Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Can I be the party pooper and say that it's not sure if they will keep the plant open?

Be ready to things to change often, these days.

They could be forced to shut down today or tomorrow. Maybe not, but it's possible (and probable).

Be ready to things to change often, these days.

They could be forced to shut down today or tomorrow. Maybe not, but it's possible (and probable).

I’m glad you still sound cool-headed because I don’t think I’d be able to at that point. But, maybe that’s not much relative to your overall portfolio value.

I think I'm down nearly 80% of my portfolio since Feb 4th, because I'm quite leveraged. All long term options though.

I'm not worried one bit. I know my shares will 99.99% be fine long term, and I wasn't planning on selling them before 2030 anyway. Worst case, some of my options expire OTM, but they're all strike prices below $1,000, and they all expire Jun'21 - Jun'22, with the vast majority expiring in 2022, so I'm not really that worried right now.

I'm always aware of all possible outcomes when making investment decisions, so I neither get very worried nor very excited if one of those outcomes actually comes true.

Maybe that's why I haven't shorted any other manufacturers and bought TSLA with the cash. Although it's very unlikely, the worst case outcome there is the shorts wiping out my entire portfolio, which I'd be very unhappy with, so it's not worth the stress to me.

ev-enthusiast

Active Member

My impression is market participants pricing in some risk for a production stop in Fremont either by law, supply chain issues or raising cases.

mars_or_bust

Member

Really? Hard times SP-wise and it’s time to beat on Musk? This thread needs a circuit-breaker.

I don't understand how pointing out errors in Elon's publicly stated position regarding the epidemic is "beating on Musk"....

It's irrelevant. Elon is always going to Elon, he will never be the person you want him to be. If you don't understand that you aren't invested in the right company.

Everytime someone criticize *some* Elon decisions the canonical response is "Then sell your shares/don't invest in TSLA".

It's an easy but flawed response.

He can be wrong, some of us provided some arguments, we'll see in the end who's right (I really hope it's him).

But please let us have a reasoned debate about his strategy against Covid, this is not the church of Saint Elon.

bubb

Member

Be very careful with leverage in this market. I'm only holding stock without margin and decided I will not be selling a single share, but keeping a cash emergency fund in case markets face extended closure (slim chance IMO). In the short term we might see some sort of rally when the Italian infection count has a first or second derivative go positive, assuming that happens before things get ugly elsewhere. Fiscal response here is all over the map so I don't see that being worked out immediately. GLTA.

If one missed 420, there might be a chance?

Unfortunately, this aged rather well.

Many have underappreciated the power of the dark forces.

Sorry dude, but the useful information in that post is zero (or maybe not, but probably)...

They could be forced to shut down today or tomorrow. Maybe not, but it's possible (and probable).

EV Promoter

Member

If you end up as us, italians, this is basically the only reason you're allowed to get out of home, lucky you, here has been developed a smuggling business of renting dogs to pisstake my dog for a walk....

Like uncle Jack said, our generation is one of snowflakes. We can't handle facts. We can't handle not panicking. We can't handle someone like Elon Musk not mincing words around us. Panics are bad. It's in the definition. "But you can't say that while people are dying." "You've gotta be sensitive." Imagine if your doctors and nurses are also panicking. We'll all be dead by September.I don't understand how pointing out errors in Elon's publicly stated position regarding the epidemic is "beating on Musk"....

pyromatter

Member

Disagree. Elon is a pilot, as am I. Pilots are trained not to panic. Extreme but considered (or sometimes automatic) reactions are fine, but panic is not. In all these discussions, it seems to me that the people who are against Elon's statements are implicitly assuming that actions like limiting all gatherings, closing bars, etc. are panic. They aren't, they are just extreme (but thought out) measures. Re-read everything he's written but taking the literal meaning of "panic" without assuming that he means "appropriate, even if draconian, measures".Sometimes we get dumb-but-thinks-he-knows-it-all Elon making decisions as opposed to smart Elon. Tonight is one of those times we get the former and I say bad call.

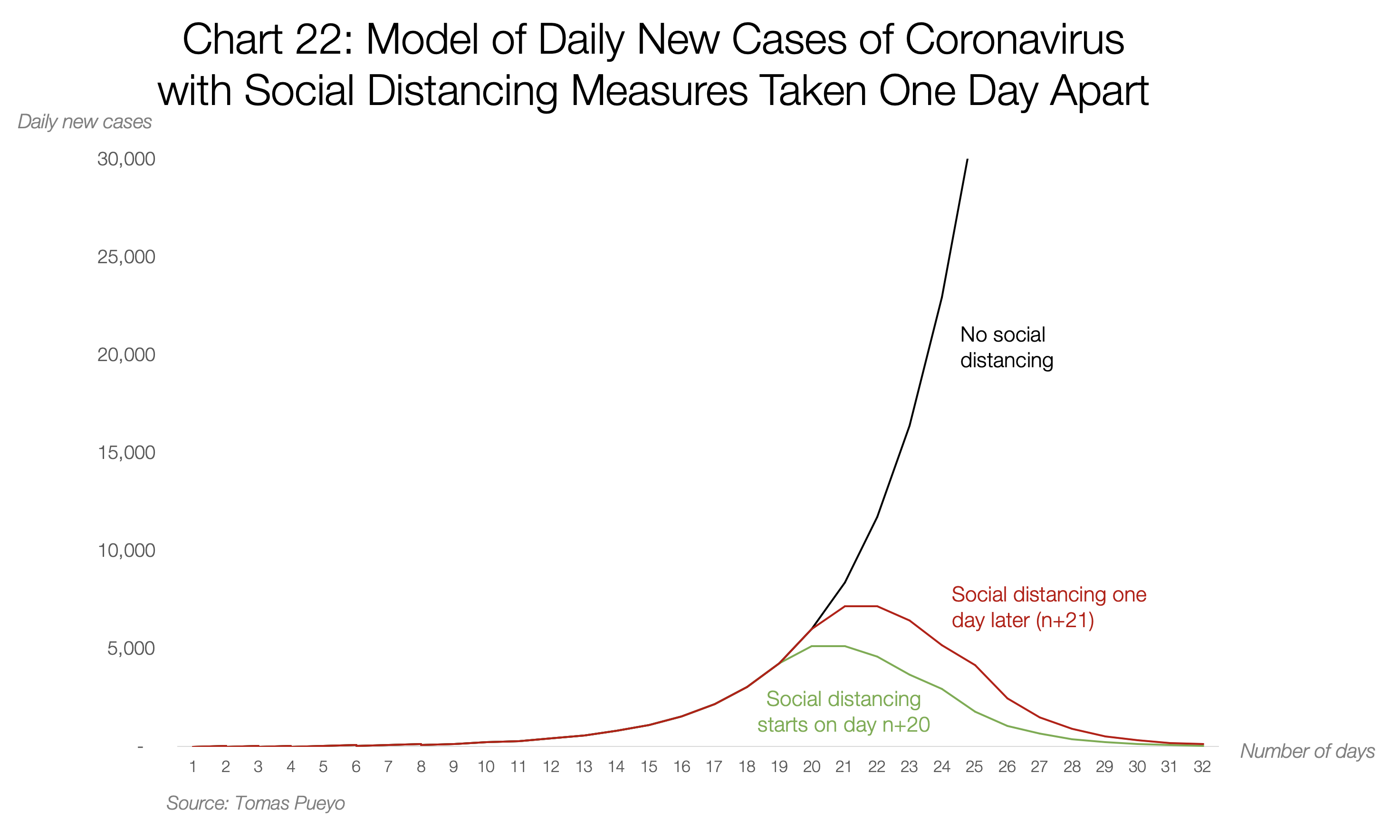

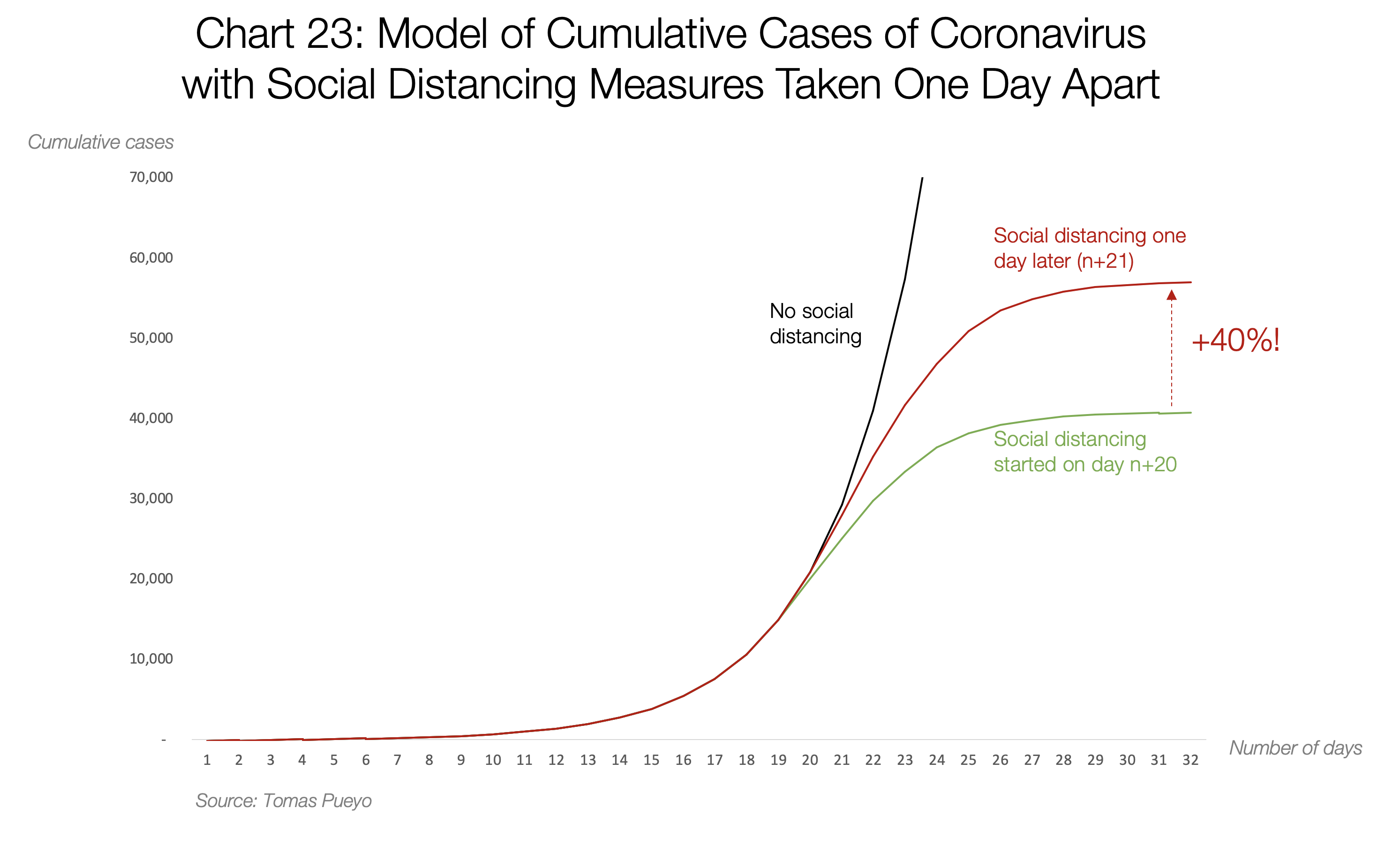

You still don't understand what we are dealing with Coronavirus right now? Things can change very quickly and days really matter. Yesterday I've posted this article in which author argues, that waiting one day with mitigation measures can increase the number of cases for 40%. This is the article: Coronavirus: Why You Must Act NowSorry dude, but the useful information in that post is zero (or maybe not, but probably)

A little zoom:

Epidemiology is a very cruel science.

And did he provide any advice contrary to the recommendation from public health officials? He sent out an email to his employees (mostly male, 20-50 years old, in reasonable good health working in a factory) stating risks of dying is lower than dying in a car crash. That is true.

The Shanghai plant was up and running for a few weeks now, in a region where Corona virus ran rampant. Shanghai was a ghost town and yet we don't see any indication of mass infection affecting the plant operation. Tesla knows what they are doing. They have the track record proving it. I honestly don't have any issue with the Fremont plant continue operation.

Yes, that message is worth spreading - the GF3 part is even backed up by a nice video,

Lars Kr. Lundin on Twitter

EVDRVN

Active Member

If Elon and the engineers had to lay low for a month or two, when they reemerged they'd have ideas and plans ready to start four new companies making god knows what revolutionary products nobody's dreamed of.

Perhaps Elon could personally call every person back that has an open CS case, he may end up learning something and forming a new company out of that. Elon, mine has been open for seven months please call. We all have considerable time on our hands.

Last edited:

I don't think we'll be at a bottom of TSLA or market in general until VIX drops significantly, about 50% or more.

S&P Dow Jones postpones quarterly rebalancing until markets settle

Thoughts on how this might ..or might not effect Tesla?

Thoughts on how this might ..or might not effect Tesla?

... and their goes the -10% curcuit breaker @ $400.56. So at least tomorrow we'll have the protection of the #SEC "Uptick Rule"... for the 5th consecutive day (and 7 of the last 8 days).

/S

Do the people who engage in naked short selling have 13 days to cover? With the amount of short selling they have done this week I wonder if the spikes we are seeing intraday are indicative of covering. Or they haven't covered yet and are we set up for another massive SP increase around the time Q1 deliveries come out?

I think we will see at least over 90K deliveries for this quarter. Guidance for Q2 will likely depend on China demand and ramp up. Dave thinks Tesla can still get to the 500K deliveries for 2020. Heck even if we guide for 450K deliveries we will go back to pre-covid19 levels in no time.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K