Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Feels like all investors are out celebrating Tesla Battery Day announcements and the inevitable consequences/demise of Ice/Oil industries. Tesla, yesterday, revealed the details of the eventual rise to the most valuable company in the world. ( See Rob Mauer podcast if my words sound too bullish) All traders are bickering regarding todays SP action and AH drop are missing the party.

Cheers!

Cheers!

Junk bond jitters may signal the start of a stock market capitulation

Key drivers of recent jitters have been a brewing fight over the next Supreme Court judge, dimming prospects for another fiscal stimulus package, the potential for a contested Presidential election after Nov. 3 and the persistence of the COVID-19 pandemic — all threatening to crack the foundation of the market’s recent gains.

...

Specifically, the biggest exchange-traded fund focused on sub-investment grade debt, the iShares $ High Yield Corporate Bond fund, HYG, -1.01%, was hit by nearly $1.06 billion of outflows on Monday, the largest single-day outflow since the start of the pandemic.

“Our sense is that further HYG weakening would be the confirming signal of real risk aversion,” said Arnim Holzer, macro and correlation defense strategist at EAB Investment Group, in a Tuesday note.

To confirm, server issues were solved after a few hours, SC's are now working again?

Supercharger worked fine but later got a message (in app and email) about billing needing attention which was true since I was not billed. When trying to resolve the need for a billing update, I got the message about the server problem and requested to try later. Trying later resulted in the same message. It is possible the access point I am using is not trusted.

I will try again tomorrow. For all I know the Superchargers are fine. Just an account access glitch related to SC billing as I see it.

Hope this is specific enough. SC charging was great.

Daily Roundup Preview: 23 September

Posts from 22 Sep 11:23 GMT to 23 Sep 23:19 GMT

Votes as of 23 Sep 23:22 GMT

Go here to see today's full Roundtable Roundup!

Top 25 Informative + Helpful

Posts from 22 Sep 11:23 GMT to 23 Sep 23:19 GMT

Votes as of 23 Sep 23:22 GMT

Go here to see today's full Roundtable Roundup!

Top 25 Informative + Helpful

| Author / Votes / Time (GMT) | Content Preview |

|---|---|

| Reductionist 44 | Link ➤ 22 Sep 23:57 | Notes from Battery day: (everything I thought was significant in one post, to avoid clutter) ### General note: The presentation was extremely information dense, which in my opinion has caused the "nothing new" sentiment that some are expressing here, because there isn't one shiny thing as a takeawa... |

| canoemore 41 | Link ➤ 22 Sep 14:11 | Electrek - Tesla slashes the price of the Powerpack by 27% on Battery Day This is interesting, I think. |

| Thekiwi 39 | Link ➤ 23 Sep 0:55 | In Asian trade, shares of Panasonic & LG Chem are falling following the Tesla announcement. People who actually pay attention to battery industry know exactly what happened today. |

| mickificki 33 | Link ➤ 23 Sep 11:34 | Goldman Sachs also raised pt to $400. Baird increases pt to $360. https://twitter.com/davidtayar5/status/1308732077152624642?s=21 also, MS said BD largely lived up to its hype https://twitter.com/davidtayar5/status/1308728581732827136?s=21 |

| lascavarian 30 | Link ➤ 22 Sep 12:55 | Looks like Tesla has signed an agreement for rare earth magnets with JL Mag FWIW. |

| JBRR 26 | Link ➤ 23 Sep 7:49 | Panasonic weighs options over Tesla new battery production TOKYO (Reuters) - Panasonic Corp 6752.T is studying options for new electric car battery production with partner Tesla TSLA.O after the U.S. carmaker unveiled a plan to expand output and halve the price of the key auto component, the Japane... |

| JBRR 25 | Link ➤ 23 Sep 8:19 | Worlds largest battery manufacturers down 5% on news that "just a car company" unveils plans to compete. |

| Reductionist 23 | Link ➤ 22 Sep 21:31 | Notes from the annual shareholder meeting (everything I thought was significant in one post, to avoid clutter) - Shanghai over 1M annual production over time - "I think the future looks very promising from an annual profitability standpoint" - Tightening supply chain major factor in achieving consi... |

| Mike Smith 22 | Link ➤ 23 Sep 9:03 | Here we have CNBC and Brian Johnson of Barclays flat out lying about Elon promising a $25,000 vehicle would be delivered within 3 years back in 2018. They're referring to a 2018 interview Elon did with Marques Brownlee, in which Marques asked Elon what it would take to create a $25,000 vehicle, and ... |

| Mike Smith 22 | Link ➤ 23 Sep 9:56 | Sandy Munro will give his reaction to Battery Day at 11am ET (8am PT) this morning: |

| kbM3 22 | Link ➤ 23 Sep 4:32 | Shirley Meng one of the top battery experts in the world 1st take. https://twitter.com/yingshirleymen1/status/1308570232433172480?s=21 |

| Mo City 21 | Link ➤ 23 Sep 11:31 | Karen chimes in. https://twitter.com/enn_nafnlaus/status/1308723500979499009?s=19 |

| JBRR 20 | Link ➤ 23 Sep 17:33 | CALIFORNIA TO BAN SALES OF NEW AUTOS WITH INTERNAL COMBUSTION ENGINES BEGINNING IN 2035 |

| lascavarian 18 | Link ➤ 22 Sep 14:36 | OMG, CNBC had Bob Nardelli (sp?) an ex auto exec speaking on battery day. Spoke glowingly of Elon but proceeded to spread false and discouraging info. So sad that Elon who is a genius, could only get EVs to 1 or 2 percent of vehicles after working so hard since 2008. Repeatedly referred to the chal... |

| NicoV 17 | Link ➤ 23 Sep 14:15 | I think Elon used the term ‘yield’ as used in the semiconductor industry: making a lot of them, but only a small number pass QA and are usable. So you typically start out with low yield (lot’s of defective/out-of-spec output), figure out what mechanism is responsible for the low yield, figure out a ... |

| willow_hiller 17 | Link ➤ 22 Sep 14:58 | Tesla planning Upgrades changes for battery day? Yesterday, I had heated rear seats, EAP, and FSD available for upgrades. This morning, they've all gone missing. Reddit users are reporting the same: Something’s coming... Cannot upgrade MY as it says I have all upgrades. : teslamotors |

| agastya 15 | Link ➤ 23 Sep 22:15 | ARK funds loaded up |

| Artful Dodger 15 | Link ➤ 23 Sep 0:06 | After-action Report: Tue, Sep 22, 2020: (Full-Day's Trading) Headline: "Bears Sell-the-Rumor, Sell-the-News" Traded: $33,959,104,348.34 ($33.96B) Volume: 79,711,192 VWAP: $426.03 Close: $424.23 / VWAP: 99.30% TSLA closed BELOW today's Avg SP Mkt Cap: TSLA / TM = $395.301B / $189.691B = 208.39% T... |

| Artful Dodger 14 | Link ➤ 23 Sep 18:33 | Uptick Rule tripped: $424.23 * 0.9 = $381.80 |

| Artful Dodger 14 | Link ➤ 22 Sep 23:45 | A SP of $381.80 anytime tomorrow triggers the uptick rule. A/Hrs session at $399.41 right now. A/hrs low was $391.51 at 19:13:53 PM 50-day M.A was $360.92 at 4 PM today. |

| Artful Dodger 14 | Link ➤ 22 Sep 16:04 | In case anyone wonders why $423.24 is so popular in today's SP, it's the Mid-BB: Channelling @SpaceCash I would say "pinned AF". Cheers! |

| Rb48888 13 | Link ➤ 23 Sep 13:05 | Gali reporting that he got to tour the new line with company execs and a group of institutional investors. Helps explain the drive to keep this in-person, and hopefully more questions answered. tl;dw The video is a long first take/reaction to the event, and I don’t think I learned anything new, e... |

| bkp_duke 13 | Link ➤ 22 Sep 22:39 | So many slides, I cannot keep up . . . |

| ZachF 12 | Link ➤ 23 Sep 11:46 | $50/KWh at the pack level with 3000+ cycles means it costs about two cents to store a KWh of electricity. Solar and wind are already printing levelized costs of ~2 cents per KWh to produce. The O&M + Fuel costs for gas and nuclear are about 2.5 cents and 3-3.5 cents for coal. This is just to run a... |

| generalenthu 11 | Link ➤ 23 Sep 18:33 | Upcoming Friday max pain is in the 405 - 410 vicinity. Sellers of ITM puts should offer a bit of support in the next day or 2. |

Reason for AH drop?

Tesla's Nevada lithium plan faces stark obstacles on path to production

Tesla could struggle to implement some of its battery advances, experts say

Of course, Reuters knows experts who know it better...

the best part is in the ‘struggle’ article, none of the experts said anything negative!

so that’s a sh!tty headline to say the least - but what would one expect from reuters?

Supercharger worked fine but later got a message (in app and email) about billing needing attention which was true since I was not billed. When trying to resolve the need for a billing update, I got the message about the server problem and requested to try later. Trying later resulted in the same message. It is possible the access point I am using is not trusted.

I will try again tomorrow. For all I know the Superchargers are fine. Just an account access glitch related to SC billing as I see it.

Hope this is specific enough. SC charging was great.

Ah that was my concern, that you'd literally be stranded or something. Sounds like that is not the case. I don't have a Tesla, clearly (someday!).

I expect market macro's to bottom in mid Oct, anywhere from 5-10% lower than they currently are. Even with declining macro's, I still think Q3 numbers will push the stock back up into 400's and by the 3rd week of October, the FOMO of S&P inclusion will restart again because everyone will know Tesla will post a profit without credits based on Q3 P/D numbers.

So I feel my window for pulling the trigger on using margin is this week. I thought the sell off would continue throughout the rest of this week, but the uptick rule was just triggered so I'm a bit worried any further sell off chances are now diminished. So decision decisions

Edit: A bummer that to get Fidelity's lowest margin rates of 4.25%, I would have to do a margin loan of 500k. Anything less and the interest rates jump to 6.5% and higher for smaller and smaller loan amounts. 500k wouldn't leverage me to the point where I would have to worry about a margin call, but still......not sure I want to be that ballsy

Edit #2: There are a couple other stocks I'd like to buy too. So not like all 500k would go into Tesla. Hmmm

If you use margin, you should look into switching to IB. Exact margin rate depends on your portfolio size, but I think my effective margin rate would be around 0.8% if I used it.

Speaking of trusted access points and SuperCharging. I have been thinking that SCs will use StarLink at some point.

Here is a link to a blog exploring the StarLink tech.

Starlink packet routing

Here is a link to a blog exploring the StarLink tech.

Starlink packet routing

I have no cushions to look under any more.

Bought another 120 today and am completely out of dry powder.....now the fools are driving the price to a point ai am thinking of selling a liver.

I wonder what a beer soaked old crusty liver goes for these days?

Bought another 120 today and am completely out of dry powder.....now the fools are driving the price to a point ai am thinking of selling a liver.

I wonder what a beer soaked old crusty liver goes for these days?

powertoold

Active Member

the best part is in the ‘struggle’ article, none of the experts said anything negative!

Tesla will struggle for sure. They've gone through hell multiple times. I hope this battery endeavor isn't another "bet the company" kind.

My friend is almost stranded cause payment is not being accepted properly so supercharging is disabled for everyone.

FYI Supercharging is currently working. My wife’s first solo mountain running trip with the new Model Y and the Dreamcase. I was just talking to her and decided it best not to say “oh love, you’re in the middle of nowhere and the car has 20 miles.....the Superchargers may be down” lol

Artful Dodger

"Neko no me"

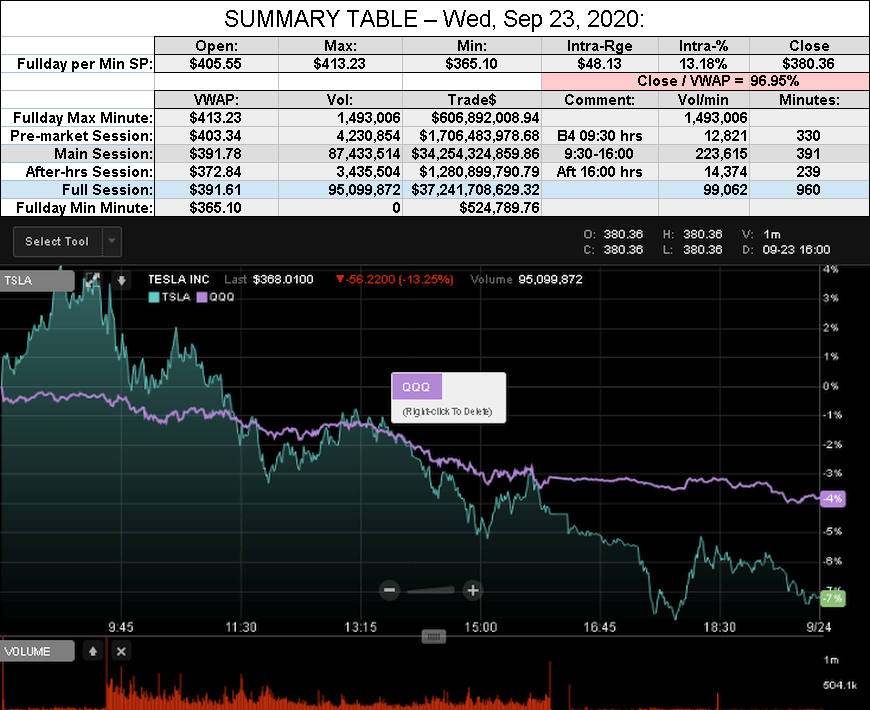

After-action Report: Wed, Sep 23, 2020: (Full-Day's Trading)

Headline: "Battery Day-Traders"

TSLA 1-mth Moving Avg Market Cap: $392.23

TSLA 6-mth Moving Avg Market Cap: $228.91

Nota Bene: 3rd tranche of CEO comp. unlocked as of Fri, Sep 04, 2020

'Short' Report:

Comment: "Bears tgt 50-day Mov Avg A/Hrs"

View all Lodger's After-Action Reports

Cheers!

Headline: "Battery Day-Traders"

Traded: $37,241,708,629.32 ($37.24B)

Volume: 95,099,872

VWAP: $391.61

Close: $380.36 / VWAP: 96.95%

(TSLA close BELOW today's Avg SP)

Mkt Cap: TSLA / TM = $354.423B / $189.426B = 187.10%

Volume: 95,099,872

VWAP: $391.61

Close: $380.36 / VWAP: 96.95%

(TSLA close BELOW today's Avg SP)

Mkt Cap: TSLA / TM = $354.423B / $189.426B = 187.10%

TSLA 1-mth Moving Avg Market Cap: $392.23

TSLA 6-mth Moving Avg Market Cap: $228.91

Nota Bene: 3rd tranche of CEO comp. unlocked as of Fri, Sep 04, 2020

'Short' Report:

FINRA Volume / Total NASDAQ Vol = 56.5% (57th Percentile rank FINRA Reporting)

FINRA Short/Total Volume = 41.2% (44th Percentile rank Shorting)

FINRA Short Exempt Volume was 1.97% of Short Volume (57th Percentile Rank)

FINRA Short/Total Volume = 41.2% (44th Percentile rank Shorting)

FINRA Short Exempt Volume was 1.97% of Short Volume (57th Percentile Rank)

Comment: "Bears tgt 50-day Mov Avg A/Hrs"

View all Lodger's After-Action Reports

Cheers!

Tesla will struggle for sure. They've gone through hell multiple times. I hope this battery endeavor isn't another "bet the company" kind.

No it is not. Don’t see how you would think that. 15B or so in the bank and profitable quarters lined up as far as the eye can see.

Besides, they would have to fail for this to be an issue. These are multiple, multifaceted improvements. They will not all fail. I do not think any of them will fail. I think Tesla will be mass producing the best batteries ever made in three years.

My experience suggests the SpCs were working fine through the computer outage. I was charging at 1030 Pacific Time; as I've free privileges no billing handshake is necessary. To me that suggests that any charging issues were indeed representative of the billing, if not the entire, entire system

Yes! The Steven Job's way to unveil a product - announcing a product only when it is ready.Indeed, in my opinion a _____ Day should not be announced until about a week prior. Related products should be available for delivery within a few weeks.

I expect that fairly soon the industry dominating benefits of the projects described today will sink into the minds of investors and Wall Street. Meanwhile, short-term traders may have begun providing a few scares that could quickly turn into gifts.

Maybe we should ask Elon what the objectives are to have an event so far ahead of the reality.

There were times when Tesla showcased a product years ahead of the delivery for specific causes - the solar roof to sell the Solar City merger; the model 3 to gauge the demands. But other events didn't benefit Tesla.

There seems no purposes other than:

1. Satisfy Elon's ego to describe cool technology and engineering.

2. Alert competitors the new technology, and which directions to move forward.

Tesla semi three year ago - helped others to sell delivery truck / van; the autonomy day FSD hardware - drove NVidia to improve its auto chip; the battery day - laid out key battery improvements for others to imitate.

asburgers

Sell order in at $8008.5

After-action Report: Wed, Sep 23, 2020: (Full-Day's Trading)

View all Lodger's After-Action Reports

Cheers!

@Artful Dodger which platform do you use for that info? You seem to aggregate it very well.

Artful Dodger

"Neko no me"

what would one expect from reuters?

Roto-Reuters: "...and away go truths down the drain"

Cheers!

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M