With tick season on its way, you might be able to get Lyme with your Corona.Well, my employer has told us to work from home for the next two weeks, same for my husband. Kids are home as schools are closed. College kids also home as classes will be online. All of us cooped up in the house at least for next two weeks with no movie theaters, shopping malls or eating out - I am already dreading it!

Also, somehow, although it is only Sunday and we would be home anyways, am feeling extremely bored!

Local Trader Joe's had most of their food shelves picked clean - but fresh fruits and veggies were available in plenty. I guess people only stock up on TP and shelf-stable foods.

We also stocked up on our favorites to keep us sane during these difficult times - including this (how could we not)

View attachment 522236

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

gerebgraus

Member

The economic situation is indeed severe due to insane policy handling of it. Moreover, it will likely remain severe for an extended period of time with some pleasant side effect for Tesla at the next election. In terms of the virus spread that will likely go down in a month or so. It could go down faster if the policy did not optimize for the long duration. (that is called flattening the curve.)Agree that confirmed case will get worse.

Disagree that panic is at its max. There’s still a lot of people who haven’t completely recognized the severity of the situation. I see it everyday online, including on Nextdoor in my neighborhood, who are still adamant that the regular flu is worse. Thanks to a particular someone. Their follow-up argument is usually along the lines of, “Everything will get better now that we have tests readily available.” A quickly growing case and death count will slowly and slowly change the opinions of the nonchalant population. People are now only starting to shut down businesses and schools. We don’t know what the earnings or economic numbers will be in the following months. The market is only 20% off from the high as of Friday, whereas the bottom in the recession was 50% off.

We can disagree, and I honestly appreciate the difference in opinions. My opinion is that there will be no plug until an anti-viral or vaccine is federally approved, or we see ourselves getting off incidence rate curve we’re on.

I’m continuing to bet the downward for now, which has served me well so far to cushion the losses on holdings that I didn’t sell yet.

myt-e-s-l-a

Member

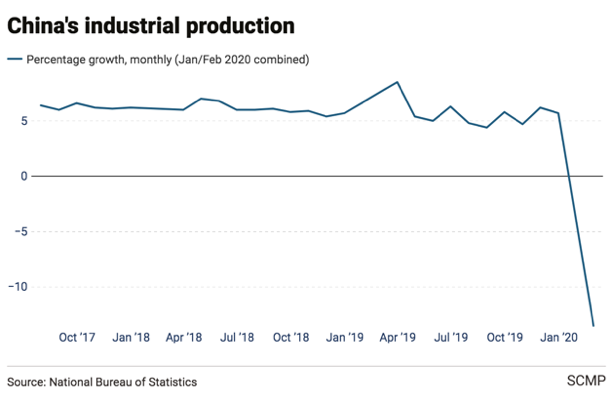

Coronavirus: China’s economy suffered dramatic collapse in warning to rest of world

- Combined data for January and February showed that industrial production, retail sales and asset investment all declined far more than analysts expected

- Lockdowns to control the coronavirus proved to be a constraint to economic growth, but with China now in recovery, data suggests what rest of the world could expect

34,200 people died in the US last year from the flu and there wasn’t one post on this board about it affecting TSLA. Where were you then? We haven’t even approached 1% of that figure with covid19.Agree that confirmed case will get worse.

Disagree that panic is at its max. There’s still a lot of people who haven’t completely recognized the severity of the situation. I see it everyday online, including on Nextdoor in my neighborhood, who are still adamant that the regular flu is worse. Thanks to a particular someone. Their follow-up argument is usually along the lines of, “Everything will get better now that we have tests readily available.” A quickly growing case and death count will slowly and slowly change the opinions of the nonchalant population. People are now only starting to shut down businesses and schools. We don’t know what the earnings or economic numbers will be in the following months. The market is only 20% off from the high as of Friday, whereas the bottom in the recession was 50% off.

We can disagree, and I honestly appreciate the difference in opinions. My opinion is that there will be no plug until an anti-viral or vaccine is federally approved, or we see ourselves getting off incidence rate curve we’re on.

I’m continuing to bet the downward for now, which has served me well so far to cushion the losses on holdings that I didn’t sell yet.

TheTalkingMule

Distributed Energy Enthusiast

61k died of flu in the US winter of 2017/18.

theschnell

Member

I’m not sure how much the market drops over the next several weeks, but I’m convinced that if we really start doing the drive through testing promised this past Friday, then we will begin to get a grip on the situation and things will slowly improve from there and the market will see that things are under control and start to recover.

Trying to time the bottom will be challenging.

I sold all my puts Friday (and the few I bought Friday expired the same day). I will probably pick up a few puts this week but not a lot. However, if they don’t start seriously ramping up the drive through testing by the end of this week, I’ll be back to loading up on puts. Reason being is that fear of the unknown is almost always worse than fear of the known. If you have to assume that everyone has Covid-19 because you know that hardly anyone can get tested, that’s far more debilitating than knowing that anyone can get tested and so the person you’re interacting with (for whatever reason) is likely not infected or else you wouldn’t be interacting with them.

Obviously testing does not completely prevent the spread of the virus. Not even close. But hopefully it identifies people earlier in their infection so they can isolate sooner and more thoroughly to reduce the spread to others, and conversely, those who test negative can get back to work and their daily lives sooner than they might otherwise.

My point being that testing provides the light at the end of the tunnel of this issue IMO, so I hope it really does get ramped up soon.

Trying to time the bottom will be challenging.

I sold all my puts Friday (and the few I bought Friday expired the same day). I will probably pick up a few puts this week but not a lot. However, if they don’t start seriously ramping up the drive through testing by the end of this week, I’ll be back to loading up on puts. Reason being is that fear of the unknown is almost always worse than fear of the known. If you have to assume that everyone has Covid-19 because you know that hardly anyone can get tested, that’s far more debilitating than knowing that anyone can get tested and so the person you’re interacting with (for whatever reason) is likely not infected or else you wouldn’t be interacting with them.

Obviously testing does not completely prevent the spread of the virus. Not even close. But hopefully it identifies people earlier in their infection so they can isolate sooner and more thoroughly to reduce the spread to others, and conversely, those who test negative can get back to work and their daily lives sooner than they might otherwise.

My point being that testing provides the light at the end of the tunnel of this issue IMO, so I hope it really does get ramped up soon.

MC3OZ

Active Member

Coronavirus: China’s economy suffered dramatic collapse in warning to rest of world

This Chart says it all

- Combined data for January and February showed that industrial production, retail sales and asset investment all declined far more than analysts expected

- Lockdowns to control the coronavirus proved to be a constraint to economic growth, but with China now in recovery, data suggests what rest of the world could expect

View attachment 522254

What the chart doesn't say is, what happens next...

We know the Coronavirus has some economic effect, we don't know how big an effect, or for how long.

For example one thing we don't know is money not spent in some areas like travel is spent in other areas like retail or simply used to improve savings or reduce debt.

Short term higher savings and reduced debt are likely, but then governments will work to stimulate the economy...

It is clear to me the best approach governments can take is active spending themselves, on health, infrastructure, loans to keep businesses afloat and direct payments to low income earners...

if governments get it badly wrong, voters get to vote for a new government... sooner or later all corrections have a bottom...

If governments get it wrong in any number of areas they can make all aspects of the problem worse, but only for a while, because sooner or later the cycle will pass, or a new government will get it right.

This chart does not give any valuable info

How much of that drop was due to the Chinese New Year?Coronavirus: China’s economy suffered dramatic collapse in warning to rest of world

This Chart says it all

- Combined data for January and February showed that industrial production, retail sales and asset investment all declined far more than analysts expected

- Lockdowns to control the coronavirus proved to be a constraint to economic growth, but with China now in recovery, data suggests what rest of the world could expect

View attachment 522254

Thekiwi

Active Member

It’s good when the morons self identify.

KSilver2000

Active Member

But hopefully it identifies people earlier in their infection so they can isolate sooner and more thoroughly to reduce the spread to others, and conversely, those who test negative can get back to work and their daily lives sooner than they might otherwise.

bolded by me

Politely, No. That is all wrong. Please don’t go telling that to people outside of TMC.

This is a test of whether you carry the SARS-COV-2 virus. It is not a vaccine for the virus. A negative test means there is a chance you might get infected tomorrow. And just because you test negative for it, does not mean you can go around as before with symptoms of the more regular cold or flu.

Fact Checking

Well-Known Member

LOL, I should read this morning's news before TMC.

Prediction: I expect the Federal Reserve to drop interest rates to 0% this week, on Wednesday - but possibly earlier. They might also announce bond liquidity measures and forms of Quantitative Easing.

That might result in a temporary rally, and will make the later rebound faster, but obviously it cannot impact the coronavirus contraction, which is a physical process.

The SEC and EU regulators might limit short selling as well this week.

But I could be wrong, not advice.

That might result in a temporary rally, and will make the later rebound faster, but obviously it cannot impact the coronavirus contraction, which is a physical process.

The SEC and EU regulators might limit short selling as well this week.

But I could be wrong, not advice.

Last edited:

Did not they already do it today (Sunday)?Prediction: I expect the Federal Reserve to drop interest rates to 0% this week, on Wednesday - but possibly earlier. They might also announce bond liquidity measures and forms of Quantitative Easing.

That might result in a temporary really, and will make the later rebound faster, but obviously it cannot impact the coronavirus contraction, which is a physical process.

The SEC and EU regulators might limit short selling as well this week.

But I could be wrong, not advice.

Yes they did. @Fact Checking hasn't caught up with the posts during his night timeDid not they already do it today (Sunday)?

Not sure if this is going to help or hurt the market tomorrow.

Federal Reserve cuts rates to zero and launches massive $700 billion quantitative easing program

Prediction: I expect the Federal Reserve to drop interest rates to 0% this week, on Wednesday - but possibly earlier. They might also announce bond liquidity measures and forms of Quantitative Easing.

That might result in a temporary really, and will make the later rebound faster, but obviously it cannot impact the coronavirus contraction, which is a physical process.

The SEC and EU regulators might limit short selling as well this week.

But I could be wrong, not advice.

This afternoon they did cut to 0% and they also re-started QE. They are all in. The futures stopped trading after a limit down almost immediately.

Singer3000

Member

Wait, are you talking about Trump or Musk?Agree that confirmed case will get worse.

Disagree that panic is at its max. There’s still a lot of people who haven’t completely recognized the severity of the situation. I see it everyday online, including on Nextdoor in my neighborhood, who are still adamant that the regular flu is worse. Thanks to a particular someone.

Fact Checking

Well-Known Member

1. while your first point(tax collection)has some merit , that is a technicality rather than the cause...money is actually debt in a fiat system...if the dollar is a IOU that people give value to, they have to have faith that the debtor(US govt) will pay it back one day, hence the masses dont cash in all the treasuries all at once..

Sorry, but this is mortally flawed goldbug logic.

You need to replace "faith" with "200 years proven track record and the economic self-interest of 300 million citizens, backed up with an army".

if they lost faith, the value of debt and dollar would tank...we have faith that the US govt won't dissolve...

If the US lost: "200 years proven track record and the economic self-interest of 300 million citizens, backed up with an army", then maybe, but not even you are arguing that, because it's obvious nonsense.

Using the opaque and ultimately meaningless word of "faith" led you to this flawed path of logic.

Btw., the following argument is flawed in the specifics as well and shows a lack of understanding of how financial systems and treasury bonds work in particular:

they have to have faith that the debtor(US govt) will pay it back one day, hence the masses dont cash in all the treasuries all at once..

That's a very naive understanding of how treasuries work. If there are more sellers of treasury bonds than buyers, and the Fed doesn't like the spiking yields, they'll step in and buy them. There's no danger whatsoever of bonds "collapsing", because the Fed has unlimited authority to acquire them - and has done so in the past.

The "masses" cannot "cash in" treasuries "one day", they have fixed maturities. They can sell them, to the Fed if there are no buyers. I.e. there's no possibility of a bank run on the Fed.

Your argument goes downhill from there I'm afraid.

Last edited:

Fact Checking

Well-Known Member

Did not they already do it today (Sunday)?

Yes they did. @Fact Checking hasn't caught up with the posts during his night time

LOL, indeed I didn't. Embarrassing.

MC3OZ

Active Member

It might sound funny but governments and central banks will have a crack at keeping the economy moving, when they try one policy and it doesn't work, political heat will ensure they try something else after that... Sooner or later they stumble on the right formula because the cumulative effect of all of these levers starts to work, or because the market reaches a natural bottom..

After we hit bottom quality rises, and low quality stays at low levels, or perhaps falls further.

Aside from the Great Depression governments and central banks have a fairly good record on intervention. not in turning things around instantly, but in making a difference eventually.

What we are seeing is a cascading cycle of panic, once the panic subsides, it is easier to see quality, what will work, and what is truly important.

After we hit bottom quality rises, and low quality stays at low levels, or perhaps falls further.

Aside from the Great Depression governments and central banks have a fairly good record on intervention. not in turning things around instantly, but in making a difference eventually.

What we are seeing is a cascading cycle of panic, once the panic subsides, it is easier to see quality, what will work, and what is truly important.

Last edited:

electrichapp

Member

LOL, I should read this morning's news before TMC.

Prediction: I expect the Federal Reserve to drop interest rates to 0% this week, on Wednesday - but possibly earlier. They might also announce bond liquidity measures and forms of Quantitative Easing.

That might result in a temporary rally, and will make the later rebound faster, but obviously it cannot impact the coronavirus contraction, which is a physical process.

The SEC and EU regulators might limit short selling as well this week.

But I could be wrong, not advice.

what is the likelihood that short selling (naked short selling specially) will be banned by US and EU for a while?

it will be interesting development if/when this happens!

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M