Tslynk67

Well-Known Member

Nice. So is this chart real-time or just a daily update?

View attachment 592174

As of close yesterday.

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

Nice. So is this chart real-time or just a daily update?

View attachment 592174

If I recall correctly that news is misleading. The solid state is an option -- not standard -- with significant caveats, such as recharge time.Other news on battery tech: Daimler unveils electric bus with 441 kWh solid-state battery pack - Electrek

Interesting, I was thinking that solid state batteries where not ready for prime time yet. Does someone know any characteristics that would make it eligible for buses/trucks but not regular cars? Wonder where the cells come from.

At the same time the eCitaro G is beginning a new chapter with innovative solid-state batteries to store energy. They will be optionally available as a second possible technology. Their huge bonus: solid-state batteries are characterised by high energy density and a particularly long service life. Chemically speaking these are lithium-polymer batteries. They are known as solid-state batteries because the usually liquid electrolyte is in solid form. Also raw materials such as cobalt, nickel and manganese are not used for this type of battery. Equipped with seven battery packs, the eCitaro G achieves a remarkable total capacity of 441 kWh and thus guarantees ranges typical of city bus operations.

As the use of solid-state batteries is extremely restricted for fast and thus intermediate charging, the battery technology covers other usage profiles than lithium-ion batteries (NMC). They, on the other hand, are ideal for fast charging whether during breaks between journeys at the depot or along the route. That is why Mercedes-Benz is pursuing a two-fold strategy and is offering the eCitaro G with both battery technologies as an option. Thus the new eCitaro G is a custom-made articulated bus which flexibly adapts itself to the various operational strategies of transport companies.

If I recall correctly that news is misleading. The solid state is an option -- not standard -- with significant caveats, such as recharge time.

The "solid-state battery" (lithium-polymer) will be 441 kWh, which means slightly more (about 10% above the NMC). There is not many details about the cells, but from the previous reports we know that Mercedes-Benz was working with Bollore’s Blue Solution.

Bollore's Lithium Metal Polymer (LMP) (see info here) uses polymer electrolyte (instead of liquid electrolyte), but to operate they required a high temperature of 60-80°C (because of poor conductivity of solid polymer at room temperature). This type of batteries was used on a small-scale in EVs (Bluecars, Bluebuses or even energy storage) for about 10 years, but we doubt those are the batteries we were all waiting for when thinking about the superior solid-state battery technology.

This keeps getting better.... My next question was going to be "What's this person's name?" Lol.One last thing to bear in mind is that there isn't just one market maker, there are a number, and they don't always agree on where Max Pain is for each of them.

This keeps getting better.... My next question was going to be "What's this person's name?" Lol.

So 1 MM person does multiple stocks or multiple MMs do TSLA and other stocks?

And they can't agree always where MP is? Isn't that strictly a math problem, or are they anticipate near future?

(FYI, I'm not fishing for manipulation here, just trying to understand MP, thanks everyone!!!)

GM, Ford, Toyota, etc:

View attachment 592185

Thank you for not dismissing my points outright with Tesla pompom fluff. I'm a committed Tesla trader and thus look at Tesla the company more so than Tesla the car manufacturer. In fact, I spend on fair amount of time on other chat sites to emphasize that Tesla is more battery manufacturer than car company, but that's a different subject. See linked European EV sales . It simply wrong to suggest Tesla is alone in the EV space because its cars are so far ahead of everyone else. That's not even true in the US where EV buy in is comparatively low.

Record EV Sales In Europe

Like Musk has said, Tesla is a group of start ups, each trying to better existing products/markets. Energy storage is likely Tesla's soon to be main source of revenue, not car manufacturing. Furthermore, Tesla's energy storage and management capabilities has leaped a few buildings ahead of anyone else, but we are still far from replacing oil, gas and coal as main sources of energy, which is Musk's overarching goal, not car manufacturing!

It's funny seeing the usual suspects complain about the CA mandate to ban new gas cars by 2035. As if anyone will be able to buy a new gas car in the US by then, or even want to.

There will be some stubborn holdouts who manage to buy them out of spite I suppose. Just like we see with LEDs vs incandescent bulbs.

Yeah, I just watched that. I think there's more to the story. GF1 is reported to have cost about $6B in CapEx to date, and is producing just 36GWh (let's say for ease of estimate).

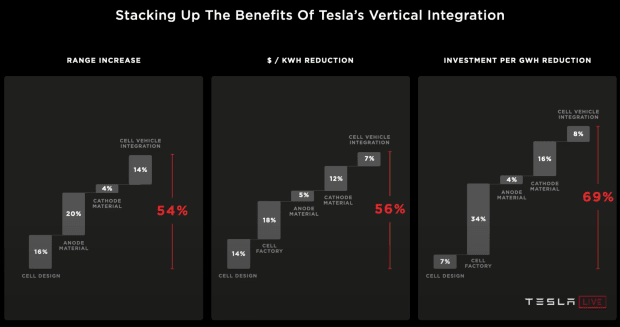

That's $167M/GWh/yr of production capacity. Ugh. Even now Pana adds just 3.5GWh/yr for $100M of CapEx, or ~$28M/GWh/yr capacity. Tesla's bty day slide stated they expect a 69% reduction in CapEx. Panasonic's latest line is already at an 83% reduction over the intial CapEx, so Tesla's slide can clearly not be referring to that comparison.

Cheers!

Model Y cars are eligible for the 2k performance upgrade now. Nice little bit of incremental revenue and profit there.

My man Chicken Genius doesn't get lots of love here. I like his channel a lot. He dips into TA a bit but is usually pretty accurate.

Also Coke sold more cans of soda then Tesla sold Model 3 cars. It is 1/10 the price of a Tesla because it has 1/20'th the battery!This GM micro car overtakes Tesla Model 3 to become the most-selling EV in China

Seems like a fair comparison

That was great!Model Y cars are eligible for the 2k performance upgrade now. Nice little bit of incremental revenue and profit there.

My man Chicken Genius doesn't get lots of love here. I like his channel a lot. He dips into TA a bit but is usually pretty accurate.

Highly recommend this.

There are some especially good insights @13:58 with Vivas Kumar who used to work at Tesla.

Now you are thinking like I have been doing so for months. And you are at the question I still have. And that is, "How much power does the MM's have? What kind of resources do they control? And that is too narrow a perspective.So the fact that SP is a bit high now against Max Pain, the MM for TSLA is selling their own stockpile of shares to bring it back to 400? But they can't do it at this moment bc buying is too strong. So MM is weak today against bigger forces? Cuz they blew it all on MMD attempts this morning, but it didn't pan out? (Speculating a relationship there.)

This is fascinating stuff, but everyone here probably knows it. Sorry if OT.

I love chicken genius. He's pure and honest. And has a good heart. And gives a worthwhile perspective of TSLA.Model Y cars are eligible for the 2k performance upgrade now. Nice little bit of incremental revenue and profit there.

My man Chicken Genius doesn't get lots of love here. I like his channel a lot. He dips into TA a bit but is usually pretty accurate.