Not only did we go to work after 9/11 NYC became one of the safest large cities in the world after the attacks ... the heightened level of awareness was palpable... we went back to work developed better disaster recovery plans and further diversified the financial networks .... I can honestly say in many ways I felt safer after 9/11 ... a lot safer... never forget those we lost .. some of my friendsLet's be clear: people are not going to hunker down in their homes for months. It's just not going to happen.

You know what people like more than not catching a virus? Eating. Having healthcare. Having the lights stay on. Not getting their home repossessed.

Spanish Flu was far, far deadlier, and people still went to work. Today? A disease which has a 1% fatality rate outside of Wuhan - 0,2-0,3% for working-age people - and this is before retrovirals, which should be approved in a couple months - in an environment with modern communications and disease control measures, rather than during a World War - isn't going to do the trick.

This is hardly the first time things have scared people. Remember 9/11 in the US, how freaked out people were about terrorism striking anywhere, anytime? Yep.... yet they still went to work. Even people in jobs in public places that would be likely targets. They were scared. But they were even more scared of losing everything they owned and ending up on the streets because they decided to become a shut-in out of fear of terrorists.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

SoGA Fan Club

Member

Tesla's Model Y Rolls Out With a Whimper Amid Cornonavirus Pandemic

The scappy automaker, who has been struggling to roll-out it's latest model, a small and stripped-down version of its now aging Model X, delivered it's first Model Y production units to Tesla's adoring loyalists. The question on everyone's minds is whether this rollout will be a repeat of the disaster faced over two years ago as Tesla struggled to reach projected production numbers with its Model 3.

/s

BTW - you sure you aren't writing articles for the FUDsters? That sounded exactly like something they'd write.

I'm worried about you now!

Artful Dodger

"Neko no me"

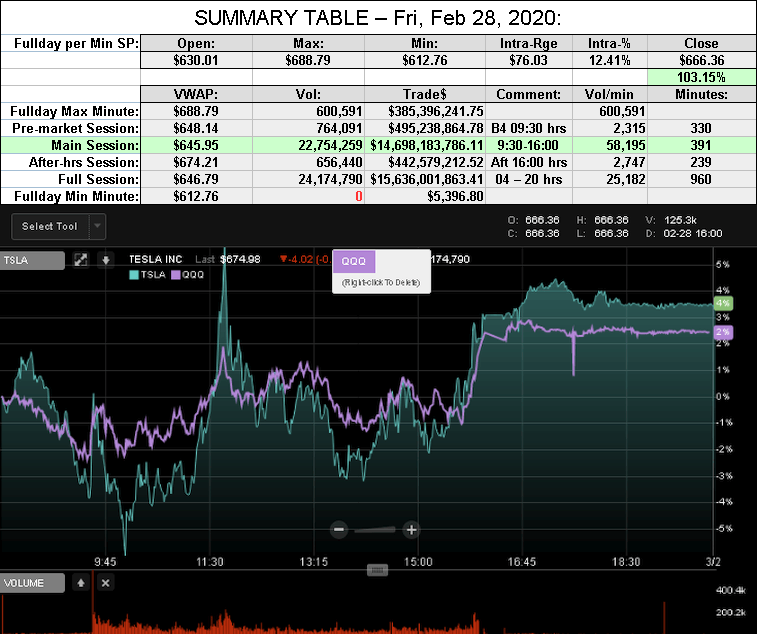

After-action Report: Fri Feb 28, 2020: (Full-Day's Trading)

Comment: "Opened at Lower-BB; 13% Intraday swing; Closed above day's avg SP for 1st time this week"

VWAP: $646.79

Volume: 24,174,790

Traded: $15,636,001,863.41 ($15.63 B)

Closing SP / VWAP: 103.15%

(TSLA closed ABOVE today's Avg SP)

Volume: 24,174,790

Traded: $15,636,001,863.41 ($15.63 B)

Closing SP / VWAP: 103.15%

(TSLA closed ABOVE today's Avg SP)

Comment: "Opened at Lower-BB; 13% Intraday swing; Closed above day's avg SP for 1st time this week"

JRP3

Hyperactive Member

I'm stocking up so I can at least do one month.Let's be clear: people are not going to hunker down in their homes for months.

But didn’t thousands of people rush to ground zero too quickly without proper masks and are now sick because of things they inhaled?Not only did we go to work after 9/11 NYC became one of the safest large cities in the world after the attacks ... the heightened level of awareness was palpable... we went back to work developed better disaster recovery plans and further diversified the financial networks .... I can honestly say in many ways I felt safer after 9/11 ... a lot safer... never forget those we lost .. some of my friends

trailhound

Member

In other news:

"The Colorado Senate Friday approved a bill 22 to 12 that will allow electric vehicle manufacturers, like Tesla and electric truck manufacturer Rivian, to sell their products directly to consumers, bypassing the traditional dealership system. There is a caveat however, the bill only allows company that sell solely EVs and has no prior traditional system of dealerships already in place to do so"

Colorado Passed A Dealership Bill Designed Entirely For Tesla And Rivian

I don't know the history of this bill and the likely hood of it becoming law.

Today was a good day it felt like a win.

trailhound- still overweight and long

"The Colorado Senate Friday approved a bill 22 to 12 that will allow electric vehicle manufacturers, like Tesla and electric truck manufacturer Rivian, to sell their products directly to consumers, bypassing the traditional dealership system. There is a caveat however, the bill only allows company that sell solely EVs and has no prior traditional system of dealerships already in place to do so"

Colorado Passed A Dealership Bill Designed Entirely For Tesla And Rivian

I don't know the history of this bill and the likely hood of it becoming law.

Today was a good day it felt like a win.

trailhound- still overweight and long

Words of HABIT

Active Member

Just sent an email to Editor-In-Chief of Canadian magazine, Renovation Contractor. Our voices need to be heard.

Dear Mr. Jim Caruk, Editor-In-Chief, Renovation Contractor Canadian Magazine

Kudos to Renovation Contractor Canadian Magazine for your December 2019 / January 2020 Edition article "Charge It - Everything you need to know about installing electric vehicle chargers", by Alex Newman. Glad to see more and more Green articles and an Annual Green Issue to boot and I enjoy reading your bi-monthly Magazine. From what is otherwise an excellently written and informative article, I do have one issue which I feel requires correction in your next issue. Alex states “New EVs can travel about 100 km on one charge, with some going as far as 160 km”.

Personally, I know my fully electric vehicle, Tesla Model 3 Long Range RWD, which I have been driving since June 2018 gets 525 km on one charge. Other EVs currently available have even longer range, such as the Tesla Model S Performance at 560 km on one charge. Heck, even the yet to be released 2020 Porche Taycan Turbo has a range of 323 km. Links to EPA results are provided below.

With information so readily available on Google, why was Alex’s information not checked for accuracy. The article portrays the myth that EVs are only short commuter City range vehicles. Range anxiety is no longer a problem for many EVs. EVs without compromise. Today.

tesla m3 EPA range

Porche Taycan Turbo EPA range

Yours Truly,

True to their word, Jim Caruk, Editor-In-Chief, Renovation Contractor Canadian Magazine, put in a correction regarding available range of EVs. I was expecting a two liner at best, and was presently surprised finding the thier latest issue a near full page apology and credit to EVs, and Tesla! Woot woot. Funny he used my reference to Porche Taycan. Thought the max MS range was now 590km/charge, however I'm not going to ask him for another correction if he wanted to round it off.

Had to take my M3 in for service today, simple drove in to the Toronto Lawrence/DVP service station unannounced (and when I say drive-in, I mean it, you literally drive through the building and park right beside the service counter (no deadly fumes). They fixed the problem (glove box kept opening), and also repaced my charger port for a more winterized version and added mud flaps (didn't ask for it, they just did it, in and out within 1 1/2 hours. Excellent service, called me by name, expanded service centre had about 10 cars servicing, ample processing staff and mechanics, moved service ctr to new building apart from sales centre which was busy. (Got our M3 on July 17th, 2018). No up changes. No charges. No other OEM can compare.

Krugerrand

Meow

In other news:

"The Colorado Senate Friday approved a bill 22 to 12 that will allow electric vehicle manufacturers, like Tesla and electric truck manufacturer Rivian, to sell their products directly to consumers, bypassing the traditional dealership system. There is a caveat however, the bill only allows company that sell solely EVs and has no prior traditional system of dealerships already in place to do so"

Colorado Passed A Dealership Bill Designed Entirely For Tesla And Rivian

I don't know the history of this bill and the likely hood of it becoming law.

Today was a good day it felt like a win.

trailhound- still overweight and long

You’re welcome Rivian. On the back of Tesla —

If a meteor was about to hit earth would we move the discussion to a separate thread?

I've been saying this for a month now, but it bears repeating. Nothing will matter more to the short term price of Tesla than the Coronavirus.

You might as well rename this thread to the Coronavirus investment thread.

If you disagree with me - well, "I'm right, and you're smart and sooner or later you'll see I'm right."

"why listen to this guy you ask?"

Because I was right.

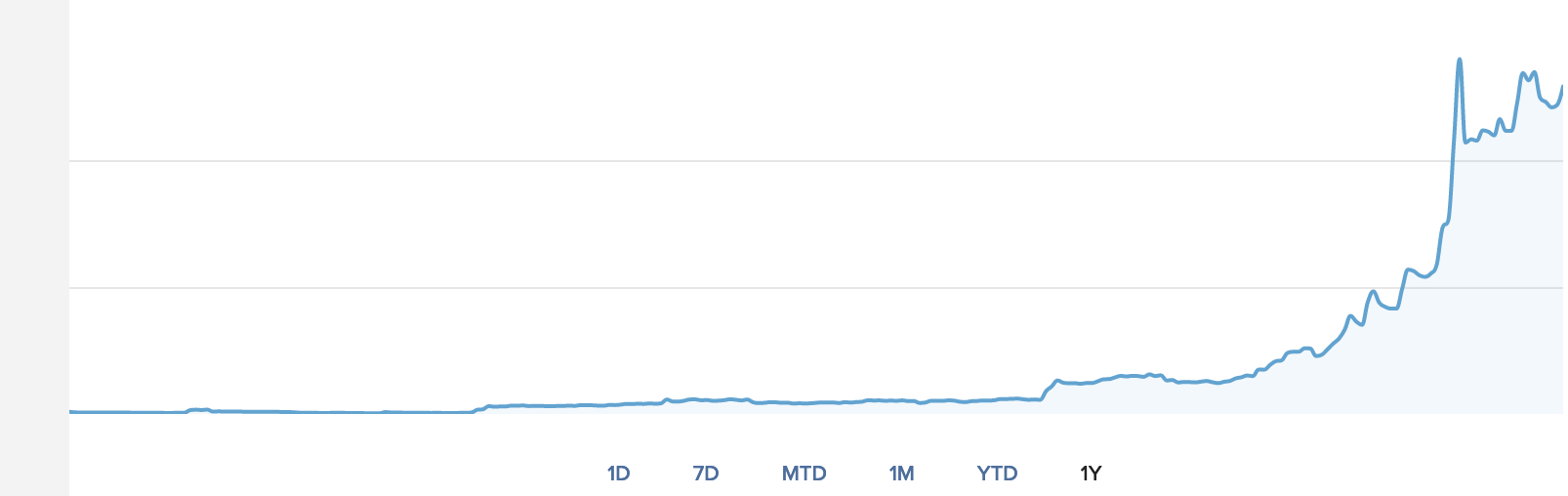

My portfolio was 100% TSLA stock, TSLA options up untill 1 month ago (and has been for 5 years.)

I assume few others here managed to salvage their portfolio through this.

My portfolio is fine. I own the same amount of shares in a growth company that I believe in, Tesla obviously, as I have for some time. I haven’t sold, so what needs salvaging?

As far as I can see, fossil fuel players are the ones who will be slowed by the virus and they’re the ones whose time is running out. Advantage Tesla.

The volatility is irksome, but as always with these drops there are plenty of care bears telling us the sky is falling. In which case I know things will be fine.

Because, remember, all those short shares have to be bought back. Every. Single. One.

But then I’m guessing you already know that. Still, it bears thinking about especially for bears. If, say, I myself were to come by some of those shares, they would be most unlikely to be available anytime soon and certainly most dear to recover.

Yes, yes, I know the virus cat is out of the bag. I’m not dismissing it. Still, the virus will pass and with it the feverishness. And my portfolio? Fine and dandy.

BTW, Earth is hit by 17 meteors a day. Just sayin’ Earth hit by 17 meteors a day | Cosmos

Krugerrand

Meow

The degree of complacency on this thread is something to behold.

Your cortisol levels must be through the roof.

FYI, you do *this* frequently. *This* being over dramatization. Yes, frequently. As in it’s a pattern in your posting.

As someone who’s not panic prone, when I start to scream fire, you’ll know it’s time to get out your apocalypse gear.

Until then, put some lavender in your bath, turn on some soothing music and try some deep breathing exercises.

The degree of complacency on this thread is something to behold.

...

Thank god Tesla raised that cash when it did, at least when this is all over it will still be there to continue its work. It will be a different matter for many other corporate giants.

Hmmm, consider what you wrote and the difference between complacency and confidence.

I’ve complete confidence In the management of Tesla to be on top of things.

Leaves me free to not be, um, complacent in other departments.

Last edited:

JRP3

Hyperactive Member

Might want to rethink the lavender.Until then, put some lavender in your bath, turn on some soothing music and try some deep breathing exercises.

Lavender oil linked to early breast growth in girls (Environmental Factor, September 2019)

What about on women? If it works I might not have to sell shares to fund the missus' dream.Might want to rethink the lavender.

Lavender oil linked to early breast growth in girls (Environmental Factor, September 2019)

StealthP3D

Well-Known Member

We are witnessing the rapid unravelling of international travel, the key plank of our globalised economy, and that is without factoring in the likely interruption to internationally integrated supply chains and the shock to aggregate demand everywhere covid-19 takes a hold.

Please spare us the rhetoric. International travel is not a "key plank of our globalized economy". Yes, the airlines and oil companies will take a big hit. No, it won't cause our global economy to stop functioning if executives and salesmen have to stay at their home office.

Sorry if this sounds miserable but I fear we havebarelybearly scratched the surface in terms of how badly this crisis will impact markets and underlying economies.

FTFY. So, the sky is falling in your world. What else is new? I've been through a lot of flu virus scares over the years and I don't recall any that amounted to much in terms of lasting impact on the markets. Please tell me why Coronavirus is worse.

Singer3000

Member

I too haven’t touched any of my shares in my very long term pension account. And the reason for that is because I feel on balance that Tesla is well placed to ride out a recession, even one that might prove be a once a generation event.My portfolio is fine. I own the same amount of shares in a growth company that I believe in, Tesla obviously, as I have for some time. I haven’t sold, so what needs salvaging?

As far as I can see, fossil fuel players are the ones who will be slowed by the virus and they’re the ones whose time is running out. Advantage Tesla.

The volatility is irksome, but as always with these drops there are plenty of care bears telling us the sky is falling. In which case I know things will be fine.

Because, remember, all those short shares have to be bought back. Every. Single. One.

But then I’m guessing you already know that. Still, it bears thinking about especially for bears. If, say, I myself were to come by some of those shares, they would be most unlikely to be available anytime soon and certainly most dear to recover.

Yes, yes, I know the virus cat is out of the bag. I’m not dismissing it. Still, the virus will pass and with it the feverishness. And my portfolio? Fine and dandy.

BTW, Earth is hit by 17 meteors a day. Just sayin’ Earth hit by 17 meteors a day | Cosmos

But last I checked, a great number of people here are engaged in trading. And a greater number still will have portions of their investment portfolio that they intend to monetise earlier than a “very long time” time frame.

Governments around the world are this weekend having serious conversations about the trade off between guaranteeing an economic downturn through restrictions on trade and movement, versus letting the virus run its course and accepting the consequences. It’s naive to pretend this isn’t going on and frankly insults your own intelligence to call a long standing and bullish poster a “care bear” for trying to highlight these risks.

Think about the second order consequences. If there is not a sharp rebound in Q2 in China after what may be in truth a double digit yoy GDP contraction in Q1, what do you suppose will happen to the banking system? One that is already stuffed to the gills with undeclared NPLs. Mass capitalisation of bad banks to clean up the balance sheet is the Communist Party’s normal play, finances by printed local currency. But what then happens to the yuan and what does that mean for the competitiveness of the wider world and the global trade system?

Italy’s banking system has already teetered on the brink of insolvency for a couple of years and it’s politics becoming more fragmented and extreme. Hopefully after a poor start, the govt contains the outbreak. But what if it doesn’t and you have a full blown recession? Do the politics of it before long force Italy out of the Eurozone? What happens to its giant Target 2 deficit (tending towards €1tr), largely financed by Germany? And what might that all do to the politics in France?

What happens to Emerging Markers, which are heavily exposed to a) commodity prices, b) tourism?

Others here far better qualified to talk about US.

It’s perfectly fine to say you’re not selling Tesla for 15 years and don’t care if the mark to market fell 90% in the interim. But I suspect there are many here who have still not considered that is even a possibility.

2virgule5

Member

Sold my trading shares at $900 last week (I call that luck!) and I’ve been buying back some all this week on the way down - KarenRei style I guess. I did buy a bunch this morning aligned with lower BB per Papafox. Did not sell any so I haven’t made money yet on those but only on my trading shares last weekDid you sell at the close? Or how did you make money?

Because it helps the Market Makers? Wild swings means money for them.FTFY. So, the sky is falling in your world. What else is new? I've been through a lot of flu virus scares over the years and I don't recall any that amounted to much in terms of lasting impact on the markets. Please tell me why Coronavirus is worse.

SMAlset

Well-Known Member

I saw this Bloomberg article a few days ago in how small business are fairing in China.

Millions of Chinese Firms Face Collapse If Banks Don’t Act

Millions of Chinese Firms Face Collapse If Banks Don’t Act

StealthP3D

Well-Known Member

Exactly, it's all relative to an investor's time horizon. If you are trying to buy and time the low of any pullback then good luck. Otherwise, long term (5 years+) investors will see these pullbacks for what they are...an opportunity.

Is it really a pullback if we are higher than we were 28 days ago?

Wow, I hadn't noticed the P/E of nearly 700! That's one high flying tech stock!Google tells me that Ford has a P/E ratio twice that of NFLX. That makes it a high growth stock in my book.

Also dividend is an incredible 8.61% - what is not to like!

But seriously, the only way F can pay dividends is by selling their seed corn, for example putting up their logo as collateral for a loan. This is a death spiral if ever I've seen one. I'd buy some puts except they're probably going to rebound with the market. Made a note...

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M