Stock went up for one day and we are getting cocky againMaybe after the next 10-1 split...

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Gigapress

Trying to be less wrong

Tesla's market cap just prior to Q3 '19 earnings was $46B, which at the time was popularly considered to be much too high.

Trailing twelve months GAAP net income is about to be around $12B.

That is a 3.8x multiple compared to the '19 market cap.

If we look just at Q3, which is more representative of where Tesla is currently performing, we're looking at about $4.07B net income which is $16.3B annualized. 2.8x multiple vs. '19 valuation.

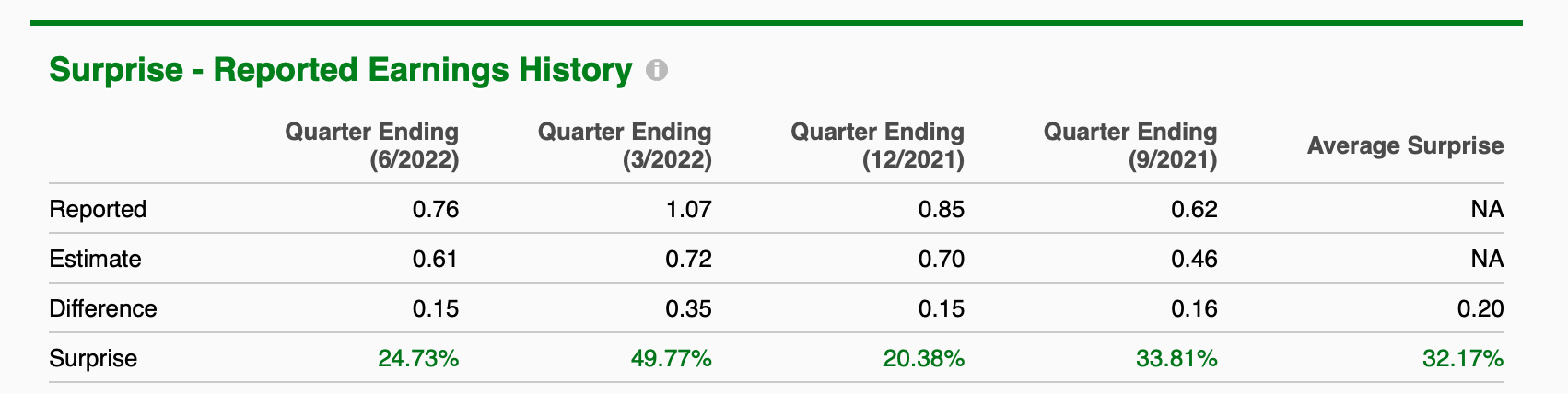

This is how clueless Wall Street and the rest of the market is with respect to predicting Tesla's earnings trajectory. It is utterly absurd that anyone still listens to them despite this track record and continued underestimation quarter after quarter. There is a term for this phenomenon: "Systematic bias" and it results from people and institutions that keep repeating the same mistakes without adjustment. I mean if you're shooting a basketball and consistently miss short three feet in front of the rim on 42 consecutive attempts, maybe you should consider throwing harder...

https://www.zacks.com/stock/quote/T...1c9ce7eb462358ebb0e977bc03b94ea1783e6ef8a1862

I don't think anyone would say a 2.8x multiple three years out is a reasonable valuation for any company, let alone one growing this fast. That's a 1/2.8 = 36% return on equity per year. Give it two or three more years and I expect they will be equally surprised by the $100B+ earnings and will act as though no one could have possibly predicted it. That would be a 7.7x multiple at today's market cap of $770B.

For this quarter I am predicting $1.29 non-GAAP EPS vs. $1.00 consensus published by Yahoo Finance. Yet another 30% beat incoming?

Trailing twelve months GAAP net income is about to be around $12B.

That is a 3.8x multiple compared to the '19 market cap.

If we look just at Q3, which is more representative of where Tesla is currently performing, we're looking at about $4.07B net income which is $16.3B annualized. 2.8x multiple vs. '19 valuation.

This is how clueless Wall Street and the rest of the market is with respect to predicting Tesla's earnings trajectory. It is utterly absurd that anyone still listens to them despite this track record and continued underestimation quarter after quarter. There is a term for this phenomenon: "Systematic bias" and it results from people and institutions that keep repeating the same mistakes without adjustment. I mean if you're shooting a basketball and consistently miss short three feet in front of the rim on 42 consecutive attempts, maybe you should consider throwing harder...

https://www.zacks.com/stock/quote/T...1c9ce7eb462358ebb0e977bc03b94ea1783e6ef8a1862

I don't think anyone would say a 2.8x multiple three years out is a reasonable valuation for any company, let alone one growing this fast. That's a 1/2.8 = 36% return on equity per year. Give it two or three more years and I expect they will be equally surprised by the $100B+ earnings and will act as though no one could have possibly predicted it. That would be a 7.7x multiple at today's market cap of $770B.

For this quarter I am predicting $1.29 non-GAAP EPS vs. $1.00 consensus published by Yahoo Finance. Yet another 30% beat incoming?

Last edited:

StealthP3D

Well-Known Member

This was already explained. Weirdly I got 2 disagrees for quoting Tesla specifically guiding 50% or better this year specifically

Here's the exact wording since those 2 people at least appear to have been ignorant of that fact, despite my being the second person to mention it, in fact I'm citing said dates/wording from the first guy who pointed it out.. Quoted dates are from the respective Tesla earnings calls on the dates given.

26 Jan 2022: "We expect ... comfortably above 50% growth in 2022"

20 Apr 2022: "50% or above growth rate remains achievable for the year"

20 Jul 2022: "We're still pushing to reach 50% growth this year"

So yes, <50% is a miss per guidance from the last 3 earnings calls

Again, a SUPER understandable one, and clearly they were dialing back certainty of the guidance while still remaining optimistic about the 50% target each quarter- but math is math- feel free to disagree with math but... the mods would prefer I not say what that makes one

Analysts are basically lazy and want Tesla to give them guidance on what to model for. Tesla doesn't play that game, at least not in the traditional sense of actually projecting a tight range that they plan on hitting. And that's where the average growth of 50%+ per year came from. Because they know not even they can guess each quarter's results with any accuracy, and they will get hammered for any "misses" of a tight range. So they keep it non-specific while still giving a general picture of what they are thinking.

Saying something is "possible" or "achievable" is different from official guidance in the traditional sense and that is not lost on analysts. Saying you are "pushing to reach 50% growth this year" makes it clear it's a hope or a goal, not a projection of what to expect. Microsoft became famous in the 1990's amongst analysts for always giving a nice tight range and then proceeding to beat it by a nice margin. They were hailed as geniuses for being able to manage analysts expectations. But they were selling software which can be replicated almost effortlessly. It's very different from automaking. And they didn't have COVID shutdowns.

I kind of like Tesla's approach of refusing to provide much more than general aspirations and making sure those aspirations accurately reflect what management is thinking.

ZachF

Active Member

China has indefinitely delayed its latest GDP report, which probably means its economy is doing far worse they want to admit.

Here's the differentiator:You are correct about that, and if that's the case here it is a heck of a deal indeed.

We'll see what Tesla says, hopefully tomorrow morning.

A car with base AP calls out Autopilot:

Details page of a car with EAP.

Details page of a car with FSD

And if you click features on an FSD car, it includes this (along with FSD computer shot, prelude to upgrade?)

Next time you read that Tesla has a demand problem, consider just two things:

1) Customer satisfaction ratings. Tesla scores the highest of any carmaker, it’s not even close.

2) Ten year old children. I’ve been driving Teslas for 10 years, and it’s still a rush every time I get a thumbs up from a kid passing by. Tesla is an aspirational car, for generations to come.

1) Customer satisfaction ratings. Tesla scores the highest of any carmaker, it’s not even close.

2) Ten year old children. I’ve been driving Teslas for 10 years, and it’s still a rush every time I get a thumbs up from a kid passing by. Tesla is an aspirational car, for generations to come.

ThisStockGood

Still cruising my Model S 70 2015

hacer

Active Member

You also have to be able to (correctly) predict future short-term stock price movements to do this. If you can do that, why do you ever need to roll?...

What Papafox recommends is to buy the later call first when the stock price is down and then sell the earlier one later when the stock price has increased. You obviously have to have available cash and/or margin to do this.

...

hacer

Active Member

Except you couldn't because it didn't go that low (so far at least). There's a chance you never will be able to buy at $200.We are all smart since we all invest in Tesla, but chicken has been smarter when it comes to stock price, market sentiment, and TA. Although it’s true that buying TSLA at $300 won’t be a mistake in a few months/year, I would still rather buy at $200 instead.

If you 'need' to roll, then yes the position has moved against you. However, there is 'need' vs 'can'.You also have to be able to (correctly) predict future short-term stock price movements to do this. If you can do that, why do you ever need to roll?

Options give you higher delta (profit or loss) for the same amount at risk (position size). Rolling is the equivalent of sell/buy on the stock side and extends the expiration date. If one has been predicting correctly, they never need to roll, but they can to their advantage. By doing so, they avoid loss of time value while continuing to have the higher delta exposure, approximating a pure-stock position valued at a multiple of the cash they have.

MadScientist23

Member

You sure "FSD capable" means it's included?

I just took delivery last night of a 2020 model Y and can confirm first hand that that means it's enabled and not just available for subscription. I haven't request FSDb yet as I want to have some fun with the speed boost first but will in the next week or two.Don't think so... if it was included it would say "FSD included." Capable means just that, you can subscribe or buy FSD, but it's not included.

IMHO that is... somebody needs to inquire of Tesla.

You know who always compliments my car? It's young drive thru workers. They spend all day serving car after car. So they naturally think about which cars they like.Next time you read that Tesla has a demand problem, consider just two things:

1) Customer satisfaction ratings. Tesla scores the highest of any carmaker, it’s not even close.

2) Ten year old children. I’ve been driving Teslas for 10 years, and it’s still a rush every time I get a thumbs up from a kid passing by. Tesla is an aspirational car, for generations to come.

I've lost count of the number of times they tell me how much they love my Tesla and they wish they could get one. It happened again yesterday. Some day, many of them will get that Tesla dream car for their very own.

Same exact experience. Also when I drop my kids off at camp in the summer, even now the young counselors all fight to be the one to come open the doors etc. It's not like I'm the only Tesla in the pickup line either.You know who always compliments my car? It's young drive thru workers. They spend all day serving car after car. So they naturally think about which cars they like.

I've lost count of the number of times they tell me how much they love my Tesla and they wish they could get one. It happened again yesterday. Some day, many of them will get that Tesla dream car for their very own.

This is what offsets all the virtue signaling nonsense I see online, at least in my own head.

Matt Porter

Member

I can imagine if I worked in a drive through I would also appreciate the clean air, and would (and did!) prefer an EV for my next car. Sitting behind other people is definitely what put me off diesels.You know who always compliments my car? It's young drive thru workers. They spend all day serving car after car. So they naturally think about which cars they like.

You know who always compliments my car? It's young drive thru workers. They spend all day serving car after car. So they naturally think about which cars they like.

I've lost count of the number of times they tell me how much they love my Tesla and they wish they could get one. It happened again yesterday. Some day, many of them will get that Tesla dream car for their very own.

Same experience with young people, they go bonkers over my Model Y.

Just last weekend we went to pick up a friend and the neighbors kids (both barely over 10 years old) literally came running to check out my car. They had tons of questions and both want their first cars to be Tesla's. It will probably be a decade or so until either of them can get one, but the enthusiasm amongst young people for Tesla is palpable and I've experienced it many times first hand since buying my Model Y.

CLK350

Member

[OT] TBH the GDP increases very much if you just dig out holes and fill them back (who's dat famous economist who said that, K something) - or dig out coal and burn it .. similar to flying off to Paris from Peking to get some Paris Duck (aka Duck Rouennaise ). Or create bombs that you use to blast cities, and then reconstruct them with more money -> increasing the GDPChina has indefinitely delayed its latest GDP report, which probably means its economy is doing far worse they want to admit.

"the economy" as in the GDP is such a vague ineffective word .. I much prefer the GNH (Gross National Happiness Index)

In light of this the Chinese actions make perfect sense. Why have people get into a panic because of some weird number gets blown off same as when it had been blown up (bogus speculative RE loans)

Green 2 days in a row so far...queue @StarFoxisDown! about the beta!

Not all companies can outperform the NASDAQ like Lucid and RivianGreen 2 days in a row so far...queue @StarFoxisDown! about the beta!

bkp_duke

Well-Known Member

Green 2 days in a row so far...queue @StarFoxisDown! about the beta!

Someone is shorting/spoofing hard this AM to keep the stock down. We will do well to end the day green if this continues.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M