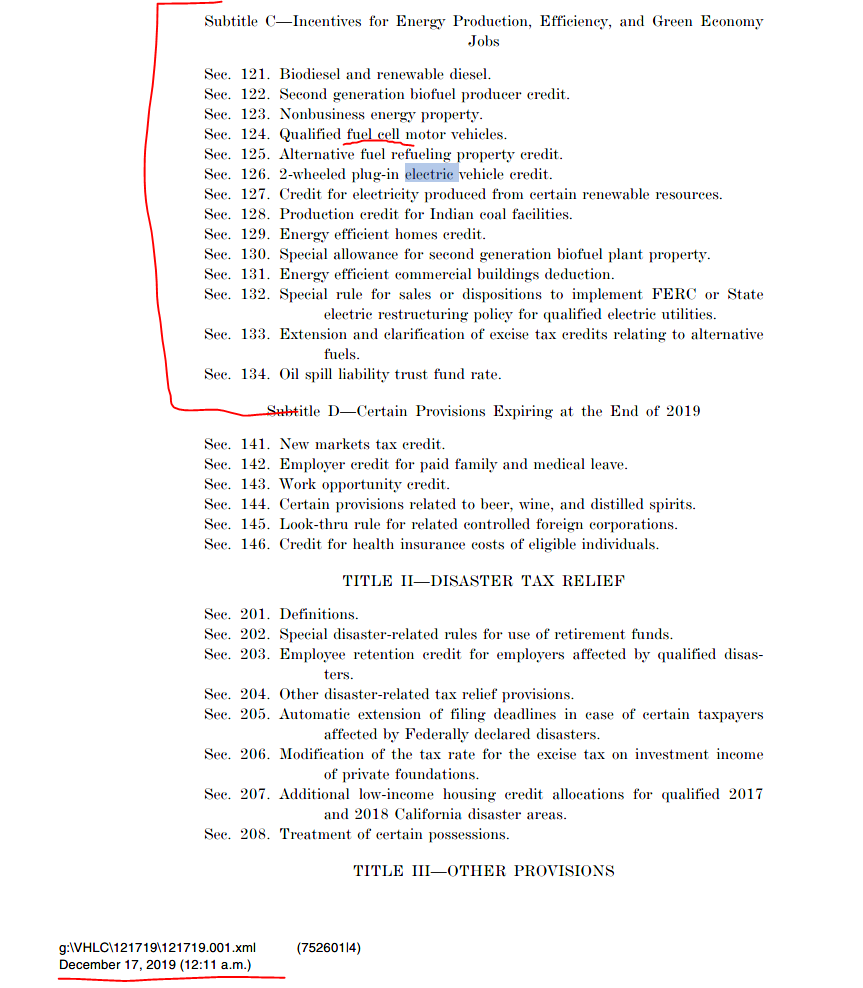

sad to confirm what's missing in the tax extender bill:

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

jeewee3000

Active Member

Upper BB on daily is currently at $377,08.

It's just healthy to consolidate back into the Bollinger Bands before taking ATH.

It's just healthy to consolidate back into the Bollinger Bands before taking ATH.

Fred42

Active Member

How do they handle pre-delivery prep for cars delivered at the lot by the dock?And the last Fremont ship heading for Europe hasn't even arrived yet: the "RCC Europe" with 3k-4k Model 3's is expected to reach Amsterdam port in 3 days:

(The ship is in the lower left corner of the map.)

Robinhood and many other apps supports fraction shares now, so unit price is not a problem anymore.

Unfortunately Robinhood says:

> Sorry! We’re not currently able to accept applications from outside the United States.

Is there a way to know how many non-US investors TSLA has?

Upper BB on daily is currently at $377,08.

It's just healthy to consolidate back into the Bollinger Bands before taking ATH.

Don't let the Bands limit you, show them who's boss!

Push it up

Shove it up

Wayyyy Up!

Go team

GO!

It really doesn't want to go below 380. That's awesome.

StealthP3D

Well-Known Member

OK, time to come clean...

I am an absolute idiot...in regard to some things. I have virtually no knowledge of many things that impact my life. I will say that I consider myself very knowledgeable in some regards, most of which no longer have any impact on my financial well being. Things like teaching music I can have a very in depth, knowledgeable discussion about. Stock however, is definitely not in my wheelhouse of enlightened perception.

A good friend of mine has been telling me how crazy I am to be involved in TSLA for a couple of years now. He is, unlike me, VERY well schooled in everything stock market. He follows the charts religiously. He looks at all the trends. He follows all of the best advice regarding his investments. He is glued to a company's "fundamentals" (I still don't really understand what that is precisely). In short, he is WAY out of my league when it comes to the financial markets. He is genuinely concerned for me that I am so invested in such a fraud that is lead by such a criminal as Elon. (Yes, those are his words.)

Shorting, hedging, puts, calls, charts, "Max Pain" (what the hell is that anyway?) This stuff is all Greek to me and I don't understand it one bit. So, why the hell do I own TSLA? Great question. Well, all I can say is this. I heard about the company back when it was just the Roadster and the Model S. I liked what they said they were trying to do. I could never afford their products, but were amazed by what they were capable of. I test drove a Model S. "OMG this thing is incredible!" They announced the Model 3. On a whim, I made a reservation just because it made me feel good. I bought a little stock. First time ever buying any stock of any kind. I had a two year wait before anything went final so I started doing some more research. "Who the hell are these people that call themselves TSLAQ?" "Is the company really a fraud?" "Is it all a lie?" Two years later I get the email...time to configure or cancel. By that time my little investment has earned enough for a sizable down payment. I go for it and sell my TSLA shares. Get the car...game over.

6 months into ownership and I have a little money to play with. I get back in. About a year later I have the opportunity to purchase some land for our dream retirement home. Yup, you see where I'm going. Made enough on TSLA for the purchase. I leave a small number of shares untouched. In the weeks since the land purchase the stock has skyrocketed and is making me more money. By the time my Cybertruck reservation (yeah, I jumped on that bandwagon too) comes to delivery, I hope to have made a chunck for another sizable down payment for it. TSLA has made it possible for me to have things I never would have been able to have without it.

So...my investment philosophy, coming from a guy that knows absolutely nothing about how the market works? Find a company you believe in. Check it out. Experience what they offer. Then, if it feels right and you have some discretionary funds...pull the trigger and then ride it out knowing you are supporting a company that makes sense for you. Yeah, you could lose everything, but if you know that is a possibility going in, it shouldn't hurt as bad if it all goes belly up. The upside?...well, for me it has been amazing!

My friend still knows WAY more than me about investing to make money. But, I don't think he gets what it feels like to be part of something you really believe in. He STILL thinks I am idiot for investing in Tesla. LOL!

Definitely, unequivocally, without a doubt NOT, IN ANY WAY an advice!

(feeling really happy about my little investment though)

So, would you say you belong to the Forrest Gump School of Investing?

A good friend of mine has been telling me how crazy I am to be involved in TSLA for a couple of years now. He is, unlike me, VERY well schooled in everything stock market. He follows the charts religiously. He looks at all the trends. He follows all of the best advice regarding his investments. He is glued to a company's "fundamentals" (I still don't really understand what that is precisely). In short, he is WAY out of my league when it comes to the financial markets. He is genuinely concerned for me that I am so invested in such a fraud that is lead by such a criminal as Elon. (Yes, those are his words.)

I gotta ask. Has he driven your Model 3 yet? Because from your description of how much stock market research he does, I would think he might have begged a test drive from you by now.

I haven't the foggiest idea what you are talking about here, but that's what I love about this place. It's highly unlikely to be BS, given the pedigree of the poster, but if it was BS then others with a similar pedigree will sort it out. I may borrow "my most recent project is an attempt to use differential evolution of fluids with an arrhenius equation database to try to evolve a hypercycle" for an upcoming Christmas party, many thanks.

- Differential evolution = genetic algorithm / artificial evolution / etc. Take your pick of terms. Basically "survival of the fittest". You have a population of possible solutions to a problem, they "breed" and "mutate", and if one is "fitter" than another it's being compared against, it "lives on" and the other "dies".

- Arrhenius equation = a popular formula for expressing reaction rate constants (the rate at which different possible chemical reactions can occur). The actual rate of the reaction is the reaction rate constant (from the Arrhenius equation) times the molar concentrations of its reactants, each to a given exponent. Or in plain English: "a database of how fast things react with each other"

- Hypercycle = a self-sustaining series of chemical reactions, which can recreate all of its component building blocks from common raw materials. The simplest form of life - not even a cell (no membrane) - just free-floating chemicals, reacting and creating more of each other. The first step in abiogenesis.

- Each member in the population (e.g. each set of experimental conditions) represents an "inflow" and a "starting cell", at a given (evolvable) temperature. Each inflow is initially randomly generated from a mix of common naturally occuring chemicals at realistic ratios to each other.

- The inflow is "relaxed" (allowed to react) for a given, randomly chosen, evolvable period of time

- The relaxed inflow is then allowed to react again for the same length of time it would take to pass through the chosen cell (another evolvable parameter). The output is saved (A).

- The cell itself is then "relaxed", with a given amount of its contents flowing out of the cell and being replaced by inflow, per unit time. The output is saved (B)

- In an ideal hypercycle scenario, (B) will look very different from (A); if they're the same, then the initial conditions in (B) made basically no difference (it just diluted until it became like (A)) - but the longer it takes for (B) to look like (A), the better of a job it did hanging on against dilution. Also, in an ideal scenario, the hypercycle will be able to handle high inflow rates without dissipating, as well as variation in the inflow. Lastly, in an ideal scenario, the contents of the inflow are as realistic as possible.

- The above parameters define the cost function (e.g. how "fit" a given experiment is). Those which do a better job replace those which did a poorer job.

Come on, isn't this sort of thing what everyone does in their spare time during the winter?

Last edited:

Ask him if those things are guaranteed ways to invest, why are fund managers, the highest paid financial professionals with the best education possible and access to entire teams to research for them, unable to beat the market return in the long run?My friend still knows WAY more than me about investing to make money. But, I don't think he gets what it feels like to be part of something you really believe in. He STILL thinks I am idiot for investing in Tesla. LOL!

Definitely, unequivocally, without a doubt NOT, IN ANY WAY an advice!

(feeling really happy about my little investment though)

Dan

If you want to be snarky, ask him if on average he has out performed the market (with proof) and why he hasn't retired

Come on, isn't this sort of thing what everyone does in their spare time during the winter?

I ate some edibles and watched cartoons so pretty similar.

Todd Burch

14-Year Member

Yes, looks like a lot of support at $380, which is a good sign. Consolidate, then ATH in 44 minutes

JRP3

Hyperactive Member

You had to say that...It really doesn't want to go below 380. That's awesome.

Was going to say the exact same thingIndeed. Except that you're not doing gradient descent to train the neural net itself, but rather to choose an optimal neural net architecture. Meta-training.

Most of my work with optimization has been through the scipy.optimize libraries, which offer quite a selection of tools - although I've more recently been needing to do it in C++ to avoid having to implement python bindings. The scipy libraries are also annoyingly deficient in A) threading, and B) ability to resume - although you can work around (A) by doing threading inside your cost evaluation function, and (B) by cashing and saving the results of every cost evaluation, so that if you have to start over, it can just look up the answers up to the point where you left off.

Most of my previous optimization projects have been with CFD model optimization, although I've also used it for things like compression, and my most recent project is an attempt to use differential evolution of fluids with an arrhenius equation database to try to evolve a hypercycle

shrspeedblade

Rideshare Monkey

Hell, I'm just excited if this range is our springboard going into production #s and earnings in January!

(I'm encouraged we didn't see more of a drop when the EV credit news hit- like I needed yet one more reason to loathe trump!)

(I'm encouraged we didn't see more of a drop when the EV credit news hit- like I needed yet one more reason to loathe trump!)

Short OT anecdote.I haven't the foggiest idea what you are talking about here, but that's what I love about this place. It's highly unlikely to be BS, given the pedigree of the poster, but if it was BS then others with a similar pedigree will sort it out. I may borrow "my most recent project is an attempt to use differential evolution of fluids with an arrhenius equation database to try to evolve a hypercycle" for an upcoming Christmas party, many thanks.

I'm just a dumb aerospace engineer, but I peripherally interact with smart planetary geologists. At a Christmas party years ago I struck up a conversation with one who was investigating alternate K-T Boundary (dinosaur killer) hypotheses (the Chicxulub impact crater had just been discovered). I had just happened to skim a SciAm article on the subject that mentioned the "Deccan Traps" (ancient volcanic region in India). So, I threw out "Oh, so you're probably interested in the Deccan Traps." He was dumbfounded, as that was exactly what he was researching.

So, never underestimate the potential of throwing out a phrase to make you look smart (especially after the egg nog).

kengchang

Active Member

How did you find this particular buy?From September

Im curious if people are still so sure these would expire worthless.

By randomly scanning the options chain?

Or was it just an anomaly in the Option Chain at that expiration where the premium was just crazy lower for that one strike price than the next higher or lower, or was the premium in line with others but certain Greeks made it a much better buy for some reason?

Thanks again. Wish I'd bought then, but you - and a few others posting here - motivated me to learn more about options.

Last edited:

larmor

Active Member

The auto story for tesla for US customers is good now which i think is why there is little change on news of EV subsidy/credit. The main story is the market coming to realization of local Shanghai factory making M3 for local consumption, thus bypassing any trade talk...I'm surprised it's not dropping now that it's out that the EV subsidy extension for the 200K+ club failed to pass.

The upcoming stories, which will remain without value by the market are FSD-- with its data (data is the new oil), solar rental thus bypassing local utilies, and that pesky 620 mile range truck (and of course super slick roadster with 620 mile range also)-- where is that 620 mile range coming from??!!!

A Sci-Am story long ago about electric cars for grid storage sparked my first interest in electric vehicles (as Sci Am did on so many other interests), making it my favorite Christmas gift magazine.Short OT anecdote.

I'm just a dumb aerospace engineer, but I peripherally interact with smart planetary geologists. At a Christmas party years ago I struck up a conversation with one who was investigating alternate K-T Boundary (dinosaur killer) hypotheses (the Chicxulub impact crater had just been discovered). I had just happened to skim a SciAm article on the subject that mentioned the "Deccan Traps" (ancient volcanic region in India). So, I threw out "Oh, so you're probably interested in the Deccan Traps." He was dumbfounded, as that was exactly what he was researching.

So, never underestimate the potential of throwing out a phrase to make you look smart (especially after the egg nog).

Edit - added in parenthesis

Last edited:

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K