And if that 1.5% adds $100 per share, I’ll be satisfiedThere will be a day, possibly 10 years from now, when Tesla's post earning rally on triple beat will be like 1.5% AH

Let that sink in for a moment. It will be a sad day.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Just had a quick briefing at my hospital about the coronavirus from our infectious disease specialist. Currently the mortality rate is less than influenza. It's not expected to cause too much of a concern. Media is panicking because it's a new strand of coronavirus vs the ones that have been infecting people around the world for years.

So in summery, less than a nothing burger.

FWIW, my son and DIL are medical professionals in two different hospital systems in San Diego. Their hospital briefings are saying the same thing.

all,

ihor numbers (estimates) are based upon data from paid participants of S3.

if the total street securities lending book is ‘n’,

a subset of those, street participants like merrill, goldman, state street (the largest sec lending desk) etc etc pay and are part of S3 data provider. in exchange for S3 data, you provide your info/stats.

since not all street participants use S3 (or give up their book to S3), then ihor only has a subset of the total street activity. so no surprise there can be deviations from what is reported publicly by nasdaq in accordance w finra after the fact

as i’ve said in past, SI is not a leading indicator. there’s no way to know real time SI. the fact that ihor reports/focuses on tesla...maybe he’s just using such a polar stock, on twitter, to get S3 some more recognition and gain subscribers? i don’t think there’s any ulterior motive than that, nor do i put a ton of stock in it.

what is important, is that his numbers reflect what is reported to S3, and then maybe extrapolated on

anything other than that, then shame on him. but i don’t think it’s anything malicious. and again, at the same time, if you look at it for what it is, it’s not that big a deal, nor should it be taken as one.

the SI is at one of highest $ value ever for tsla - that to me, is more stunning.

so again,

s3 doesn’t have the full picture...doesn’t have all the data to provide complete accuracy. also isn’t harmful if you know that going into it.

even so, as of 1/15 tsla SI ~11.9bb, right up there in the top all time (~13bb)

which is crazy. it may be true that short in shares have gone up since 1/15. ihor may be right, or he may be wrong

fact is, anything in this range, or frankly anything over 5-7bb on a company with this much going for it is nuts

if we ever did have a squeeze, GTFOOTW

we haven’t had it yet

ihor numbers (estimates) are based upon data from paid participants of S3.

if the total street securities lending book is ‘n’,

a subset of those, street participants like merrill, goldman, state street (the largest sec lending desk) etc etc pay and are part of S3 data provider. in exchange for S3 data, you provide your info/stats.

since not all street participants use S3 (or give up their book to S3), then ihor only has a subset of the total street activity. so no surprise there can be deviations from what is reported publicly by nasdaq in accordance w finra after the fact

as i’ve said in past, SI is not a leading indicator. there’s no way to know real time SI. the fact that ihor reports/focuses on tesla...maybe he’s just using such a polar stock, on twitter, to get S3 some more recognition and gain subscribers? i don’t think there’s any ulterior motive than that, nor do i put a ton of stock in it.

what is important, is that his numbers reflect what is reported to S3, and then maybe extrapolated on

anything other than that, then shame on him. but i don’t think it’s anything malicious. and again, at the same time, if you look at it for what it is, it’s not that big a deal, nor should it be taken as one.

the SI is at one of highest $ value ever for tsla - that to me, is more stunning.

so again,

s3 doesn’t have the full picture...doesn’t have all the data to provide complete accuracy. also isn’t harmful if you know that going into it.

even so, as of 1/15 tsla SI ~11.9bb, right up there in the top all time (~13bb)

which is crazy. it may be true that short in shares have gone up since 1/15. ihor may be right, or he may be wrong

fact is, anything in this range, or frankly anything over 5-7bb on a company with this much going for it is nuts

if we ever did have a squeeze, GTFOOTW

we haven’t had it yet

JRP3

Hyperactive Member

Tesla patent for electrolyte additive to improve battery life. Battery Day can't get here soon enough.

Tesla filed a patent 'Dioxazolones and nitrile sulfites as electrolyte additives for lithium-ion batteries'For further progress in the use of electric vehicles and energy storage systems from the network, it is desirable to develop the chemistry of lithium-ion cells, which provides a longer service life at high temperatures and high voltage cells without a significant increase in cost. The introduction of sacrificial electrolyte additives on the order of a few weight percent is a practical method to form protective solid-electrolyte interphase (SEI) layers that limit electrolyte decomposition during cell storage and operation. In recent years, significant efforts have allowed to obtain a large number of such additives that can be used to improve the characteristics of cells for various applications.

This patent provides compositions for use as electrolyte additives in lithium-ion battery systems and relates to the chemical composition of rechargeable battery systems, including active electrolyte additives, to improve the properties of rechargeable lithium-ion battery systems. This disclosure covers new battery systems with fewer active electrolyte additives that can be used in various energy storage applications, for example, in vehicles and power systems. More specifically, this disclosure includes additive electrolyte systems that enhance performance and lifetime of lithium-ion batteries, while reducing costs from other systems that rely on more or other additives.

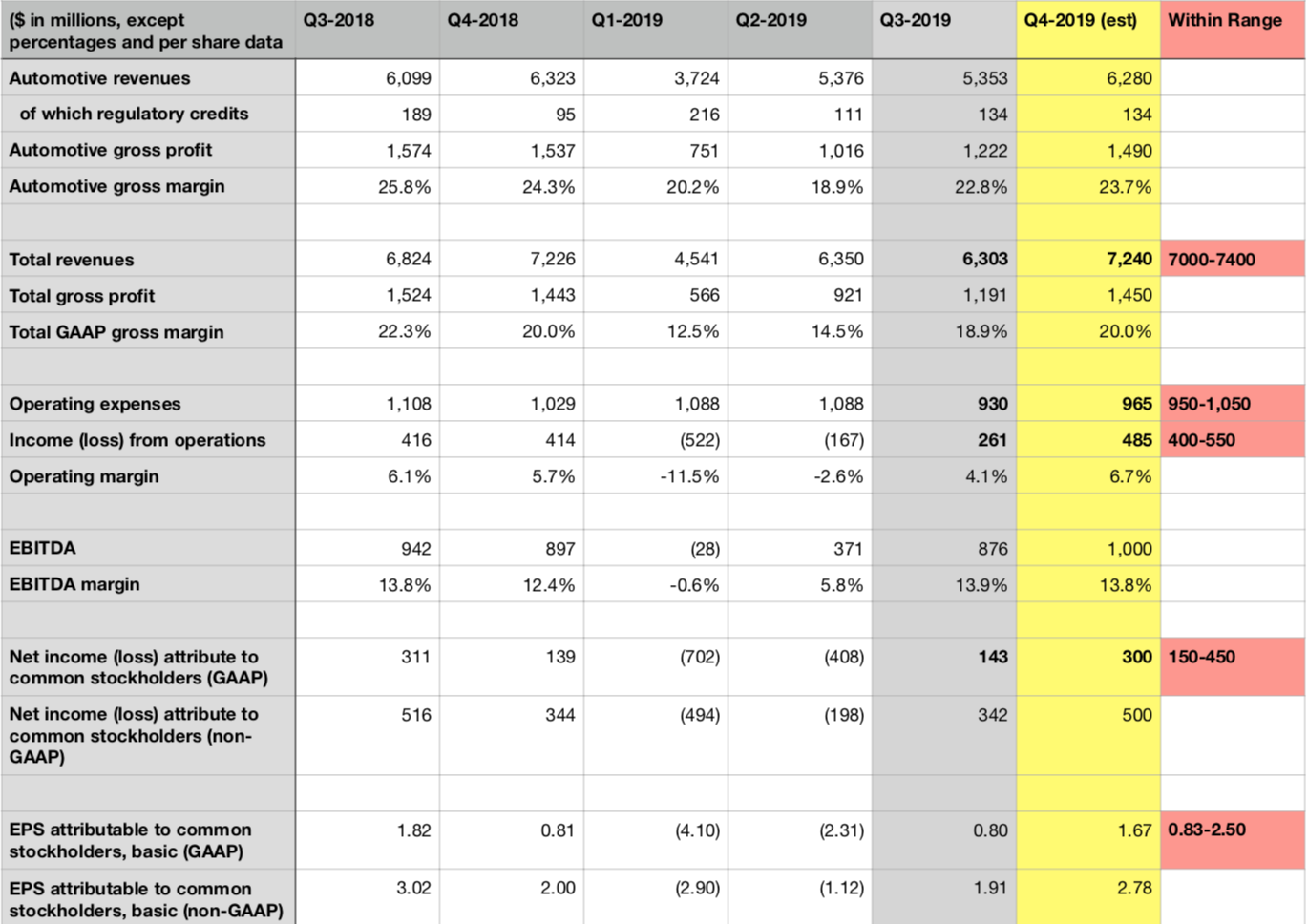

Let's say for net gaap income:

Q2 2019 - (408m)

Q3 2019 - 143m

Q4 2020 - 265m (hypothetical)

Q1 2020 - 1m (hypothetical)

Tesla will be eligible for S&P 500 inclusion after Q1 earnings.

So, the magic number is Tesla needs to announce at least $265m in gaap net income tomorrow, and then be slightly profitable for Q1. We'll see what kind of guidance Tesla gives, if any, regarding this.

My estimates...

Q2 2019 - (408m)

Q3 2019 - 143m

Q4 2020 - 265m (hypothetical)

Q1 2020 - 1m (hypothetical)

Tesla will be eligible for S&P 500 inclusion after Q1 earnings.

So, the magic number is Tesla needs to announce at least $265m in gaap net income tomorrow, and then be slightly profitable for Q1. We'll see what kind of guidance Tesla gives, if any, regarding this.

My estimates...

No, it would still qualify if it reported $1M tomorrow and $256M for Q1. Or $128.5M both quarters. I don't understand why people are fixating on the $256M number.So, the magic number is Tesla needs to announce at least $265m in gaap net income tomorrow, and then be slightly profitable for Q1. We'll see what kind of guidance Tesla gives, if any, regarding this.

tschmidty

Member

Our first stop after landing in New York is All American , my wife gets a grilled cheese, fries an a knish. Next stop Nathan's on route 110 in Huntington I get a grilled Hot dog(s) with kraut, deli mustard and fries.

Really no kidding and I am not that fat (yet?)...

How are any of these posts related to investing in Tesla?

I guess people plan to celebrate with beer and all american burgers tomorrow after closing bell? maybe stop at a firework place on the way to the restaurant?How are any of these posts related to investing in Tesla?

While I still believe things can go either way, I'd truly love to have some all american burgers.

It's all about the Hotdogs-per-Share-Ratio now!How are any of these posts related to investing in Tesla?

But I'd still suggest buying them on margin.

Last edited:

Well I, for one, kind of relish these marginal threads.It's all about the Hotdogs-per-Share-Ratio now!

But I'd still suggest buying them on margin.

JusRelax

Active Member

No, it would still qualify if it reported $1M tomorrow and $256M for Q1. Or $128.5M both quarters. I don't understand why people are fixating on the $256M number.

$256M is a magic number because that is the number where Tesla can make one cent of profit in Q1 and still be eligible to join the S&P500 after Q1.

Q1 2019 is still very fresh in many investors' (and shorts') minds, so minimizing the amount of profit they need to make in Q1 is key in their minds of increasing the possibility of joining S&P500 after Q1 earnings are released.

If Tesla records $265M in Q4 2019 and also states that Q1 2020 is sold out everywhere globally, IMO this is the lethal combo that will set the shorts running for the hills since S&P500 eligibility would basically be guaranteed after Q1 earnings.

Skryll

Active Member

And according to what I heard installers being booked to November for powerwalls I see lots of cash flow opportunity for q1 from the $0 valued battery storage business. Especially now that with higher SP price more tesla existing owners may feel empowered to retrofit solar (i am) and upgrade vehicles. I noticed a lot more new model 3 and x as well as used model s in our neighborhood. Maybe there is an upgrade wave under way.$256M is a magic number because that is the number twhere Tesla can make one cent of profit in Q1 and still be eligible to join the S&P500 after Q1.

Q1 2019 is still very fresh in many investors' (and shorts') minds, so minimizing the amount of profit they need to make in Q1 is key in their minds of increasing the possibility of joining S&P500 after Q1 earnings are released.

If Tesla records $265M in Q4 2019 and also states that Q1 2020 is sold out everywhere globally, this is the lethal combo that will set the shorts running for the hills since S&P500 eligibility would basically be guaranteed after Q1 earnings.

Yuri_G

Member

Who posted the post-earnings price movement chart before Q3 earnings? I found that extremely helpful.

Even people like me holding long term calls lost a lot of money this year. This tends to happen when the SP goes down by 50%.

------------------------------

Here is what happened in the last 11 quarters.

Note that consistently when the SP goes down after ER, it hits the lowest point within 2 or 3 days. But when it goes higher, it takes a week or two to reach the highest. In the below chart I only look at 12 business days after the ER.

View attachment 468989

Found it. Thanks EVNow!

Q4 2020 - 265m (hypothetical)

Q4 2019

shootformoon

Member

And don't drive on a highway where there is construction. At least I assume that's the reason that chunks of I95 are missing from Super Cruise near Philadelphia. I've been using AP through that area of 95 since shortly after v9 software was released. This type of construction lasts years.

Super Cruise map is on this page.

quote:

"HANDS OFF THE WHEEL. EYES ON THE ROAD."

Where is Sen. Markey?

anthonyj

Stonks

Why is everyone thinking Tesla will report only 250m profit? They sold almost 20k more cars than Q3, more S/X and raised prices. Will be over $500m profit

Elon even tweeted that the shares are underappreciated.

Elon Musk on Twitter

Elon even tweeted that the shares are underappreciated.

Elon Musk on Twitter

Why is everyone thinking Tesla will report only 250m profit? They sold almost 20k more cars than Q3, more S/X and raised prices. Will be over $500m profit

Elon even tweeted that the shares are underappreciated.

Elon Musk on Twitter

had not figured that one out yet

For those who didn't watch the video, someone bought almost $2 million worth of June $800 calls.

AquaMan

Member

Some of you folks are pretty sophisticated with valuation.

Me? I'm long because I believe Tesla will continue to grow, FAST, because they've proven over and over that competitors can't touch their technology and vision.

And I see something else. For the last 60-plus years, the basic definition of "a car" has hardly changed. We got greater fuel efficiency, we went from carburetors to fuel injection, seat belts and airbags were improved, and most cars have added some kind of touchscreen with Bluetooth and backup cameras. Big whoop.

Tesla is THE company that "rethunk the idea of what a car can be." The others just don't have the vision to innovate as Tesla has. Tesla has taken risks and some of them may not work out, but some definitely will.

For example, 10 years from now, will Cybertruck be a joke, or will it be iconic? We all have our beliefs on that, but frankly we don't know yet. But we DO know this... Cybertruck won't go down in history as "just another truck".

Oh, and they're on the cutting edge for solar too.

And the Semi... that could genuinely change shipping!

Tesla will go down in history as a game changer even if they fail, and I've chosen to ride along for this financial adventure.

Me? I'm long because I believe Tesla will continue to grow, FAST, because they've proven over and over that competitors can't touch their technology and vision.

And I see something else. For the last 60-plus years, the basic definition of "a car" has hardly changed. We got greater fuel efficiency, we went from carburetors to fuel injection, seat belts and airbags were improved, and most cars have added some kind of touchscreen with Bluetooth and backup cameras. Big whoop.

Tesla is THE company that "rethunk the idea of what a car can be." The others just don't have the vision to innovate as Tesla has. Tesla has taken risks and some of them may not work out, but some definitely will.

For example, 10 years from now, will Cybertruck be a joke, or will it be iconic? We all have our beliefs on that, but frankly we don't know yet. But we DO know this... Cybertruck won't go down in history as "just another truck".

Oh, and they're on the cutting edge for solar too.

And the Semi... that could genuinely change shipping!

Tesla will go down in history as a game changer even if they fail, and I've chosen to ride along for this financial adventure.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M