mars_or_bust

Member

OK, Tesla SP is hemorrhaging, but Tesla's is competition is hemorrhaging much much more actually. So when all this blows over (6-12 months probably) Tesla will be in a much better relative position than now. Long term wise, this crisis is excellent for Tesla, even though we all lost a bunch of (virtual) money (and will likely lose even more in the coming months).

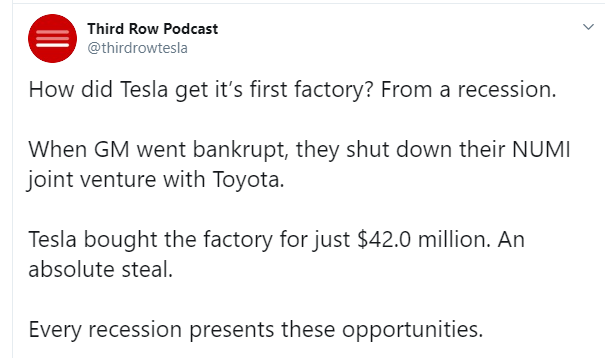

As Third Row podcast tweeted:

As Third Row podcast tweeted: