I wouldn't be particularly disappointed by 105k (vs the 104.4k minimum required to hit the 360k FY guidance that Tesla were "highly confident in exceeding").

However, everything is pointing to me to both a large step up in production and a large reduction in inventory in Q4. I have increased my base case deliveries forecast from 110k to 116.5k.

My 4Q19 base case:

Production: Model 3 90.9k (Fremont +10% QoQ, GF3 3k). S&X 17k. Total 107.9k.

Deliveries: Model 3 98.5k (2k GF3). S&X 18k. Total 116.5k.

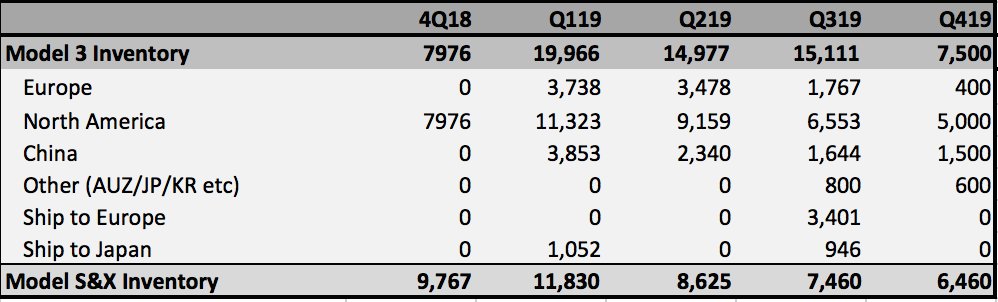

Final Inventory: Model 3 7.5k. S&X 6.5k.

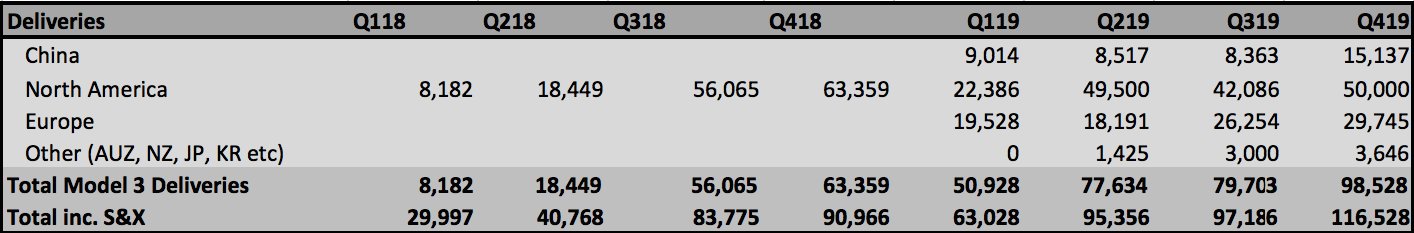

Regional breakdown for Model 3:

Note my historical regional breakdown is different to the InsideEVs US estimates which I never believed matched real delivery timing. My breakdown is from regional shipping, registration and revenue data & inventory estimates & leaks (e.g c.61k North America sales in Q2 implied by Electrek)

My Inventory estimate breakdown is below. I expect very large inventory reduction in Q4.

Relative to Q3: Final ships are arriving much earlier, Tesla configurator stopped showing current Q delivery estimates much earlier & International production started c.5 days before Q3 end (first Q1 ship is not due until the 8th Jan).