Nice to hear because my copy will be arriving today.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

We are definitely in a strange pattern that reminds me of how TSLA traded from 2014-2019, where the good news kept flowing in, but the stock didn't seem to respond. Like everyone is noting, the Boring tunnels in Las Vegas are going to be a huge amount of free advertising for Tesla. A LOT of people go to Vegas from all over the country. This is on top of huge margins in China, coming EV tax credit, 900k+ production this year, factories, etc. The spring is coiling tighter. We just don't know when it is going to pop. Could be months. I'm happy to keep selling Puts and Calls in the meantime. I'm selling two week out covered calls between 800-850 strike, waiting for a pop, so that I can sell June 2022 Leaps for 1300-1500 strike. Then if the SP drops again, buy them back, switch back to weekly/monthlies, until the next pop. I'm too risk averse to throw money away buying Calls. The Covered calls I sold a few days ago already paid for the annual maintenance on my airplane.

I know, there are other YouTubers I like that have said as much. I have him in the neutral category currently but I'm open.I would plead to everyone to give Kevin a chance. He did acknowledge his thumbnails and titles are designed to trick YT algorithms for maximum visibility. I find his videos always bullish on the market and Tesla. His EQ is great and he covers a wide range of topics.

Todd Burch

14-Year Member

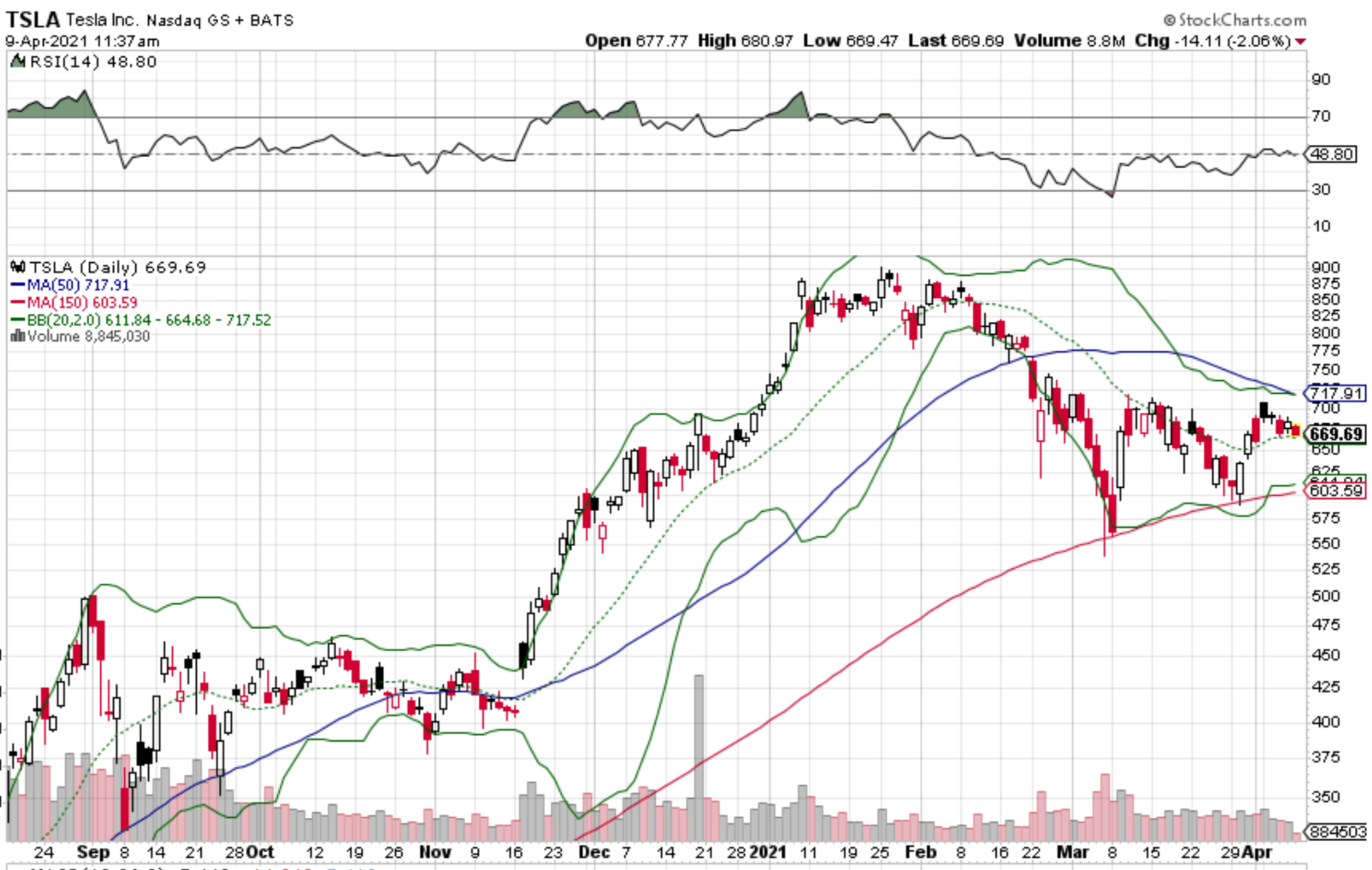

Tesla has moved almost exactly sideways over the last month.

Very similar pattern to last fall's September-November selloff and sideways trading. Let's hope we can get another catalyst to propel us upward again.

Tesla has moved almost exactly sideways over the last month.

With as high as Tesla's PE ratio is today, the stock might very well trade mostly flat for a few years again, while earnings rise to decrease the PE to more appealing levels for investors.

In time the SP is going way up for certain, but the next few years could go any number of ways really.

Todd Burch

14-Year Member

With as high as Tesla's PE ratio is today, the stock might very well trade mostly flat for a few years again, while earnings rise to decrease the PE to more appealing levels for investors.

In time the SP is going way up for certain, but the next few years could go any number of ways really.

I highly doubt it: FSD revenue for which incremental sales are nearly 100% margin will start getting recognized, along with significantly-increased revenue and profit numbers--not to mention ramping of Tesla energy/solar roof, which Elon hinted at in the Q4 call. If we trade flat then the PE ratio will go way down, which wouldn't be consistent for a high-growth company.

StarFoxisDown!

Well-Known Member

With as high as Tesla's PE ratio is today, the stock might very well trade mostly flat for a few years again, while earnings rise to decrease the PE to more appealing levels for investors.

In time the SP is going way up for certain, but the next few years could go any number of ways really.

I've seen this argument before and it's nonsense. In fact it's just below FUD to me because basics of fundamentals and metrics say you're very wrong in your assumption. Tesla's PE will drop dramatically after Q1 earnings and then rapidly shrink every quarter after. Why would you use trailing P/E when you know for a fact that P/E was severely compromised in Q1 and Q2 of 2020 because of covid? That greatly distorts what Tesla's actual P/E is. If Tesla stayed at this share price for a year and grows earnings like it has been doing, the P/E would be under 100 in the matter of a year. Using trailing P/E instead of forward P/E is likely the most rookie thing I can ever see a investor do. If it stayed at this level for 2 years, it would be much lower than Amazon's and approach Apple's level.

lafrisbee

Active Member

get it fleshed out as a stand alone app and sell it on Android and Apple...and Tesla Store when it opens.I pitched that idea, fleshed out because I’m in the tour industry, to Tesla about eight years ago. It’s a good one....but at the time they weren’t interested.

You could even have it as a base software and let certain entities create their own "tours."

For instance. The smallest example is of a huge hospital near me that I even get lost in (and I worked there for 7 years.) type in a lab or room number and follow the arrow on your phone. The largest would be to "connect" to every roadside history sign, yet give photos and video, and multiple choices for diving in.

But Tesla ought to see this as a worthwhile venture since they are software and transportation oriented.

Tes La Ferrari

Active Member

Does Tesla offer a post delivery software range unlock / upgrade on these cars post delivery the way they used to with the 60D to 75D Model S a few years ago ? ( or are these cars delivered with materially fewer cells )?For the first time, a Model 3 SR can be ordered directly on the Tesla site without having to call and make a special order. Might just be due to the Canadian government being unhappy that Tesla created a “fake” car to get the federal rebate though.

View attachment 652322

If this is legally permissible, that would deliver even more high margin revenue to Tesla in the future, result in a lower sales tax outlay for the consumer in jurisdictions where “luxury taxes” are applied based the purchase price of the car.

ie in British Columbia, Canada - the sales tax on a new or used car can range from 12-25/26%. But if you buy accessories or servicing; you would pay 12% - if it is done after the car was delivered.

Last edited:

TheTalkingMule

Distributed Energy Enthusiast

With as high as Tesla's PE ratio is today, the stock might very well trade mostly flat for a few years again, while earnings rise to decrease the PE to more appealing levels for investors.

In time the SP is going way up for certain, but the next few years could go any number of ways really.

My internal model 3 weeks ago had our 2021-2023 range at $600-1500, global economic downturn inclusive. We had no business being toward the bottom of that range 3 weeks ago, and after the implications of a blowout 1Q P&D I was more inclined to narrow that range to something like $700-1500. $700 being at the bottom of a global recession 2 years from now.

I do think the high P/E combined with the unprecedented margins calls of the last two weeks have created an unpredictable doldrum that MM's algos are leveraging. That's got to be super super super tenuous and at about the top of their naked short appetite.

In for one 4/30 $820c with my last $425.

lafrisbee

Active Member

What the hell is an "internal" model 3?My internal model 3 weeks ago had our 2021-2023 range at $600-1500, global economic downturn inclusive. We had no business being toward the bottom of that range 3 weeks ago, and after the implications of a blowout 1Q P&D I was more inclined to narrow that range to something like $700-1500. $700 being at the bottom of a global recession 2 years from now.

I do think the high P/E combined with the unprecedented margins calls of the last two weeks have created an unpredictable doldrum that MM's algos are leveraging. That's got to be super super super tenuous and at about the top of their naked short appetite.

In for one 4/30 $820c with my last $425.

lafrisbee

Active Member

$682.47 end of day. $685 is what maxpain shows, but then they don't go into the finer aspect.

tschmidty

Member

To be fair, we have heard of ramping of Solar and Energy for quite a while without any significant revenue contribution and I doubt we will with Q1 results either. FSD revenue may start getting recognized but we also have carbon tax credits that will be declining down the road.I highly doubt it: FSD revenue for which incremental sales are nearly 100% margin will start getting recognized, along with significantly-increased revenue and profit numbers--not to mention ramping of Tesla energy/solar roof, which Elon hinted at in the Q4 call. If we trade flat then the PE ratio will go way down, which wouldn't be consistent for a high-growth company.

I just think the comment @Mengy made shouldn't be dismissed. There is a pretty good argument to be made for the stock to be fairly valued at it's current price until earnings really start to lower the PE ratio. Which I absolutely believe will happen with Austin and Berlin coming online, but it isn't crazy to think Q1 earnings results will not result in a lot of stock movement. We could be at a wait and see approach until the end of the year. I don't think so and I hope not, but I will not have shocked Pikachu face if it is the case.

CreativeName

Member

Neurolink is getting better by the secondWhat the hell is an "internal" model 3?

I've seen this argument before and it's nonsense. In fact it's just below FUD to me because basics of fundamentals and metrics say you're very wrong in your assumption. Tesla's PE will drop dramatically after Q1 earnings and then rapidly shrink every quarter after. Why would you use trailing P/E when you know for a fact that P/E was severely compromised in Q1 and Q2 of 2020 because of covid? That greatly distorts what Tesla's actual P/E is. If Tesla stayed at this share price for a year and grows earnings like it has been doing, the P/E would be under 100 in the matter of a year. Using trailing P/E instead of forward P/E is likely the most rookie thing I can ever see a investor do. If it stayed at this level for 2 years, it would be much lower than Amazon's and approach Apple's level.

Woah there, hold the pitchforks!!! I didn't say I thought we would trade flat for a few years, I personally think we'll be over $1K by years end.

However, as a long term investor I must acknowledge the possibility that we could trade flat for awhile now.

In this market anything is possible, and as a responsible investor I must admit Tesla's current P/E is high for its revenues. That's not stopping me from holding long nor buying more shares, but it would be irresponsible of me to discount all possibilities for the near future and simply assume we'll be going up very soon. I never thought we'd hit $900 in January either but we did, I was wrong. My mistakes can go both directions though...

Artful Dodger

"Neko no me"

Low Pre-market volume...heading straight down...Mr market maker sending out the narrative.

TSLA Pre-Market Quotes | Nasdaq

| Consolidated Last Sale | $677.89 -5.91 (-0.86%) |

|---|---|

| Pre-Market Volume | 360,128 |

| Pre-Market High | $687.50 (06:06:55 AM) |

| Pre-Market Low | $676.66 (09:09:01 AM) |

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M