Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Stop dodging , what is your production estimate for 2023.Oops!

still, the question begs, is this how I or anyone else should value my farm?

I say no Because that two hour run rate is meaningless

and it is why I say Tesla run rate is meaningless.

it is subject to pure bias, manipulation, hope, time scale error. It is based upon a small unit of time,

and only the chief twit aka cheerleader uses it

this qtr tesla is on track to produce 450,000 cars.

what is 450,000 times 4 ?

Correct, but it's pretty certain those funds will be Tweeter generated, not an influx of cash from him or other outside sources. Anyway, enough of this here, need to move to the proper thread.He is implying Elon will need to raise funds to run twitter.

I don’t make short term estimates.Stop dodging , what is your production estimate for 2023.

this qtr tesla is on track to produce 450,000 cars.

You keep using this word "Capacity" interchangeably with Run Rate.Let me get this straight, you are arguing against my position stating that run rate is only capacity

by argUing it is what they are capable of?

They are not the same. Since I can't clarify without repeating myself... I won't.

Do they teach multiplication in weifoph? You left off a zero, it's 219,000.Fifty pounds in 2 hrs is 25 pounds per hour.

365 days x 24 hrs per day x 25 is really really really Close to 22,000 pounds

ZeApelido

Active Member

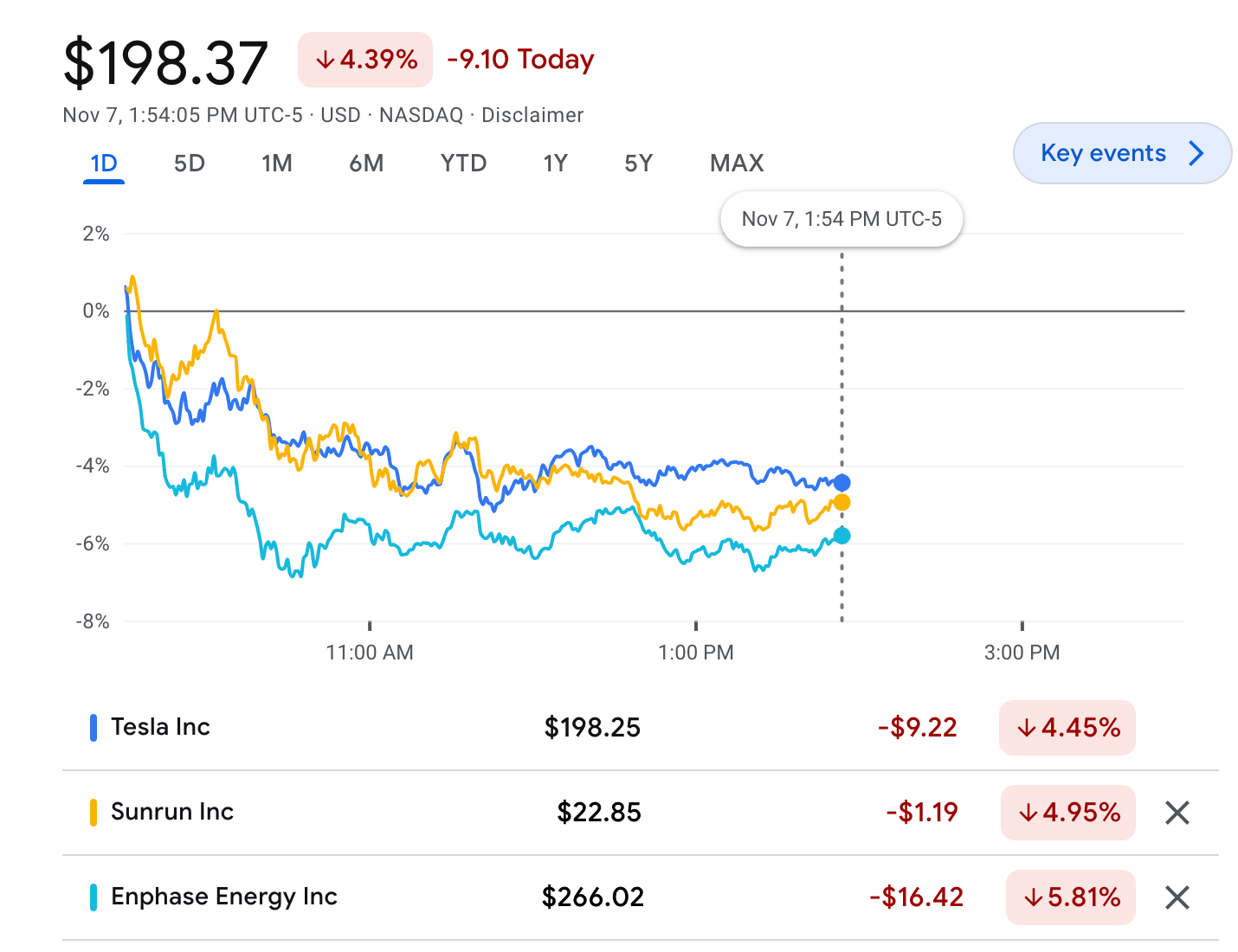

[speculation] Today's drop seems to coincide with other renewable companies, for instance Sunrun and Enphase also have similar downtrends. Rivian and Lucid a bit down but not as much. This might be related to some risk adjustment to (probably unfounded) future changes to the IRA because of tomorrow's election and political power changes.

I'm really hoping post election and CPI reports of slowing inflation can bring a bit more certainty to the market. Plz?

I'm really hoping post election and CPI reports of slowing inflation can bring a bit more certainty to the market. Plz?

Nah, getting old and reading on pad close to face changes vision.Do they teach multiplication in weifoph? You left off a zero, it's 219,000.

cusetownusa

2022 LR5 MSM/Bl | 19"

Run rate is zero for those vehicles right now. I don’t understand your argument. Can you elaborate?What is the run rate of CT or TSLA semi, today? Right now?

Regardless of that run rate, there are ZERO of those models for sale.

Run rate is capability, not production available for sale.

It is extrapolation into the FUTURE, not the present.

NO! For the love of everything good, NO!Can you elaborate?

I figured it was either that or the new math ;-)Nah, getting old and reading on pad close to face changes vision.

Gigapress

Trying to be less wrong

2 million run rate could be more like $25-30B earnings because gross profit per car is rising and operating leverage is growing.A 2 million a year run rate is within months.

That alone could translate into a $20 billion profit

Run rate within a year.

The present mkt cap of $650 billion would imply a forward p/e of 32.

for a firm growing way above 40%.

We are in the value zone, just my opinion.

$18k gross profit (let’s say it goes up about $2k from the $16k 2022 Q1-Q3 average)

$8B OpEx

$1B energy and services & other profit

15% tax

$25B net income

That matches Toyota, except with 5x fewer cars sold.

Could get to $30B with:

$19k gross profit

$7B OpEx

$2B energy and services & other profit

10% tax

Last edited:

Thekiwi

Active Member

I didn't think it would have a short term impact on TSLA stock price, but Elon taking the self destruction of his personal brand to Plaid speed over the last week makes me think I was wrong.

I didn't think it would have a short term impact on TSLA stock price, but Elon taking the self destruction of his personal brand to Plaid speed over the last week makes me think I was wrong.

Why couldn’t he just commission a 300ft yacht like a normal billionaire.

Or shave his head and buff up like Bezos ?

He could have done that 22 years ago.Why couldn’t he just commission a 300ft yacht like a normal billionaire.

Or shave his head and buff up like Bezos ?

Then you probably would not know his name.

ElectricIAC

Good-Natured Rascal

Who needs yachts when you have rockets?He could have done that 22 years ago.

Then you probably would not know his name.

and it is why I say Tesla run rate is meaningless.

it is subject to pure bias, manipulation, hope, time scale error. It is based upon a small unit of time,

and only the chief twit aka cheerleader uses it

I worked as a manufacturing engineer for 30 years, a manufacturing line's run rate is a very important metric to track and measure regularly. It is the farthest thing from "meaningless".

From your myriad of posts on the matter I don't believe you understand the term "run rate" at all. Many more people than Elon use it, I can assure you of that.

StarFoxisDown!

Well-Known Member

Yes it’s a pivotal quarter and a make or break for both bull and beat narratives because….at least for now…..there are no production interruptions at any of the Tesla factory + Austin/Berlin are in their S curve production grow to rate this quarter.Do many people feel this Q4 is a pivotal "make or break" quarter for Tesla?

To me it will likely be just another record breaking quarter which will go mostly unrecognized due to the market environment and macros. Followed by the SP not moving much at all even though it certainly would in a healthy market.

What kind of stock action are most people expecting to see after Q4 earnings?

So for the bear thesis to be true, Tesla is going to overproduce for the amount of demand bears say Tesla has (or doesn’t have) by at least 100k.

We’ve also haven’t seen a QoQ jump like we’ll see in Q4 in a quite a long time. Yes, the YoY % have looked great but again, because of the constant production interruptions, QoQ growth has been limited…..adding more to the peak everything for Tesla from bears

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K