Interesting excerpt from this book:

One example within the book deals with separating noise and signal (meaning) within investing. Let’s say you have a dentist that can invest with a 15% average annual return with 10% annual volatility. For reference, the S&P 500 index has a ~10% average annual return and ~14% average annual volatility. The dentist has good thing going, with the portfolio doubling in value every 5 years on average.

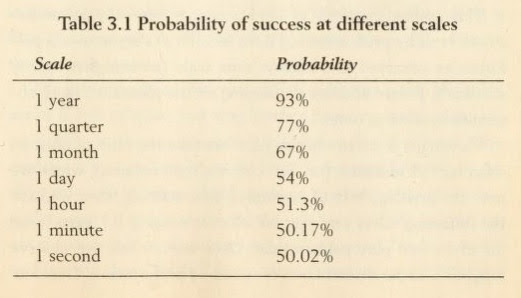

An unexpected factor in his success is the frequency upon which he looks at his portfolio balance. Here’s a chart from the book showing the probability of a positive change in value based on how often the portfolio is checked.

If he were to check his portfolio every minute, he would only see a positive return 50.17% of the time. That is basically indiscernible from a coin flip.

The problem is loss aversion.

Being emotional, he feels a pang with every loss, as it shows in red on his screen. He feels some pleasure when the performance is positive, but not in equivalent amount as the pain experienced when the performance is negative.

At the end of every day the dentist will be emotionally drained. A minute-by-minute examination of his performance means that each day (assuming eight hours per day) he will have 241 pleasurable minutes against 239 unpleasurable ones. These amount to 60,688 and 60,271, respectively, per year. Now realize that if the unpleasurable minute is worse in reverse pleasure than the pleasurable minute is in pleasure terms, then the dentist incurs a large deficit when examining his performance at a high frequency.

Again, this doesn’t go away even if you know about the phenomenon:

Regardless of what people claim, a negative pang is not offset by a positive one (some psychologists estimate the negative effect for an average loss to be up to 2.5 the magnitude of a positive one); it will lead to an emotional deficit.

Now, if he were to check that same portfolio only when his monthly statement arrives, he would see a positive return 67% of the time (2 out of 3). Finally, if he has the patience to check only once a year, she would see a positive return 93% of the time. The time scale matters.

Thought i'd share this with TMC......