SMAlset

Well-Known Member

Have to say after coronavirus news everywhere it's nice to hop over to the vehicle forum area and see people getting their new cars, Model Ys too.

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

Not yet but our country has a history of breaking monopolies. It generally is thought to protect consumers.

Yes but you can look at the big 3 and they were all split. Don't get me wrong, it is not (based on today) what I would want for Tesla.The U.S. last broke a monopoly in 1981, i.e. almost 40 years ago. It's both legally and politically difficult, under the Sherman Act and its precedence a conviction and breakup requires the finding of a "predatory monopoly", which only the most arrogant monopolies do and leave evidence of doing. Clever corporate messaging and lobbying re-phrased breakups as "corporate death sentence" which couldn't be farther from the truth. (The Baby Bells thrived after the breakup.)

To suggest that the US has a "history" of breaking monopolies is like suggesting that Mark B. Spiegel has a history of telling the truth: it does happen occasionally, but it is not the typical pattern at all and takes a lot of effort.

Diversification! I love it.

So you will be showing us how to reduce the volatility of our portfolio with a blend of Tesla bonds, convertible bonds, direct TSLA shares, TSLA Calls, Leaps and writing (selling) TSLA puts?

Yes but you can look at the big 3 and they were all split. Don't get me wrong, it is not (based on today) what I would want for Tesla.

I have had 5 beers already. You have to stop posting these things!

One lucky thing Tesla has going for it is that the virus is unlikely to slow down FSD development too much. It's pretty easy to code and test while practising social distancing. My only doubt would be if the development code is on fully isolated computers to prevent hacking.I agree with most of what you say but give the Tesla network some chance, how long it will take is hard to know, but I think Tesla will be first or second. If they are second there will not be far behind first and with the advantage of a lower cost base will dominate the market.

I think Elon, Karpathy and co know what they are doing and know a lot more about it that we do, yes they are probably optimistic but my bet is 6-24 months worth of optimism, not 5 years.

This is an area where I think past progress is no indicator at all of future progress...

The thing that bothers me the most is low sun blinding the cameras, or some other camera obstruction, I think there is a software solution, but the physics of that start out as a big disadvantage...

We may well see a phased return to work, with certain critical sectors allowed to return to normal and allow the virus to spread at a manageable level. Then gradually allow other sectors to restart as herd immunity takes hold.Epidemiologists think it will be a roller coaster. Anyone who hasn’t yet read the report, pls read the Imperial College study.

We lock down, bring hospitalization to manageable levels. Then everyone wants to lift restrictions and then the cases go up again - forcing us to lock down. No idea how the market will react to this.

We’ll see how Wuhan handles lifting of lockdown and the resulting cases.

I hate to say this as a bull and as someone who got back in at 358, but over the last two days I’ve been getting stronger doubts about a quick recovery for Tesla:

I fear this chain of events will set back Tesla for at least 1-2 years. Which is a terrible shame because the path to domination was so clear. Tesla will eventually get back on that path again and it will be in an even stronger position than before compared to the competition, but it will have to go through the ‘valley of the shadow of death’ first, for the third time in its history.

- If the economies of the US and Europe take a 20% hit in the second quarter new car sales will drop by 50% or more. People have other things on their mind, other concerns. This will hit Tesla sales too, despite pent up demand for Model Y. I don’t expect many Model S and X sales, and Model 3 sales will probably be lackluster.

- Such a huge GDP drop will have lasting effects for the rest of the year and maybe beyond. Some sectors of the economy, like tourism, travel and leisure, will need 1-2 years to recover. The economy as a whole will suffer. Handing out checks of a few thousand dollars to everyone is unlikely to stimulate car sales.

- The stock market crash destroyed a lot of wealth, which will have a lasting effect on the sale of luxury cars.

- China may be recovering from the corona crisis, but if demand for products from the US, Europe and the rest of the world dries up the export sector will not get back on its feet. This is such an important part of the Chinese economy that new car sales will suffer.

- Climate change will be taking a back seat for a while now that the pandemic has become concern #1. Going electric may not be high on people’s priority list when they have other concerns.

- Governments all around the world will have to spend trillions to keep their economies from totally collapsing (as an example: the Dutch government said it would need 45 to 65 billion euro just for the second quarter to prop up companies. And we are a small country of just 17 million people). In many countries there will be no money left to subsidize the switch to electric.

- In order to save the European car industry the mandatory changes to fuel economy will likely be relaxed, and fines postponed (which would effectively kill the Tesla-FCA deal).

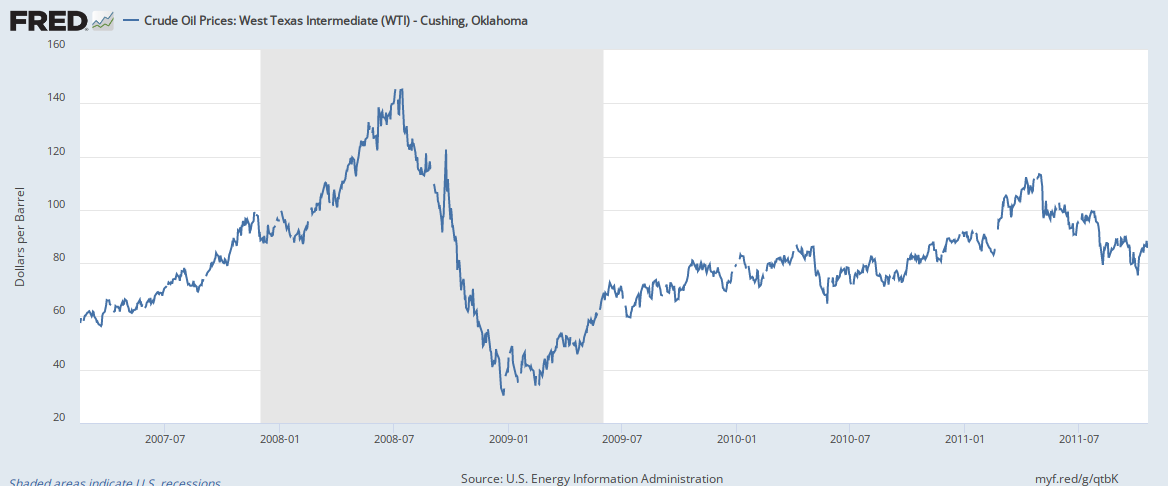

- The low oil price, which is unlikely to recover during a recession or depression, doesn’t stimulate switching to electric.

Having said that, I will be buying more shares if we would go under 350. I might not see a quick appreciation of those shares but that’s ok. It may take a few years longer than we expected but Tesla will still become that 1 trillion dollar company.

If Tesla has 80% US market share and making money hand over fist with robotaxi it will be broken up and it won't be politically difficult.

SpaceX is dominating mostly foreign competition. US politicians are happy about that and SpaceX doesn't operate on foreign territory.

Historically, space/NASA is only about ~15% of Boeing's revenue. SpaceX isn't killing Boeing. Boeing is committing suicide.

Tim Higgins/WSJ editors with a front page article titled to scar Musk:

“Elon Musk’s Defiance in the Time of Coronavirus”

Elon Musk’s Defiance in the Time of Coronavirus

Journalism continues to disappoint.

In order to save the European car industry the mandatory changes to fuel economy will likely be relaxed, and fines postponed (which would effectively kill the Tesla-FCA deal).

I have a question for everyone her. I know this is pretty much uncharted waters so it will all be speculation but...

When this all runs it's course and things start to return to "normal", whatever that is, how do you think the market will recover? Slow steady rise, roller coaster fluctuations or quick rise?

Dan

I don't think there's a consensus. Elon first announced "Battery Investor Day", then in a tweet he announced:

Elon Musk on Twitter

"Tesla April company talk will be from our Giga New York factory, where we make SolarGlass & several other products. Will also offer customer & media tours."

There has been no clarification on whether this is the Battery Investor Day - I initially assumed it was, because Elon references this as something already mentioned - and Battery Day was the only previous announcement.

I don't agree with those who say that there will definitely be two events. We don't know.

The low oil price, which is unlikely to recover during a recession or depression, doesn’t stimulate switching to electric.

Yes, it's a sad state of affairs when the Governor of New York declares liquor stores as "essential businesses" but California is actively working to stop production of cars that don't emit toxic fumes that make people more susceptible to succumbing to Coronavirus:

New York liquor stores are considered 'essential' businesses, will stay open