Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

This is the only attitude to have on this if you’re long. Great plan, strong conviction and it’s paying off.I don't think its silly at all. Let me paint a picture for you...

6 months ago, I had 1,300 TSLA shares, roughly around 90% of all liquid capital I have (net worth if you like). I kept roughly another $100k in other shares and $100k in cash. When TSLA share price dropped from $350 to $183 early this year, I was still very confident in TSLA, for that reason I did not sell any shares, but I didn't want to go absolutely all in because then I would be left with nothing if it did crash and there was a small but real chance (maybe 10-20% chance I calculated, even Elon said they were "very close" when they couldn't get Model 3 ramping).

I have a small family, just turned 40 etc. I am playing a long game with TSLA, I don't want to sell any at all...at least not until $3,000 per share, so whether I buy the shares at $180 or $500 doesnt matter that much long term. Since the share price has been increasing again, I have bought another 300 sahres all the way up to $540, trying to take advantages of MMDs and small rebounds along the way.

I still want another 200 shares to get to a 0.001% share holding of the company then I will stop and hold long term. That will be family's legacy for the next 40 years!

I will say back in May when it was at $180 the concern of Tesla folding didn’t seem real. I recall more talk of buyouts from the likes of Apple or Google. But late 2018 prior to Q3 seemed more dire. It felt heavily manipulated back in the spring though, I think for me it was just about holding onto the word of Musk that kept saying Q3 and 4 will be a return to profitability. Once we got there I felt it could take off

Mike Smith

Active Member

As a customer, ETrade shows it to me graphically. But I'm pretty sure you do have to be a customer.Is there a pre-market graph available online? Can only see the numbers, but I would like to have a graph of pre-market trading (it may be delayed)

humbaba

sleeping until $7000

Old, but I just saw this on twitter:

love it!

edit: although I would make it "Tesla" rather than $TSLA because (at least in the short term) the stock price is decoupled from the company's performance, much less innovation

@BullTesla said:d(Innovation)/dt=$TSLA

love it!

edit: although I would make it "Tesla" rather than $TSLA because (at least in the short term) the stock price is decoupled from the company's performance, much less innovation

Is there a pre-market graph available online? Can only see the numbers, but I would like to have a graph of pre-market trading (it may be delayed)

Yahoo has one:

Mike Smith

Active Member

Let me get this straight - Adam Jonas had a price target less than half of Tesla's current price, but the market is surprised that he doesn't think you should buy it. Interesting.

TradingInvest

Active Member

I added a bit. Will add a bit more every time it goes $10 lower.

woodisgood

Optimustic Pessimist

*shrug* Like ARK has been alluding to in their interviews, traditional auto analysts are going to lose TSLA to tech analysts. Bye, Adam.

Um, a little confused...? That article says the entire US national battery production is 33 GWh and Tesla is 42% of that (so, math says 14 GWh). Yet GF1 is already at 35 GWh on the way to 54 GWh? Where are they pulling these numbers from?

engle

Member

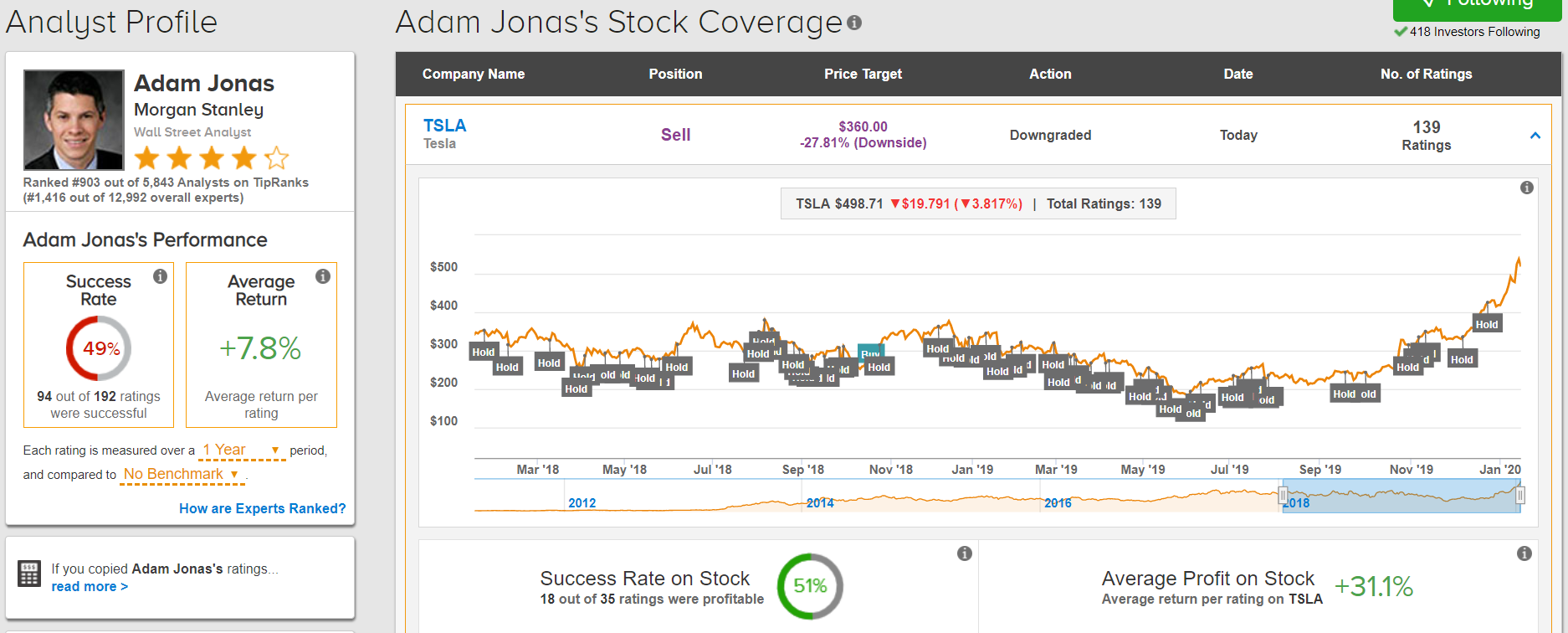

Anyone can get a free account at http://tipranks.com to see this analist Adam Jonas' record analyzing not just TSLA, but all the equities in his teams' "coverage universe". It is laughable:

Do MS clients get advance notice of his actions so they can trade TSLA ahead of the public and in advance of Jonas' legal market manipulations?

My background research reveals he is about 45 years old, grew up in Canton, OH and graduated with a Bachelor of Business Administration in General Finance in 1996 from the University of Michigan. If I were hiring analists, I would want people with advanced degrees and/or experience in the industries they are analizing. Mr. Jonas has neither. No wonder his success rate is a coin flip!

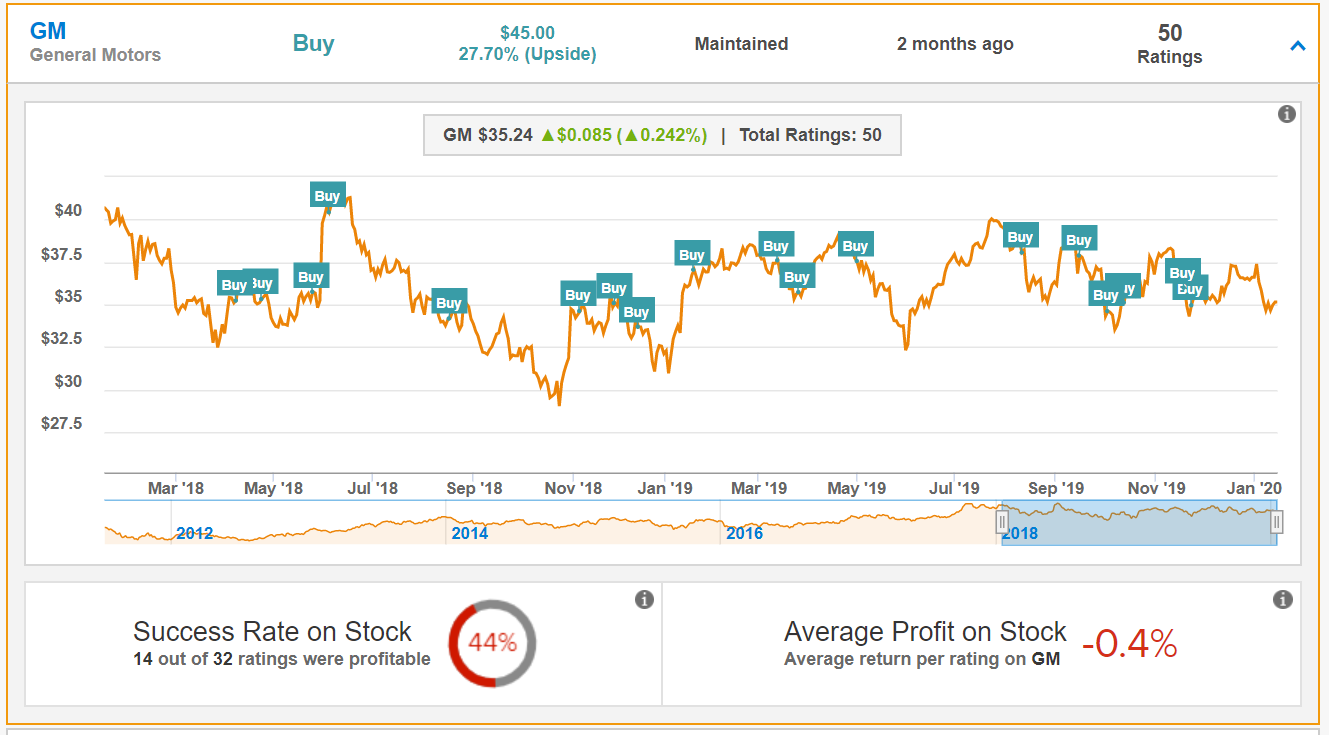

It gets even worse when you look at his record with names like GM: (just do the opposite of what he recommends!)

Meet Adam Jonas, Morgan Stanley's Head of Global Auto & Shared Mobility Research | Morgan Stanley

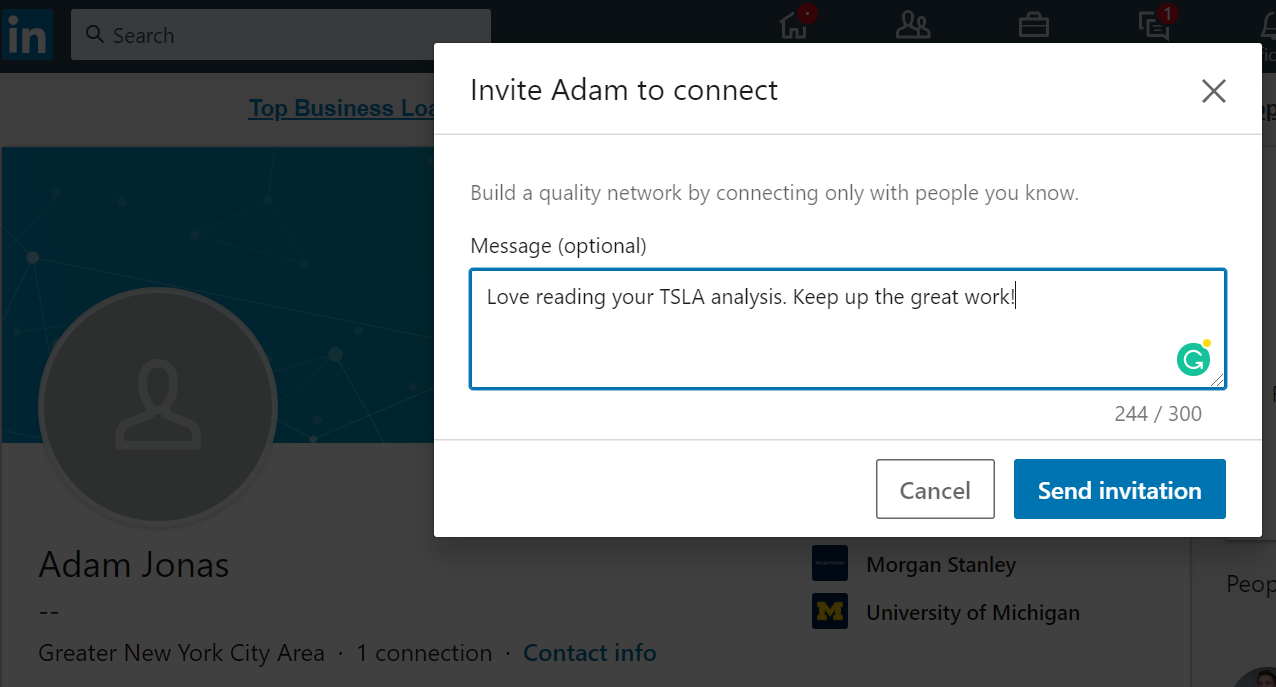

https://www.linkedin.com/in/adam-jonas-6b4599120/ (he only has 1 connection on LinkedIn so doesn't understand or value professional social networking I guess. Let's all bombard and overwhelm his email inbox with "CONNECT" requests! I just did along with the message "Love reading your TSLA analysis! Keep up the great work!" ;-)

I think his TSLA "sell" is just designed to shove the price down temporarily so MS clients can scoop-up shares prior to the earnings call, rinse and repeat.

I *feel* like shorting MS stock, trading at a 52-week high! Its market cap is now ironically 91.758B or slightly higher than TSLA due to Jonas' downgrade. LMFAO (I've never shorted anything in my life and now is not the time to start!)

Russ

Do MS clients get advance notice of his actions so they can trade TSLA ahead of the public and in advance of Jonas' legal market manipulations?

My background research reveals he is about 45 years old, grew up in Canton, OH and graduated with a Bachelor of Business Administration in General Finance in 1996 from the University of Michigan. If I were hiring analists, I would want people with advanced degrees and/or experience in the industries they are analizing. Mr. Jonas has neither. No wonder his success rate is a coin flip!

It gets even worse when you look at his record with names like GM: (just do the opposite of what he recommends!)

Meet Adam Jonas, Morgan Stanley's Head of Global Auto & Shared Mobility Research | Morgan Stanley

https://www.linkedin.com/in/adam-jonas-6b4599120/ (he only has 1 connection on LinkedIn so doesn't understand or value professional social networking I guess. Let's all bombard and overwhelm his email inbox with "CONNECT" requests! I just did along with the message "Love reading your TSLA analysis! Keep up the great work!" ;-)

I think his TSLA "sell" is just designed to shove the price down temporarily so MS clients can scoop-up shares prior to the earnings call, rinse and repeat.

I *feel* like shorting MS stock, trading at a 52-week high! Its market cap is now ironically 91.758B or slightly higher than TSLA due to Jonas' downgrade. LMFAO (I've never shorted anything in my life and now is not the time to start!)

Russ

Attachments

Last edited:

Smart move. No time value left in the option, so you start the clock on capital gains at a cost basis well below market.Firs time in my life exercised option. Call 295 for tomorrow

Runarbt

Active Member

Don't look!!

... because it's still red.

This is actually excellent imho. :-D

We are now establishing $500 as the new floor/solid support. If we can get a new range 500-550 - I dont mind a sideways movement for a few weeks.

Edit: oups.. 498.. * up up..*

Last edited:

"Hey you, 2018 Me, yeah it's Me, 2020 you."

"Me? You? What?"

"Yeah shut up, so listen. Fun fact here."

"uhh, ok"

"There will be a day in January where you get real sad because TSLA is down to $500."

"LOL, I guess I develop a really bad meth problem in 2020 because you sound crazy."

I'm hoping this adds more weight to the potential big upside if ER really beats expectations. If not I'm not unhappy with 500 being the new 300.

"Me? You? What?"

"Yeah shut up, so listen. Fun fact here."

"uhh, ok"

"There will be a day in January where you get real sad because TSLA is down to $500."

"LOL, I guess I develop a really bad meth problem in 2020 because you sound crazy."

I'm hoping this adds more weight to the potential big upside if ER really beats expectations. If not I'm not unhappy with 500 being the new 300.

I can't imagine that they don't. Do MS clients get advance notice of his actions so they can trade TSLA ahead of the public and in advance of Jonas' legal market manipulations?

Last edited:

Mike Smith

Active Member

On the bright side the RSI just dropped from a way over-bought 85 to a respectable 67.

X Fan

Active Member

Anyone can get a free account at http://tipranks.com to see this analist Adam Jonas' record analyzing not just TSLA, but all the equities in his teams' "coverage universe". It is laughable:

View attachment 500831

Do MS clients get advance notice of his actions so they can trade TSLA ahead of the public and in advance of Jonas' legal market manipulations?

My background research reveals he is about 45 years old, grew up in Canton, OH and graduated with a Bachelor of Business Administration in General Finance in 1996 from the University of Michigan. If I were hiring analists, I would want people with advanced degrees and/or experience in the industries they are analizing. Mr. Jonas has neither. No wonder his success rate is a coin flip!

It gets even worse when you look at his record with names like GM: (just do the opposite of what he recommends!)

View attachment 500818

Meet Adam Jonas, Morgan Stanley's Head of Global Auto & Shared Mobility Research | Morgan Stanley

https://www.linkedin.com/in/adam-jonas-6b4599120/ (he only has 1 connection on LinkedIn so doesn't understand or value professional social networking I guess. Let's all bombard and overwhelm his email inbox with "CONNECT" requests! I just did along with the message "Love reading your TSLA analysis! Keep up the great work!" ;-)

View attachment 500827

I think his TSLA "sell" is just designed to shove the price down temporarily so MS clients can scoop-up shares prior to the earnings call, rinse and repeat.

I *feel* like shorting MS stock, trading at a 52-week high! Its market cap is now ironically 91.758B or slightly higher than TSLA due to Jonas' downgrade. LMFAO (I've never shorted anything in my life and now is not the time to start!)

Russ

Lol @ his 49% accuracy stat......analysts are similar to weather broadcasters here in Fl...they have a 50/50 chance of being right (or just flip a coin similar to Tommy from Peaky Blinders for same accuracy).

Quesder

Member

What is meth? What is meth problem? Do you mean math?"Hey you, 2018 Me, yeah it's Me, 2020 you."

"Me? You? What?"

"Yeah shut up, so listen. Fun fact here."

"uhh, ok"

"There will be a day in January where you get real sad because TSLA is down to $500."

"LOL, I guess I develop a really bad meth problem in 2020 because you sound crazy."

I'm hoping this adds more weight to the potential big upside if ER really beats expectations. If not I'm not unhappy with 500 being the new 300.

I can't imagine that they don't.

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K