I'm automatically highly skeptical of any energy-related forecast that shows only a shallow change over multi-decadal timecales. It reminds me of the terrible IEA wind and solar forecasts:

The world is expected to need

nearly $50T in new energy investment by 2035. The notion that storage isn't going to be a major part of this is frankly nonsense.

The biggest problem is that most forecasters have repeatedly failed to understand how fast storage will drop in price - to the point that they even get it wrong

in realtime. The notion that Tesla could do the Hornsdale battery for $387/kWh installed was laughed at by many supposed experts. Yet they did so, and without blowing their margins. Yet this is still very early in terms of large-scale storage products for Tesla. Tesla is at ~$100/kWh at the cell level, and 5 years from now I wouldn't be surprised to see them pushing ~$50/kWh cell cost (assuming mining tech cooperates in terms of supply pricing). Certainly well under $100/kWh at the very least. And meanwhile, manufacturing improvements will continue to push the total hardware cost down closer to the cell cost .

This will radically alter the economic picture for mass storage projects.

Indeed, even the

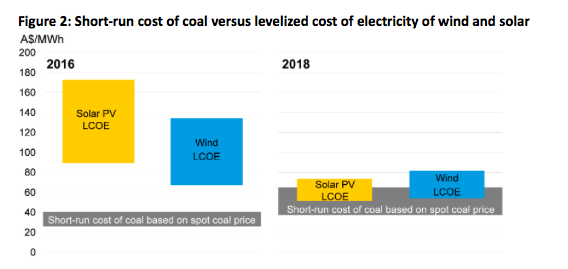

demand for mass storage is thrown off by the continual failure to predict how quickly wind and solar production would grow. They're now getting to the point where the cost of building new wind and solar projects is lower than the cost of

just keeping existing coal plants running.

Storage, even with major price drops, won't entirely eliminate the need for backup power. But there's no shortage of plants that will be driven out of the baseload market that can transition to a peaking / load-following / backup role... so long as they're given sufficient time to ramp. And in terms of rapid-response peaking, nothing competes with battery storage - even today.

Additionally, once you start getting grid-scale storage costs low enough, you're no longer just looking at just a market for rapid-response peaking (and voltage/frequency maintenance on remote lines); you're now starting to make overnight battery storage practical in increasingly large markets.