MC3OZ

Active Member

Summary of info supporting S/X refresh and maybe more:

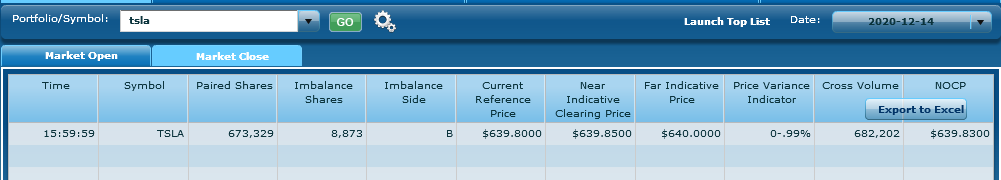

Haven't seen this posted, but it adds credence to theory of a refresh: https://twitter.com/BillWri90307793/status/1338368355271512064?s=20

- Extra week of down time on S/X line in Fremont

- Price increase in Europe

- Reddit posts today about making Lucid Air "obsolete" on launch (posted in this thread)

- Fact that many believe a refresh on these models is "overdue." Tesla is keenly aware of this

That Twitter account, Bill Wright, works for Tesla in NV. He previously posted a semi emoji on his Twitter feed the night before Elon's email about increasing focus on the semi was revealed. I believe he posts on this forum under another handle. He's a good Twitter follow.

Wild speculation: some of this points to the start of production of Roadster. 4680s may still be production capacity limited, Reddit leak talks about making Lucid Air obsolete, and Elon tweeted within the past two months (paraphrasing here and my quick Twitter search didn't turn up a link): "we really should make the Roadster at some point..."

Will be interesting to see what happens.

The Roadster might come the same time as the Plaid Model S.

It has occurred to me one of the hold ups on the Plaid Model S might be new stamping dies, and the Roadster might use some of the same dies.

I will not be surprised if the "Refresh" Model S/X only have minor changes to the external body shape, but the Plaid Model S has (in addition) a wider rear end. The prototypes we saw had that, and the Roadster has a similar shape,