Sparky

Member

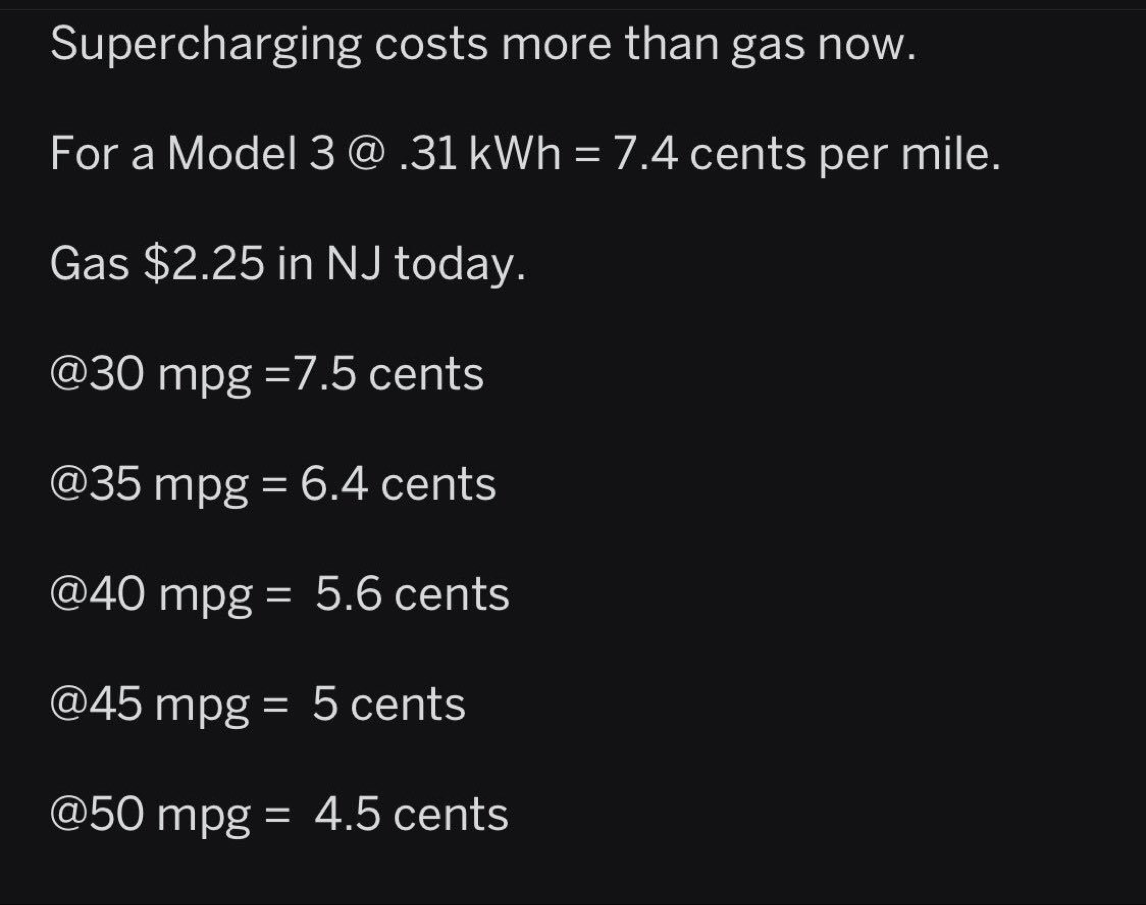

I saw the breathless Electrek headline on this topic and I guess it could have become newsworthy without the layoff news and accompanying price drop overshadowing things. But, SC fees are still not a big deal in my mind. As others posters mentioned, the % of long distance charging is low. Most trips will start with a full charge and may only need one SC stop on the way. The key thing is there has to be enough stalls with enough juice. When you're not waiting to charge and you get nearly full kW the extra $2 or so that Tesla is charging just doesn't matter. The tension in the next year is to have enough Superchargers for all the damn 3's they're selling without breaking the bank. For trips, waiting in line is just a bad user experience and that story will hurt sales IMO. Tesla knows all this. Here's how it's supposed to work:

Toyota Camry 4 cylinder will get you about 30 MPG, 0-60 7.6 seconds

Toyota Camry Hybrid will get you about 50 MPG, 0-60 7.9 seconds.

The slowest Model 3 will(123 MPGe) do 0-60 in 5.5 seconds, quicker than a Camry V6 XSE( MSRP $35k Plus).

Then there is safety.......

Yesterday, dog and I traveled NorCal to SoCal in my Model 3; 340 mi. I left with almost a full charge, 300 mi.

Stopped once in Buttonwillow, CA. 2 out of 10 stalls in use. Got out after 3+ hours ready for a break. Let the dog out for a bio break.

Walked across the street, decided to see what Popeye's Chicken was all about. Almost zero service there since everyone was watching Pats beat Chiefs in OT. Walked over to next FF joint and got a couple of tacos (I know it's bad but my dog loves the crunchy taco shells). Stopped at Starbucks for a double espresso.

We finished tacos got in car and drove home. A screenshot of my charging episode below. 500 mi/hr!

Cost $10.14. Whole trip took 5hrs, 40 mins.

Honestly, if it used to be $8 then they're not charging nearly enough. Really, $18, I wouldn't notice. The crappy tacos were $7.

If Tesla can make 90% of the travel charging work like this; the extra $2-$4 isn't an issue. I'm not jumping back in, kicking on AP with NOA and thinking "damn, shoulda taken the Corolla and saved $3".

Last edited: