About 15 years ago, I put on an ATAS metal roof. It's survived two large hail storms, and you have actually get up on the roof (not recommended, metal roofs are slippery) to see any dents. This roof actually sits about 30 mm above the deck, so there is always airflow and the roof deck stays at ambient temperature.I did. After a big hail storm this summer we need a new roof. Looked into metal roofs for extra hail protection but they seem no better then normal shingles- even if the metal is structurally sound after hail it can look terrible and insurance won't cover that. With an insurance check and bids in hand the solar roof really is the same price as shingles+solar. Just hope Tesla really will be ready to install next year.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

2virgule5

Member

I swear I could guess who pulled the ‘disagree’ on recalling TT007, a clear sign I’m spending way too much time on this boardThat guy has some serious conviction and patience. Hats off to him.

Last edited:

What do you think: Are we turning a page with regards to TSLA here? If we go back to the old thread: Elon Musk vs. Short sellers

The key point behind the relentless attacks on Tesla was to induce a crisis of confidence that will prevent people from buying the actual Tesla products and thus drive them out of business (also ref. the Fairfax example).

Can you help me pierce my bubble? If Tesla even on a "decline" in turnover manages to squeeze out a profit, if their expansion right now is clearly not soaking up all the cash available to Tesla - is this attack vector on TSLA futile? And will we see a significant portion of the short position go away now?

Every day more Tesla cars are flooding the markets. And sales cause sales (we all know this) - so all the FUD in the media is getting less and less effective if a) your neighbour tells you the car is awesome and b) the company shows pretty decent financials.

Now if the shorts were to fold: could we expect a short covering rally? (Not a squeeze, I don't believe in that). What's your take?

IMHO, it ultimately depends on when the "short to kill" contingent determines that continued shorting is no longer going to do much to slow Tesla down. At some point they’ll feed the fool shorts they’ve been gulling into the fire. That could be now even — or not.

Even if they decide it will help them to try to regain control of the narrative, they’ll still have to decide how much they are willing to keep spending for diminishing returns.

Also, it could be that the gesticulating towards the 10-Q may be just to get the gullible shorts (like our recent "student") to wait at the door while the masters of the netherworld make their exit.

I just buy, hold, and wonder at the unfolding glory of Tesla.

If he was a real one, he would know that the right words are "chartered forensic accountant".

The Accountant

Active Member

The Q1 plan obviously seems to be have China cover any flatness in Fremont sales. But Tesla is probably really going after Q4 sales in the U.S., so Europe may be somewhat starved from product for the rest of the year. That would leave some pent up demand for a Q1 next year.

But tesla may be flat or down a bit in Q1. It doesn't matter.

Tesla has a lot to do in Fremont getting ready for the model Y. Some slowness in Fremont Q1 isn't necessarily a bad thing.

With the logistics nightmare experienced during this past Q1, Tesla will not be down in Q1 2020 vs Q1 2019. Also - I am not sure that you are correct that Tesla is prioritizing US this quarter...I seem to recall that there were more ships heading out to Europe at this time vs the same time last quarter (maybe someone can confirm the ship count).

I believe the end of quarter fire drills have stopped at Tesla and we will see quite a bit of Q4 demand pushed to Q1 2020. This along with GF3 deliveries in China should make Q1 2020 much better than Q1 2019.

G

goinfraftw

Guest

With the logistics nightmare experienced during this past Q1, Tesla will not be down in Q1 2020 vs Q1 2019. Also - I am not sure that you are correct that Tesla is prioritizing US this quarter...I seem to recall that there were more ships heading out to Europe at this time vs the same time last quarter (maybe someone can confirm the ship count).

I believe the end of quarter fire drills have stopped at Tesla and we will see quite a bit of Q4 demand pushed to Q1 2020. This along with GF3 deliveries in China should make Q1 2020 much better than Q1 2019.

With that said, the Model Y is planned for production in summer 2020. So, how does that get accounted for in the 2 quarters of tooling leading up to what is considered scaled production?

Not sharpest tool in shed. Just a very short one.

With the logistics nightmare experienced during this past Q1, Tesla will not be down in Q1 2020 vs Q1 2019. Also - I am not sure that you are correct that Tesla is prioritizing US this quarter...I seem to recall that there were more ships heading out to Europe at this time vs the same time last quarter (maybe someone can confirm the ship count).

I believe the end of quarter fire drills have stopped at Tesla and we will see quite a bit of Q4 demand pushed to Q1 2020. This along with GF3 deliveries in China should make Q1 2020 much better than Q1 2019.

Ships leaving early in the quarter are not a sign of unwinding the wave. Ships leaving in December would be.

Not sharpest tool in shed. Just a very short one.

The sad thing is knowing that people like this are going to lose their retirement savings and/or homes, while people like fly4dat salvage a large chunk of their positions to short again some weeks or months in the future:

fly4dat on Twitter

SebastianR

Active Member

IMHO, it ultimately depends on when the "short to kill" contingent determines that continued shorting is no longer going to do much to slow Tesla down. At some point they’ll feed the fool shorts they’ve been gulling into the fire. That could be now even — or not.

Even if they decide it will help them to try to regain control of the narrative, they’ll still have to decide how much they are willing to keep spending for diminishing returns.

Also, it could be that the gesticulating towards the 10-Q may be just to get the gullible shorts (like our recent "student") to wait at the door while the masters of the netherworld make their exit.

Exactly this is my question. There will always be some shorts - who cares. But the question is, when the "short to kill" ones stop. Q3 last year I thought we would turn a corner and be home free. Boy, was I wrong...

I have no doubts that January 2020 will look much bleaker than today and I have no doubts that there will a a contingent of shorts on stand-by to exploit the situation (so no leverage for me come end of year). But fundamentally Tesla has shown that they now have Model 3 production numbers and costs under control. If they can fund Solar Roof, Truck development, Model Y production planning and ramp, China expansion as well as Service Centres + Supercharger roll-out today with declining ASPs for Model 3 and declining sales numbers for Model S and X, there is really not much to cling on from a short perspective. Especially since deliveries and production of total number of cars has been going up steadily...

I just buy, hold, and wonder at the unfolding glory of Tesla.

This one for sure ;-)

Tesla model 3 sales on fire in China? Someone said this is an old photo so one of you guys maybe can confirm or deny.

Jeffrey Yin Shen on Twitter

A redditor from China also claimed

"Sales seem to be crazy in China right now. Workers reporting the systems are going down from too many requests.

Some insight from locals - The 355k RMB price tag is very reasonable, comparable to many cars in class. A Tesla is an easy choice - Free license plate is an incredible incentive for EVs, since it normally costs ~100k RMB for a Class A license plate in Shanghai for example - Lack of places to charge is a concern to many potential buyers"

Jeffrey Yin Shen on Twitter

A redditor from China also claimed

"Sales seem to be crazy in China right now. Workers reporting the systems are going down from too many requests.

Some insight from locals - The 355k RMB price tag is very reasonable, comparable to many cars in class. A Tesla is an easy choice - Free license plate is an incredible incentive for EVs, since it normally costs ~100k RMB for a Class A license plate in Shanghai for example - Lack of places to charge is a concern to many potential buyers"

The Accountant

Active Member

With that said, the Model Y is planned for production in summer 2020. So, how does that get accounted for in the 2 quarters of tooling leading up to what is considered scaled production?

I appreciate your comment...but in Q1 2019, Telsa only delivered 63,000 vehicles. I don't see Q1 2020 coming in below that.

Q1 2020 will be better than Q1 2019 in all respects.

/S But they don't really make those cars, all the Teslas you see on the street are just figments of your imagination. /SIf they can fund Solar Roof, Truck development, Model Y production planning and ramp, China expansion as well as Service Centres + Supercharger roll-out today with declining ASPs for Model 3 and declining sales numbers for Model S and X, there is really not much to cling on from a short perspective. Especially since deliveries and production of total number of cars has been going up steadily...

The Accountant

Active Member

Ships leaving early in the quarter are not a sign of unwinding the wave. Ships leaving in December would be.

Yes - I agree. The wave is not ending. What I am saying is that in Q2 there was a delivery fire drill with even office personnel (accountants too) making deliveries. There was a push in Q3 to get deliveries completed by quarter end too but not with the same craziness as Q2.

I believe that there will be more than enough orders in Q4 to hit the annual 360,000 estimate and that we will see orders (mainly in the US) coming in Q4 with delivery dates of Q1 2020.

Fact Checking

Well-Known Member

we should embrace bearish Tesla opinion as well, as long as they are not abusive.

Why? Serious question.

When in this current 10+ year journey was their opinion helpful to ‘investors’?

I believe that institutional investors generally have a massive information, IT tooling and (social) networking advantage over private/retail investors, but retail investors have three primary advantages over the "pros":

- much, much longer time frames

- ability to have much deeper draw-downs without clients or higher ups frowning or withdrawing funds

- hyper-focused, sector and company specific competitive analysis

For long term buy-and hold strategies I agree that just strengthening your thesis to the level of near certainty works well, and you can probably save a lot of time by not embracing the nonsense, which is indeed 90% noise.

But to make full use of leveraged volatility, timing is of essence, and for that all the negatives and positives of the short and medium term have to be understood as well - including the current sentiment and emotions on both the long and the short side of the trade. That cannot be done without reading and occasionally engaging the more rational "Tesla skeptics". Not all of them are dumb.

In recent times not at all but in the early days I found some of the somewhat more rational contrarian views prodded me to dig deeper and do more research to backup my position. Everything I found supported my/Tesla's premise and made me more confident.

I believe potential competition has to be monitored all the time: while Tesla is in a natural monopoly right now, with half a dozen serious "moats" that will take years to take down, but current forms of capitalism generally tolerate such scenarios for only short periods of time.

Secondly, many of the doubters on social media are genuine, and can be convinced if engaged - and there's always a lot of neutral people reading various discussions, so debunking false narratives makes sense. All of this helps Tesla in a small way, and there's strength in numbers.

Last edited:

kengchang

Active Member

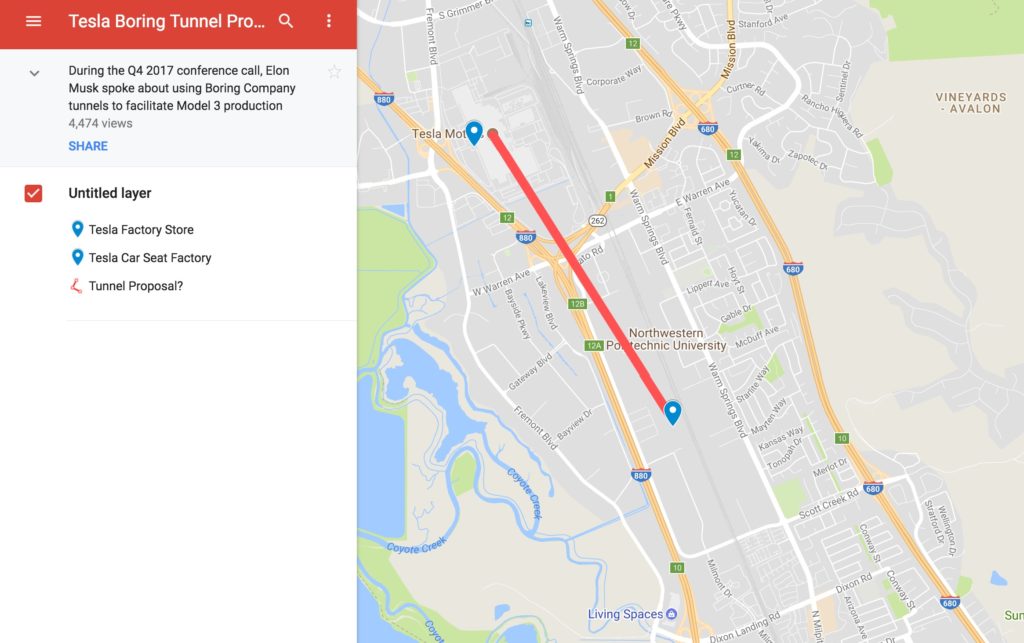

Seat is totally in different facility very close by the Fremont factoryMy understanding was that Fremont needed to make additional room for seat and other part manufacturing, and that the drive unit production was moved to GF1 for this purpose.

KSilver2000

Active Member

I believe that there will be more than enough orders in Q4 to hit the annual 360,000 estimate and that we will see orders (mainly in the US) coming in Q4 with delivery dates of Q1 2020.

Isn’t the 360,000 target a number for deliveries, not orders. Number of orders (demand) is less in question than deliveries (supply, or is it logistics).

Fact Checking

Well-Known Member

Seat is totally in different facility very close by the Fremont factory

Yes, the seat factory is ~3 miles from the main Fremont building:

ReflexFunds

Active Member

With that said, the Model Y is planned for production in summer 2020. So, how does that get accounted for in the 2 quarters of tooling leading up to what is considered scaled production?

Mass production of 1k per week in June likely means production begins in February or March. Most construction will have to be done in Q4 and most tooling and equipment installed by very early Q1. Maybe payment days are 90-180 days so perhaps capex most likely to hit in Q1 and Q2.

For batteries I think the first 2-3k production is already installed and paid for in GF1 (some will first be used for GF3 before being diverted to Y at Fremont). But maybe 4-5k more capacity (and likely including Tesla cells this time) will have to be invested during 1H20 to prepare to take Model Y to 7k per week eventually. Some of this payment may fall into 2H20 however.

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K