That's a better answer than the far shorter one that I had been considering: "You're confusing me"...but let it pass. Thanks, both of you.You're confusing RSA with DES (Data Encryption Standard). At the time the computation requirements for any public-key system like RSA were far too large for banking transactions like ATMs. Everything was based on the 70's era Data Encryption Standard, updated to use larger keys. For those who didn't know, AES is actually from Belgium, the submission was originally called Rijndael... so export controls were largely meaningless.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Seems like during this runup the sellers of calls try to hold the line at $20 above the prior week's close. So this week, $460 is the real battle. If the SP goes significantly above that this week, the call writers will likely feel real pain.

Of course, I'm quite fine with the SP rising $20 per week, but it would be great to start really taking out the call writers. A lot of the SP games would end if that could happen.

Of course, I'm quite fine with the SP rising $20 per week, but it would be great to start really taking out the call writers. A lot of the SP games would end if that could happen.

Left's Citron hedge fund posts 43% gain in first year

remember Andrew Left who abandoned his TSLA short position late 2018?

He cameback with good 2019 performance and advice:

remember Andrew Left who abandoned his TSLA short position late 2018?

He cameback with good 2019 performance and advice:

Left also gave investors lessons that he learned last year; reminding himself and others to stay away from what he calls "big story 'cult stock'" companies and sticking with what he does best: exposing fraud.

Best they get building those battery factories pronto. While they’re at it, hope they find some secret sauce to a) make those batteries as good as Tesla’s, b) last a million miles, c) figure out how to manage them in the car, d) figure out how to integrate all the systems in the car, e) provide OTA updates, f), g), h) etc...

Oh, and make a profit doing it. I’m sure it’ll be a breeze.

So, define swiftly for me. At what date in time does your belief change?

lols, I’m not here advocating that the OEMs are setting a wise course, nor am I by any means saying they are about to act swiftly.

I mentioned circa 2025 in the last post as to when we might see a major shift in course and large scale government support, and in a previous post, likely 2025-2030.

so no, as I’ve posted here, I explicitly do not think the incumbents are going to move swiftly TO this strategy. in fact, their continuing to drag their feet for many years to come was at the core of the entire thesis of the “fractured tipping point” thread I started here 3 years ago and have described here in this thread in the past.

The Fractured Tipping Point Moat

what I am saying re swiftly, is that IF the incumbents are to survive (at least the bulk of them), it will very likely require a plan both requiring government support and very large and rapid GF rollout IF/WHEN they quit dragging their feet and adopt this strategy. This approach would likely require outside player(s) help re battery and GF construction know how (potentially Tesla). The incumbents may or may not go for this, or go for it aggressively enough. either way I continue to expect rampant foot dragging until in roughly 5-10 years they start moving swiftly if they are to have much chance of surviving.

Again, we shall see.

Last edited:

That nut claims to drive a volt.The delicious irony would be if they drove a Tesla.

How dumb can you be?Left's Citron hedge fund posts 43% gain in first year

remember Andrew Left who abandoned his TSLA short position late 2018?

He cameback with good 2019 performance and advice:

"People who buy stock or cars from this company are part of a cult. They are irrational and love it no matter what. So I'm totally going to bet against that!"

I have dealt a lot with BIS/EAR regulation of crypto software, so I say with a little authority that this regulation means almost nothing for Tesla.Long time lurker, created this account to ask about this tweet from a TSLAQ person that almost seems legit.. leads to a .gov site basically saying that US companies are banned from exporting self-driving vehicles... specifically targeting Tesla's NN tech, effective immediately

eh-sama on Twitter

Thoughts?

1. It specifically deals with "point cloud", which is what you get from Lidar. Tesla specifically said that they don't try to make a point cloud out of images.

2. it regulates (but does not forbid) export of the software itself, but when the software is embedded in a device (eg. car) that's fine. Otherwise no cellphone could ever cross a border.

3. Although it's already in force, it is only temporary for one year, comments are (now) open.

4. from the actual Federal Register with my elisions and emphasis:

Nothing in Tesla's cars allows the user to identify to the system any of the things it displays.... having all of the following:

1. Provides a graphical user interface that enables the user to identify objects (e.g., vehicles, houses, etc.) from within geospatial imagery and point clouds in order to extract positive and negative samples of an object of interest;

Maybe Tesla does this...2. Reduces pixel variation by performing scale, color, and rotational normalization on the positive samples;

Nothing in the car does training.3. Trains a Deep Convolutional Neural Network to detect the object of interest from the positive and negative samples; and

We don't know enough about Tesla's software to be sure, but I see no evidence of them doing this.4. Identifies objects in geospatial imagery using the trained Deep Convolutional Neural Network by matching the rotational pattern from the positive samples with the rotational pattern of objects in the geospatial imagery.

I think the regulation is aimed at battlefield robots... but I don't know anything about that field.

So saying that this applies to Tesla is FUD.

Clicked on a investment article and came across this gem:

"On the surface, that all sounds well. Until, that is, someone has to pay for these incentives. While the Norwegians should be commended for their zero-emission efforts, they’re going about it through big government policies. Primarily, Norway uses an automotive taxation system. Essentially, the more you pollute, the more you pay. Under this draconian law, the government forcibly made EVs cheaper comprehensively than fossil-fueled cars."

"On the surface, that all sounds well. Until, that is, someone has to pay for these incentives. While the Norwegians should be commended for their zero-emission efforts, they’re going about it through big government policies. Primarily, Norway uses an automotive taxation system. Essentially, the more you pollute, the more you pay. Under this draconian law, the government forcibly made EVs cheaper comprehensively than fossil-fueled cars."

StealthP3D

Well-Known Member

And it’s that which will accelerate the transition. What happens to OEMs doesn’t then actually matter. They can disappear or not and be *refurbished* (for lack of a better word) and nobody will care one way or another. The transition happens with or without them, without adversely affecting the country. The people as a whole decide, not individual OEMs.

I love it! But it's undeniable that in giving the power to the people, he is effectively taking it away from the OEM's. Not out of spite, out of necessity. It's beautiful.

Who else had the wisdom to do this? I don't see anyone lurking in the shadows!

Krugerrand

Meow

...

what I am saying re swiftly, is that IF the incumbents are to survive (at least the bulk of them), it will very likely require a plan both requiring government support and very large and rapid GF rollout IF/WHEN quit dragging their feet and adopt this strategy. This approach would likely require outside player(s) help re battery and GF construction know how (potentially Tesla). The incumbents may or may not go for this, or go for it aggressively enough. either way I continue to expect rampant foot dragging until in roughly 5-10 years they start moving swiftly if they are to have much chance of surviving.

So all of this back and forth and you don’t actually believe it’s going to happen. Good to know we’re on the same page.

So all of this back and forth and you don’t actually believe it’s going to happen. Good to know we’re on the same page.

Yikes, that is not even remotely what I’ve said

woodisgood

Optimustic Pessimist

Left's Citron hedge fund posts 43% gain in first year

remember Andrew Left who abandoned his TSLA short position late 2018?

He cameback with good 2019 performance and advice:

Didn't they end up going long TSLA?

Tslynk67

Well-Known Member

Artful Dodger

"Neko no me"

I agree. I am up 54.4% (as of yesterday's Close) on the TSLA shares I bought 21 months ago and have held throughout.I'm happy to have sold a LEAP call 360 that I bought 22 months ago. ..

So in hindsight, I think I would have been much happier had I simply bought shares rather than this option. But I'm not complaining, I'll take a 52% gain on dumb luck over a 99% loss on bitter folly.

I'm still hodling. My investment horizon is 7-8 yrs, and I see huge upside for Tesla and all risks well controlled.

What's your next move with the proceeds from your LEAPs?

Cheers!

Krugerrand

Meow

CNBC is making montages of Elon dancing now. It was a slow motion remix with the song “I hope you dance” playing lol

Diversion tactic. Just like they did with the Joe Rogan clip, the fractured CYBRTRK window, etc.

They think they’re being clever trying to attack the man and keep eyes off the ball — Tesla’s successes. It’s a form of passive aggressive bullying. ‘Everyone look at how ridiculous the CEO of an 80B company behaves at the official opening of a factory!’

It seemed to work at first, especially when he fueled the fire, but now it’s backfiring. Epically. Dancing like Elaine Benes, sincerely sharing his joy, and celebrating with the factory workers and customers only makes him a more appealing human being.

CNBC has two positive analyst on right now. They keep asking about the competition and I wish the two guys they brought on would bring that argument home a bit. They need to help people understand the electric car movement. Tesla is moving faster simply because the car is better, miles, range, and most importantly your buying the structure of the Tesla network. With the other manufacturers they are still electrifying in a half assed manner and so Tesla will remain the best option.

plus people like that dancing guy too

plus people like that dancing guy too

jkirkwood001

Active Member

I feel like @Papafox - when is the requirement to report on this continuous SP good news going to end?!?

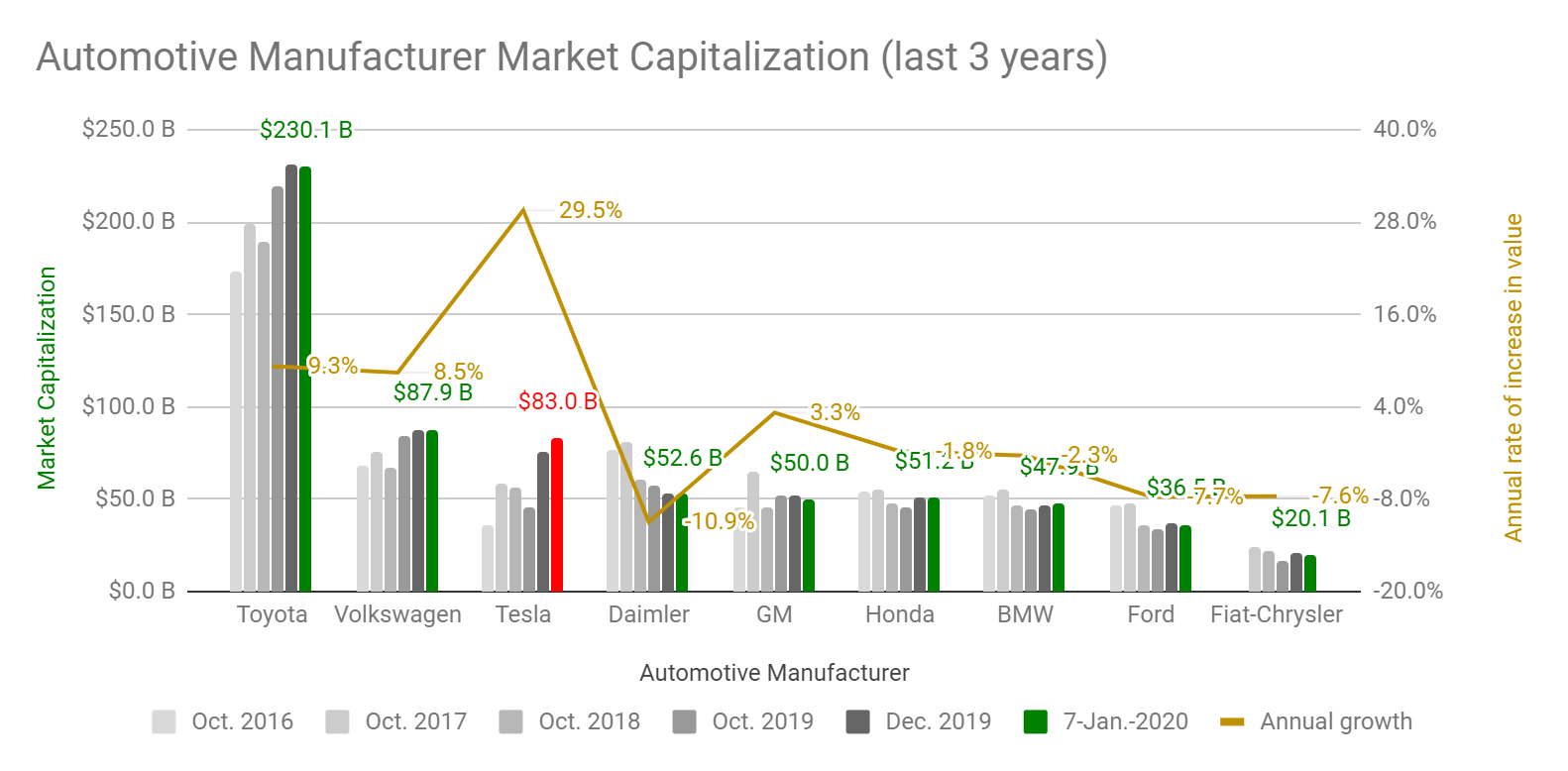

- Worth 3x more than Fiat-Chrysler (sorry Lee)

- Worth $30B more than Daimler (Mercedes)

- Worth $35B more than BMW

- Worth 2x - no, 2¼ times - more than Ford

- Only $4.8B less than VW (the second most valuable auto manufacturer in the world)

Last edited:

StealthP3D

Well-Known Member

Karen’s call spreads have better risk adjusted returns, than being outright long

As an investor, you should know that's a matter of opinion. I'm not saying I agree or disagree (as I haven't analyzed her spreads), just that there is no 100% objective way to determine the actual risk. It's a matter of opinion because the business and investment world is not a cookie-cutter world that can be represented by neat mathematical formulas. If it were, computers could allocate all capital for the cost of maintaining the computers and investors would all receive the same return on their capital.

Long time lurker, created this account to ask about this tweet from a TSLAQ person that almost seems legit.. leads to a .gov site basically saying that US companies are banned from exporting self-driving vehicles... specifically targeting Tesla's NN tech, effective immediately

eh-sama on Twitter

Thoughts?

That looks like a big nothingburger. The only thing Teslas do in China (I am assuming this ban is aimed at that country) is gather images and send them to the US for processing and neural learning. Nohting of strategic importance is being exported.

Shorties are salivating over this, but it won't help them.

And welcome as active poster. That was not a low profile entrance

Seems like the business world smells blood in the water. When even have companies like Sony floating EV concepts that doesn't bode well for incumbents that have no moat.lols, I’m not here advocating that the OEMs are setting a wise course, nor am I by any means saying they are about to act swiftly.

I mentioned circa 2025 in the last post as to when we might see a major shift in course and large scale government support, and in a previous post, likely 2025-2030.

so no, as I’ve posted here, I explicitly do not think the incumbents are going to move swiftly TO this strategy. in fact, their continuing to drag their feet for many years to come was at the core of the entire thesis of the “fractured tipping point” thread I started here 3 years ago and have described here in this thread in the past.

The Fractured Tipping Point Moat

what I am saying re swiftly, is that IF the incumbents are to survive (at least the bulk of them), it will very likely require a plan both requiring government support and very large and rapid GF rollout IF/WHEN they quit dragging their feet and adopt this strategy. This approach would likely require outside player(s) help re battery and GF construction know how (potentially Tesla). The incumbents may or may not go for this, or go for it aggressively enough. either way I continue to expect rampant foot dragging until in roughly 5-10 years they start moving swiftly if they are to have much chance of surviving.

Again, we shall see.

Even some of the shorts have conceded that it won't impact Tesla. That looks like a big nothingburger. The only things Teslas do in China (I am assuming this ban is aimed at that country) is gather images and send them to the US for processing and neural learning. Nohting of strategic importance is being exported.

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K