Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

N5329K

Active Member

Artful Dodger

"Neko no me"

FTFY.Been a couple of years, but "mean" MEDIAN is half the instances are above and half the instances are below.

Carl Raymond

Active Member

Global energy usage per day = 222TWh

How much storage is needed for this? Maybe half? 111TWh

You only need storage for time-inflexible energy needs. Much of it is flexible.

Car charging

Pool filtering

Heating, cooling (store heat, ice instead)

Drying food

Smelting

Water pumping

P2G

etc

Consider how rarely you flick a switch with a “I need it now” approach and pull high loads. Making toast. Coffee. Often it’s only minutes.

JakeP

S P4996 ==> P02547

I recall this happening once to ORCL stock decades ago...one “glitch” managed to tank the whole stock. Always suspected it was a manipulation.

[Edit: this is in reference to the glitch trade at 428 captured above, I don’t know what happened to my thread quote]

[Edit: this is in reference to the glitch trade at 428 captured above, I don’t know what happened to my thread quote]

jhm

Well-Known Member

We've done and discussed this kind of calculation many times in the Shorting Oil thread. Your in the ballpark. Battery storage for the grid is likely to be between 6 and 8 hours today. Studies have shown this is optimal when paired with a 50% over supply of wind and solar. Also electrolyzers can cut into demand for grid batteries in a 100% RE world. Life cycle gains also reduce annual demand for replacement batteries. So I think 13 to 20 TWh annual capacity. It's huge in any case.I have followed Elon, Tesla and SpaceX pretty closely since they were founded, and I have been thinking lately about how Elon would see the whole picture. Jim Keller was saying he broke problems down into what is possible from a physics point of view, and then worked backwards figuring out how to get there.

If we apply that to Tesla let's imagine what is the limit of physical possibilities, where Tesla is responsible for the lion's share of modernising these areas on a worldwide/solar system wide level, for the foreseeable future:

1) Electric transport

2) Energy creation and storage

3) Deliveries

4) Taxis

5) Public transport

4) Mining (via Boring Company)

5) Auto Insurance

6) Banking (I don't think he ever gave up on his x.com dream, though I doubt it will be via Tesla)

Now imagine Tesla has to get 80% of this done all by themselves - which is pretty much their current percentage of EV market share in the US. Elon might have a practical plan to get to 2 terawatts which he is willing to share, but I am sure he is thinking even bigger. He will be thinking about how to most quickly change the entire world to electric. Let's do some numbers:

Energy:

Global energy usage per year = 158,000 TWh

% of that which is not renewable = 51%

Global energy usage to be replaced with renewables = 81,000 TWh

Global energy usage per day = 222TWh

How much storage is needed for this? Maybe half? 111TWh

Let's say we need an annual capacity of new storage+generation of 11TWh

Passenger vehicles:

90 million per year

I read, 2TWh is enough for 26 million

So need about 7TWh total

Trucks:

4 million/year roughly worldwide (I think - I think this is across all classes of truck tho)

900kWh for semi, so lets say 600 average across all classes

so thats only 2.4TWh per year

Grand total about 20TWh needed per year

So you can see there is an order of magnitude difference between Elon's 2 TWh plan and what is actually needed. Feel free to point out any of my mistakes in my basic calculations... it could be as much as 200TWh - I don't have much confidence in my calcs.

If Elon can get to 2TWh, you can be sure he will quickly get to 20 in about the same time as it took to get from here to 2TWh. Let's say he can get to 2TWh in 10 years, then to get to 20 it will be 10 more years roughly, and after a decade of that production rate the whole world will be electric. So roughly 30 years from now, when Elon is 77 +/- 15 years. The timeframe for him getting to 2TWh is very interesting to me. Maybe he thinks he can get there in 5 years which would pretty much halve my guess of 30 years to 15 years.

TLDR; You need a 30 year investment timeframe to benefit from Elon's grand plan of an electric world.

Tesmanian reporting that Tesla's China stores will be reopening on the 17th, and are preparing for a mass-delivery event (they did online pre-delivery livestream consultations with buyers to introduce them to their cars during the downtime).

Tesla China Massive MIC Model 3 Delivery Soon, Stores Reopen on Feb 17

Tesla China Massive MIC Model 3 Delivery Soon, Stores Reopen on Feb 17

Another advantage of on-line ordering. No (biological) virus transmission.Tesmanian reporting that Tesla's China stores will be reopening on the 17th, and are preparing for a mass-delivery event (they did online pre-delivery livestream consultations with buyers to introduce them to their cars during the downtime).

Tesla China Massive MIC Model 3 Delivery Soon, Stores Reopen on Feb 17

Artful Dodger

"Neko no me"

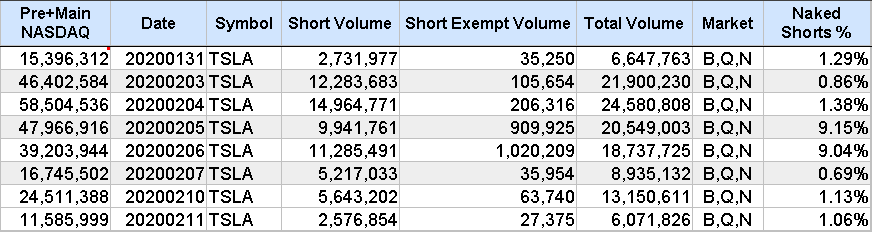

NASDAQ reports volume of 320 shares at 18:04 hrs at a VWAP of $313.502Glitch

After-Hours somebody executed a trade at $313.50 at 18:04:08 (why would they?), possibly a fat-fingered trading entry.

Or, somebody spent some bucks to mess with the daily charts...

Cheers!

Last edited:

Don’t use operating margin % for a calculation.

Tesla has massive amount of operational leverage (gross margin growth is basically decoupled from OpEx growth) that is going to launch the operational margin % to Max Q over the next 2 years. Look at anticipated Gross margin and then subtract relatively flat OpEX costs to get your operating profit. OI&E is also essentially flat (interest costs decreasing) so the gains from operating leverage will flow straight through to net income as well for the most part.

Did you account for Elon guiding to minimal profit targets while they’re growing?

UnknownSoldier

Unknown Member

Also, I think it's time to treat myself to a gift. Is it blasphemy to use TSLA gains to buy my dream ICE weekend car (a 911 4S - I love driving manual)?… I will still be using a Model 3 as my daily

Haha, I was thinking of something like this too but I wasn't sure if it was blasphemy or not to say it. With the era of the ICE automobile now at dusk and twilight looming, it would be nice to enjoy one of the last great ICE before the end. Unfortunately it seems I've made less than you, as I was thinking of a nice Cayman S myself.

MC3OZ

Active Member

You only need storage for time-inflexible energy needs. Much of it is flexible.

Smelting

Actually smelting ideally needs 24x7 electricity otherwise bad stuff can happen and it is a big job to get up and running again...

A lot of electricity discussion in Australia focuses on the Portland Smelter, it can go without power for a few hours...

The problem for these 24x7 industrial loads is coal provides cheaper power over overnight, I think RE provides cheaper power in the day, eventually it comes out even.....

Dig a bit deeper and there are hidden subsidies for a lot of industry, and tax payers pick up the tab.....

Thekiwi

Active Member

Did you account for Elon guiding to minimal profit targets while they’re growing?

As far as I’m aware Elon has suggested gross margins staying in the 20%+ range, and OpEx growth being kept tightly focused. For “minimal profit” to happen would require one or both of those things to change a lot. Could happen of course, but would be a significant change in the short term situation.

Artful Dodger

"Neko no me"

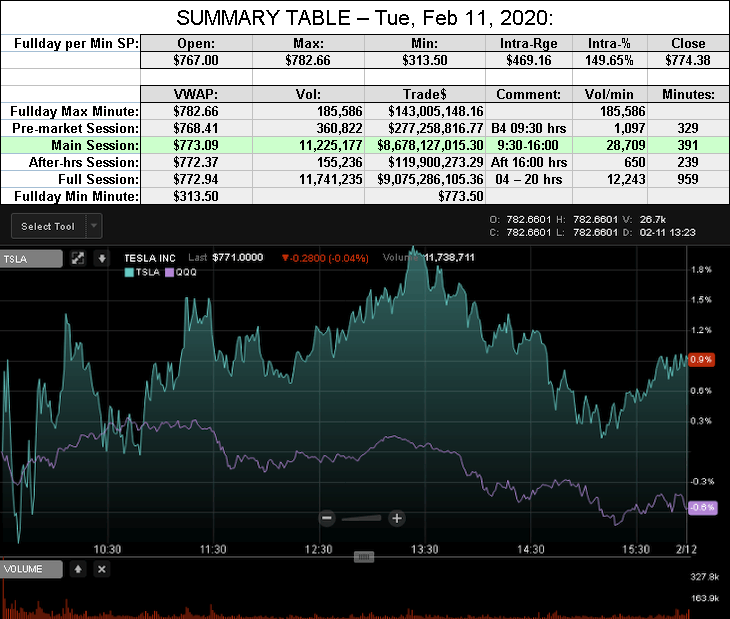

After-action Report: Tue, Feb 11, 2020: (Full-Day's Trading)

Peace has returned to Whoville as the IV Crush calms the Options Market for TSLA.

(Extended Hours not shown in Chart below due to a $313.50 trade at 18:04 hrs)

Bonus Feature: FINRA Short+ShortExempt Volume for the past 8 trading sessions:

VWAP: $772.94

Volume: 11,741,235

Traded: $9,075,286,105.36

Closing SP / VWAP*: 100.19%

(*TSLA closed ABOVE today's Avg SP)

Volume: 11,741,235

Traded: $9,075,286,105.36

Closing SP / VWAP*: 100.19%

(*TSLA closed ABOVE today's Avg SP)

Peace has returned to Whoville as the IV Crush calms the Options Market for TSLA.

(Extended Hours not shown in Chart below due to a $313.50 trade at 18:04 hrs)

Bonus Feature: FINRA Short+ShortExempt Volume for the past 8 trading sessions:

Last edited:

My sentiments exactly! To be fair, I’m overreaching a bit and buying used, so it helpsHaha, I was thinking of something like this too but I wasn't sure if it was blasphemy or not to say it. With the era of the ICE automobile now at dusk and twilight looming, it would be nice to enjoy one of the last great ICE before the end. Unfortunately it seems I've made less than you, as I was thinking of a nice Cayman S myself.

MC3OZ

Active Member

“We’re out”: Big contractor dramatically quits Australian solar sector | RenewEconomy

I posted this article specially for this quote, as in addition to battery storage, equipment for grid connected solar farms is an opportunity for Tesla, and Maxwell has some relevant experience....

What Tesla could do in this area is offer more an more hardware and software to support grid connected solar farms solving the engineering challenges in a standardised flexible way, as well as selling batteries and software...

A lot of the challenges solar farm projects are having mainly stem from a lack of planning, archaic rules, the need for grid upgrades and a lack of battery storage.... these problems are temporary...

“We have still got a series of issues with equipment, particularly inverters. Sure they will be solved as fast as they can, but when I look at it for next couple of years, it is very challenged.

I posted this article specially for this quote, as in addition to battery storage, equipment for grid connected solar farms is an opportunity for Tesla, and Maxwell has some relevant experience....

What Tesla could do in this area is offer more an more hardware and software to support grid connected solar farms solving the engineering challenges in a standardised flexible way, as well as selling batteries and software...

A lot of the challenges solar farm projects are having mainly stem from a lack of planning, archaic rules, the need for grid upgrades and a lack of battery storage.... these problems are temporary...

Haha, I was thinking of something like this too but I wasn't sure if it was blasphemy or not to say it. With the era of the ICE automobile now at dusk and twilight looming, it would be nice to enjoy one of the last great ICE before the end. Unfortunately it seems I've made less than you, as I was thinking of a nice Cayman S myself.

My sentiments exactly! To be fair, I’m overreaching a bit and buying used, so it helps

I'm not one to judge people for their weird car fetishes.

If Q1 is disappointing then this could give us one last good buy opportunity that we will have in a long time. I think Q2, Q3, and Q4 will be profitable. Unless, something like that fing virus happens. This stock will go up accordingly with each profitable quarter. If Tesla isn’t profitable for Q1 this may be one of the last great buying opportunities at these levels. I for one will back up the truck and buy more shares and some calls.

If Q1 is disappointing then this could give us one last good buy opportunity that we will have in a long time. I think Q2, Q3, and Q4 will be profitable. Unless, something like that fing virus happens. This stock will go up accordingly with each profitable quarter. If Tesla isn’t profitable for Q1 this may be one of the last great buying opportunities at these levels. I for one will back up the truck and buy more shares and some calls.

Yes, but it's a bit of a gamble. If Q1 is decent and the stock continues to go up, then NOW is the last great buying opportunity. So by setting that cash aside instead of buying now, you're really betting against the company for Q1. I don't have the guts to do that.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M