yep. 2 golden crosses and 2 death crosses in 2 daysSo it could go up or it could go down.......got it

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Or stay flat, move sideways, crash, or pop, perhaps, maybe, who knows?So it could go up or it could go down.......got it

Noticed that SpaceX is hiring for chip manufacturing in Hawthorne. For Starlink. This looks to me to be the first time that Musk Inc. has explored this type of manufacturing, leaving aside Neuralink's specialized chips.

This has obvious potential utility to Tesla some time down the road in one way or another. I do not know what type of semiconductors will be manufactured or what ideas they are exploring. Often, SpaceX seems to be the place where new ideas are explored and implemented first, then Tesla benefits also. For instance, SpaceX designed its own chips before Tesla starting doing it too. Stainless steel also. Dojo cooling, etc. Of course, this could be a limited effort for SpaceX's classified programs only, where TSMC, Samsung, and STMicroelectronics are not allowed to tread.

For anybody knowledgeable about this industry, what is a good source to educate myself about this? The job descriptions talk a lot about packaging and assembly, so if this is an indication of a very limited effort, that would be good to know.

Semiconductor Production Manager

Semiconductor Fabrication Operator Level 4/5

Semiconductor Fabrication Operator

Semiconductor Manufacturing Specialist

This has obvious potential utility to Tesla some time down the road in one way or another. I do not know what type of semiconductors will be manufactured or what ideas they are exploring. Often, SpaceX seems to be the place where new ideas are explored and implemented first, then Tesla benefits also. For instance, SpaceX designed its own chips before Tesla starting doing it too. Stainless steel also. Dojo cooling, etc. Of course, this could be a limited effort for SpaceX's classified programs only, where TSMC, Samsung, and STMicroelectronics are not allowed to tread.

For anybody knowledgeable about this industry, what is a good source to educate myself about this? The job descriptions talk a lot about packaging and assembly, so if this is an indication of a very limited effort, that would be good to know.

Semiconductor Production Manager

Semiconductor Fabrication Operator Level 4/5

Semiconductor Fabrication Operator

Semiconductor Manufacturing Specialist

Last edited:

Knightshade

Well-Known Member

Noticed that SpaceX is hiring for chip manufacturing in Hawthorne. For Starlink. This looks to me to be the first time that Musk Inc. has explored this type of manufacturing, leaving aside Neuralink's specialized chips.

This has obvious potential utility to Tesla some time down the road in one way or another. I do not know what type of semiconductors will be manufactured or what ideas they are exploring. Often, SpaceX seems to be the place where new ideas are explored and implemented first, then Tesla benefits also. For instance, SpaceX designed its own chips before Tesla starting doing it too. Stainless steel also. Dojo cooling, etc. Of course, this could be a limited effort for SpaceX's classified programs only, where TSMC, Samsung, and STMicroelectronics are not allowed to tread.

For anybody knowledgeable about this industry, what is a good source to educate myself about this? The job descriptions talk a lot about packaging and assembly, so if this is an indication of a very limited effort, that would be good to know.

Semiconductor Production Manager

Semiconductor Fabrication Operator Level 4/5

Semiconductor Fabrication Operator

Semiconductor Manufacturing Specialist

Doubtless someone deeper on this stuff than I can comment, but most of the job listing say:

SpaceX said:Starlink is taking the next step in vertical integration by bringing integrated circuit packaging and assembly in-house for development and manufacturing. You will work closely with IC packaging engineers, equipment manufacturers and leadership.

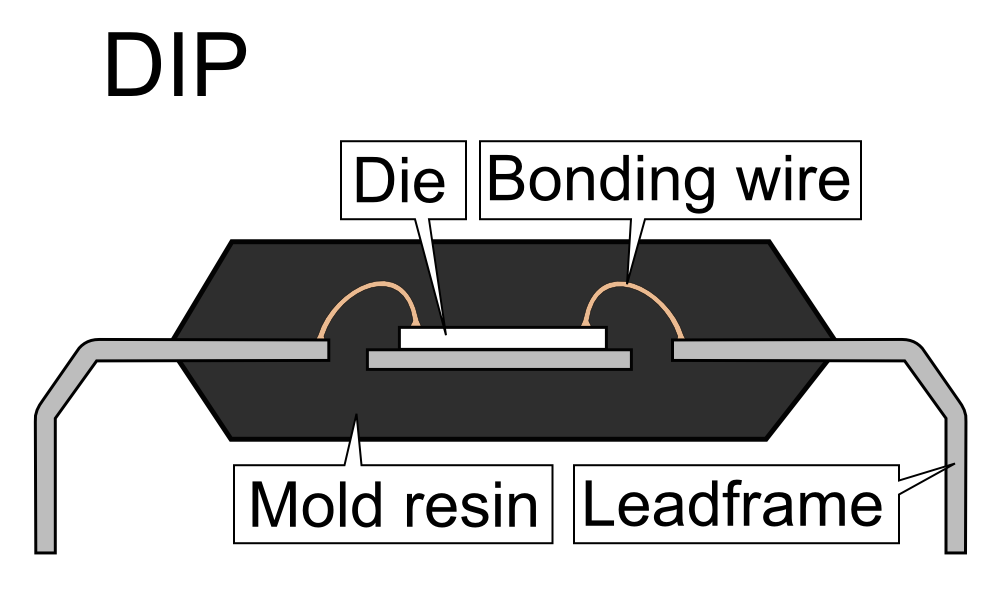

And if you're wondering what ICP is (besides that!) it's the final step of assembly-

So not actually making the wafers or chip dies, but mounting/packaging them.

Since it's for starlink it might be they still get the chip dies from a commercial fab, but need highly customized packaging for their satellites and are bringing that in house.

Would still require a decent bit of engineering knowledge and cleanroom facilities, but not NEARLY the cost or square footage needed for a real chip fab.

The manager job has a bit more, saying:

SpaceX said:Lead a team of technicians and specialists to perform wafer processing operations (wafer thinning, dicing, deposition, dispense, cleaning, picking, mounting, inspection, test, etc)

This includes some more of the later steps in the manufacturing process of chips, but still leaves out some of the most complex, and earliest, ones (manufacturing the core wafer, oxidation, lithography and etching are notably missing)

So again it sounds like they're gonna start with stuff from a "real" fab and then do the back half of the process in house as it's far less resource, tech, cost, knowledge intensive but still leaves them both potential cost savings and increased customization options....without having to invest the Billions With A B you need for a "real" fab.

Last edited:

BrownOuttaSpec

Active Member

I think you need to work on your charting skills. The 50 day SMA isn't going to fluctuate $7 over 4 hours. It should like something more like this:

Oh, that's smart given how many ICs they use in Dishy to run the phased array. And Tesla could use someDoubtless someone deeper on this stuff than I can comment, but most of the job listing say:

And if you're wondering what ICP is (besides that!) it's the final step of assembly-

So not actually making the wafers or chip dies, but mounting/packaging them.

Since it's for starlink it might be they still get the chip dies from a commercial fab, but need highly customized packaging for their satellites and are bringing that in house.

Would still require a decent bit of engineering knowledge and cleanroom facilities, but not NEARLY the cost or square footage needed for a real chip fab.

The manager job has a bit more, saying:

This includes some more of the later steps in the manufacturing process of chips, but still leaves out some of the most complex, and earliest, ones (manufacturing the core wafer, oxidation, lithography and etching are notably missing)

So again it sounds like they're gonna start with stuff from a "real" fab and then do the back half of the process in house as it's far less resource, tech, cost, knowledge intensive but still leaves them both potential cost savings and increased customization options....without having to invest the Billions With A B you need for a "real" fab.

Multi-chip module - Wikipedia too.

SpaceX is not getting into chip manufacturing. Chip fabs cost tens of billions. That is a bridge too far - even for Musk.Noticed that SpaceX is hiring for chip manufacturing in Hawthorne. For Starlink. This looks to me to be the first time that Musk Inc. has explored this type of manufacturing, leaving aside Neuralink's specialized chips.

This has obvious potential utility to Tesla some time down the road in one way or another. I do not know what type of semiconductors will be manufactured or what ideas they are exploring. Often, SpaceX seems to be the place where new ideas are explored and implemented first, then Tesla benefits also. For instance, SpaceX designed its own chips before Tesla starting doing it too. Stainless steel also. Dojo cooling, etc. Of course, this could be a limited effort for SpaceX's classified programs only, where TSMC, Samsung, and STMicroelectronics are not allowed to tread.

For anybody knowledgeable about this industry, what is a good source to educate myself about this? The job descriptions talk a lot about packaging and assembly, so if this is an indication of a very limited effort, that would be good to know.

Semiconductor Production Manager

Semiconductor Fabrication Operator Level 4/5

Semiconductor Fabrication Operator

Semiconductor Manufacturing Specialist

Looks like they want to do wafer processing and chip packaging in-house. That is relatively low grade work that most companies contract out.

Makes sense given a certain scale.

did you notice i was using a 1 minute chart.....? 6/22 - 6/23I think you need to work on your charting skills. The 50 day SMA isn't going to fluctuate $7 over 4 hours. It should like something more like this:

View attachment 950273

you are using a daily chart

TSLA fluctuated around $14 in the last 2 days, ~$250 - $264

zoom down in on the data

today only, 1 minute chart, 2 death, 1 golden. 50 day deciding what it wants to do

(whats it gonna be quant? up or down?)

If you zoom out to daily, all that below data becomes a single black candlesticK today

(a reason why a TA can get any answer they are looking for)

Last edited:

JusRelax

Active Member

There's something wrong with how the moving averages are calculated on your charts (which I assume are taken from yahoo, since I got the same readings on yahoo as your charts). The actual 50-day and 200-day moving averages are nowhere close to $260; they are at around $195-$196:did you notice i was using a 1 minute chart.....? 6/22 - 6/23

you are using a daily chart

TSLA fluctuated around $14 in the last 2 days, ~$250 - $264

zoom down in on the data

today only, 1 minute chart, 2 death, 1 golden. 50 day deciding what it wants to do

(whats it gonna be quant? up or down?)

If you zoom out to daily, all that below data becomes a single black candlesticK today

View attachment 950319

(a reason why a TA can get any answer they are looking for)

Yahoo's 1-min charts make it seem like on a daily chart the golden cross hasn't yet been achieved (yahoo shows end of day 50-day MA at 255.97 which is lower than 200-day MA at 258.99), but this is contrary to reality. Even on a daily chart, the 50-day MA has passed the 200-day MA which means that the golden cross has officially been achieved, just as @Curt Renz announced earlier today.

Basically, I'd take yahoo's MA charts with a grain of salt, considering that they show that the MA changes significantly between the 1 minute to 1 day to 1 month charts, etc.

Yeah, Yahoo's moving average is in terms of data points, not necessarily days. Need to set the rulers to 1 day to get the expected results.There's something wrong with how the moving averages are calculated on your charts (which I assume are taken from yahoo, since I got the same readings on yahoo as your charts). The actual 50-day and 200-day moving averages are nowhere close to $260; they are at around $195-$196:

View attachment 950331

Yahoo's 1-min charts make it seem like on a daily chart the golden cross hasn't yet been achieved (yahoo shows end of day 50-day MA at 255.97 which is lower than 200-day MA at 258.99), but this is contrary to reality. Even on a daily chart, the 50-day MA has passed the 200-day MA which means that the golden cross has officially been achieved, just as @Curt Renz announced earlier today.

Basically, I'd take yahoo's MA charts with a grain of salt, considering that they show that the MA changes significantly between the 1 minute to 1 day to 1 month charts, etc.

Skryll

Active Member

Coup in Russia - bullish ?

Mod: This is news, but all current followup is moved to the relevant thread about Ukraine invasion. --ggr

Mod: This is news, but all current followup is moved to the relevant thread about Ukraine invasion. --ggr

Last edited by a moderator:

Carl Raymond

Active Member

Coup in Russia - bullish ?

Been watching the feeds for a couple of hours. Only questions at this stage.

Has Putin run or will he try to hold?

Are they marching on Moscow or only Rostov?

Is Prigozhin worse? His troops recruited from prisons.

Seems good for Ukraine, fingers crossed good for Russian people.

By Monday the world may look different.

Artful Dodger

"Neko no me"

Triple Bottom? @Artful Dodger

Haha no, but shortzes did try to make a point in the After-hrs session today that 'AI ain't no thang...' which of course means Tesla AI is definately a thing, and one they're desperately afraid of.

More exactly, shortzes drove the SP back down to the same range that it had in the Oct 1st gap down on AI Day 2. Shortzes are absolutely afraid that the Market will (inexplicably) become 'forward-looking' (oh *sugar*) and realize that Tesla is going to achieve FSD sometime within the next 18 months (100 exaflops of training power with Dojo by end of 2024, and a million miles of FSD Beta fleet training data every 14 hrs says so).

Further, this is the beginning of artificial general intelligence (AGI) at Tesla, who is almost certainly working on a 'large-language model' right now with X.AI (Elon's startup). Image telling your car to take you home, and it stops at the store for milk because you forgot, haha. This one solves problems in the real world, possibly leading to a joint-venture between Tesla and X.AI as a competitor to ChatGPT.

The future will be amazing, and these shortzes are afraid of that. Desparately afraid.

Cheers to the Future!

P.S. Weekend OT: can we have Tim/Bill as the Undercard?

Artful Dodger

"Neko no me"

Bungholio and his twirling fartknockers...

I tried to watch Down O'Dower's video on youtube, but he had already deleted the livestream. Technical problems I guess... as in, FSD Beta v11.4.4. didn't have enough technical problems!

I give credit to Ross Gerber, and I do think he got some heads-up/coaching tips via @TeslaBoomerMama on what pungee sticks to watch for on that pre-laidout course. DanO's iceburg is melting rapidly...

Cheers!

Been watching the feeds for a couple of hours. Only questions at this stage.

Has Putin run or will he try to hold?

Are they marching on Moscow or only Rostov?

Is Prigozhin worse? His troops recruited from prisons.

Seems good for Ukraine, fingers crossed good for Russian people.

By Monday the world may look different.

This is all closely related to what has been going on in Ukraine. Please continue in the Russia/Ukraine conflict thread, where a lot of discussion and information sharing is already taking place.

I really don't get the point; if you are using FSD properly, then hands are on the wheel and foot is ready to intervene. Driver keeps car, and environment, safe via disengagement. If Dan complains, point him to the usage instructions.I tried to watch Down O'Dower's video on youtube, but he had already deleted the livestream. Technical problems I guess... as in, FSD Beta v11.4.4. didn't have enough technical problems!

I give credit to Ross Gerber, and I do think he got some heads-up/coaching tips via @TeslaBoomerMama on what pungee sticks to watch for on that pre-laidout course. DanO's iceburg is melting rapidly...

Cheers!

"Dan, it's Level 2. FSD Beta is safe because I'm safe."

Matt Porter

Member

This Sunday, CVPR 2023 Workshop on End-to-End Autonomous Driving. Tesla's Phil Duan is presenting "Building Vision Foundation Models for Autonomous Driving".

Hoping someone is registered and can report back for us all

Here Phil's talk now, a few new details in here about vision park assist and how Tesla are sharing models between cars and Optimus.

phoggy123

Member

I dont typically follow TA all that much or trade off it. But a couple thoughts

1. I am hopeful but somewhat nervous with this quarter. Given the consistent discounts on everything but Y, we need to hope Y volume is through the roof. I think we are going to get a P+D number that is "expected" or maybe even good, but then margins are below consensus for Auto.

2. Mega Pack - This is again the wild card IMO. this is the make or break to keep the margins high enough to not spark a sell off in 4 weeks.

We may very well make the run to 300+ but as a business I think we are in a bit of a holding pattern. If Model Y 4680 production is any indication, I'd say it's going to be 6 months before non Tesla employee orders make their way through. 4680 model Y didn't make it to the configurator for like a year. If manufacturing is actually tooling up this means they need to start publishing specs and pricing.

If somehow pricing + specs stay where we started all time highs aren't out of the question for 2023 IMO.

1. I am hopeful but somewhat nervous with this quarter. Given the consistent discounts on everything but Y, we need to hope Y volume is through the roof. I think we are going to get a P+D number that is "expected" or maybe even good, but then margins are below consensus for Auto.

2. Mega Pack - This is again the wild card IMO. this is the make or break to keep the margins high enough to not spark a sell off in 4 weeks.

We may very well make the run to 300+ but as a business I think we are in a bit of a holding pattern. If Model Y 4680 production is any indication, I'd say it's going to be 6 months before non Tesla employee orders make their way through. 4680 model Y didn't make it to the configurator for like a year. If manufacturing is actually tooling up this means they need to start publishing specs and pricing.

If somehow pricing + specs stay where we started all time highs aren't out of the question for 2023 IMO.

I dont typically follow TA all that much or trade off it. But a couple thoughts

1. I am hopeful but somewhat nervous with this quarter. Given the consistent discounts on everything but Y, we need to hope Y volume is through the roof. I think we are going to get a P+D number that is "expected" or maybe even good, but then margins are below consensus for Auto.

2. Mega Pack - This is again the wild card IMO. this is the make or break to keep the margins high enough to not spark a sell off in 4 weeks.

We may very well make the run to 300+ but as a business I think we are in a bit of a holding pattern. If Model Y 4680 production is any indication, I'd say it's going to be 6 months before non Tesla employee orders make their way through. 4680 model Y didn't make it to the configurator for like a year. If manufacturing is actually tooling up this means they need to start publishing specs and pricing.

If somehow pricing + specs stay where we started all time highs aren't out of the question for 2023 IMO.

I think we'll see record production and sales plus record Megapack sales BUT middling margins and profits due to the lower prices, which would IMHO lead to the stock crashing a bit because hey it's TSLA and record production & sales isn't enough to overcome the MM's antics anymore.

I'd love to be wrong of course and see the stock rally past $300 after Q2, I'm just not expecting that.

GhostSkater

Member

Here Phil's talk now, a few new details in here about vision park assist and how Tesla are sharing models between cars and Optimus.

I know they can't share much of what they are doing on the bleeding edge, but those presentations have become more and more of the same, even the examples they use are the same for few months or even a year or more

I'm not complaining to take down on the team, it's just every new one I open excitedly to find about new stuff and it's just one or two tidbits that are new

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K