LN1_Casey

Draco dormiens nunquam titillandus

Just look at it go! Almost as much as California's insurance premiums after the last few quakes.

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

Getting in is the easy part. Knowing when to get out is the tricky part. Not Advice.

How do you know?

It's sad we are happy about $250 when this thing should easily be over $350...

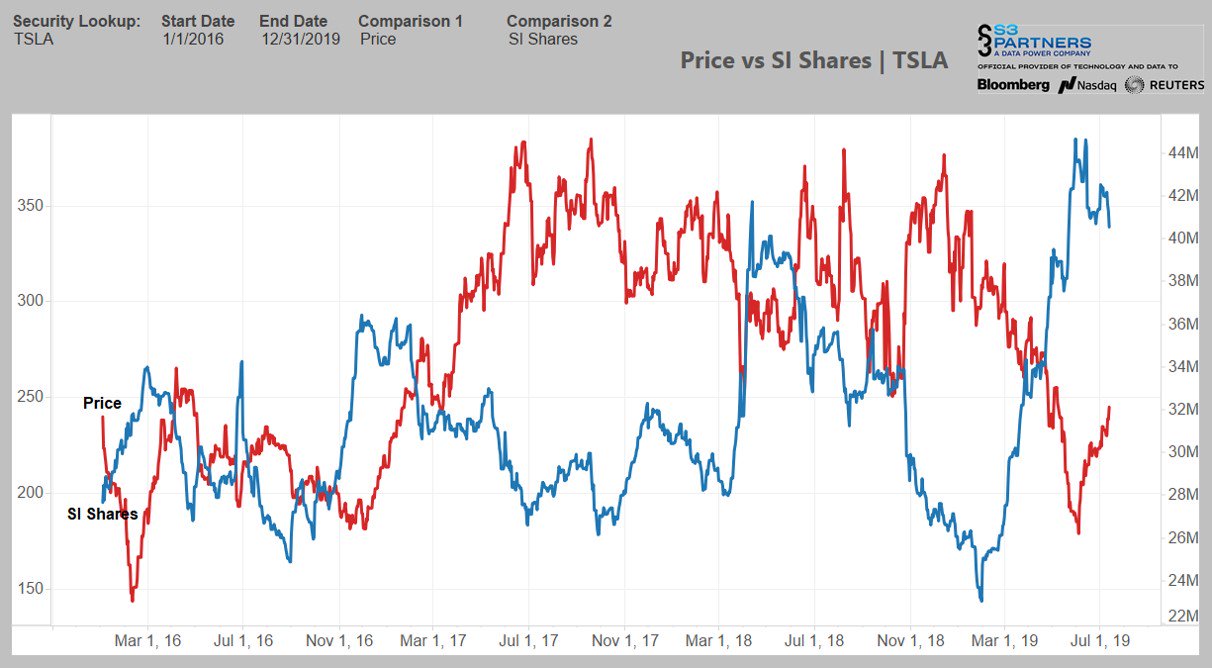

This is too funny! The intra-day chart is looking like a parabolic curve. The shorts want out but they can't get out without jacking the price up further. Other traders see this and want in on the action which just makes the shorts want to get out more (which makes the traders want IN even more)! LOL!

I have a pretty good idea on getting out, so no worries there. I have bought what I have intended to buy, will not be buying more and if the worst happens, I'll be fine. Best case scenario: if the SP doubles, I would sell half, get the original investment out and keep the rest for a few years.

But I have to say that it is fun to own some stock and watch it go up!The most funny thing to me is that ME - a complete newb with stocks - have now already made more money than so many TSLAQ Twitter clowns that are deep in the red

I have some documentation somewhere about the relationship of causation and correlation. I think it was bullish, but sometimes the data is completely independent.I remember someone posted a table for distribution of Tesla ER dates and the ER performance (beat and miss), and it shows the early ER dates are related to good numbers... I couldn't find it now... Does someone have it? Thanks!

Recent contract negotiations for a renewal finally finished. Retainer secured. Wonder if this type of paid bashing pays more than a board seat.Not going to link to it, but I guess Bob Lutz has turned back into Bob Putz.

Ming Zhao on Twitter

Local news says $tsla China GF3 will start training new workers on July 29 to prepare for test production in as early as September. Formal production may begin in December, aiming for weekly 3000 Model 3s next year.

Gonna do a prediction here so I can get some mad forum creds when it comes true.

August 2019, China GF3 start assembly in tent. Lathrop storage filled with excess production of parts during the spring, parts are shipped to China for those part where local production is not yet ready. While assembly happens in China, local production of parts is rapidly added. As less and less parts are needed to be shipped to China, Freemont plant starts to prepare for Model Y production which will happen in Freemont with different general assembly but with many shared parts. Production of Model Y targeted for 2020Q1 but will start 2020Q2.

A question for all the experts here... Over the last month I've started buying TSLA shares but before that I've never had any stock, never even had a trading account, so there's some basics that I'm curious about.

People here make statements like "If it breaks-through X, then it's an easy path to Y" or "if it falls-through Z, then Q is the next resistance". How do you know these numbers?