Giga Berlin will have 8 of the huge "giga press" machines. Tesla Giga Berlin to Have 8 Giga Presses for Next-Level Manufacturing

Supposed max production of Giga Berlin will be 2 million per year. Tesla Gigafactory Berlin to produce up to 2M vehicles per year: German report

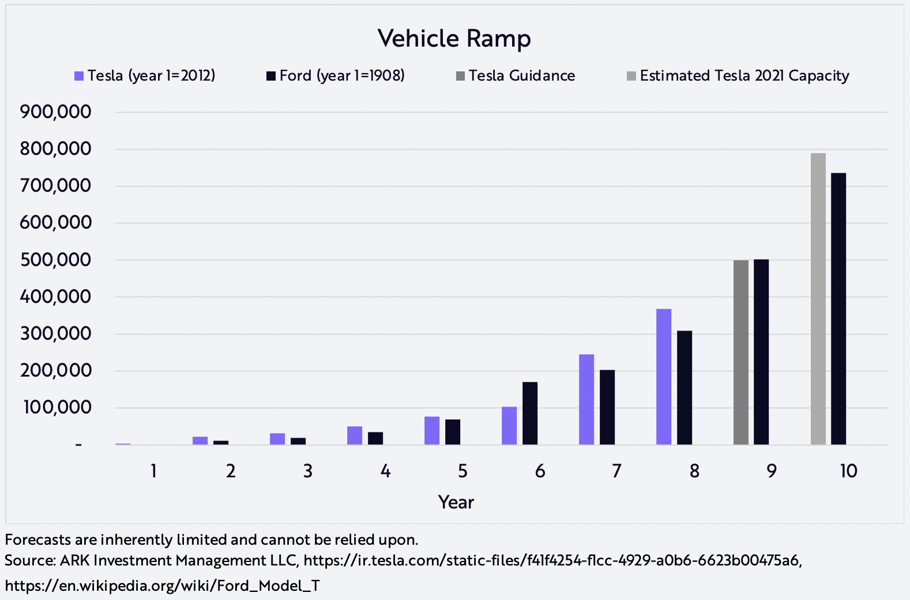

I think people are sleeping on Berlin. It's a much bigger deal than Elon and Tesla are letting on. Remember, Sandy Munro says Tesla "lies" by purposely understating things (except autopilot, of course).

I agree that Giga Berlin is a much bigger deal and underappreciated in its planned output.

The preliminary early posted water supply did ask for 750k p.a. and later 1Mio vehicles p.a.. Thats official but phase 2 and phase 3.

In the Brandenburg parliament, Tesla presented 500k p.a. (see below video) to start with the Model Y but confirmed a few times that is just the start. I expect 1 Mio p.a. over the first years and expansion beyond later. The property is large enough.