Millions) Delivered Batteries (GWh) Subsidy Benefit ($B) Delivered Vehicles (Thousands) Delivered Batteries (GWh) Subsidy Benefit ($B) Delivered Batteries (GWh) Subsidy Benefit ($B) Cumulative Subsidy ($B) 2023 40 $ 1.8 1 80 $ 7.3 1 1 $ 0.0 121 $ 9.1 $ 9.1 2024 60 $ 2.7 1.5 120 $ 11.0 10 10 $ 0.5 190 $ 14.1 $ 23.2 2025 90 $ 4.1 2.3 180 $ 16.4 14 14 $ 0.6 284 $ 21.1 $ 44 2026 140 $ 6 3.2 250 $ 23 20 20 $ 0.9 410 $ 30 $ 74 2027 210 $ 9 4.1 330 $ 30 25 25 $ 1.1 565 $ 41 $ 115 2028 300 $ 14 5 430 $ 39 33 33 $ 1.5 763 $ 54 $ 169 2029 500 $ 23 7 550 $ 51 40 40 $ 1.8 1090 $ 75 $ 244 2030 700 $ 32 9 700 $ 65 50 50 $ 2.3 1450 $ 99 $ 343 2031 1100 $ 50 12 900 $ 84 70 70 $ 3.2 2070 $ 137 $ 480 2032 1600 $ 72 15 1200 $ 110 100 100 $ 4.5 2900 $ 187 $ 666 Total 4700 $ 210 60 4800 $ 440 360 360 $ 20 10000 $ 666 $ 2,200

TLDR Tesla is gonna bankrupt the U.S.

$USD --> $USDQ

thesmokingman

Active Member

In the back of my mind and probably a lot of others is how the **** are they gonna pay for all this, especially given the ludicrous deficit? It's insanity.TLDR Tesla is gonna bankrupt the U.S.

$USD --> $USDQ

I’m just imagining what Bernie Sanders and AOC will say to their staff when they realized they handed Tesla and Elon Musk a great big huge payday.

I’m sure they will be super proud that they are doing good things for the environment.

Then change the law to add caps (which… makes a ton of sense regardless).

I’m sure they will be super proud that they are doing good things for the environment.

Then change the law to add caps (which… makes a ton of sense regardless).

In the back of my mind and probably a lot of others is how the **** are they gonna pay for all this, especially given the ludicrous deficit? It's insanity.

They will tax Tesla of course. Or perhaps Elon Musk directly.

Personally, if I thought this kind of kick in the pants were needed to get this revolution going, I’d say it was fantastic. But it’s not super clear it’s going to actually change anything since Tesla was already pushing as hard as they could and nobody else seems to have a clue.

Artful Dodger

"Neko no me"

In the back of my mind and probably a lot of others is how the **** are they gonna pay for all this, especially given the ludicrous deficit? It's insanity.

Minimun Corporate Tax rate moves to 15% in January. If Tesla makes $20B in net income in 2023, that implies a minimun tax owing of $1.5B so the 'rebates' come out of that.

Accident

Member

Wow This US Tax Change is Huge

After all the consternation and moaning in the last year about the US government wanting to screw over Tesla while claiming to support sustainable energy, now that the dust has settled what we actually are left with is amazing. I'm stunned the the US government actually passed a law that's this heavily in favor of getting off fossil fuels. I'm estimating $23 billion of impact to Tesla's profit just in the first two years.

The Inflation Reduction Act gives:

- $45/kWh subsidy to battery cell and pack manufacturers

- $7.5k refundable EV tax credit to people of most normal income levels

- 30% of total cost of residential solar + storage cost in refundable tax credit

Megapack

Tesla says the Lathrop, California plant is going to produce 40 GWh. Let's assume Tesla isn't sandbagging like they are with Shanghai's ">750k" number.

$45 / kWh = $45M / GWh --> 40 GWh gets $1.8B subsidy per year, which is $0.50/share with 3.6B shares outstanding next year.

Semi

The Semi would get a $45k subsidy for a 1 MWh battery pack, which is 22.5% of its $200k list price.

$45M subsidy for every 1k Semis sold in USA.

Cars

For every car Tesla sells with average battery size of 80 kWh, the subsidy is $3.6k.

If the average revenue per car is $60k by next year, that's 6% increase in gross margin for free.Tesla will sell ~1M cars in America next year, so that's $3.6B, or $1/share, straight to the bottom line.

Direct Subsidy Total

So Tesla could get in total $1.8B + $3.6B = $5.4B or about $1.50/share in direct subsidy incentives from the US government in 2023.

Consumer $7.5k Credit

That $5.4 billion is in addition to whatever extra revenue Tesla ends up getting due to the $7.5k consumer tax credit, either from more price rises or more customers using some of the savings to buy upgrades like paint, wheels, tow hitch, FSD etc. If half of that goes to Tesla as increased revenue and Tesla sells 1M cars in the US in '23, then that's another brings us up to $9.1B or $2.54/share estimated for the government sustainable energy incentives.

Residential Solar + Storage 30% Credit

The IRA also extends the life of the 30% tax credit for home solar, and now it includes storage such as Powerwalls too.

I have to guess more with this one because we don't have good data on this and I haven't looked much into the current state of the solar side. Tesla deployed 100 MW of solar in Q2. If that's at an average price on the order of $2/W and half of Tesla Solar was for residential instead of commercial or utility scale, then that's $100M of residential solar revenue which is about to resume getting a 30% government bonus for the customers, plus the same bonus for all Powerwall sales. As the solar business grows to a multibillion-dollar operation this incentive will partially flow back to Tesla, but it's not as significant as the battery and EV credits.

Stacking It Up

This law is very likely to stay in effect until at least the end of Biden's 1st term, which is over in January '25. Since Tesla will sell even more in the US in '24 than in '23, that might be more like $4.00/share in benefits from the policy, for a combined total of ~$6.50/share or $23 billion of estimated value just in the first two years. This isn't counting the 30% solar benefit, which would add even more bonus.

For a sense of scale:

- Analyst average forecasts according to Marketwatch (link) are for Tesla to earn $5.81/share in '23 and $7.02 in '24.

- Tesla has earned $3.54/share total cumulative net income since turning profitable in 2019.

- The 2024 subsidy estimate is almost as much as annual US federal subsidies for the entire agriculture industry.

What If the Law Lasts Longer?

If the law persists any longer than that, then the benefit to Tesla will be enormous. In theory the IRA doesn't have these credits expire until after 2032.

Here's an idea of how crazy this could get if Tesla grows like they say they will and the law stays in place, I estimate they would garner a cumulative total of $2.2 TRILLION in subsidy impact. I seriously doubt this law will last in its current form much past 2025 or 2026 because it will get increasingly hard to justify to voters why Tesla is getting such big handouts, and the total cost will include subsidies for all the hybrids and batteries from other companies that can meet the sourcing requirements.

View attachment 848477

Storage Cars & Pickups Semi Total Year Delivered Batteries (GWh) Subsidy Benefit ($B) Delivered Vehicles (Millions) Delivered Batteries (GWh) Subsidy Benefit ($B) Delivered Vehicles (Thousands) Delivered Batteries (GWh) Subsidy Benefit ($B) Delivered Batteries (GWh) Subsidy Benefit ($B) Cumulative Subsidy ($B) 2023 40 $ 1.8 1 80 $ 7.3 1 1 $ 0.0 121 $ 9.1 $ 9.1 2024 60 $ 2.7 1.5 120 $ 11.0 10 10 $ 0.5 190 $ 14.1 $ 23.2 2025 90 $ 4.1 2.3 180 $ 16.4 14 14 $ 0.6 284 $ 21.1 $ 44 2026 140 $ 6 3.2 250 $ 23 20 20 $ 0.9 410 $ 30 $ 74 2027 210 $ 9 4.1 330 $ 30 25 25 $ 1.1 565 $ 41 $ 115 2028 300 $ 14 5 430 $ 39 33 33 $ 1.5 763 $ 54 $ 169 2029 500 $ 23 7 550 $ 51 40 40 $ 1.8 1090 $ 75 $ 244 2030 700 $ 32 9 700 $ 65 50 50 $ 2.3 1450 $ 99 $ 343 2031 1100 $ 50 12 900 $ 84 70 70 $ 3.2 2070 $ 137 $ 480 2032 1600 $ 72 15 1200 $ 110 100 100 $ 4.5 2900 $ 187 $ 666 Total 4700 $ 210 60 4800 $ 440 360 360 $ 20 10000 $ 666 $ 2,200

If I understood the bill correctly, the new 15% minimum corporate tax that is also part of the IRA, will impact TSLA negatively and it will basically eliminate any gains from the Advance Manufacturing Production tax credit.

According to the bill, there is a $45/kWh tax credit ($35 for cells and $10 for the pack). Which would have kept TSLA tax liability at $0 until the credit expires. However, the new minimum corporate tax is set at 15% for corporations with at least $1B in profits regardless of any tax credits.

Here’s a summary from Bloomberg:

How would the corporate minimum tax work?

Companies with at least $1 billion in income would be required to calculate their annual tax liability two ways: one using longstanding tax accounting methods, which is 21% of profits less deductions and credits; the other by applying the 15% rate to the earnings they report to shareholders on their financial statements, commonly known as book income. Whichever amount is greater would be what they owe.Asking the wrong question >> MMT to the rescueIn the back of my mind and probably a lot of others is how the **** are they gonna pay for all this, especially given the ludicrous deficit? It's insanity.

Gigapress

Trying to be less wrong

Thanks, I didn’t know that. That would cut out the majority of the benefit but the $7500 consumer tax credit would still be big.If I understood the bill correctly, the new 15% minimum corporate tax that is also part of the IRA, will impact TSLA negatively and it will basically eliminate any gains from the Advance Manufacturing Production tax credit.

According to the bill, there is a $45/kWh tax credit ($35 for cells and $10 for the pack). Which would have kept TSLA tax liability at $0 until the credit expires. However, the new minimum corporate tax is set at 15% for corporations with at least $1B in profits regardless of any tax credits.

Here’s a summary from Bloomberg:

How would the corporate minimum tax work?

Companies with at least $1 billion in income would be required to calculate their annual tax liability two ways: one using longstanding tax accounting methods, which is 21% of profits less deductions and credits; the other by applying the 15% rate to the earnings they report to shareholders on their financial statements, commonly known as book income. Whichever amount is greater would be what they owe.

Are we sure the tax credit for batteries isn’t exempt from this 15% alternative minimum tax rule?

I feel like the old 21% of profit is higher so nothing will change no?If I understood the bill correctly, the new 15% minimum corporate tax that is also part of the IRA, will impact TSLA negatively and it will basically eliminate any gains from the Advance Manufacturing Production tax credit.

According to the bill, there is a $45/kWh tax credit ($35 for cells and $10 for the pack). Which would have kept TSLA tax liability at $0 until the credit expires. However, the new minimum corporate tax is set at 15% for corporations with at least $1B in profits regardless of any tax credits.

Here’s a summary from Bloomberg:

How would the corporate minimum tax work?

Companies with at least $1 billion in income would be required to calculate their annual tax liability two ways: one using longstanding tax accounting methods, which is 21% of profits less deductions and credits; the other by applying the 15% rate to the earnings they report to shareholders on their financial statements, commonly known as book income. Whichever amount is greater would be what they owe.

Tesla pays each time they issue debt, and then a smaller fee each year for ongoing monitoring. This is agreed at the time the debt is being issued and is one of the arrangement costs of issuance (usually the largest fee is paying the investment banks to sell the debt to investors, then the lawyers to produce the relevant legal docs, then smaller fees like audit, ratings, listing fees, and data providers)I am not aware of Tesla agreeing to pay Moody's to get a credit rating. If anyone knows of the situation, please respond.

Moody’s Investors Service Disclosure

Excerpt:

In 2006, Moody's Investors Service ("MIS") derived approximately 86% of its revenue from issuer payments for credit ratings. Most issuers of debt securities rated by MIS have, prior to assignment of any rating, agreed to pay MIS for rating services rendered by it. MIS's fee structures and ranges are summarized in fee schedules that are provided to issuers. The fee for any particular rating is based on a variety of factors, such as the type of rating being assigned, the complexity of the analysis being performed, and the principal amount of the issuance. Depending on such factors, fees for MIS's rating services may range from $1,500 to $2,400,000. A small number of the ratings assigned and updated by MIS are not paid for by issuers. Such ratings are subject to the same analytic standards and the same rating committee process as ratings that are paid for by issuers.

You wouldn't hear about it because it's irrelevant in size, it would be like hearing about Tesla's annual toilet paper cost

Math error with the last sum? Sum of cummulative sums? The sums don't add up, should be more like $670B right?Wow This US Tax Change is Huge

After all the consternation and moaning in the last year about the US government wanting to screw over Tesla while claiming to support sustainable energy, now that the dust has settled what we actually are left with is amazing. I'm stunned the the US government actually passed a law that's this heavily in favor of getting off fossil fuels. I'm estimating $23 billion of impact to Tesla's profit just in the first two years.

The Inflation Reduction Act gives:

- $45/kWh subsidy to battery cell and pack manufacturers

- $7.5k refundable EV tax credit to people of most normal income levels

- 30% of total cost of residential solar + storage cost in refundable tax credit

Megapack

Tesla says the Lathrop, California plant is going to produce 40 GWh. Let's assume Tesla isn't sandbagging like they are with Shanghai's ">750k" number.

$45 / kWh = $45M / GWh --> 40 GWh gets $1.8B subsidy per year, which is $0.50/share with 3.6B shares outstanding next year.

Semi

The Semi would get a $45k subsidy for a 1 MWh battery pack, which is 22.5% of its $200k list price.

$45M subsidy for every 1k Semis sold in USA.

Cars

For every car Tesla sells with average battery size of 80 kWh, the subsidy is $3.6k.

If the average revenue per car is $60k by next year, that's 6% increase in gross margin for free.Tesla will sell ~1M cars in America next year, so that's $3.6B, or $1/share, straight to the bottom line.

Direct Subsidy Total

So Tesla could get in total $1.8B + $3.6B = $5.4B or about $1.50/share in direct subsidy incentives from the US government in 2023.

Consumer $7.5k Credit

That $5.4 billion is in addition to whatever extra revenue Tesla ends up getting due to the $7.5k consumer tax credit, either from more price rises or more customers using some of the savings to buy upgrades like paint, wheels, tow hitch, FSD etc. If half of that, $3.7k, goes to Tesla as increased revenue and Tesla sells 1M cars in the US in '23, then that brings us up to $9.1B or $2.54/share estimated for the government sustainable energy incentives.

Residential Solar + Storage 30% Credit

The IRA also extends the life of the 30% tax credit for home solar, and now it includes storage such as Powerwalls too.

I have to guess more with this one because we don't have good data on this and I haven't looked much into the current state of the solar side. Tesla deployed 100 MW of solar in Q2. If that's at an average price on the order of $2/W and half of Tesla Solar was for residential instead of commercial or utility scale, then that's $100M of residential solar revenue which is about to resume getting a 30% government bonus for the customers, plus the same bonus for all Powerwall sales. As the solar business grows to a multibillion-dollar operation this incentive will partially flow back to Tesla, but it's not as significant as the battery and EV credits.

Stacking It Up

This law is very likely to stay in effect until at least the end of President Biden's 1st term, which is over in January '25. Since Tesla will sell even more in the US in '24 than in '23, that might be more like $4.00/share in benefits from the policy, for a combined total of ~$6.50/share or $23 billion of estimated value just in the first two years. This isn't counting the 30% solar benefit, which would add even more bonus.

For a sense of scale:

- Analyst average forecasts according to Marketwatch (link) are for Tesla to earn $5.81/share in '23 and $7.02 in '24.

- Tesla has earned $3.54/share total cumulative net income since turning profitable in 2019.

- The 2024 subsidy estimate is almost as much as annual US federal subsidies for the entire agriculture industry.

What If the Law Lasts Longer?

If the law persists any longer than that, then the benefit to Tesla will be enormous. In theory the IRA doesn't have these credits expire until after 2032.

Here's an idea of how crazy this could get if Tesla grows like they say they will and the law stays in place, I estimate they would garner a cumulative total of $2.2 TRILLION in subsidy impact. I seriously doubt this law will last in its current form much past 2025 or 2026 because it will get increasingly hard to justify to voters why Tesla is getting such big handouts, and the total cost will include subsidies for all the hybrids and batteries from other companies that can meet the sourcing requirements.

View attachment 848477

Storage Cars & Pickups Semi Total Year Delivered Batteries (GWh) Subsidy Benefit ($B) Delivered Vehicles (Millions) Delivered Batteries (GWh) Subsidy Benefit ($B) Delivered Vehicles (Thousands) Delivered Batteries (GWh) Subsidy Benefit ($B) Delivered Batteries (GWh) Subsidy Benefit ($B) Cumulative Subsidy ($B) 2023 40 $ 1.8 1 80 $ 7.3 1 1 $ 0.0 121 $ 9.1 $ 9.1 2024 60 $ 2.7 1.5 120 $ 11.0 10 10 $ 0.5 190 $ 14.1 $ 23.2 2025 90 $ 4.1 2.3 180 $ 16.4 14 14 $ 0.6 284 $ 21.1 $ 44 2026 140 $ 6 3.2 250 $ 23 20 20 $ 0.9 410 $ 30 $ 74 2027 210 $ 9 4.1 330 $ 30 25 25 $ 1.1 565 $ 41 $ 115 2028 300 $ 14 5 430 $ 39 33 33 $ 1.5 763 $ 54 $ 169 2029 500 $ 23 7 550 $ 51 40 40 $ 1.8 1090 $ 75 $ 244 2030 700 $ 32 9 700 $ 65 50 50 $ 2.3 1450 $ 99 $ 343 2031 1100 $ 50 12 900 $ 84 70 70 $ 3.2 2070 $ 137 $ 480 2032 1600 $ 72 15 1200 $ 110 100 100 $ 4.5 2900 $ 187 $ 666 Total 4700 $ 210 60 4800 $ 440 360 360 $ 20 10000 $ 666 $ 2,200

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K