anthonyj

Stonks

I have 500 shares, the 50 was for a swing which I sold?Then why did you buy 50 shares?! You have to make up your mind.

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

I have 500 shares, the 50 was for a swing which I sold?Then why did you buy 50 shares?! You have to make up your mind.

China stuck Elon's Tesla with 25%-40% import tariffs and locked him out of Chinese EV incentives for years.

Elon complained to Trump he pays 25% tariff into China while Chinese cars pay 2.5% tariff coming into the USA. Elon said it was like competing in the Olympics while being forced to wear lead shoes.

After years of negotiations, a trade war, and agreeing to side deals like opening a R&D center in China and perhaps agreeing to buy cells from Chinese companies Tesla is being allowed to open its own factory in China.

Elon is a libertarian. Chinese Communist Party is exact opposite of that.

There are orders of magnitude more Chinese engineers immigrating to the USA than American engineers immigrating to China.

My brother texted me the blog below by Bill Cunningham posted on Seeking Alpha.

I generally don't pay any attention to Seeking Alpha, and I'm extremely confident there's no such day of reckoning coming.

That said, given my brother specifically asked about whether there's anything concerning with this one, and given that quickly scanning Cunningham's previous SA blogs it doesn't seem like he just posts blatant obvious nonsense, I don't want to simply dismiss this blog... no day of reckoning I'm confident of, but, some considerable liability I've not been aware of, not impossible.

For me what he writes about gets into quite technical accounting details heavily involving Solar City financial arrangements ("Variable Interest Entitiies" according to Cunningham). To be honest, it would take me many hours to study up and try to answer my brother's question... and it might turn out that all that time was spent just to discover a more jargon filled version of typical Seeking Alpha gibberish bearish false narratives.

If there's anyone here who already has the knowledge base to just read this blog in a few minutes to determine if there's anything uncovered of substance in it, I'd really appreciate your opinion on it.

Tesla's Day Of VIE Reckoning Approaches - Tesla, Inc. (NASDAQ:TSLA) | Seeking Alpha

You're mixing calls for puts. When you sell a put, you've given someone else the right to sell a stock to you at a fixed price. In the US stock market, this can happen at any time.

At under 320, he'll be forced to buy the stock at $320 (even if the stock had dropped to under $300 that day). If the stock stays above $320 and rises to $400, he'll at least collect the put premium.

Writing a $400 put would ensure that he'd have to buy the stock at $400 at anytime between now and Feb 15th! Not a good move.

Hence my "beyond the working range"

I had a heat pump in my last house. I guess it was okay for Texas weather generally but those couple of REALLY cold days in the winter you needed the "emergency heat" because basically that unit was useless for heat below freezing.

The are other units on the market that can go well below freezing, even without the superior CO2 tech, but I didn't realize that was something I needed to look out for when I had to replace my HVAC in that house ... live and learn (preferably from others' mistakes, not my own!).

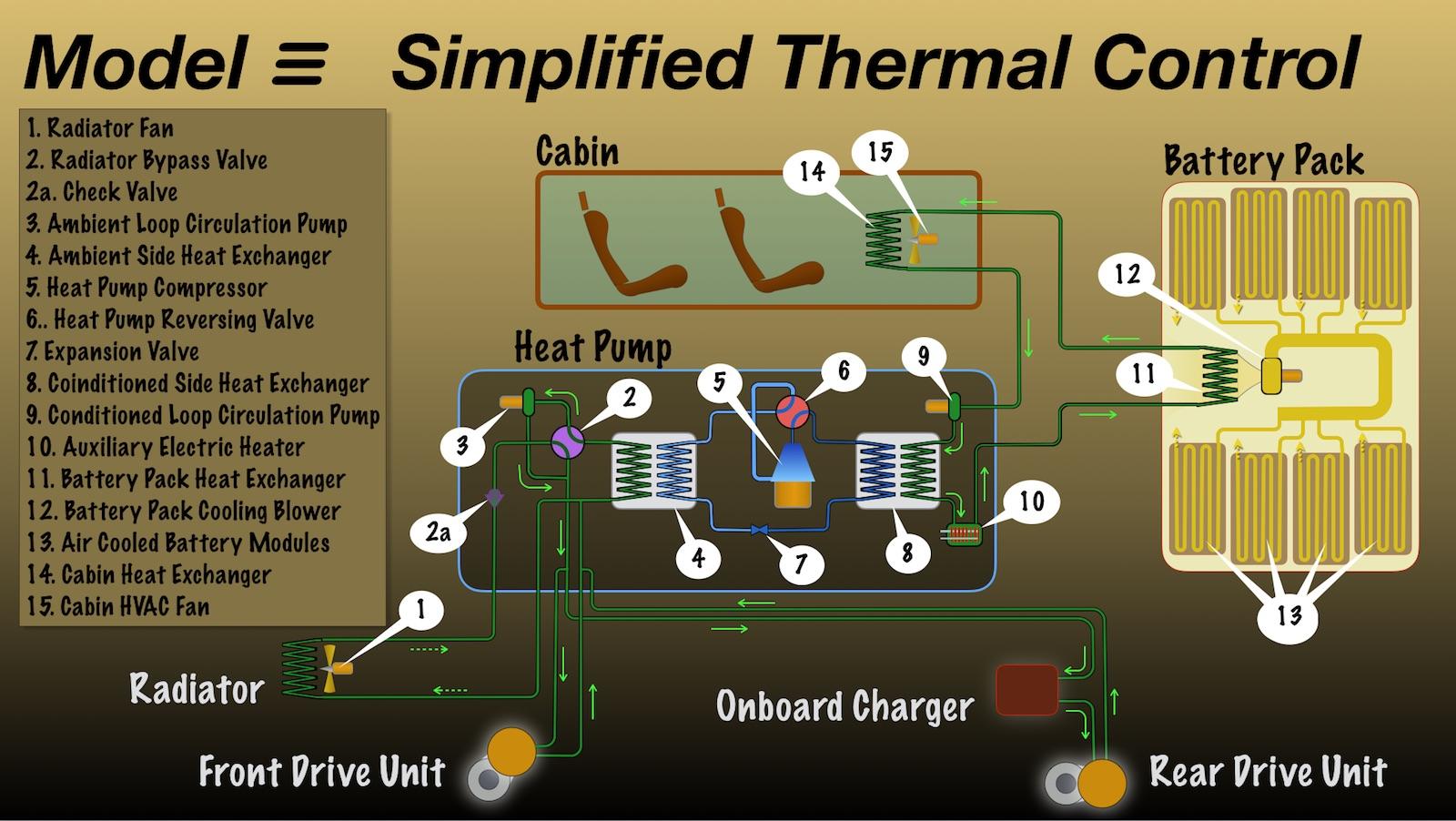

Coolant flow to the cabin runs through the pack:

If you want to heat the cabin with the compressor, you have to also heat the pack. But I suppose if you wanted pack heating you could do that via reversing heat pump flow flow (#6). Maybe if you wanted to minimize pack heating you could shut off the pack cooling blower (#12). But you certainly couldn't heat the cabin with the compressor while cooling the pack.

Still, it looks like it should be possible to heat both with the compressor, no? Hmm, if so, then shouldn't Model 3 be listed as having a reversible heat pump? I mean, there's a literal heat pump reversing valve...

ED: Also, since when does Model 3 have an "Auxiliary Electric Heater"? I thought they did away with that.... maybe this is just some low power thing and not a primary source of heat?

Your Favorite Short with another impressive article.

Volkswagen's Electricity Price Undercuts Tesla's Superchargers By 35% To 66% - Tesla, Inc. (NASDAQ:TSLA) | Seeking Alpha

Right off the bat, is he assuming a constant kW charge rate regardless of SoC? I love him.

I see. To clarify, sounds like these Solar City instruments are included in the roughly $5 billion or so of debt figure (don't remember the exact number) already widely referenced to as debt Tesla took on when they bought Solar City.

My impression is the guy blogging on SA is trying to confuse people into thinking he's found billion(s) of future Tesla liability virtually nobody was aware of, when in reality, nearly every article that has ever talked about Tesla's purchase of Solar City has noted this liability as it is part of the ~$5 billion in Solar City debt these articles so reliably mention.

fwiw, this paragraph from the SA blog apparently tricked me into thinking it might be some sort of buried liability, balance sheet gamesmanship, so I appreciate you're helping me shake off that misimpression.

"These transactions fall into a bit of a netherworld. Although they appear on Tesla's balance sheet, they are classified neither as debt nor as stockholders' equity. Instead, they are listed as "non-controlling interests" or "redeemable non-controlling interests" and are reported below the liability line in the equity section of the balance sheet."

In the Munich Tesla store I was told 0.17 € / kWh, i.e. 0.085 € / kWh @ 120 kW.

Standard Southern California Edison Rates

So I guess all that talk about electricity being much more expensive in the EU than in the USA doesn't come from California.

(Here in Germany I pay 0.24 € / kWh, about 0.27% / kWh).

0.27%?

Machine Planet on Twitter

As you can in this photo taken at 12:13 PM, a lot of Telsas are still at the pier ..

+ To improve logistics/delivery, surely Tesla must use more than one port for EU/China deliveries? maybe some from East coast for Europe?

Must be a toll-free zone ...Thanks. Time for a coffee, I guess.

Btw, a colleague of mine just returned from Iceland.

She had gone to a bar, where they would ring a bell every time a person was born in Iceland. Apparently, there was no bell for when a person died.

That only works if you don't expect the SP to keep rising. As we get to the Q4 ER, I was worried I would never see 335 again....If your covered Calls turned bad last Friday, you could have closed those and sold this weeks covered Calls, all at the same time. You wouldn't have to take the loss. If you push out a few times, there is a good chance shorts will help you out once in a while.

Unless I am missing something here, if the price goes below $320 anytime from now until February 15, the owner of those puts can put their stock to the seller at $320 per share. That's $32,000 per put sold. If "a lot" of puts is 10, that's a $320,000 obligation, if "a lot" is 100, seller of the puts will have to come up with $3.2M.......I hope I have misconstrued something here.Not understanding you. If the stock price closes just under 320 on 2/15, you made a brilliant trade. You can buy back your puts for a few cents and you'll have made even more money than if you had bought the shares represented by those puts (presumably highly leveraged) plus the premium. Yum! What would make you look somewhat stupid is if it closes at 400 that day. Then you left $80+ per share on the table -- you should have written 400 puts rather than 320s, but at least you made a bunch of money. And, of course, you'll look really stupid (plus lose money) if it closes at $250.

Duh Teslas continue to accumulate at the pier. Did they think that a single ship was going to take Tesla's entire allotment for Europe AND China for the year? They better get used to Teslas building up there; it's going to be happening for the foreseeable future. Or is the claim that because there's only 2k Model 3s on it that its a Potemkin Delivery? As if there's no other customers taking that route?