Bats guano do it.I think you missed the concurrent aggregated reinforced articulated localized geosynthetic H piles made of bat goop. Hmmpf

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Another nice gigaberljn video;

This is a very good parking job, I must admit.

StealthP3D

Well-Known Member

These were 5 calls I sold when the SP was $805, so I didn't get a huge premium for them, but enough to buy 4 more core shares. I chose that strike as I thought it was safe, but still gave a decent premium, but with $TSLA you never know

Dang! You weren't bullish enough to make the real money! But that's the way it goes with stock or options trading, no one gets all the profit, all the time.

I have noticed a trend regarding TSLA traders. The more bullish traders seem to make the bulk of the profits. This is how it tends to go with traders of companies that are more productive and more innovative than average. I expect this trend will continue for at least another 5 years. These are the companies that it's especially profitable to buy and hold over longer periods of time rather than having an itchy finger on the "sell" button.

I have noticed a trend regarding TSLA traders. The more bullish traders seem to make the bulk of the profits. This is how it tends to go with traders of companies that are more productive and more innovative than average. I expect this trend will continue for at least another 5 years. These are the companies that it's especially profitable to buy and hold over longer periods of time rather than having an itchy finger on the "sell" button.

Or putting it another way, being bullish is a good strategy as long as the stock is moving up.

Artful Dodger

"Neko no me"

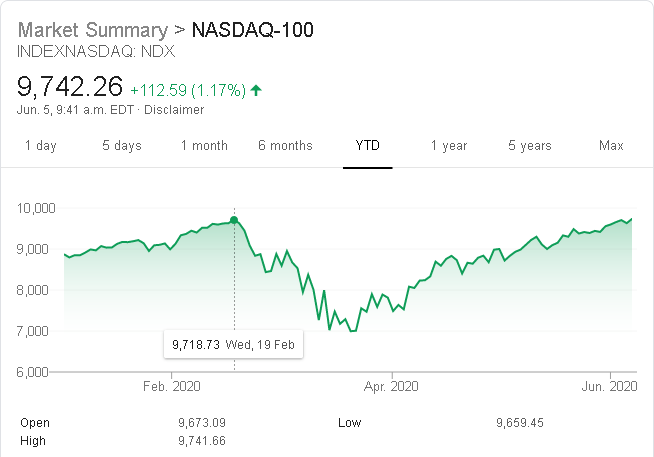

FYI, the NASDAQ-100 NDX is now (9,742.26) above the previous YTD high close (9,718.73) reached back on Wed, Feb 19, 2020:

Cheers!

Cheers!

US unemployment rate dropped to 13.3% with 2.5 million jobs added in May -- pretty big surprise (economists had predicted 19%).

U.S. regains 2.5 million jobs in May, unemployment falls to 13.3% as economy starts to recover from coronavirus

U.S. regains 2.5 million jobs in May, unemployment falls to 13.3% as economy starts to recover from coronavirus

Last edited:

StealthP3D

Well-Known Member

Or putting it another way, being bullish is a good strategy as long as the stock is moving up.

I prefer to look at it a little differently. Because stock movements are naturally chaotic. So the fact that the stock is moving up doesn't mean it will continue to move up. And these shorter-term trends matter to a trader while they shouldn't matter at all to a long-term buy/hold investor.

On the other hand, companies that are above average in terms of innovation and productivity will move up, on average, more than that of more typical companies. This might seem like an obvious and trivial observation but it is an important reason why buy/hold investors tend to outperform traders.

The trick is to pick a stock that will move up for many years to come. This is about a sound core business (financials) and innovation (road map plus progress in actualizing the road map).Or putting it another way, being bullish is a good strategy as long as the stock is moving up.

Jack6591

Active Member

Rough guess estimate on valuation.

4 Giga factories each manufacturing 500,000 Units per year, hence 2 million total.

2 million units at $4,000 net profit per unit. That implies $8 billion net profit.

Give that a 40 multiple, therefore a $320 billion mkt cap.

At present we are at about $160 billion mkt cap.

Hence a double in the stock price if all else remains the same.

The 2 million production figure is at least 2 years away.

4 Giga factories each manufacturing 500,000 Units per year, hence 2 million total.

2 million units at $4,000 net profit per unit. That implies $8 billion net profit.

Give that a 40 multiple, therefore a $320 billion mkt cap.

At present we are at about $160 billion mkt cap.

Hence a double in the stock price if all else remains the same.

The 2 million production figure is at least 2 years away.

Is Tesla's Model Y Crossover the World's Best Car?

BY Dow Jones & Company, Inc.

— 10:00 AM ET 06/05/2020

I WAS DEBATING whether to proclaim the new Tesla Model Y the best car in the world. Given that the all-electric medium-size crossover ($57,190 for the Long Range Dual Motor AWD, as tested) is the most technically advanced electric automobile made; and that electric cars are functionally superior to those powered by internal combustion; there is a certain Vulcan logic to it.....

BY Dow Jones & Company, Inc.

— 10:00 AM ET 06/05/2020

I WAS DEBATING whether to proclaim the new Tesla Model Y the best car in the world. Given that the all-electric medium-size crossover ($57,190 for the Long Range Dual Motor AWD, as tested) is the most technically advanced electric automobile made; and that electric cars are functionally superior to those powered by internal combustion; there is a certain Vulcan logic to it.....

The trick is to pick a stock that will move up for many years to come. This is about a sound core business (financials) and innovation (road map plus progress in actualizing the road map).

Yes, if you can identify those stocks consistently you can do well at investing.

US unemployment rate dropped to 13.3% with 2.5 million jobs added in May -- pretty big surprise (economists had predicted 19%).

U.S. regains 2.5 million jobs in May, unemployment falls to 13.3% as economy starts to recover from coronavirus

Can't imagine the trend if a vaccine comes along

Folks who missed rally past couple of days, missed out a lot

Paywalled link: Is Tesla’s Model Y Crossover the World’s Best Car?Is Tesla's Model Y Crossover the World's Best Car?

BY Dow Jones & Company, Inc.

— 10:00 AM ET 06/05/2020

I WAS DEBATING whether to proclaim the new Tesla Model Y the best car in the world. Given that the all-electric medium-size crossover ($57,190 for the Long Range Dual Motor AWD, as tested) is the most technically advanced electric automobile made; and that electric cars are functionally superior to those powered by internal combustion; there is a certain Vulcan logic to it.....

Can't imagine the trend if a vaccine comes along

Folks who missed rally past couple of days, missed out a lot

Honestly, these numbers completely shocked me.

Far, far better than I would have guessed in my most positive scenario.

It's being reported as the biggest one-month jobs gain ever (I haven't fact checked that): May sees biggest jobs increase ever of 2.5 million as economy starts to recover from coronavirus

Mike Smith

Active Member

Bought Jun 12 calls for a Baron Bounce on Monday.

Someone really does not want TSLA to stay over $880! Going to get out the popcorn and watch today's battle.

Yes, but after it went down it went up again some. It could be there is more than one actor in the game.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M