Bjørn Nyland aka Teslabjørn just released this video from where he and some friends set a new World Record distance driven with an EV in 24 hours. In a Tesla Model 3 LR.

Spread the word!

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

BTW, when ecotality was trying to install charging stations, they had approached Starbucks (IIRC). Star bucks wasn't interested - they preferred more foot traffic than staying customers.

Oooh, interesting. Tesla's avoiding converting non-Chinese currency to Chinese currency, and is starting China off with "old generation" equipment which will hamper any Chinese attempts to steal Tesla's trade secrets. All makes sense... implies that cells will go directly from somewhere-which-is-not-Nevada to Shanghai, interestingly.

Some other smart moves involved here. The major problem with the old machines was that they were too slow. They will be just fine for the ramp-up phase in Shanghai, during which everything else will be going slowly so they won't have to go that fast.

They can definitely be configured to make SR+, the only question is whether it will be cost-effective (the other problem was that these machines had too high a cost structure). COGS for the early Model 3s out of Shanghai may be elevated, until the Grohmann machines are bought out of Chinese profits.

I wonder: the capitalization rules for Chinese subsidiaries requires that the parent inject a certain amount of capital into the company over the 10 years after incorporation. Are they allowed to inject the capital in kind, in the form of equipment? If so, this is a clever way to avoid trapping cash in Chinese renminbi.

For Tesla to prevail in Europe they will need a richer product portfolio than they have talked about to date and European GF's, which seems to be stalled.As we're discussing Maxwell and VW Group's current and future offerings, I've got a nice little side-project that some of you may or may not like.

There's a thread over in the UK part of TMC about Model 3 leases, so many of you would have no reason to go there. But if I could draw your collective attention to it - M3 Leasing. As you can see the discussion has moved on from focusing on leasing the Model 3 to "VW will outcompete Tesla in a few years". To many of us learned folks here, that's clearly something which facts and available evidence doesn't back up. And I've tried to express some reasons why, but I think some here are much better at articulating this. So if you fancy being a teacher to some over on that thread, feel free.

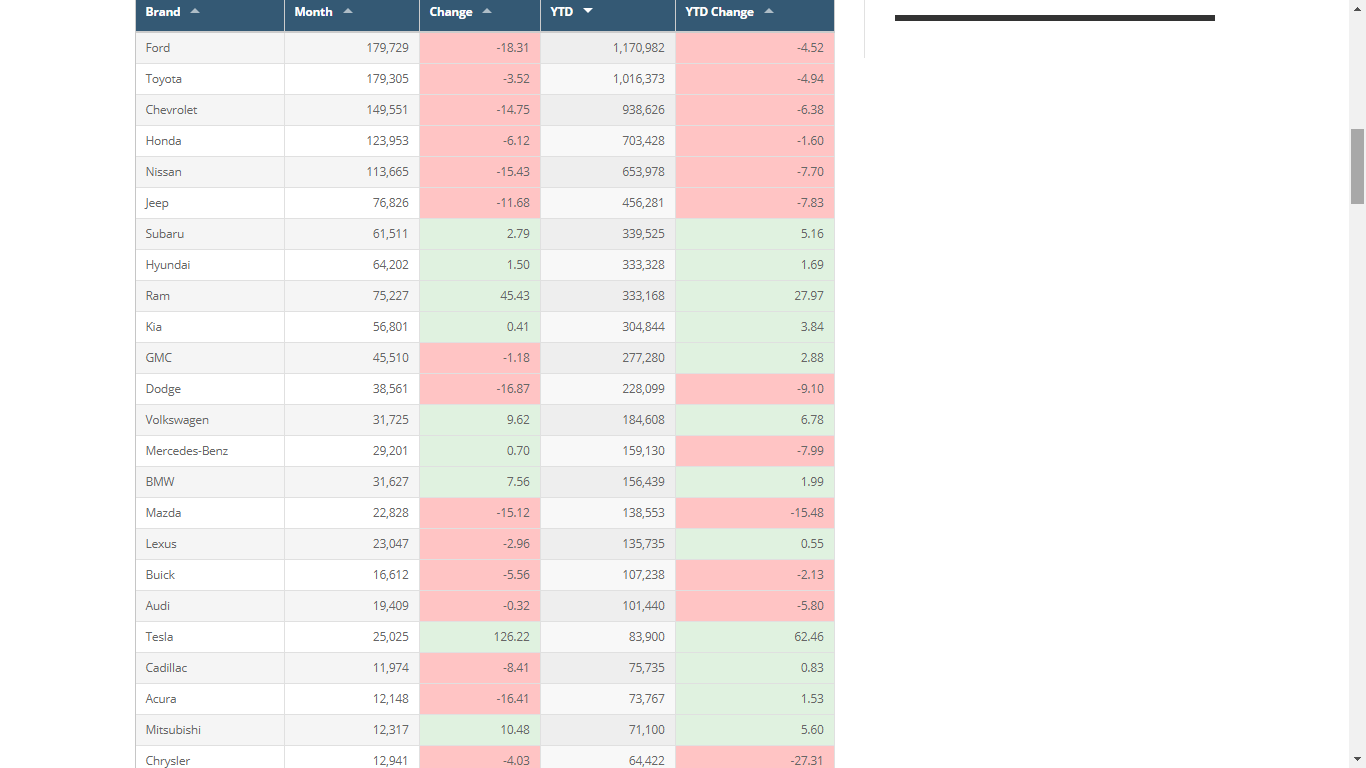

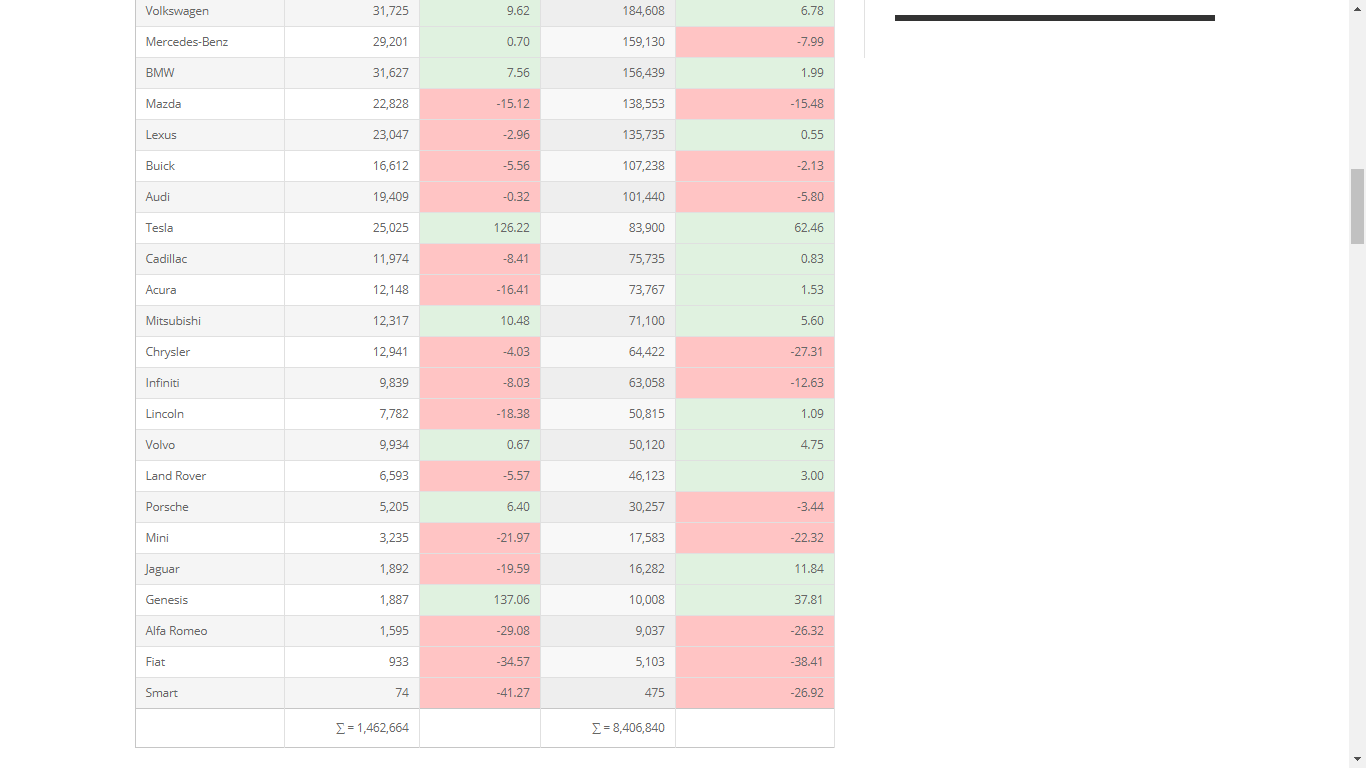

Remember “cars” only represent about half the consumer vehicles sold.Tesla had 1.12% US market share in 2018 and is within couple hundred units of 1% US market share in 2019. Given US deliveries are always backloaded I am very confident Tesla will break 1% again.

U.S. Auto Sales Figures by Brand

V3 is (supposedly) cheaper to operate ...My guess is that at some point in the future when they do finally start upgrading V1/V2 to V3 (not for quite some time yet - possibly a few years) they would repurpose them as urban chargers (vs throwing them away).

Cough cough no way. Cough cough NorwayFor Tesla to prevail in Europe they will need a richer product portfolio than they have talked about to date and European GF's, which seems to be stalled.

The factory is looking great in the sun. The images from the inside are amazing. two weeks ago the internals looked almost empty, now there is so much material in there you can hardly see the floor.

I'm also kind of amazed why VW or Panasonic didn't bid up Maxwell, but I'm not complaining: this technology is now in very good hands.

Inventory write down in Q1 doesn't help ASP in Q2. It just makes sure margin on s/x doesn't completely tank in Q2.

Old ASP : 105,000

old COGS : 84,000 (20% margin)

Write off : 6,000 (80M/13,000)

new COGS : 78,000

new ASP : 90,000 (15k discount)

new margin : 12/90 = 13%.

Tesla “prevails” in Europe if sustainable transportation prevails. I believe I’ve heard that there are European automobile producers. All Tesla has to do is shame them into producing EVs that people want to buy.For Tesla to prevail in Europe they will need a richer product portfolio than they have talked about to date and European GF's, which seems to be stalled.

The tables in the link are for consumer vehicles, not cars. (Nowhere does the link mention cars.)Remember “cars” only represent about half the consumer vehicles sold.

Yes, I was just trying to show what would happen if it was all to new inventory that was sold in Q2.Couldn't some of that write down have been allocated to used vehicles and energy products?

Tesla held the fair to recruit technical staff such as production supervisors, installation and repair technicians, quality inspectors and others for the new Shanghai plant.

A Weibo user named AichilumiantiaoMT complained that the pay being offered by Tesla is "not as good as expected."

"Maybe because it is Tesla, everybody has high expectations for its pay," the user said.

The person also disclosed that the Tesla Gigafactory 3 offers monthly pay of about 9,000 yuan ($1,305.77) for a production supervisor. The wage does not include accommodation, which is usually the case with other companies, according to insiders.

The average monthly salary of 8,765 yuan for urban jobs in Shanghai in 2018, according to data from the Shanghai Municipal Human Resources and Social Security Bureau.

"New source is telling 30-50% higher than what’s on BMW in China."

I'm not so sure about that.Hydrogen makes sense for Buses, Semis, heavy equipment

Remember “cars” only represent about half the consumer vehicles sold.

I wonder if the COGS for the old machines is labour related, if so there might not be as dramatic a difference between the old and new lines once relatively cheap Chinese labour is considered.