Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

We're still talking about 1% market penetration, so the general public did not yet have a chance to know and love the product.The general public has been taught for years to buy companies that have great products and are the "big dog" in their industry. They've been taught to buy products they know and love. With the explosion of new Tesla owners out there, I think there will be plenty of retail investors buying a chunk of TSLA for the future.

But the real volume will come from the big funds who have been sitting on the sidelines waiting for TSLA to go broke or make a major strategic blunder. Because the time is near when they will see the demand is growing, not shrinking, the cost of production is gradually declining and Tesla is becoming a more mature corporation and their buyers are becoming more mainstream. If they wait until they are profitable, they will miss most of the appreciation.

Growth stocks that are not yet profitable are always a gamble, that doesn't keep people from flocking to them when the time is right and it's become apparent they are the dominant player. Too much emphasis has been placed on profitability - that is mostly a talking point of the $TSLAQ crowd that will go (mostly) away when it becomes apparent that Tesla has built a solid and growing foundation and can remain cash flow positive indefinitely, even as they continue to grow products and production. People still think Tesla is losing money on every car they build because that is the false narrative pushed by the shady naysayers who want Tesla to fail. I would be willing to venture than many or most Tesla shareholders that frequent this board regularly know more about Tesla and their business than many hedge fund managers sitting on the sidelines.

Unless events beyond Tesla's control derail the success of the China factory, I think that will be the catalyst when people realize how much profit potential there is in making EV's. I'm predicting even the TSLA bulls will be shocked at how much cheaper Tesla will be able to make the Chinese Model 3 and in what volumes it will sell at with a gross margin MUCH higher than US-made Model 3's. Every investment is a gamble, some have better risk/reward ratios than others.

Funds waiting for Tesla going broke- I can't believe that. They are not TSLAQ. They could be waiting for other indicators such as profits.

I agree that time is getting closer to a point when profitability is imminent or competitors go belly up in a testament of what is happening. So, potential buyers have a dilemma of whether to wait until the last possible cheap entry point or do it a bit early to secure the pricing. We're talking 2-3 quarters max before the train leaves the station.

What I do not agree with is exorbitant profits in China. I believe that Elon will AGGRESSIVELY lower the prices in each region to maintain 25-30% max profit among all models in that region.

Fact Checking

Well-Known Member

Short interest down to 36M

Robinhood investors slowly unloading

So, I want to know, who is the mystery buyer?

Well, shorts covering = buying, right?

RobStark

Well-Known Member

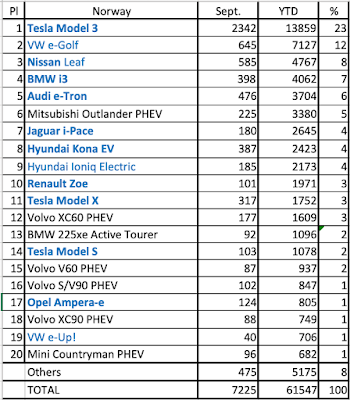

Top 10 Norway Sept regardless of Fuel Source. No pure ICEv in Top 10.

7 of Top 8 Pure BEV.

Looking at the manufacturers ranking, Tesla is uncontested leader (28%, up 2%), being followed by Volkswagen (13%), while BMW (10%, up 1%), has managed to win the 3rd spot over Hyundai and Nissan (both with 9%), but the German carmaker still has plenty of obstacles to overcome, it if wants to keep the Bronze medal.

EV Sales: Norway September 20

paulch

Member

Remember: Battary pack + solar panel = printing money in California. Significantly reduce electricity bills and may even generate revenue from the power generated by solar panels. The cost of the pack will be paid off very quickly.Beyond just a few packs it is a very poor use of capital, unless they do double duty and arbitrage power too.

Remember: Battary pack + solar panel = printing money in California. Significantly reduce electricity bills and may even generate revenue from the power generated by solar panels. The cost of the pack will be paid off very quickly.

Do you have calculations handy? I don't believe power walls have a good ROI in the major metros I've looked at. They are just there to give you protection when the grid goes down.

KSilver2000

Active Member

Remember: Battary pack + solar panel = printing money in California. Significantly reduce electricity bills and may even generate revenue from the power generated by solar panels. The cost of the pack will be paid off very quickly.

Someone obviously doesn't have battery + PV, or have even looked into it. Otherwise, you would know that statement is silly.

Singer3000

Member

Galileo has a nice video up today on Hyperchange about his Nevada Giga tour.

There can now be little dispute that Tesla plans to vertically integrate cell production. If people still had doubts after Maxwell then Hibar settles the debate.

What has my interest piqued is what this means for Panasonic? Is Elon moving the bishop and rook into place so he can also pickup Pana’s US division on the cheap?

Or will the existing agreement continue as is, with Pana sweating its deployed capex and pump out 2170s for Model 3 (and 18650s for S&X out of Japan) for the foreseeable future but that’s it, with all further capacity in Nevada fully in-house?

I can’t think of another event in the next 6 months that would impact TSLA as much as a Pana US takeover (macro slide and black swans aside of course).

One gets the feeling that something major has for a while been keeping the Gigafactory’s footprint stuck where it is but come 2020 something has to give, if Tesla are to meet their ambitions on Semi, storage and Y.

There can now be little dispute that Tesla plans to vertically integrate cell production. If people still had doubts after Maxwell then Hibar settles the debate.

What has my interest piqued is what this means for Panasonic? Is Elon moving the bishop and rook into place so he can also pickup Pana’s US division on the cheap?

Or will the existing agreement continue as is, with Pana sweating its deployed capex and pump out 2170s for Model 3 (and 18650s for S&X out of Japan) for the foreseeable future but that’s it, with all further capacity in Nevada fully in-house?

I can’t think of another event in the next 6 months that would impact TSLA as much as a Pana US takeover (macro slide and black swans aside of course).

One gets the feeling that something major has for a while been keeping the Gigafactory’s footprint stuck where it is but come 2020 something has to give, if Tesla are to meet their ambitions on Semi, storage and Y.

Here's three pieces of information that are very interesting if taken together:

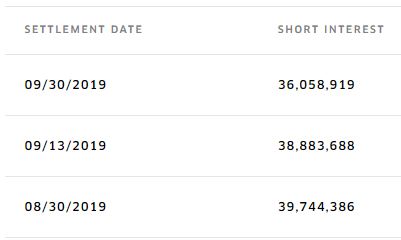

First: the change in TSLA short interest between 8/30/19 and 9/30/19

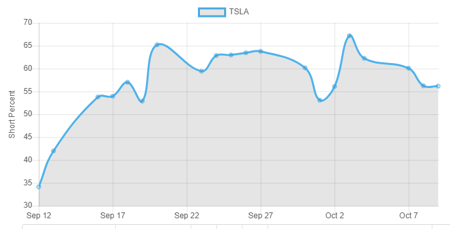

Next, comes Ihor Dusaniwsky's chart of TSLA short interest (and SP) through Oct1

Notice that Dusaniwsky didn't reflect the enormous decrease in short interest through the end of September in his chart. In fact, he still showed greater than 39M shares shorted when it was barely 36 million. I find it odd that his techniques are so poor as to not notice a 7% decrease in short interest taking place over a two week period.

The problem with such a big dip in short interest is that it makes other shorts nervous and more inclined to bail as well (what do those who just left know that caused them to bail?). So, how do you keep the stock price from changing too much while you whittle down your short holdings? You manipulate the "sugar" out of TSLA, that's how. Look what happened to percentage of selling by shorts during the final two weeks of September and the first week of October. To my eye, percentage of selling by shorts, which is what the chart below shows, is primarily a measure of how much manipulative churning of short shares is going on, with the aim of keeping the stock price from rising too quickly as you extract yourself from a TSLA short position.

Was the increase in short percentage of selling (a measure of manipulations in my mind) just coincidentally high as the shorts were making major reductions in short interest? I don't think so. Rather, it's like the outlaw who says to his buddy, "Cover me while I make a break for it!"

By the way, have you notice the significant increase in FUD in recent weeks? I have. Yep, that strikes me as another "Cover me while I make a break for it!" scenario.

The significant changes in short interest means that there's been increased buying pressure, which could explain the continued upward price pressure we've been seeing with TSLA. Maybe it's not an institutional buyer driving up the price. Maybe we're seeing the effects of shorts fleeing their positions.

The implication for us investors is that these departures may lead to other short covering as the remaining shorts get nervous, which would in turn lead to more upward pressure on the stock price. Interesting times.

Meanwhile, Dusaniwsky needs to update his Tesla chart soon, otherwise he looks like he is helping to keep this whole covering event from being too widely noticed by the Tesla investing community.

First: the change in TSLA short interest between 8/30/19 and 9/30/19

Next, comes Ihor Dusaniwsky's chart of TSLA short interest (and SP) through Oct1

Notice that Dusaniwsky didn't reflect the enormous decrease in short interest through the end of September in his chart. In fact, he still showed greater than 39M shares shorted when it was barely 36 million. I find it odd that his techniques are so poor as to not notice a 7% decrease in short interest taking place over a two week period.

The problem with such a big dip in short interest is that it makes other shorts nervous and more inclined to bail as well (what do those who just left know that caused them to bail?). So, how do you keep the stock price from changing too much while you whittle down your short holdings? You manipulate the "sugar" out of TSLA, that's how. Look what happened to percentage of selling by shorts during the final two weeks of September and the first week of October. To my eye, percentage of selling by shorts, which is what the chart below shows, is primarily a measure of how much manipulative churning of short shares is going on, with the aim of keeping the stock price from rising too quickly as you extract yourself from a TSLA short position.

Was the increase in short percentage of selling (a measure of manipulations in my mind) just coincidentally high as the shorts were making major reductions in short interest? I don't think so. Rather, it's like the outlaw who says to his buddy, "Cover me while I make a break for it!"

By the way, have you notice the significant increase in FUD in recent weeks? I have. Yep, that strikes me as another "Cover me while I make a break for it!" scenario.

The significant changes in short interest means that there's been increased buying pressure, which could explain the continued upward price pressure we've been seeing with TSLA. Maybe it's not an institutional buyer driving up the price. Maybe we're seeing the effects of shorts fleeing their positions.

The implication for us investors is that these departures may lead to other short covering as the remaining shorts get nervous, which would in turn lead to more upward pressure on the stock price. Interesting times.

Meanwhile, Dusaniwsky needs to update his Tesla chart soon, otherwise he looks like he is helping to keep this whole covering event from being too widely noticed by the Tesla investing community.

CalX

Member

I agree and have been surmising that the recent upward pressure is actually shorts capitulating rather than some large buyer. I bet the pressure will continue into earnings. Bye bye @bloodsportcap.The significant changes in short interest means that there's been increased buying pressure, which could explain the continued upward price pressure we've been seeing with TSLA. Maybe it's not an institutional buyer driving up the price. Maybe we're seeing the effects of shorts fleeing their positions.

The implication for us investors is that these departures may lead to other short covering as the remaining shorts get nervous, which would in turn lead to more upward pressure on the stock price. Interesting time.

Last edited:

Tslynk67

Well-Known Member

Nasdaq Futures have recovered, now just -0.0X%

Would like $TSLA to keep some momentum until Monday at least when GF3 officially produces some (a?) car... Could eb a great catalyst for a pop.

Would like $TSLA to keep some momentum until Monday at least when GF3 officially produces some (a?) car... Could eb a great catalyst for a pop.

MC3OZ

Active Member

Galileo has a nice video up today on Hyperchange about his Nevada Giga tour.

There can now be little dispute that Tesla plans to vertically integrate cell production. If people still had doubts after Maxwell then Hibar settles the debate.

What has my interest piqued is what this means for Panasonic? Is Elon moving the bishop and rook into place so he can also pickup Pana’s US division on the cheap?

Or will the existing agreement continue as is, with Pana sweating its deployed capex and pump out 2170s for Model 3 (and 18650s for S&X out of Japan) for the foreseeable future but that’s it, with all further capacity in Nevada fully in-house?

I can’t think of another event in the next 6 months that would impact TSLA as much as a Pana US takeover (macro slide and black swans aside of course).

One gets the feeling that something major has for a while been keeping the Gigafactory’s footprint stuck where it is but come 2020 something has to give, if Tesla are to meet their ambitions on Semi, storage and Y.

I think Tesla and Panasonic have long running supply contracts though to 2023.

I don't think that stops Tesla getting cells elsewhere or making their own cells.

What happens after 2023 is more interesting, my hunch is Panasonic still making cells for Tesla Energy in GF1 and/or Japan....

IMO Tesla's priority is to take all automotive cell production in house by 2023... that is so they can ramp cell production to match vehicle production as needed..

IMO lumpy and slow deliveries for Tesla energy are more acceptable .... large battery projects have longer lead times... domestic battery installations can be delayed, Tesla can also get cells from multiple suppliers..

They might take most Tesla Energy cell production in house, but only after automotive, that is probably down to the economics...

For automotive ramping in parallel and timely supply is essential, that is also where Tesla would like to have an R&D edge...

Last edited:

Do we have short memory?

Tesla moved it up 1 week early for Q1 ER, and most people here were giving high fives expecting earnings would bump the SP higher. Then people tried to come up with reasons why Tesla is late to the call on Q2.

Early or late ER doesn’t mean anything with Tesla.

Huh? Q1'19 ER wasn't early. 30 January. Vs. Q4 '18 and Q2 '19, which were both on the 24th. I guess it was early compared to Q1'18, although that wasn't exactly a good quarter either.

Mike Smith

Active Member

Tslynk67

Well-Known Member

I think Tesla and Panasonic have long running supply contracts though to 2023.

I don't think that stops Tesla getting cells elsewhere or making their own cells.

What happens after 2023 is more interesting, my hunch is Panasonic still making cells for Tesla Energy in GF1 and/or Japan....

IMO Tesla's priority is to take all automotive cell production in house by 2023... that is so they can ramp cell production to match vehicle production as needed..

IMO lumpy and slow deliveries for Tesla energy are more acceptable .... large battery projects have longer lead times... domestic battery installations can be delayed, Tesla can also get cells from multiple suppliers..

They might take most Tesla Energy cell production in house, but only after automotive, that is probably down to the economics...

For automotive ramping in parallel and timely supply is essential, that is also where Tesla would like to have an R&D edge...

Surely in the vastness of GF1 there's room to install some new cell lines, especially with the Maxwell DBE technology. Given the demand I see no reason why both can't continue in parallel, especially while there's a field-validation of the new cells via R2 or Semi.

I see no further reason why Tesla wouldn't licence their technology to Panasonic, for a tidy fee. After all, it's all about accelerating the adoption of EV's.

MC3OZ

Active Member

Surely in the vastness of GF1 there's room to install some new cell lines, especially with the Maxwell DBE technology. Given the demand I see no reason why both can't continue in parallel, especially while there's a field-validation of the new cells via R2 or Semi.

I see no further reason why Tesla wouldn't licence their technology to Panasonic, for a tidy fee. After all, it's all about accelerating the adoption of EV's.

I agree on licensing the technology, it may be part of the deal.....

But part of the deal may be that Tesla owns the exact automotive formula and keeps that secret, while the energy storage formula is widely available..

Panasonic and others can license DBE from Tesla for a fee, or as part of a wider negotiation...

There are lots of possibilities, so many it is hard to guess right..

j6Lpi429@3j

Closed

I got the impression that the limit on GF1 was basically manpower, in that everybody within commuting distance of the site already works thereSurely in the vastness of GF1 there's room to install some new cell lines,

In any case, I think the more likely imminent pop for the stock will be footage of M3s being made in China. Thats something that looks good on a CNN news segment, and the hopelessly ill-informed investors will see that as more significant than some abstract improvement in battery production automation or cell chemistry change.

Interesting positive article on Business Insider:

I used one of Tesla's Supercharger stations for the first time, and it solved the biggest problem I had when driving the Chevy Bolt and Nissan Leaf

I used one of Tesla's Supercharger stations for the first time, and it solved the biggest problem I had when driving the Chevy Bolt and Nissan Leaf

Interesting positive article on Business Insider:

I used one of Tesla's Supercharger stations for the first time, and it solved the biggest problem I had when driving the Chevy Bolt and Nissan Leaf

What got me the most is that it's from Mark Matousek. That guy has been a hardcore FUDster for years, and he's never before gone so far as to even try a Supercharger? And they've let him write article after article about Tesla?

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K