Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

samppa

Active Member

wow! I went to sauna and had a nice swim in 17 degree sea. Came back and tsla is 1450!

mtndrew1

Active Member

Sorry to interrupt the party and this may have been covered already, but has everyone watched the new Sandy Munro video?

At 7:35 he starts addressing the Model Y report and, paraphrasing, refers to the Y build cost reduction as compared to the Model 3 as “shocking.”

Could be some insight into the profitability of the Y program.

At 7:35 he starts addressing the Model Y report and, paraphrasing, refers to the Y build cost reduction as compared to the Model 3 as “shocking.”

Could be some insight into the profitability of the Y program.

StealthP3D

Well-Known Member

Same here. Now I need my wife to change my TDAmeritrade password so I don’t do anything stupid

I'll change it for you. PM me your credentials. I promise I won't send them to anyone else.

Barron's - 18 minutes ago: Would Tesla Stock Rise 60% If Added to the S&P 500? Please, That’s a Stretch.

Excerpt:

Reuters, in a Friday article discussing Tesla's index inclusion, pointed to what happened to Yahoo's stock after it was included in the S&P 500 back in 1999, saying that shares of Yahoo! jumped "64% in five sessions between the announcement ...and its actual entry." Reuters also wrote that analysts predict high demand for shares upon Tesla's entry.

Some, however, are skeptical what happened to Yahoo! will happen to Tesla. Barron's suggested -- after talking with Baird managing director and trader Greg Gaynor -- that any gains from S&P inclusion are already reflected in Tesla's share price. Gaynor agreed, basing his opinions, in part, on what his clients are doing, many of which are actively trading shares. Tesla stock, after all, is up 50% over the past month.

Still, not every analyst thinks Barron's is right. Gary Black, a former tobacco-sector analyst for Bernstein in the 1990s and the former chief executive of Aegon Asset Management, told Barron's this past week he believes S&P inclusion isn't fully baked into the share price. He said inclusion could push the stock up more than 10%.

Excerpt:

Reuters, in a Friday article discussing Tesla's index inclusion, pointed to what happened to Yahoo's stock after it was included in the S&P 500 back in 1999, saying that shares of Yahoo! jumped "64% in five sessions between the announcement ...and its actual entry." Reuters also wrote that analysts predict high demand for shares upon Tesla's entry.

Some, however, are skeptical what happened to Yahoo! will happen to Tesla. Barron's suggested -- after talking with Baird managing director and trader Greg Gaynor -- that any gains from S&P inclusion are already reflected in Tesla's share price. Gaynor agreed, basing his opinions, in part, on what his clients are doing, many of which are actively trading shares. Tesla stock, after all, is up 50% over the past month.

Still, not every analyst thinks Barron's is right. Gary Black, a former tobacco-sector analyst for Bernstein in the 1990s and the former chief executive of Aegon Asset Management, told Barron's this past week he believes S&P inclusion isn't fully baked into the share price. He said inclusion could push the stock up more than 10%.

kalefranz

Member

Good chance July 23 and 24 are held back by MM, and then we finally rip on the next Monday. But a $1,600 covered call might not even hold past this upcoming Monday or Tuesday...

Edit: Might not hold past today.

Hock1

Member

IMO, Tesla should split the stock (preferably 20 for 1), and it should be announced along with the ER on July 22. Assuming all conditions are met for S&P inclusion, post-split share count of about 3.7B would greatly increase the liquidity of the shares. We don't want lack of liquidity to be a reason the committee declines to include.Between 97% larger mkt cap and the buying implications for Inclusion In the S&P index , coupled

With the largest short interest , creates some serious buying pressure dynamics.

this dynamic still continues to overcome profit taking .

Once the short interest diminishes and the stock is included in the index,

Then valuation expectations might play a bigger role.

willow_hiller

Well-Known Member

Could be the explanation for the spike: https://twitter.com/AsherWildman13/status/1281623831589814272?s=20

Surprise press conference from Florida Governor about Tesla upcoming.

Surprise press conference from Florida Governor about Tesla upcoming.

Bull attack

Mo City

Active Member

IMO, your thinking is on the right track.BTW from an investor standpoint, we should not be looking at FSD as only some binary event. The continual improvement of FSD features will allow take rate / FSD price to both increase, even if it is not good enough for robotaxis.

I am not a financial modeler, but I can try some WAGs. Say Tesla has point to point FSD (Level 2) by the end of the year. Will require human intervention at times just like Autopilot on highways. At that time, what percent of purchases will pay for FSD at what price?

I would guess Tesla could sell it for $10,000 with a 50% take rate. Maybe that's conservative? As Tesla nears 1 million cars / year production rate early next year, that's around 1 billion in additional profit per quarter (just from FSD).

In another or so, again there are no robotaxis but the FSD has gotten so good that many people are Youtubing their autonomous commutes, and some jurisdictions even allow autonomous driving as long as there is a driver. At this point, the demand for the software is much bigger, Tesla could probably sell it for $20k at 50% take rate. Vehicle production rate is probably 1.5 million, so now it's ~ $3 billion additional profit per quarter.

Any better educated guesses on how much Tesla can earn from Not-Yet-Robotaxi FSD?

As FSD improves, the price will increase, impacting revenue. $20K for FSD (or even more) will happen if the product becomes compelling enough. FSD improvement increases both the price and take rate. TSLA rises as a result.

The 2nd stage is when FSD becomes good enough to convince the market (including major skeptics like me) Tesla will actually deliver legit FSD with current hardware. TSLA will erupt like never before. This will be one of the defining moments of Tesla's history.

Lastly, Tesla irons out enough "small" issues to launch robotaxis. Nuff said.

Todd Burch

14-Year Member

Someone 'splain what's happening? I thought we were gravitating toward $1400ish today? I mean, not complainin'  .

.

ZeApelido

Active Member

Could be the explanation for the spike: https://twitter.com/AsherWildman13/status/1281623831589814272?s=20

Surprise press conference from Florida Governor about Tesla upcoming.

Maybe some allowance of autonomous vehicles on the road?

Artful Dodger

"Neko no me"

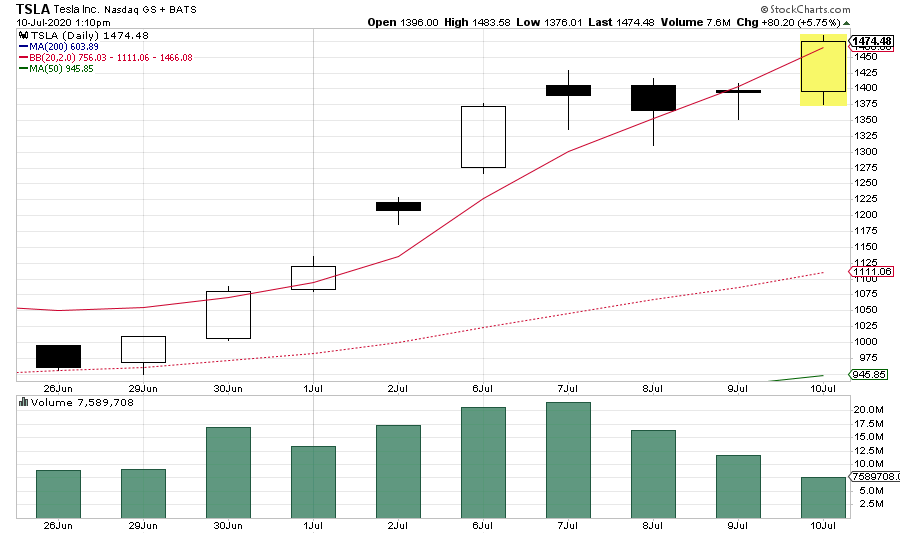

... and SP marched right on up to the Upper-BB ($1,461.38 @ 13:00 ET)

New intraday high is $1,466.83 as of 13:05 hrs

EDIT: NEW ATH $1,483.58 as of 13:10 hrs

EDIT2: ATH now $1,496.00 as of 13:30 hrs

Cheer!

New intraday high is $1,466.83 as of 13:05 hrs

EDIT: NEW ATH $1,483.58 as of 13:10 hrs

EDIT2: ATH now $1,496.00 as of 13:30 hrs

Cheer!

Last edited:

Could be the explanation for the spike: https://twitter.com/AsherWildman13/status/1281623831589814272?s=20

Surprise press conference from Florida Governor about Tesla upcoming.

Lol announcement just happening when a Tesla fan group charging after lunch.

willow_hiller

Well-Known Member

Could be the explanation for the spike: https://twitter.com/AsherWildman13/status/1281623831589814272?s=20

Surprise press conference from Florida Governor about Tesla upcoming.

Investment of $8.5 million into state charging infrastructure, presumably Superchargers included: https://twitter.com/AsherWildman13/status/1281629733193744384?s=19

EDIT: 16 new Tesla Superchargers in Florida. Not bad, but not the massive news I was expecting.

JusRelax

Active Member

Wow this is crazy. Yesterday, on twitter, I saw that someone bought 200 $1500 7/10 calls at $2.75. They spent $550k on a bet that the stock today would end over $1502.75. When I saw that, I thought that guy is insane.. now I'm wondering if he actually knew something!

Mo City

Active Member

Gary is going to grab and run very hard with this. He seems to be asleep right now. Just waiting for him to let the machine gun rip.Barron's - 18 minutes ago: Would Tesla Stock Rise 60% If Added to the S&P 500? Please, That’s a Stretch.

Excerpt:

Reuters, in a Friday article discussing Tesla's index inclusion, pointed to what happened to Yahoo's stock after it was included in the S&P 500 back in 1999, saying that shares of Yahoo! jumped "64% in five sessions between the announcement ...and its actual entry." Reuters also wrote that analysts predict high demand for shares upon Tesla's entry.

Some, however, are skeptical what happened to Yahoo! will happen to Tesla. Barron's suggested -- after talking with Baird managing director and trader Greg Gaynor -- that any gains from S&P inclusion are already reflected in Tesla's share price. Gaynor agreed, basing his opinions, in part, on what his clients are doing, many of which are actively trading shares. Tesla stock, after all, is up 50% over the past month.

Still, not every analyst thinks Barron's is right. Gary Black, a former tobacco-sector analyst for Bernstein in the 1990s and the former chief executive of Aegon Asset Management, told Barron's this past week he believes S&P inclusion isn't fully baked into the share price. He said inclusion could push the stock up more than 10%.

DurandalAI

Member

I learned that lesson far too late. I get physically ill when I think that I have lost 700 shares due to covered calls that I bought in at an average price of $360.

Sure, I haven't lost any money, and I got 125% return in a year period, but I missed out on $760,000 in gains...

Much regret.

I try to look at the positive side though, that I'm doing much better than Mark Spiegel on portfolio returns!

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M