If there was no demand then why does it take months to get parts for damaged Teslas? Even my windshield has taken a few weeks. A company slowing production due to no demand doesn't seem likely to not have extra parts laying around.I did my homework, I don't believe the FUD that Tesla has no demand. Unless we are coming to a scenario that the whole world will stop buying 90 million vehicles a year. Tesla vehicles are still by far the most compelling product for most buyers.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

myt-e-s-l-a

Member

Closed it @ .11. It was fun exercise for this forum. We need some levity in this down time.So close was at 235.14

What'd you do?

Cheers!

Fred42

Active Member

And most people won't buy a car from a company they think might be failing.I wish we could take a timeout and talk about more quantitative and financial modelling perspectives. Has this forum produced any post-results model? I would be more comfortable if I knew what it took exactly to stay cash flow positive. My investment thesis is basically just biding time for FSD to mature, so profits are essentially irrelevant in the meantime, but cash is necessary to avoid unfortunate compromises.

Sales volume has to go up dramatically to counter what will probably be descending model 3 per unit profitability, but it would be good to be more precise.

Back to being 12 pages behind on this thread.

Bought another 100 shares a few hours ago at 240. Felt like a bargain at the time. Still does, but apparently there was another $9 of bargain I could have wrung out with a little more patience.

Like ARK, I won’t go above 10% on any single stock, so I can only buy another 100 shares at most. I hope it doesn’t get low enough to tempt me to throw my last shot at it. The little bounce at the end of the day was nice to see.

If Musk isn’t buying at these prices, he’s crazy.

Does EM need SEC resolution to buy?

Ellison could add like crazy and ensure he never gets removed from the board

humbaba

sleeping until $7000

True. But most car buyers don't follow stocks.And most people won't buy a car from a company they think might be failing.

Yes, some do -- I'm not disputing that. But there are a lot of car buyers.

Given the price reductions it seems the value of the tax credits have been going directly to Tesla's bottom line.looking back, In a way trying to get Fed tax credits to max US buyers helped the buyers, but hurt the company big time. ...

If 10K were on ships to EU at end of 4Q, things might have been smoother for Q1 ..

Same. The odds of something happening to destroy my investment are very low. The biggest risk to me right now is going private at a low SP. Otherwise this could go super low and not recover for 5 years and I'll be fine.I'm long TSLA with the majority of my retirement account holdings. Not spooked at all. A little annoyed, but not spooked. In 10 years, none of this will matter.

humbaba

sleeping until $7000

Which I think is an excellent example of what happens when an idealist runs a company. Musk really wants people to buy his cars more than he cares about profits. I think there is reason to believe that he over did the price cuts, but I don't for a minute doubt his intentions.Given the price reductions it seems the value of the tax credits have been going directly to Tesla's bottom line.

HG Wells

Martian Embassy

Inventory model 3's

Atlanta 1 LRAWD

Miami 6 LRAWD

No SR+ within 200 miles at above locations.

Chicago 27 SR+ 6 LRAWD

Atlanta 1 LRAWD

Miami 6 LRAWD

No SR+ within 200 miles at above locations.

Chicago 27 SR+ 6 LRAWD

anthonyj

Stonks

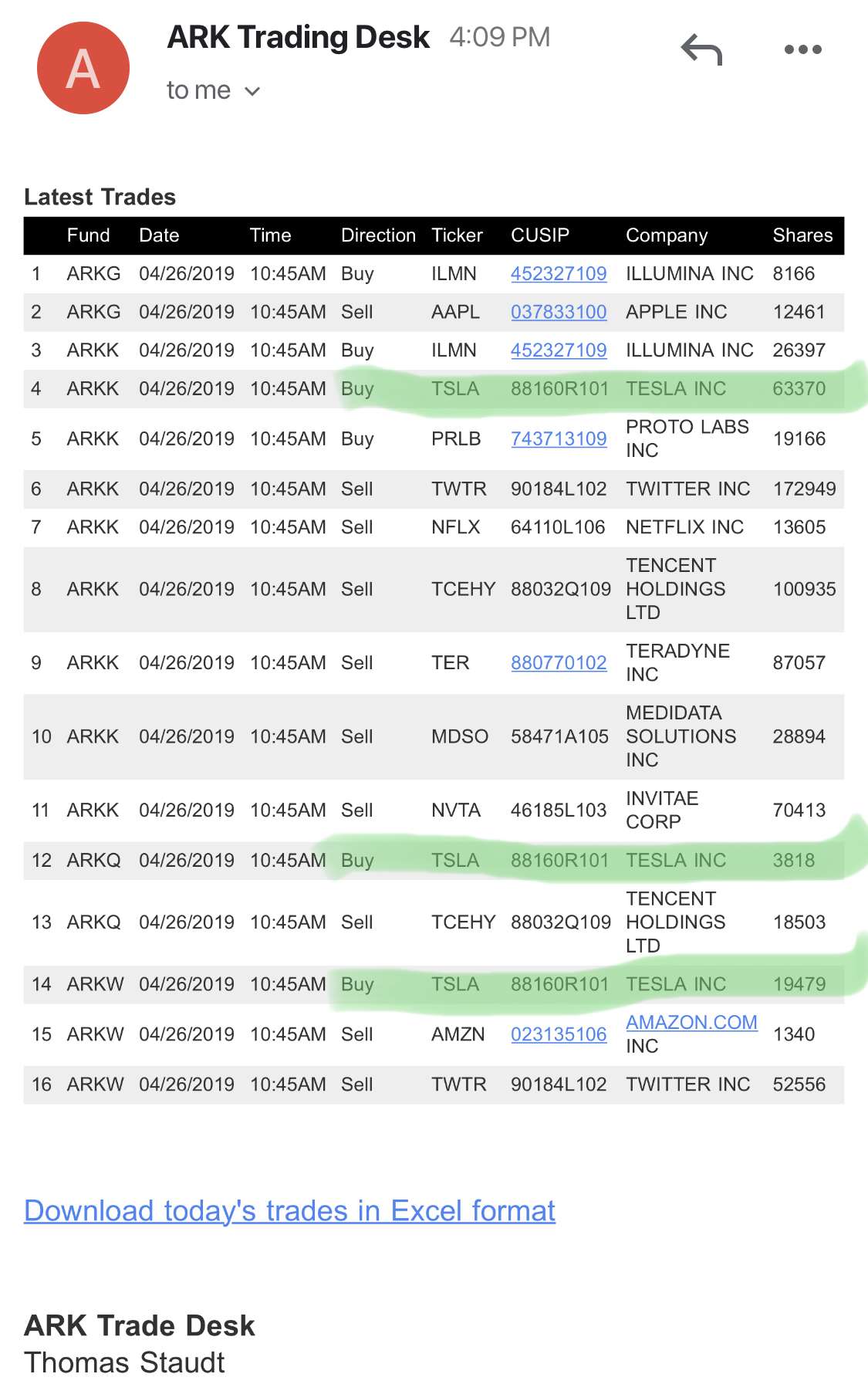

ARK buys some more of that Tesla stuff, 86,667 shares

First time I lost money selling options in a while...think I lost more today than all the ‘easy’ money I had made the past few months. They even got to me to close out positions at the lows...honestly could not say I had a handle on how low it could go today. Bet money that 240 would hold from yesterday....did not turn out too well.

How many people here think that this will be a 400 dollar stock a year from now?

Hard to put a handle on it. Crappy quarter aside Tesla has never been in better shape...and yet.... today.

How many people here think that this will be a 400 dollar stock a year from now?

Hard to put a handle on it. Crappy quarter aside Tesla has never been in better shape...and yet.... today.

It is revealing to pay attention to how AutoLine views the EV marketplace. This link from yesterday.

Listen particularly at minute 1:48 where the EV marketplace is discussed. They are calling for an EV disaster for Detroit.

AD #2581 – Whole EV Segment Drops, Could Satellite Images Make 3D Maps? Challenger Sales Pull Away From Camaro

I think part of what we are seeing in this recurring discussion of demand is that the marketplace is lukewarm to EVs. Opposition marketing has been effective. There is a fear that there is some end to early adopters and that demand may slide one day. Do we really know the answer to this or does it remain a bit of a question. There is no way to know.

I think it is the same with FSD. Do people really want it? Surely many do but how deep is the interest. Andy Grove of Intel used to say that inflection points are revealed when a product is 10x better. I think EVs meet that criteria but the larger world may not be there yet for FSD.

I think Jobs had success with smartphones by linking to an existing passion - music. Music was the known passion that could pull an unwitting public out of a rut into a new realm. Maybe FSD should be linked to something as passion-filled as music. Or something else...

Listen particularly at minute 1:48 where the EV marketplace is discussed. They are calling for an EV disaster for Detroit.

AD #2581 – Whole EV Segment Drops, Could Satellite Images Make 3D Maps? Challenger Sales Pull Away From Camaro

I think part of what we are seeing in this recurring discussion of demand is that the marketplace is lukewarm to EVs. Opposition marketing has been effective. There is a fear that there is some end to early adopters and that demand may slide one day. Do we really know the answer to this or does it remain a bit of a question. There is no way to know.

I think it is the same with FSD. Do people really want it? Surely many do but how deep is the interest. Andy Grove of Intel used to say that inflection points are revealed when a product is 10x better. I think EVs meet that criteria but the larger world may not be there yet for FSD.

I think Jobs had success with smartphones by linking to an existing passion - music. Music was the known passion that could pull an unwitting public out of a rut into a new realm. Maybe FSD should be linked to something as passion-filled as music. Or something else...

ARK buys some more of that Tesla stuff, 86,667 shares

View attachment 400975

Those who sold TSLA, and buying ARK - ARK is buying on you behalf

Only one Trading house sees the future ...

jhm

Well-Known Member

Sorry, it was my limit order at $230 that put a halt to this madness. Price Is Right rules.I set up a buy at $220 (instead of $230 because I'm both greedy and pessimistic), and it changed direction. You're welcome?

anthonyj

Stonks

Chipotle and AMD went through the same poopoo last year, now they are ballinFirst time I lost money selling options in a while...think I lost more today than all the ‘easy’ money I had made the past few months. They even got to me to close out positions at the lows...honestly could not say I had a handle on how low it could go today. Bet money that 240 would hold from yesterday....did not turn out too well.

How many people here think that this will be a 400 dollar stock a year from now?

Hard to put a handle on it. Crappy quarter aside Tesla has never been in better shape...and yet.... today.

Off Shore

Off Topic Member

Warning: May be habit-forming.Thinking of buying some shares at this slump. Recently picked up my first Model S and absolutely love it.

dmvevguy

Member

Well, I'm just not going to look anymore at the stock price. I have some cash coming in next week that I'll deploy. I cannot wait for the next few years esp if they hit Robotaxi service...that would blow away Lyft + Uber. Worst case scenario, I love the car (product) and the AP / service!

I am greatly saddened to hear some have been forced to sell. All of us have different financial circumstances. I treasure your comments even in cases I disagree and hope you will stick around and are able to recover as investors in Tesla. I began investing in 2001 just after 9/11 so had some luck with the recovery afterward and invested in Tesla in 2010-18. Last purchases in the $340-55 range which I don't regret. At first I never worried about losing all but after 28 years single, had to get married in 2003. (I looked pregnant.) So keeping principal began to matter, and still does. We are about 43% down from our all time high, 14% this year. We are about 40% TSLA and 10% BIDU which is also under pressure this year. Nonetheless, my wife of 15 years is well covered and doesn't have to work, so no worries.

TSLA is not for anyone with less than a five year horizon, as many have said here. My future is limited because of age. Yesterday I had lunch with a guy 85 who just had a complete physical and all the tests were average at the good level. We have the same family practitioner who has told me he is much healthier that I. I added at lunch, "I'm average too, in all the diseases I have. Mild to moderate joint degeneration in my right hip, with scoliosis, yada, yada" to laughter.

Whether I make it or not if she keeps the TSLA my wife should be a multi-millionaire in two to three years. Meanwhile, what's with NVDA taking a bath today as well? Also, we are about to plunge into a profound political crisis which hasn't hit the broader markets yet but it will. I still think TSLA is a hedge against that—China being only one very positive factor of at least two to four more, all in different ways but just as important as China.

Edit bolded.

TSLA is not for anyone with less than a five year horizon, as many have said here. My future is limited because of age. Yesterday I had lunch with a guy 85 who just had a complete physical and all the tests were average at the good level. We have the same family practitioner who has told me he is much healthier that I. I added at lunch, "I'm average too, in all the diseases I have. Mild to moderate joint degeneration in my right hip, with scoliosis, yada, yada" to laughter.

Whether I make it or not if she keeps the TSLA my wife should be a multi-millionaire in two to three years. Meanwhile, what's with NVDA taking a bath today as well? Also, we are about to plunge into a profound political crisis which hasn't hit the broader markets yet but it will. I still think TSLA is a hedge against that—China being only one very positive factor of at least two to four more, all in different ways but just as important as China.

Edit bolded.

Last edited:

Inventory model 3's

Atlanta 1 LRAWD

Miami 6 LRAWD

No SR+ within 200 miles at above locations.

Chicago 27 SR+ 6 LRAWD

62 model 3's in inventory in my area (NYC) which is the most I've seen since the page went up. was initially 45 then in the 20s till today.

MartinAustin

Active Member

I did my first ever Fremont factory tour today! Everyone knows about the NDA stuff so I can't say exactly what I saw (cough, Raven, cough) but there were brand new parts of quite particular types lying all around and going into cars right now. The activity level jam-packed nature of the factory was probably the most impressive. Occasionally felt like I was on board a submerged nuclear submarine!

Everything looked smooth and going as fast as possible.

Everything looked smooth and going as fast as possible.

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K