OK. Catvatars it is (at least for a while).Everyone slowly turning into Cat Avatars, obviously. We even got the Artful Dodger.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Not going to link to it, but I guess Bob Lutz has turned back into Bob Putz.

Maybe his recent praise of Tesla was a ploy to get more money from whomever is paying him.

I wish all the best to anyone who takes investment advice from this befuddled gentleman.

In his rant, first he insults Tesla vehicles,

but then says the big global auto companies will make electric vehicles as good or even better than Tesla’s.

So which is it Mr. Lutz? Nobody wants Teslas? Or Tesla sets the bar for all the other auto makers?

Meanwhile we're still waiting for the big global auto makers to get on board with seriously making EVs

synopsis please..?

“The fate of Tesla is sealed. The situation is almost hopeless given the losses they are currently writing. Demand has given away. Tesla had 400,000 pre-orders for the Model 3. In fact, they only sold 80,000 or 90,000 of them, and they have trouble selling more. The Model S is now ten years old, and sales are sluggish. It’s the same picture for the Model X, the SUV with the wing doors – that’s an ugly vehicle anyway. Tesla will have about a year until each of the big global auto companies has its own fleet of electric vehicles on offer. These cars will be as good or even better than Tesla’s.”

If you can't say something bad about someone, don't say anything.CNBC has gone totally silent on TSLA news since July 10.

TheTalkingMule

Distributed Energy Enthusiast

Saw TSLA in the green on my TV this morning highlighted with a few other early gainers. Said to myself, "Wow, someone at CNBC allowed a green TSLA on the screen!"CNBC has gone totally silent on TSLA news since July 10.

Realized I was watching Bloomberg.

Watch, FUD returns after Earning. Clockwork. They're just letting off pressure (prob buying on the side). 285 tops this round?

"Stay strong and short!"... no, doesn't rhyme.Maybe somebody should start posting to their favorite thread(s) some suggestions like:

"Please hold the bag, it is too early to get out at this SP".

Yeah, they deserve this taunting.

Edit: apparently I forgot the "/s" tag, thanks @jerry33 /S!

Last edited:

dc_h

Active Member

What triggered this run-up? The Neuralink news?

I think technical analysis is bullish, combined with good numbers and this quarter being more bullish then Wall Street expected. Tesla's production targets are looking more realistic and the possibility that they may turn a profit in Q2, means shorts have the possibility of big losses with limited upside of Tesla bankruptcy. Combine that with the possibility of Shanghai really happening, the short term and long term TSLAQ story should really be looking bad.

Hope we see the momentum continue through earnings. It was a long and sharp downturn, so hopefully the upside will be last longer and start to reflect the long term progress Tesla has made in the last 12 months.

Stars aligned

Member

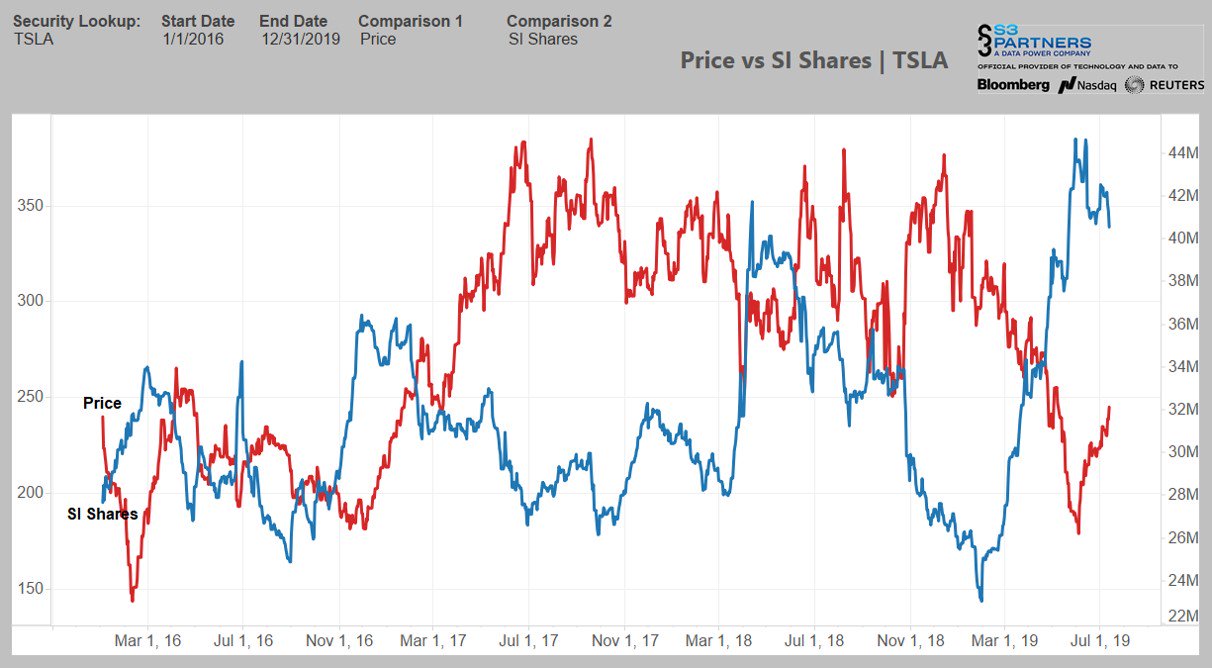

Well, SP since low approx. 40%. Short interest since high approx. -10%. Not bad at all...@ihors3 has a chart showing $TSLA price/share overlaid with short interest. Scaling issues make seeing the relationship trickier (charting the two against one another versus an overlay would be better IMO) but the recent climb has been accompanied by a drop in short interest. This suggests an orderly exit by the shorts. My preference would be for the stock to climb despite increased shorting. I don't really care about retail shorts (exit now, please), but I'd like to see the noisy ones like toilet boy lose their shirts. (Yeah, I might be a little vindictive.)

(https://pbs.twimg.com/media/D_iAvxYWwAE2Rwy.jpg:large)

Tslynk67

Well-Known Member

Congrats on selling your shares. Or not?

Had no choice, it was money I could play with for a month - it was purely a play on the delivery report to get a short-term positive trade.

But hey, I increased my core share-holding by 0.8% - I'll do this again next quarter end if it feels right.

dc_h

Active Member

Just do what all the smartish analysts, like Adam Jonas do: Just make it up. You can't be worse than anyone else speculating in the market.

If you assume that they are creating a buy opportunity, some of the advice makes more sense.

What you are looking for is "Stay strong and long!""Stay strong and short!"... no, doesn't rhyme.

Tslynk67

Well-Known Member

Plus Adam Jonas reiterating his $10 bear case

Go on Jonas, throw us a bone, how about 10% upgrade to $11??

I did my part buying 25 shares early this AM.

Jumping on the avatar bandwagon thanks to Simon Tofield.

Jumping on the avatar bandwagon thanks to Simon Tofield.

Tslynk67

Well-Known Member

All this talk of spreading your risk with 30-40 different stock in a portfolio... Screw that, I'm all in $TSLA and boo hoo if I lose it all, my life stays as it is - comfortable enough, but if it goes where we expect, that's one hell of a retirement I have lined up in 15 years time.

Personal choies, I don't care about the risk, all bought with cash.

Personal choies, I don't care about the risk, all bought with cash.

RFernatt

Solar/EV Owner/Enthusiast

A question for all the experts here... Over the last month I've started buying TSLA shares but before that I've never had any stock, never even had a trading account, so there's some basics that I'm curious about.

People here make statements like "If it breaks-through X, then it's an easy path to Y" or "if it falls-through Z, then Q is the next resistance". How do you know these numbers?

My take is long term. For something like TSLA, buy, hold, and add more when price is attractive and you have the funds unless something significant and structurally negative occurs. Ignore the fluctuating FUD quarterly crap. Not advice and YMMV.

Don't have a cat, but I do know a certain Vulcan...GO TSLA!OK. Catvatars it is (at least for a while).

adiggs

Well-Known Member

OK. Catvatars it is (at least for a while).

And an excellent choice in cavatar!

Good article by Simon Alvarez over on Teslarati. He summarizes an interview with Paul Eichenberg. Some takeaways:

"Overall, it appears that traditional automakers’ decision to “wait and see” if Tesla survives and succeeds was a miscalculation at best."

"Elaborating further, Eichenberg mentioned that big-tier corporations such as Honeywell and Delphi, whose businesses are tied to the internal combustion engine, are now positioning themselves through spinoffs as a way to shed their ICE-centered assets."

"Overall, it appears that traditional automakers’ decision to “wait and see” if Tesla survives and succeeds was a miscalculation at best."

"Elaborating further, Eichenberg mentioned that big-tier corporations such as Honeywell and Delphi, whose businesses are tied to the internal combustion engine, are now positioning themselves through spinoffs as a way to shed their ICE-centered assets."

From my Thinkorswim newsfeed 15 minutes ago:

"Moody's Upgrades Tesla Auto Lease Trust 2018-A Notes"

I wouldn't be surprised if we soon learn about upgrades from stock analysts.

The lease trust ratings are mostly independent of the the company as they primarily relate to the performance of the leases in the trust (that said, OEM performance does have some impact as a stronger OEM should lead to better performance of the leases in terms of collections and vehicle resale value, and the ability to call the deal).

Looking at the upgrade memo, Moody's cite stronger residual value performance and lower losses than they originally modelled - something pretty easy to achieve as Moody's hit the Tesla transaction with very conservative assumptions in their initial assessment.

That said, Tesla now has a significantly stronger balance sheet after the capital raise and is seeing sustained M3 production so a Moody's upgrade of TSLA could be on the cards.

My guess is that Tesla is about to announce their next transaction and Moody's have been reviewing historical deal performance as part of the assessment of the new pool of leases. The timing would be about right as Tesla haven't issued a deal since late last year - their warehouse lines must be filling up enough by now to go back to market. The 2018-A transaction settled in Feb-18 so the upgrade is unlikely to be part of Moody's standard annual review of the deals they monitor.

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 11K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K