Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Optimeer

Member

Attached for perspective the announced pricing from the Model Y unveil event on March 15th, 2019.

The new pricing in China is

- MY RWD (SR) 259‘900 CNY = 37‘880 USD (1‘120 USD lower than initially announced)

- MY LR (AWD) 309‘900 CNY = 45’150 USD (5‘850 USD lower than initially announced)

- MY P 359‘000 CNY = 52‘320 USD (7‘680 USD lower than initially announced)

I am not able to predict the original planned margins and the new margins.

For me the main question is now how the competition will react to this move. Some will be in a weak position and do have to cut production, reduce the portfolio or even close factories. This will be good for Tesla in the long term. BYD could react by lowering their prices, which would reduce the benefit of today’s price reduction.

The new pricing in China is

- MY RWD (SR) 259‘900 CNY = 37‘880 USD (1‘120 USD lower than initially announced)

- MY LR (AWD) 309‘900 CNY = 45’150 USD (5‘850 USD lower than initially announced)

- MY P 359‘000 CNY = 52‘320 USD (7‘680 USD lower than initially announced)

I am not able to predict the original planned margins and the new margins.

For me the main question is now how the competition will react to this move. Some will be in a weak position and do have to cut production, reduce the portfolio or even close factories. This will be good for Tesla in the long term. BYD could react by lowering their prices, which would reduce the benefit of today’s price reduction.

Attachments

EverettRuess

Member

Rob Mauer was punished by some for even suggesting over the last few weeks that there "could be" a demand issue in China.

Cult Member

Born on the 4th of July

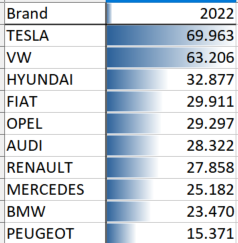

Top 10 of BEV sold in Germany 2022 - and the winner is

No clear number three after TESLA and VW, but HYUNDAI is on a good way. After them, a lot of inefficient minor production and sale. Total number of new BEV in Germany for 2022 was 470.559 from 2.651.357 cars. That's a factor of more than five still to go.

No clear number three after TESLA and VW, but HYUNDAI is on a good way. After them, a lot of inefficient minor production and sale. Total number of new BEV in Germany for 2022 was 470.559 from 2.651.357 cars. That's a factor of more than five still to go.

Without question TE future, including competitive advantage, is very relevant to us, just as Model Y competitive advantage is China vs BYD is relevant.I thought I was clear I was talking about the whole discussion, not just one half of it.

Just because a person is long winded and authoritative sounding doesn’t mean we have to keep going deeper and deeper down a rabbit hole of obscurity and irrelevance.

FWIW, my first solar power installation was 1990’s on my Bahama island. During succeeding years I have tried to keep track but I am no expert.

@petit_bateau is very knowledgeable and documents his opinions. That is VERY relevant to Tesla, especially now, as commercial, residential and utility storage are booming worldwide. I hope he continues.

@NicoV adds adds a different perspective, also documented. That is, as is his norm, very valuable.

Iread every post from both @NicoV and @petit_bateau . They are very different but both of great value to better understand TSLA risks and opportunities.

It is time for us to stop debating speculative techniques and start concentrating on the business opportunities of TSLA. TE, including grid services and Virtual Power Plants are on topic!

We do have other threads including , for example, Russia/Ukraine conflict, where topics clearly off here, but still relevant, can be discussed. Obviously we have other threads for TE, car models, etc. Here we always deal with current TSLA topical investor interest. That means there is inevitable overlap. MOD overload is ferocious when we have so many relevant items that could be, and often are, placed elsewhere.

This thread has value when non-technical ones among us can learn more about highly relevant items of current interest (e.g. new FSD advances, TE, market share and much more. Those of us uninterested in a given point can skim, while some are prodded to pursue such topics more deeply elsewhere.

Deciding just what fits here is practically impossible. Perhaps that is just as it should be. For me, anyway, my day begins on this thread.

Thanks for posting. I've been waiting for this.

As a reminder, in 2021 the Tesla Model 3 was the 2nd best selling car in the UK behind the Vauxhall Corsa

And now in 2022 we have the Tesla Model Y as the third best selling car

And in the BEV only list, those two models absolutely smash the competition.

If you add the two together, only Ford exceeds Tesla in the all cars bestsellers in 2022

Tesla is fast becoming the dominant player in new car sales in the UK

In summary UKTesla

German market looking good for Tesla in 2022, too:

-Tesla sales up 76.2% compared to 2021

-BEVs had 17.7% market share

For December:

-Tesla market share 2.6%

-Model Y most sold SUV

-Model 3 most sold EV

Pressemitteilungen - Fahrzeugzulassungen im Dezember 2022 - Jahresbilanz

Flensburg, 4. Januar 2023. Der letzte Zulassungsmonat des Jahres schließt das Jahr positiv ab. 314.318 Personenkraftwagen (Pkw) wurden im Dezember 2022 neu zugelassen, +38,1 Prozent mehr als im Dezember 2021.

Pressemitteilungen - Die Nummer 1 der Segmente und die Nummer 1 der alternativen Antriebsarten im Dezember 2022

Flensburg, 6. Januar 2023. Im Berichtsmonat Dezember 2022 zeigten sich in vier Segmenten ein Wechsel des zulassungsstärksten Modells. Im Segment der Kompaktklasse war der VW ID.3 das meist zugelassene Modell, in der Oberen Mittelklasse war es der BMW 5er. Bei den SUVs dominierte der Tesla Model...

willow_hiller

Well-Known Member

Quick pre-market musing:

We know Elon has said that his Master Plan part 3 will be about massive scale and tonnage. Sounds relatively straight forward, and it's presumably written already, so why hasn't it been shared yet?

I can only assume that there are some critical actions Tesla will take to achieve part 3 that Elon doesn't want to announce prior to undertaking them. This could easily include things like successive price cuts.

We know Elon has said that his Master Plan part 3 will be about massive scale and tonnage. Sounds relatively straight forward, and it's presumably written already, so why hasn't it been shared yet?

I can only assume that there are some critical actions Tesla will take to achieve part 3 that Elon doesn't want to announce prior to undertaking them. This could easily include things like successive price cuts.

growler23

Member

If I understand your question correctly, the ground around the house, where the grounding rod is dug in, can get extremely dry in the summer months. We also have the problem of having a soil type (lots of clay) that expands significantly when wet, and contracts a lot when dry, which one supposes could cause poor electrical grounding.Interesting. My own direct personal SolarEdge experience is that out of 24 module optimisers and approx 7-years run-time and two inverters (two separate systems) we have had a grand total of one optimiser failure and no inverter failures. Detected using SolarEdge web-monitoring within a week. Replaced within a fortnight under warranty. You don't by any chance have dry earths do you ? (In the UK there is no chance of that). Over the years I've done plenty of on and off grid systems, mostly SMA, Fronius, Mastervolt. These happen to be the only two SolarEdge.

Outside of TSLA, jobs report seems to have given macros a lift. What could the market possibly be happy about with this report as the biggest fear is rate hikes:

Market tired of selling off? Buy the news? I have no idea.

Market tired of selling off? Buy the news? I have no idea.

We tend to forget that Tesla has had an almost unique situation last year. While they were starting to ramp two money furnaces, they were able to increase selling prices to compensate for that. Probably not often you get that happy coincidence. At 3,000 a week they probably still aren’t neutral, but a hell of a lot better than at 30 a week. I’m not sure how to parse all the continuing construction, but the start up drag has to be less this year. My doofus guess is that Q1 profit will not look much different than last years. Maybe better if volume continues rapid growth.

nativewolf

Active Member

He wasn’t punished so much as some were revealing that they were indeed useless noise.Rob Mauer was punished by some for even suggesting over the last few weeks that there "could be" a demand issue in China.

Dig deeper

Member

Employment not falling off of a cliff while inflation does is the "soft landing" scenario. Hard to have a "nasty" recession unless unemployment spikes.Outside of TSLA, jobs report seems to have given macros a lift. What could the market possibly be happy about with this report as the biggest fear is rate hikes:

Market tired of selling off? Buy the news? I have no idea.

Offset by the fear that the FED may see good employment numbers as a sign to keep raising rates and in turn overdoing it.

Accident

Member

Outside of TSLA, jobs report seems to have given macros a lift. What could the market possibly be happy about with this report as the biggest fear is rate hikes:

Market tired of selling off? Buy the news? I have no idea.

Wage growth slowed. Average hourly earnings up 0.3% compared to 0.6% last month.

Mike Smith

Active Member

The fact that Tesla is able to reduce China prices so much suggests that the Shanghai upgrades dramatically reduced costs and Q4 could be a huge beat.

It's better to do one big price cut than a bunch of little ones that keep consumers waiting for more price cuts. They should do a tiny price increase in about a month to make sure everyone knows the cuts are over.

It's better to do one big price cut than a bunch of little ones that keep consumers waiting for more price cuts. They should do a tiny price increase in about a month to make sure everyone knows the cuts are over.

They [Austin and Berlin] were gross margin positive in Q3We tend to forget that Tesla has had an almost unique situation last year. While they were starting to ramp two money furnaces, they were able to increase selling prices to compensate for that. Probably not often you get that happy coincidence. At 3,000 a week they probably still aren’t neutral, but a hell of a lot better than at 30 a week. I’m not sure how to parse all the continuing construction, but the start up drag has to be less this year. My doofus guess is that Q1 profit will not look much different than last years. Maybe better if volume continues rapid growth.

On the Q2 call, Elon said they were ramping production and would adjust pricing to manage backlog.operating margin was 17.2 percent with Automotive gross margin at 27.9 percent operating margin is one of our best yet with improvements in operating leverage however Austin and Berlin ramp costs weighed on our margins particularly if you compare it to q1 removing regulatory credits and Austin and Berlin our operating margins would have been our strongest yet and auto gross margin would have been nearly 30 percent. Note that while small and growing each car we built in Austin and Berlin is contributing positively to profitability

Last year's Shanghai upgrades and production capacity increase should reduce vehicle costs further.

Artful Dodger

"Neko no me"

so why hasn't it been shared yet?

I can only assume that there are some critical actions Tesla will take to achieve part 3 that Elon doesn't want to announce prior to undertaking them.

Don't you think it prudent to wait until the battery materials sourcing requirements are made public before releasing Master Plan part 3?

I doubt that executing the plan is being delayed by not releasing the document itself. Case in point: the Lithium Hydroxide refinery in Corpus Christie, TX.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M