I moved my reply here from the Daily Charts thread because I hope some of you with more expertise is specific areas than me will join the discussion.

* GF-3 deliveries impact on Q-1

We need some of our spreadsheet wizards who know the accounting rules to step in and give some perspective on this issue. As a rough idea, though, I'd say that with labor costs very low in China and list price of Model 3s still high in the country, Tesla could produce positive margins, even in Q1. The combination of higher delivery numbers in China next quarter and at least a small contribution towards profits would be viewed very favorably by the market.

.

One of the most important timing issues relates to the timing consequences of commencing GF-3 deliveries. Conventional wisdom is that any Q4 GF3 deliveries to end consumers will trigger immediate depreciation charges that will have the effect of producing substantial losses. I have read each of the published documents related to GF3 and conclude that there is not adequate disclosure to know fir certain what GAAP treatment might be required. The precise language for GF 3 itself, equipment plus pre-production expenses is crucially important. We simply do not have sufficient data to know with certainty.

Since we now appear to know that GF 3 produced vehicles are now in transit it seems highly likely that the various agreements have been structured to permit GAAP amortization and/or expense recognition on a favorable basis. If that is the case it seems possible that even early production at GF 3 will be GAAP positive.

Objectively the casH flow impact should be more important than GAAP, but at the moment attention is strongly influenced by S&P. Hence, I personally do not think Q 4/deliveries will actually take place unless GAAP profitability and positive cash flow have both been assured.

This is, of course, built on logic, not direct accounting evaluation. We will probably know the facts well before year end financial results are reported.

I think there are a small group of indicators which are:

US car sales-

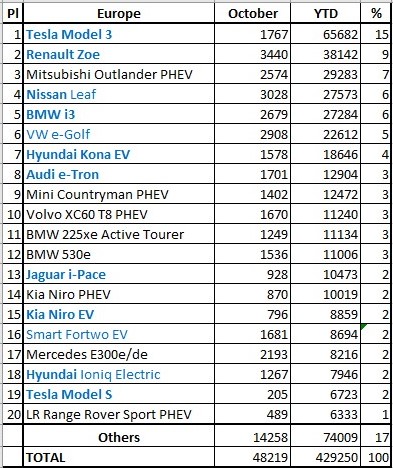

EU car sales-

China...

TE reports.

If TE reports strong commercial/utility deliveries that will be a large contributor to improved profitability. Solar deliveries alone may well reduce losses. Overall, TE stopping the negative impact will be consequential, if it happens, We have clues, but we also have major conditional sales in solar and substantial lease exposures there. I thing that those factors will combine to have TE neutral rather than past losses.

US sales most likely will have declined, but some evidence suggests that since delivery dates began to lengthen in November they may not need the boost, due to the positive push from the last quarter of Federal tax credits. The model mix will tell this story.

EU will be a big blowout due to Netherlands, Norway and accelerated deliveries for U.K., plus a bit of push from new geographies.

Korea clearly is doing very well already but China will be the most important by far. Apart from GF 3 deliveries there have been more shiploads delivered.

if the ship count and local inventory counts are anywhere near accurate we will see stable finished inventory coupled with decreased work in process, which will have positive cash flow. Much of that assumes that all the efforts to speed up trade in disposition in the US have been effective. The only dependable clues seem to have been suction volume reports, which have been obscured by seasonality.

All this gives grounds for cautious optimism. Still, the clues that used to be reliable are now a bit opaque because Tesla has grown in complexity and diversity making VIN counting and fast-reporting countries not enough to depend on any more.

My personal bet is on record sales with GAAP profitability and positive cash flow. Exact results will have been managed to ensure all three of those happen. It is almost certain to be so because Fremont and GF-1 have been flat-out while even GF-2 has had substantial increase in production.

All of that will be because Q 1 will be GAAP positive too, driven by far higher than expected GM from GF 3.

Lest we forget, there are always deferred income categories from FSD, as well as increased Supercharger income to offset past expenses plus increasing revenues from collision repair and service. Each of those is on the verge of becoming material, just as will offsets of common carrier charges resulting from cessation if cellular firmware updates plus charges for cellular access. Thus far none of those have been consequential. In aggregate, though, they will begin to be so beginning this quarter. Will there be enough disclosure to figure this out? Just as with AAPL, I would not count on transparency, just count on positive effects heretofore unseen.