Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

RobStark

Well-Known Member

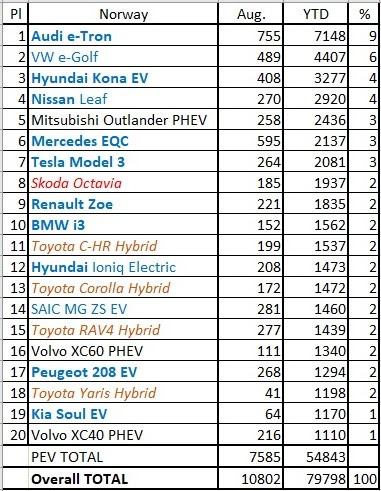

Overall TOP 20 Vehicles in Norway.

Polestar 2 landed in Norway with 494 registrations in August.

EV Sales: Norway August 2020

My interpretation is they are cancelling the lower-end model to shore up batteries for the bigger, more profitable (less money-losing) models.

But it looks like cancelling the lower-end model (E-Up) will only happen after they get rid of the 16 month backlog, which means the extra battery capacity will not become available before 2022. And not much of it either, as the cars only have small battery packs.

isnt China number in August supposed to be out by now? Its unsually quiet

Tesla sold another 11.8K vehicles in August. Just released by Chinese authorities.

Last edited:

Whats the deal with Norway? Not enough Model 3s going there?

Artful Dodger

"Neko no me"

Pre-Market Low: $375.61 (04:24:12 AM)And tech futures went green - seems from that respect that we dodged a bullet yesterday!

$418.32 * 0.9 = $376.48

Uptick rule possibly in play again later today.

MartinAustin

Active Member

I initially thought the Model Y news would have percolated to the stock. Now I recall that the stock market rarely sees this kind of good news. It often reacts to bad news though. Is there any bad news? Trying to figure out what is causing the pre-market trading. Perhaps it's going to be one of those pre-market sessions where it just winds its way back up to where it started - $390-ish - or even back up to where it stopped trading on Friday.

In any case it would seem that Q3 is going to be amazing - just as Elon has said on at least two ER calls. (still trying to figure out exactly where he said it though). Super buying opportunity right now.

In any case it would seem that Q3 is going to be amazing - just as Elon has said on at least two ER calls. (still trying to figure out exactly where he said it though). Super buying opportunity right now.

Jack6591

Active Member

>> Super buying opportunity right now.

MC3OZ

Active Member

I initially thought the Model Y news would have percolated to the stock. Now I recall that the stock market rarely sees this kind of good news. It often reacts to bad news though. Is there any bad news? Trying to figure out what is causing the pre-market trading. Perhaps it's going to be one of those pre-market sessions where it just winds its way back up to where it started - $390-ish - or even back up to where it stopped trading on Friday.

In any case it would seem that Q3 is going to be amazing - just as Elon has said on at least two ER calls. (still trying to figure out exactly where he said it though). Super buying opportunity right now.

The wave is often misrepresented as a demand issue, some are probably doing that...

QuantumScape might be viewed in some quarters as competition....

Bears and other critics often play up every little thing they can find, and usually they are wrong...

Might be shorts opening new positions, or S&P 500 speculators taking profits...

People who paid attend to Elon's trip to Berlin, know there was plenty of good news..

RobStark

Well-Known Member

But it looks like cancelling the lower-end model (E-Up) will only happen after they get rid of the 16 month backlog, which means the extra battery capacity will not become available before 2022. And not much of it either, as the cars only have small battery packs.

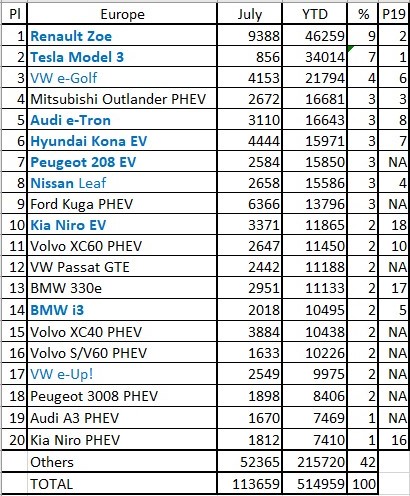

So far VW have sold 9975 e-Up!s with a 32.3 kWh battery pack.

It seems selling ~3500 more Porsche Taycans would be more profitable.

ProfTournesol

Member

so, this will be a deep red day. Looks like TSLA is heading back to the 300 range.

based upon what?so, this will be a deep red day. Looks like TSLA is heading back to the 300 range.

ProfTournesol

Member

The nasdaq is running for the exit after the softbank news, nobody wants to get stuck. TSLA will get hit hard, because of the fast rise during this same 'softbank' period. This doesn't say anything on the long term, when there is panic common sense is gone (for most).based upon what?

I'm expecting a bottom around 300 (and wishing for it), when I see it I will start adding again.

My interpretation is they are cancelling the lower-end model to shore up batteries for the bigger, more profitable (less money-losing) models.

That's my interpretation as well.

Herbert Diess confirmed in an internal meeting that they are making €5k loss per e-UP! and since the ID.3 is shortly in delivery they want to put the demand on the ID.3 series and reduce losses with the e-UP and e-Golf. The ID.3 is money-losing bussiness for now too but that's normal at start.

It's a carbon credit-related calculation and even if they would have sufficient battery supply they still would IMO close the order book.

dc_h

Active Member

I initially thought the Model Y news would have percolated to the stock. Now I recall that the stock market rarely sees this kind of good news. It often reacts to bad news though. Is there any bad news? Trying to figure out what is causing the pre-market trading. Perhaps it's going to be one of those pre-market sessions where it just winds its way back up to where it started - $390-ish - or even back up to where it stopped trading on Friday.

In any case it would seem that Q3 is going to be amazing - just as Elon has said on at least two ER calls. (still trying to figure out exactly where he said it though). Super buying opportunity right now.

The S&P issue and China sales are disappointing. China production looks good, so hopefully September sales will be big enough to deliver 40,000 for Q3 MIC 3's.

That used to be the case, but with deregulation the price varies by the minute. Of course, most people purchase a fixed plan for a certain number of years, but the actual price varies wildly so the price the consumer pays is more than it would be with battery storage eliminating the excess peaker profits. (A few people have purchased a real-time plan where they get charged the actual rate--works well until they hit one of the shortage periods and then they get a couple of thousand dollar monthly bill.Except their rates are pretty fixed (rate changes seem pretty glacial thanks to public utility commissions), so dumping an expensive peaker plant for cheap batteries would be plain ol’ profitable.

https://twitter.com/DeItaOne/status/1303276862165184515?s=20

$TSLA - ON SEPT. 4, COMPLETED SALE OF $5.0 BLN OF COMMON STOCK THROUGH "AT-THE-MARKET" OFFERING PROGRAM PREVIOUSLY DISCLOSED ON SEPT. 1

EDGAR Filing Documents for 0001564590-20-042696

$TSLA - ON SEPT. 4, COMPLETED SALE OF $5.0 BLN OF COMMON STOCK THROUGH "AT-THE-MARKET" OFFERING PROGRAM PREVIOUSLY DISCLOSED ON SEPT. 1

EDGAR Filing Documents for 0001564590-20-042696

Nuclear Fusion

Banned

No help for the S&Phttps://twitter.com/DeItaOne/status/1303276862165184515?s=20

$TSLA - ON SEPT. 4, COMPLETED SALE OF $5.0 BLN OF COMMON STOCK THROUGH "AT-THE-MARKET" OFFERING PROGRAM PREVIOUSLY DISCLOSED ON SEPT. 1

EDGAR Filing Documents for 0001564590-20-042696

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M