Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Gasparino having fun trolling TSLAQ:

Tesla, WeWork CEOs top winners & losers of 2019

Also on a roll: Icelandic broadcaster RÚV, with this year's áramótaskaup (New Years parody show), which had quite a focus on the environment this year (be sure to turn on subtitles unless you speak Icelandic. )

)

Also, (mostly) unrelated, but still amusing...

Tesla, WeWork CEOs top winners & losers of 2019

Also on a roll: Icelandic broadcaster RÚV, with this year's áramótaskaup (New Years parody show), which had quite a focus on the environment this year (be sure to turn on subtitles unless you speak Icelandic.

Also, (mostly) unrelated, but still amusing...

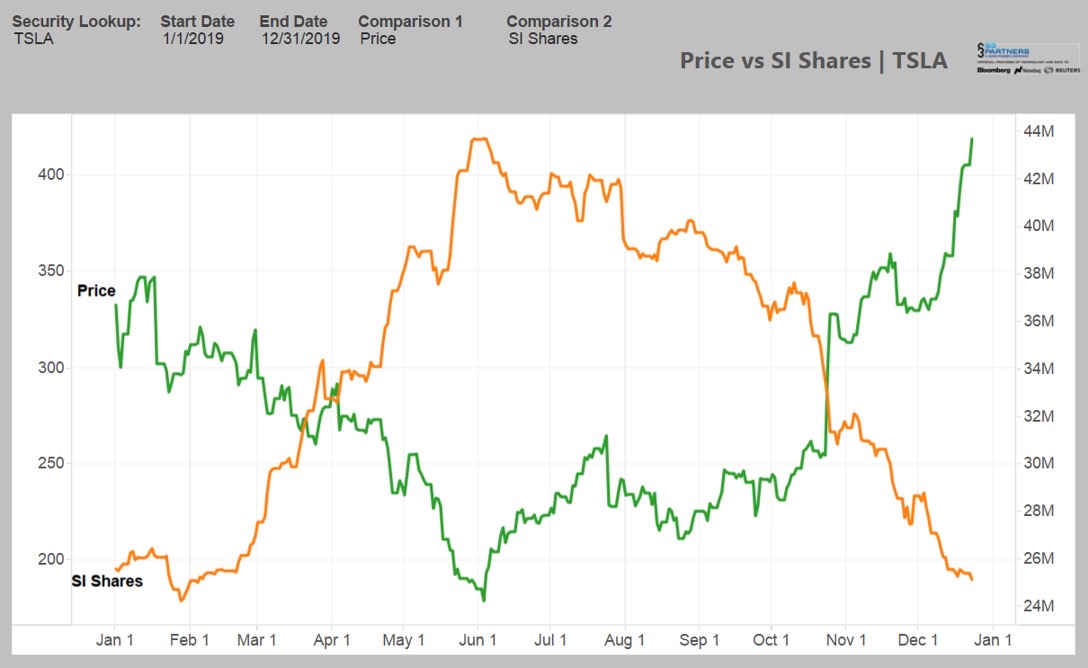

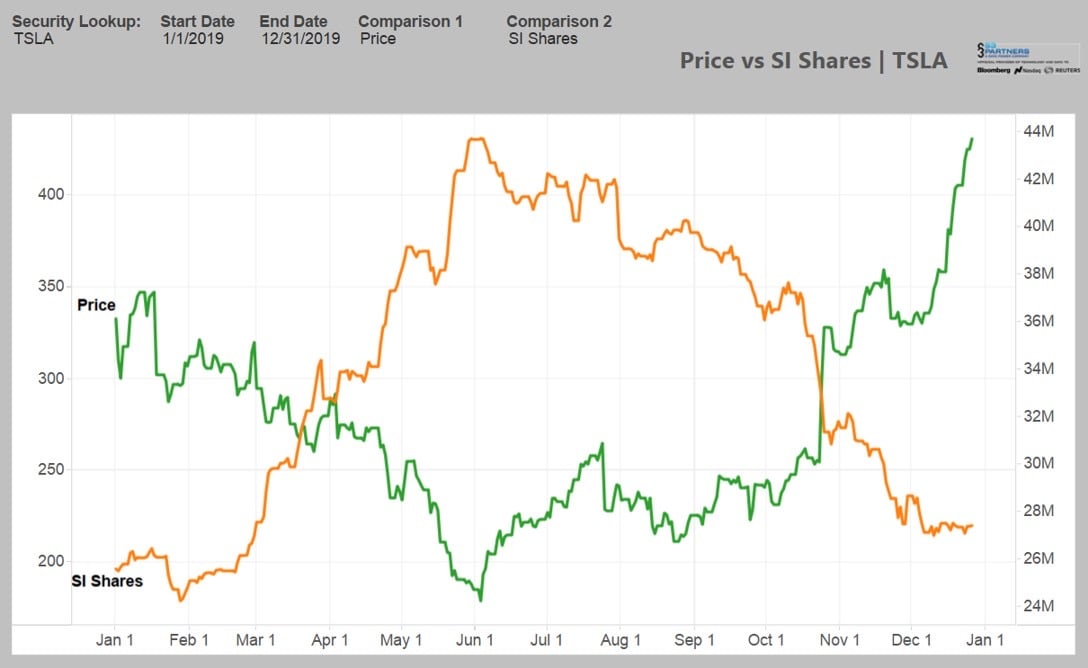

I was looking at Ihor’s short interest graph again:

On dec 24, he posted:

Then on Dec 27 after the official short interest data for Dec 13 was released, he posted updates to Dec numbers:

Look at the graph, you can notice how wrong his numbers was, it was not quantitative inaccuracies, it’s qualitative misleading information.

From the wrong data, one could have thought much of the Dec run up has a big short covering component, which implies there could be a correction when they come back at it again later.

But in reality SI has been mostly flat for the run up, and the Dec run was purely driven by bulls.(let’s see when shorts would have to start to cover )

)

Just an reminder of how wrong Ihor’s data could be. But kudos to him for not deleting old predictions and owning the mistakes.

Happy New Year to everyone here!

On dec 24, he posted:

Then on Dec 27 after the official short interest data for Dec 13 was released, he posted updates to Dec numbers:

Look at the graph, you can notice how wrong his numbers was, it was not quantitative inaccuracies, it’s qualitative misleading information.

From the wrong data, one could have thought much of the Dec run up has a big short covering component, which implies there could be a correction when they come back at it again later.

But in reality SI has been mostly flat for the run up, and the Dec run was purely driven by bulls.(let’s see when shorts would have to start to cover

Just an reminder of how wrong Ihor’s data could be. But kudos to him for not deleting old predictions and owning the mistakes.

Happy New Year to everyone here!

G

goinfraftw

Guest

But in reality SI has been mostly flat for the run up, and the run was purely driven by bulls.(let’s see when shorts would have to start to cover)

Kinda provides the proof point. Holders are holding through this run. Robintrack

Lots of new planned Supercharger pins added to the map

Hér erum við | Tesla

Iceland gets one more dot added, at Egilsstaðir (far side of the island from Reykjavík), which would create a closed - but very sparse (tough for SR/towing/winter) - ring.

Canada gets a route through Saskatoon to Edmonton. Curiously, they don't show the new route already going in through Jasper. I think southern BC gets denser. The Butte to Calgary route shows.

Some cities show huge urban expansion plans. For example, Minneapolis plans to go from 2 to 8.

Burns, Oregon - site of the biggest lower-48 Supercharger gap in the US once Dakota-Montana closes - now has a planned Supercharger. The next biggest gaps (Ely, NV and Grangeville, ID) still don't have one.

New Mexico route: El Paso to Mazatlan. I think Tuxtla Gutiérrez may be new, suggesting possibly plans to move further into Central America.

Looks like they're finally planning to finish out northern Norway, and even dipping into northern Finland.

Oh, hey, Alaska gets their first Supercharger, at Anchorage!

Hmm, is there a difference-shower? I see a lot of things that I *think* are new, but I'm not positive, as I haven't been following their areas as closely.

(Still looking around!)

Hér erum við | Tesla

Iceland gets one more dot added, at Egilsstaðir (far side of the island from Reykjavík), which would create a closed - but very sparse (tough for SR/towing/winter) - ring.

Canada gets a route through Saskatoon to Edmonton. Curiously, they don't show the new route already going in through Jasper. I think southern BC gets denser. The Butte to Calgary route shows.

Some cities show huge urban expansion plans. For example, Minneapolis plans to go from 2 to 8.

Burns, Oregon - site of the biggest lower-48 Supercharger gap in the US once Dakota-Montana closes - now has a planned Supercharger. The next biggest gaps (Ely, NV and Grangeville, ID) still don't have one.

New Mexico route: El Paso to Mazatlan. I think Tuxtla Gutiérrez may be new, suggesting possibly plans to move further into Central America.

Looks like they're finally planning to finish out northern Norway, and even dipping into northern Finland.

Oh, hey, Alaska gets their first Supercharger, at Anchorage!

Hmm, is there a difference-shower? I see a lot of things that I *think* are new, but I'm not positive, as I haven't been following their areas as closely.

(Still looking around!)

Last edited:

The Accountant

Active Member

I sold recently at 349, which in hindsight was a bit early but it was my plan when I got in at 220 and 240. I'll stay out until we are well into Q1 again. I think the tail winds of Q4 will have turned by then along with the less favorable seasonality and sentiment will probably go down with them.

What's your plan B, if you're wrong and things continue on the upwards trajectory? Hoping TSLA goes down right around Battery Investor Day seems overly optimistic (pessimistic?) to me.

No plan B. Tesla did not rally before (and certainly not after) autonomy day so battery day doesn't worry me. I'll just have to live with seeing you all get rich. I think the current valuation is too high to justify holding. Of course if Tesla grew into it's price then Ill reconsider but that is more of a medium term thing.

TSLA is quite a manic-depressive stock so I try to make my money holding 1-6 months at a time. Has worked ok so far.

As @Papafox and @StealthP3D have alluded to a few times with their insightful posts, Tesla is not a stock to attempt to guess the dips.

I have learned that the hard way:

In July 2013, I made a $500k investment in Apple at $60/share. Sold it one short year later in Aug 2014 for $116/share for $980k. Almost a 100% return. At the time, my best investment gain ever (by far). I was so thrilled

The stock sits today at $293/share and I would have been sitting on $2.4m (a 5x gain). I felt the stock had run up too fast and I was going to get back in on the dip. I never found the right time to get back in. In fact , I would have sold earlier than Aug 2014 (for a smaller gain) but I was waiting for the 1 year holding period for capital gains. Waiting for the 1 year holding period made me money.

After much reflection from that experience, I have two points to share:

- I had tended to sell my Winners too soon and hold my Losers too long. If the investment thesis is still intact, I now let the Winners run.

- There are many companies that will provide returns of 5x, 10x, etc but it is difficult to identify them (e.g. the small biotech with a new cancer drug). If I am lucky, I have the ability to spot maybe 4 or 5 of these companies during my entire investment career...and when they arrive, my plan is too bet big and hold (as long as the investment thesis stays intact).

After the Apple experience, I had been looking for that next 5x, 10x investment. I had been waiting patiently since 2014 to place that big bet. I always had Tesla on my radar screen but in 2019 the thesis really worked for me. I made a big investment prior to the dip and then doubled my investment at the dip - at an entry point below $200/shr. TSLA SP may go up and down over the next several years but I am not going to make the same mistake I did with Apple, selling and looking for the dip. There may never be a time to get back in.

Btw, having invested in Tesla, my Apple investment now ranks #2 on my all-time gains rankings.

This is not advice, as everyone has different investment goals and tolerances.

Happy New Year everyone!

Last edited:

Fact Checking

Well-Known Member

We ended the year with the latest cybertruck order number to be 1131976xx. This puts the total reservation at ~457k.

I think you forgot to subtract the ~30k cancelled orders?

Here's the previous measurement and your RN:

- 113,160,000 - 112,745,000 - 30,000 = 385,000 Cybertruck pre-orders on 2019/12/12

- 113,197,600 - 112,745,000 - 30,000 = 422,600 Cybertruck pre-orders on 2019/12/31

I'm surprised Elon hasn't updated his numbers. Maybe he is waiting for 500k?I think you forgot to subtract the ~30k cancelled orders?

Here's the previous measurement and your RN:

- 113,160,000 - 112,745,000 - 30,000 = 385,000 Cybertruck pre-orders on 2019/12/12

- 113,197,600 - 112,745,000 - 30,000 = 422,600 Cybertruck pre-orders on 2019/12/31

They must be planning for initial production capacity of at least 300k p.a. based on the number of reservations. I doubt Rivian is planning for a number that high. Ford must also be wondering how hard it will hit their truck sales....it will be interesting to see if there is a dip in Ford sales as a leading indicator of CT demand.

He should fix his article. It says "missteps in 2019", but there wasn't anything notable from Elon in 2019.Gasparino having fun trolling TSLAQ:

Tesla, WeWork CEOs top winners & losers of 2019

View attachment 495211

I'm sure he means 2018 which is old news at this point (it's 2020 now).

And will pay higher insurance rates for the privilege.Driving ourself will go the way of horses and sailboats - only those really keen will be doing it.

Davidzhao365

Member

Great tips! How do we know Tesla is one of the good bets like Apple in 2013 to 2014? How do you compare the two? (Personally I used Apple to come up a revenue multiple for Tesla)As @Papafox and @StealthP3D have alluded to a few times with their insightful posts, Tesla is not a stock to attempt to guess the dips.

I have learned that the hard way:

In July 2013, I made a $500k investment in Apple at $60/share. Sold it one short year later in Aug 2014 for $116/share for $980k. Almost a 100% return. At the time, my best investment gain ever (by far). I was so thrilled. What a mistake that was.

The stock sits today at $293/share and I would have been sitting on $2.4m (a 5x gain). I felt the stock had run up too fast and I was going to get back in on the dip. I never found the right time to get back in. In fact , I would have sold earlier than Aug 2014 (for a smaller gain) but I was waiting for the 1 year holding period for capital gains. Waiting for the 1 year holding period made me money.

After much reflection from that experience, I have two points to share:

- I had tended to sell my Winners too soon and hold my Losers too long. If the investment thesis is still intact, I now let the Winners run.

- There are many companies that will provide returns of 5x, 10x, etc but it is difficult to identify them (e.g. the small biotech with a new cancer drug). If I am lucky, I have the ability to spot maybe 4 or 5 of these companies during my entire investment career...and when they arrive, my plan is too bet big and hold (as long as the investment thesis stays intact).

After the Apple experience, I had been looking for that next 5x, 10x investment. I had been waiting patiently since 2014 to place that big bet. I always had Tesla on my radar screen but in 2019 the thesis really worked for me. I made a big investment prior to the dip and then doubled my investment at the dip - at an entry point below $200/shr. TSLA SP may go up and down over the next several years but I am not going to make the same mistake I did with Apple, selling and looking for the dip. There may never be a time to get back in.

Btw, having invested in Tesla, my Apple investment now ranks #2 on my all-time gains rankings.

This is not advice, as everyone has different investment goals and tolerances.

Happy New Year everyone!

I would say logistic issues in Q1 right after a huge tax credit cliff that caused not only a massive bleed financially but also a good deal of MSM running the narrative of zero demand vs an actual goof is Elon/Tesla's 2019 biggest misstep.He should fix his article. It says "missteps in 2019", but there wasn't anything notable from Elon in 2019.

I'm sure he means 2018 which is old news at this point (it's 2020 now).

Or in my case, the biggest opportunity to load up.

And will pay higher insurance rates for the privilege.

Not sure about that one. Insuring veteran cars isn't neccecary so expensive since owners take good care and drive carefully on sunny days only.

Davidzhao365

Member

Happy new year fellas!

I am happy that I got my most viewed tweet last night by dropping by the Fremont factory and making a video

for the delivery event

David Zhao on Twitter

I am happy that I got my most viewed tweet last night by dropping by the Fremont factory and making a video

for the delivery event

David Zhao on Twitter

J

jbcarioca

Guest

If Tesla comes even near the 2020 planned openings there will be busy, busy installers everywhere. Mexico will have the entire route toCancun covered as well as the entire route from a few popular Texas/Northern Mexico connections. Then there are a good many extensions and additions to China, still no Superchargers to Lhasa, but there are already decent Destination Chargers. I'll be surprised if there are not a plethora of as-yet-unannounced additions and expansions all over major Chinese cities.

A surprise is that nothing shows for Israel. Of course nothing showed for Jordan and a few others around the world. Certainly major Israeli cities beginning with Tel Aviv will happen within the next few weeks, announced or not.

OTOH, it's quite logical to expect that Iceland probably will see the undated spots and some others this year. Tesla must be well aware of all the pent-up demand especially with Cybertruck orders and the immediate effects of Model 3 presence.

There must be some major new infrastructure coming, even if it does not yet have nice pins attached to manage expectations.

A surprise is that nothing shows for Israel. Of course nothing showed for Jordan and a few others around the world. Certainly major Israeli cities beginning with Tel Aviv will happen within the next few weeks, announced or not.

OTOH, it's quite logical to expect that Iceland probably will see the undated spots and some others this year. Tesla must be well aware of all the pent-up demand especially with Cybertruck orders and the immediate effects of Model 3 presence.

There must be some major new infrastructure coming, even if it does not yet have nice pins attached to manage expectations.

SebastianR

Active Member

2 days ago I have seen a Taycan and chatted with the owner at an Ionity charger where I did get interesting insights that I will share in my weekly Patreon letter. No worries you don't have to be a Patron to read it just wait a week and it will be free.

Ein frohes Neues Jahr! (Happy New Year to everyone else...) - on the Taycan note: I met a Taycan in Bruchsal Ost Ionity Charger on the 22nd of December just before lunch. It was a very nice family driving. I was charging my Model 3 - they were unable to use Ionity but had to go to an old EnBW Tripple Charger since the Taycan wasn't playing nice with the Ionity charger. I offered to unlock they Inoity charger but I was told the "colleagues already warned me that this car might experience problems charging very fast". I was a bit shocked to see that Porsche doesn't have fast CCS charging nailed by now. No idea how long they stood at the other charger, I was on my way fast enough and happy I didn't need to rely on an inexperienced EV-maker (Porsche) playing nice with an inexperienced charging net provider (Ionity) - at this point in time I would happily pay an additional $5000 per car just to have access to the Tesla Supercharger Network.

Watch Europe in 2020: new EU emissions rules are now in place. I expect an unlocking of many car makers EV efforts: German forums talk about EVs being deliberately held back until 2020. So I expect quite a bit of movement in many of the big markets. I also expect that some of the open hostility towards EVs e.g. in Germany will change significantly this year (also ref. Audi advertising the eTron more openly in major sports events as mentioned above)

Last edited:

Especially if they're convertibles...Not sure about that one. Insuring veteran cars isn't neccecary so expensive since owners take good care and drive carefully on sunny days only.

You can’t. Apple is a horrible comparison, it has 0 potential compared to Tesla. Ford, Edison, Standard Oil, all at year 1 is the comparison. Add in Boeing, ATT, Time Warner, Apple, Microsoft, CSX if you want to include Musk Enterprises (SpaceX, Boring, Neuralink) that will be backups.Great tips! How do we know Tesla is one of the good bets like Apple in 2013 to 2014? How do you compare the two? (Personally I used Apple to come up a revenue multiple for Tesla)

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M