Crypto-ICO-level of shame already. Next thing - a professional boxer, a forgotten celebrity and a crazy ex billionaire will start hyping it on twitter.View attachment 558776

When you accidentally reveal you were paid to copy paste a post Trevor Milton wrote......

Credit:

@WholeMarsBlog

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

jkirkwood001

Active Member

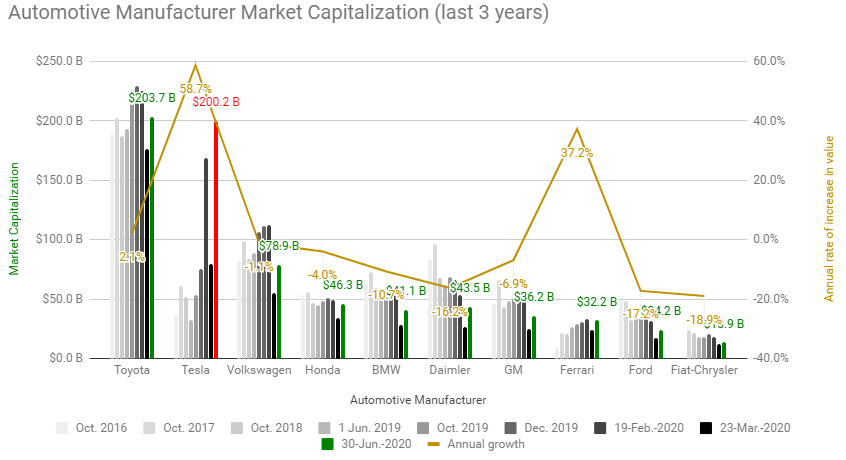

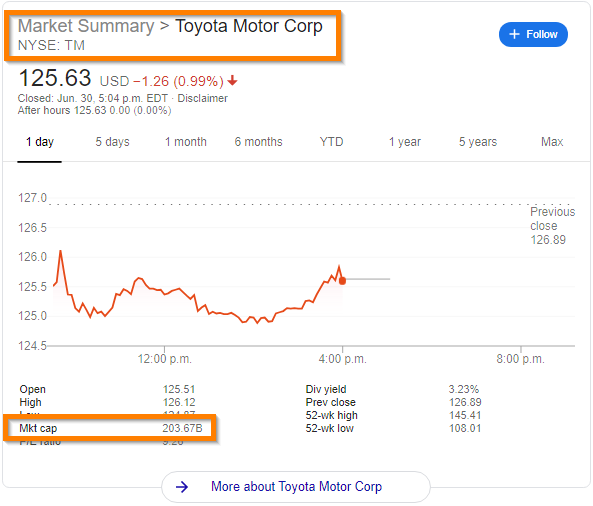

Ignoring all criticisms that Toyota's valuation in the chart below includes their treasury shares, it's wonderful to see TSLA pass $200 B. I'll take TSLA's 59% growth per year over TN's 2.1% any day.

My favourite headline today was "Tesla overtakes Exxon's market value in symbolic energy shift away from fossil fuels".

My favourite headline today was "Tesla overtakes Exxon's market value in symbolic energy shift away from fossil fuels".

StealthP3D

Well-Known Member

Seriously though there is a lot of us taking advantage of this “discounted” opportunity and I think it’s going to make a seriously surprising difference in earnings next month despite any potential record deliveries.

The uptake of FSD and store purchases will have a big enough bump above the background levels to be clearly visible to anyone looking at the day-to-day sales numbers.

Next thing you know, the SEC will be investigating this thread for coordinated stock manipulation.

Because they don't have anything better to do.

Artful Dodger

"Neko no me"

I think you're right. I haven't heard that there's any difference yet between the Production neural net running on HW2.5 vs 3.0 only that the Beta version of FSD require the extra compute power provided by HW3.Looks as if it should count because it's been delivered to the customer.

Anybody running HDW3 able to confirm this? TIA.

Hmmm. That wasn’t the first time it crossed 100B. Wasn’t that way back in January, so more than 13 Tuesdays ago.Yes, all of thirteen Tuesdays ago.

edit: Yes, I had to look that up. It really was that long ago.

Better yet no gap from Monday so no gap to have to come back and fill.

Krugerrand

Meow

I could hear you talking before I wrote that post.... but I am hearing other voices too....

The thing is my ol man's got more money than I want. His will be for if I get in trouble, otherwise it goes through my fingers untouched.

Therapy can get expensive, unless the voices are all in agreement.

More seriously. Good for you! Congratulations!

Knightshade

Well-Known Member

Looks as if it should count because it's been delivered to the customer.

I think you're right. I haven't heard that there's any difference yet between the Production neural net running on HW2.5 vs 3.0 only that the Beta version of FSD require the extra compute power provided by HW3.

Anybody running HDW3 able to confirm this? TIA.

I don't think that's quite right.

They can only recognize revenue on delivered features. It's why they recognize more deferred revenue as they release new stuff.

It's also why they moved almost all the features over to FSD, so they could recognize a lot more of the revenue going forward.

For a basic AP owner going to FSD, even with 2.5, they get a BUNCH of added features- and Tesla can recognize revenue instantly for all of them except the stoplight/stop sign one.

For an EAP owner going to FSD, still with HW2.5, they get zero additional features until after the obligation of the HW3 upgrade is completed.

“Happy to help. ETFs learn typically a week before a stock enters the index and will build a position in advance of it being added formally to cushion the impact."

And why isn’t that insider trading?

That seems illegal or at least unfair until you realize we've known for the past decade and have been building our positions since.

I was wondering the same... plus now I'm going to start looking at ETF position builds a bit more closely...

S&P inclusion is not information held, controlled, or acted on by the soon to be added company, so there is nothing company insider about the ETFs purchasing. They theoretically don't know until 3 days ahead of inclusion.

Rather, it's the market looking out for the stability of the market.

It was my understanding that the S&P reconstitution notices are made publicly, and not initially only to fund managers. But I could see that Todd's explanation did not make that clear. I put off commenting again until receiving clarification from Todd.

Todd replied, "Everyone at same time. Usually with 7 days notice."

.

Someone with the know how, can you please create a new forum topic for a poll: Tesla Micro-Activist Investor - How much in merch, accessories and upgrades did you buy to help the EOQ push?

Always worth revisiting this old favourite on a day like today and reminding ourselves of the never ending supply of useful idiots

(the share price at the time was $231)

A wealth manager dings Tesla, says there's 'absolutely no reason' to own the company's shares right now

Mark Matousek

Oct 4, 2019, 4:22 PM

According to Mark Tepper, CEO of the wealth-management firm Strategic Wealth Partners, there's "absolutely no reason" to own Tesla stock.

(the share price at the time was $231)

A wealth manager dings Tesla, says there's 'absolutely no reason' to own the company's shares right now

Mark Matousek

Oct 4, 2019, 4:22 PM

According to Mark Tepper, CEO of the wealth-management firm Strategic Wealth Partners, there's "absolutely no reason" to own Tesla stock.

ByeByeJohnny

Active Member

It wasn't specified it had to be the first time. It did do so 13 Tuesdays ago.Hmmm. That wasn’t the first time it crossed 100B. Wasn’t that way back in January, so more than 13 Tuesdays ago.

If you asked me when I had ice-cream I would say 5 minutes ago, not 2 hours ago when I also had ice-cream. Or yesterday.

So we need to determine a number that means stockowners buying extras can take credit for making the difference on profit or not. I'm saying if profits come in under $3 million it's possible.

Why can't these people realize that the Elon's pay deal is brilliant as it costs Tesla very little (in fact pays them money as he still has to buy shares, albeit at a lower amount than market) and it's the purchasers of his stock when he decides to sell it that will pay his "salary." Talk about pay for performance, it's absolutely brilliant! Tesla is only out the opportunity cost of not selling shares at market rate!

Why can't these people realize that the Elon's pay deal is brilliant as it costs Tesla very little (in fact pays them money as he still has to buy shares, albeit at a lower amount than market) and it's the purchasers of his stock when he decides to sell it that will pay his "salary." Talk about pay for performance, it's absolutely brilliant! Tesla is only out the opportunity cost of not selling shares at market rate!

There is also the issue that the shareholders voted to approve it, did we not? So why is it suddenly a big bad thing that Elon did to us shareholders? (We did it to ourselves.)

Option 1: not everyone acts in Tesla's interests.Why can't these people realize that the Elon's pay deal is brilliant as it costs Tesla very little (in fact pays them money as he still has to buy shares, albeit at a lower amount than market) and it's the purchasers of his stock when he decides to sell it that will pay his "salary." Talk about pay for performance, it's absolutely brilliant! Tesla is only out the opportunity cost of not selling shares at market rate!

Option 2: Hanlon's Razor

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M