That's exactly what I said about the terribly dull questions, and it seems to me like many answers hardly corresponded with the questions anyway.Yeah I was like what did he just say???

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

But they had a phone line.All due respect can the comms problems possibly be that big a deal? I do say this as a non-owner. I just don't grok how it could matter that much. Ford in its heyday didn't even have email

Many Tesla problems can be solved without a service call, but you need to know the process, or they can look in the logs. Not being able to speak to a person is a very big deal. The chat tool would be okay--if there was one. I looked for some time on their site today where it's supposed to be, but no luck. The new phone tree only allows four kinds of personal interaction. For all other questions go to tesla.com/support where you can chat.

Remus

Active Member

The market didn't give it any weight at the end of Q1?FCF sounds good, until we consider the # of cars in transit at end of Q1 ...

I remember the narrative was no demand, and bankruptcy secured. So how long do we wait until that happens?

This question does not have a good answer.Wasted opportunity to ask this question:

Since cell supply is no longer a constraint (or soon to no longer be a constraint), does this mean we can expect Tesla truck, semi, Roadster 2 etc sooner rather than later?

Y is #1 in line for cells and they'll need 2x the current cell volume.

If going 23gwh->28gwh resolved the bottleneck for 3, then going to max 35gwh with the current hardware is below ~25x2=50gwh for expected 3+Y volume. No cells for truck or whatever else.

To resolve this, they need to talk about path to 2Twh that they'll disclose in Feb 2020 battery investor day and not before.

If they say in Feb that 2Twh comes from Maxcells that will be available in the fall for the Y, they may nuke their 3 sales by doing this, so the Feb may be too early as well. Unless FSD comes first and then people buy whatever cells available (many

Thekiwi

Active Member

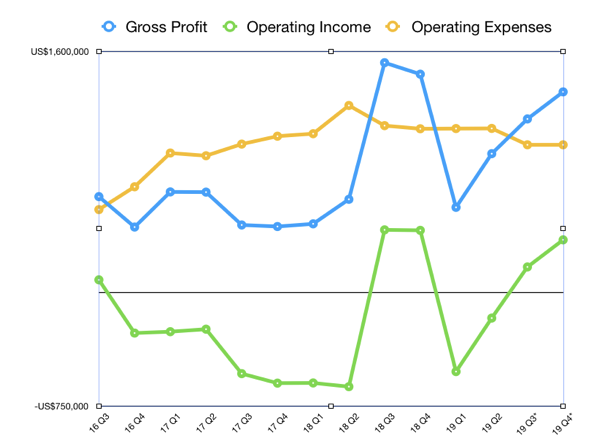

Can comfortably see Operating Income swinging back into decent sized profits for Q3, and growing in Q4.

Where was Tasha? Asking for a friend.....I rode the elevator down with Cathie Wood after the ARK event and asked her, "Do you think Wall Street is overreacting on TSLA tonight?"

She laughed and said, "Of course! Of course! Like always!"

woodisgood

Optimustic Pessimist

Battery/Drivetrain day was previously indicated to be Fall-ish 2019, so they’re pushing it back a bit.

Which suggests that they might actually have something substantial to reveal as opposed to just reviewing/explaining what is known but poorly understood, like Autonomy Day.

Which suggests that they might actually have something substantial to reveal as opposed to just reviewing/explaining what is known but poorly understood, like Autonomy Day.

sundaymorning

Active Member

BMW announces plans to double US battery capacity to 30k hybrid batteries per year or likely c.0.3 GWh per year - Gets a front page

Reuters article.

Tesla announces it has plans for 2TWh of battery cell supply - Not mentioned. Instead 4 reuters articles on how Tesla misses quarterly EPS consensus (which was due to lower regulatory credit sales and FX loses)

The difference is that BMW paid for their articles

brian45011

Active Member

JB stepping out of the day-to-day to be an "Advisor" is telling.JB is (was?) BMS guy. All his patents are there. All talks he made are about BMS.

He has nothing to do with the batteries. Apparently Tesla slows down on BMS development and focuses on new types of cells.

Beside possible burnout (see Tom Mueller) his reason for retirement can be a "personal" project, like it was the case with Jerome.

Autonomously, even!Boring Machines have been tunneling under the lithium mines.

Todd Burch

14-Year Member

I just want to remind everyone what Elon said about future quarter growth:

Q3 2019: "looks stronger than Q2 currently"

Q4 2019: "will be very strong"

Q1 & Q2 2020: "Tough..." "Seasonality".

Q3 & Q4 2020: "Will be incredible" (this is the Y effect)

I think we should heed those comments about Q1 & Q2 being tough very seriously. it might mean flat or even shrinkage in sequential deliveries

So...like just about every other year....for just about every other manufacturer as well?

Short term seems like some hard times ahead...

Q3 don't expect profit, right? Q4 is good, so some SP bump is here, but that's 2 quarters of FUD. Ouch, that hurts.

Then Q1 20 is very tough. Prob. seasonal issues? plus low volume China production screwing margins? Plus capex for both China and Y?

So, again big SP drop here? Then pretty tough Q2, prob more capex and tuning, SP depressed?

Depending on how and who is looking at this, even after Q4 19 with good results, if this is served with "expect a big Q1 loss" during ER, then may not be much optimism for SP to rise.

Seems like a whole challenging year ahead.

Will be glad to be wrong.

Q3 don't expect profit, right? Q4 is good, so some SP bump is here, but that's 2 quarters of FUD. Ouch, that hurts.

Then Q1 20 is very tough. Prob. seasonal issues? plus low volume China production screwing margins? Plus capex for both China and Y?

So, again big SP drop here? Then pretty tough Q2, prob more capex and tuning, SP depressed?

Depending on how and who is looking at this, even after Q4 19 with good results, if this is served with "expect a big Q1 loss" during ER, then may not be much optimism for SP to rise.

Seems like a whole challenging year ahead.

Will be glad to be wrong.

I don't get why there are putting off battery day so long. Waiting on another acquisition? Would that give them enough time to buy Panasonic's cylindrical cell business as someone else speculated here?

2TWh seems difficult under the current relationship they have with Panasonic. Panasonic seems to be diversifying their business away from Tesla.

They mentioned it being show and tell, so they want the new line with new cells up and running to show when they tell the world about it.

Maybe

KSilver2000

Active Member

Short term seems like some hard times ahead...

Q3 don't expect profit, right? Q4 is good, so some SP bump is here, but that's 2 quarters of FUD. Ouch, that hurts.

Then Q1 20 is very tough. Prob. seasonal issues? plus low volume China production screwing margins? Plus capex for both China and Y?

So, again big SP drop here? Then pretty tough Q2, prob more capex and tuning, SP depressed?

Depending on how and who is looking at this, even after Q4 19 with good results, if this is served with "expect a big Q1 loss" during ER, then may not be much optimism for SP to rise.

Seems like a whole challenging year ahead.

Will be glad to be wrong.

Maybe range bound between $200-$260 for the next 12 months then?

Remus

Active Member

Recently added some shares avg about 195, trimmed half of them avg about 240.

Since I have loads of paper loss, thinking of realizing some of the loss tomorrow, and probably buy back a month later, since there still time before q3 delivery.

After Q1 I was sweating bullets due to the 'demand' talk, with no real clarity into the disappointing delivery.

Now I am relaxed. The profit margin, cash flow seems ok to me. Turned out demand problem was imaginary. The problems are production and service, although very important, but easier to deal with.

I think shorts will be able to push SP down further. I will buying 31 days later.

Since I have loads of paper loss, thinking of realizing some of the loss tomorrow, and probably buy back a month later, since there still time before q3 delivery.

After Q1 I was sweating bullets due to the 'demand' talk, with no real clarity into the disappointing delivery.

Now I am relaxed. The profit margin, cash flow seems ok to me. Turned out demand problem was imaginary. The problems are production and service, although very important, but easier to deal with.

I think shorts will be able to push SP down further. I will buying 31 days later.

brian45011

Active Member

Never perturbate the capital markets prematurely--maybe in February 2020.Aren't they planning a Battery Day much like the Autonomy Day soon?

RFernatt

Solar/EV Owner/Enthusiast

Regarding FUD and the population, here's an anecdote from someone on another board where I used to moderate. We still keep in touch occasionally and he hit me up this week with some questions about Tesla after I made a post about EV charging on the old board. So, general folks do pick up on the FUD enough to question a purchase. Again, just another anecdote.

"To be honest, I'm not so much concerned abut the technical stuff as I am about Tesla's stability as a company and the continuing changes in pricing and various configurations. I'd hate to pay a premium for something only to have it changed to a standard feature a few months later - like the white paint "option."

I'm also concerned about quality control in general and the quality of materials and equipment in the Model 3, since it's being touted as a luxury car but looks pretty bare bones inside.

The smart move would be to spend a lot less on the Kona EV but then we wouldn't get all the Tesla goodies, including the Supercharging network - that's a big plus for me. I'll continue thinking it over; we really need to go to the Tesla store and check out the cars."

"To be honest, I'm not so much concerned abut the technical stuff as I am about Tesla's stability as a company and the continuing changes in pricing and various configurations. I'd hate to pay a premium for something only to have it changed to a standard feature a few months later - like the white paint "option."

I'm also concerned about quality control in general and the quality of materials and equipment in the Model 3, since it's being touted as a luxury car but looks pretty bare bones inside.

The smart move would be to spend a lot less on the Kona EV but then we wouldn't get all the Tesla goodies, including the Supercharging network - that's a big plus for me. I'll continue thinking it over; we really need to go to the Tesla store and check out the cars."

Thekiwi

Active Member

Short term seems like some hard times ahead...

Q3 don't expect profit, right? Q4 is good, so some SP bump is here, but that's 2 quarters of FUD. Ouch, that hurts.

Then Q1 20 is very tough. Prob. seasonal issues? plus low volume China production screwing margins? Plus capex for both China and Y?

So, again big SP drop here? Then pretty tough Q2, prob more capex and tuning, SP depressed?

Depending on how and who is looking at this, even after Q4 19 with good results, if this is served with "expect a big Q1 loss" during ER, then may not be much optimism for SP to rise.

Seems like a whole challenging year ahead.

Will be glad to be wrong.

Maybe Profits in Q3 and very likely in Q4 - continuing positive trend.

As long as Y is still on track to ship in Fall 2020 - some weakness in Q1/Q2 should be easily overlooked in view of the looming revenue explosion and resulting massive profit boost about to hit later in the year.

Just a reminder to all longs: Tesla is around breakeven at the current point of about 100k+ quarterly deliveries (based on Q3 expectations) - once that increases to 150k including higher margin Y in 2nd half 2020, money is going to be absolutely gushing in as the company moves into deep green territory

Antares Nebula

Active Member

As I previously said, significant share sales did not square with JB remaining as CTO. I suspected that he may step down this quarter, esp w/ Drew Baglino on stage during the shareholders meeting. Many batted me down on this. I'm one of the most ardent bulls, but one has to stay objective, esp when money is involved.

Proceed, once again, with the thumbs down.

Proceed, once again, with the thumbs down.

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K