Gigapress

Trying to be less wrong

...or it could not, because of ramp-up cost, not using 4680s, and using Giga Nevada, which might be sub optimized with a lot of manual labor involved. But Semis need to come out to satisfy upset corporate customers and to gain enough confidence in a certain deployment threshhold to invest in a highly automated process.

But naw, everything's automated and Tesla Bots will make that *sugar*, meaning gross margins of >60%. More likely to hear highly upvoted 2000 word posts around that lol.

I would recommend reviewing my post @bkp_duke was referring to. I calculated an estimated $80k IR Act subsidy for each Semi sold. It would be pretty pathetic if Tesla didn't make good margins. You are welcome to think factoring the subsidy in is unfair, but believe it or not, I decided to do that because it's real money Tesla will be actually receiving and I am not claiming the Semi will come out of the gate with excellent margins unsubsidized.4) The IRA credits are unfair you can't factor those into anything. Those were created to help legacy auto survive, which need a LOT of help due to their apathy/incompetence the past decade. So of course the IRA is going to print stupid money for everyone in the renewable energy industry, from Tesla to Enphase to ABML, etc.

$80k Subsidy for Tesla Semi in USA???

I'm starting to think the Tesla Semi is likely to sell exclusively (or almost so) in the United States for the foreseeable future. I underestimated the benefits of the Inflation Reduction Act with respect to the Semi on my first readthrough. It's looking like the cumulative impact could be roughly on par with Volkswagen's entire market cap.

I am not a lawyer or tax expert and this is not investment advice. Please let me know if you think I'm misinterpreting this.

From what I'm seeing, there's three credits at play here:

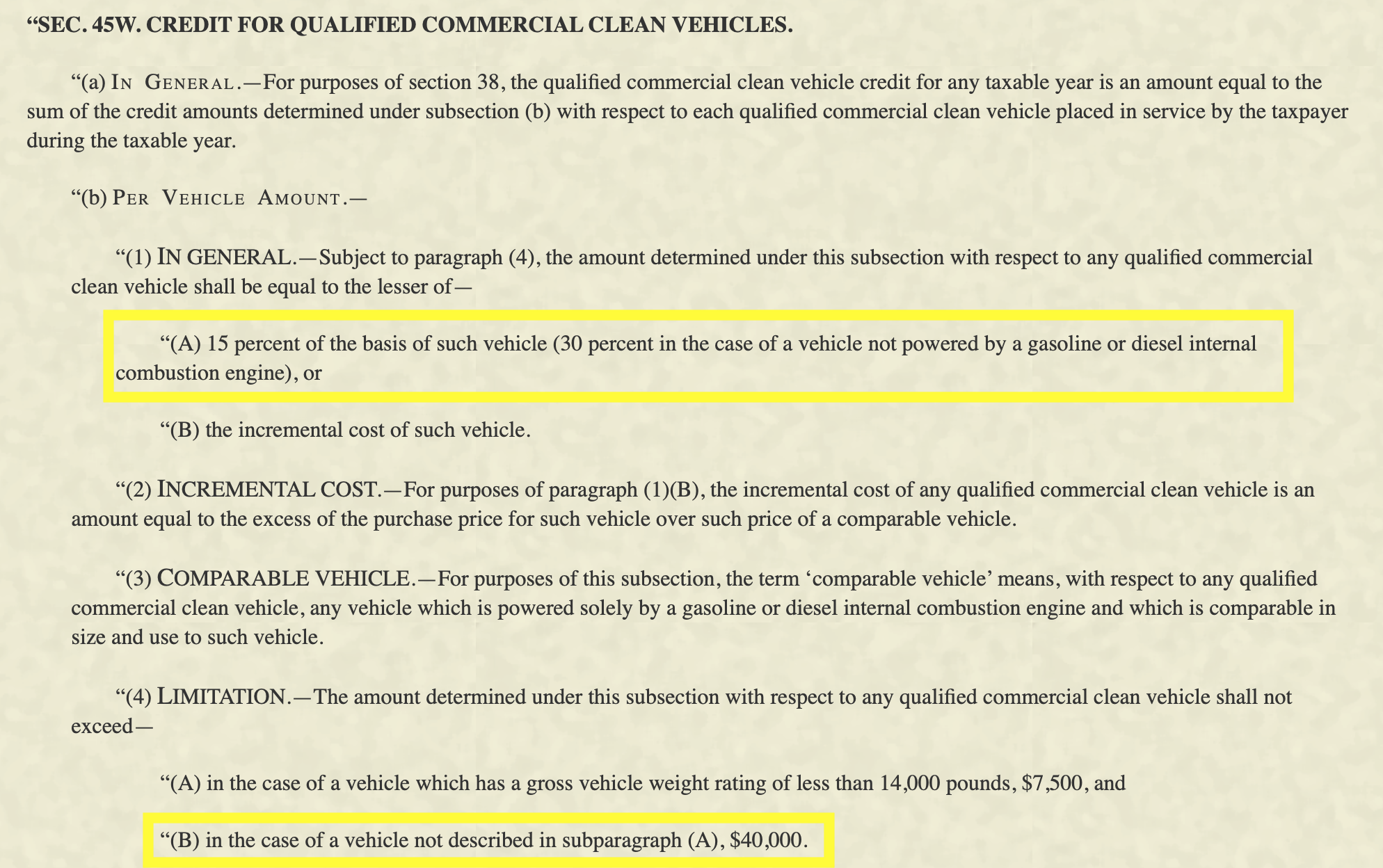

The 30% credit I had missed earlier when presenting this table a few weeks ago in this post. $180k was the 500-mile Tesla Semi list price from back when the order page used to show a price, so we would max out at the $40k limit which is 22% of the price. That's still amazing.

- $45/kWh for battery manufacturing

- 10% of value of critical minerals going into the batteries

- 30% clean commercial vehicle credit, up to $40k max

https://www.congress.gov/bill/117th-congress/house-bill/5376/text

Is the Semi a "qualified commercial clean vehicle"? It looks like it to me.

Section 30D(d)(1)(C) requires for eligibility that the vehicle shall be produced by a "qualified manufacturer" which is defined just based on reporting requirements with which I'm pretty sure Tesla is compliant:

Section 30D(d)(1)(D) requires that the vehicle "is treated as a motor vehicle for purposes of title II of the Clean Air Act".

26 U.S. Code § 30D - Clean vehicle credit

www.law.cornell.edu

This credit lasts through 2032 if the law stays in place.

One question here is whether the "incremental cost" limit will apply instead. I have no insight regarding how the IRS will interpret and enforce this rule or exactly what diesel semi truck would be considered the "comparable vehicle". Some of them cost the same as the Tesla Semi, but most cost like $100-140k from what I can find online. So there's a reasonable chance the IRS might be restrictive and the Tesla won't get most of this credit, but I think that's pretty unlikely since the Tesla isn't a specialty truck or a sleeper cab or anything like that, and it looks like those are the trucks that cost like $180k.

However, this subsidy goes to the customer buying the truck instead of directly to Tesla, but that doesn't really matter because the impact on the supply and demand equilibrium is the same either way (one of the first things I was taught in economics school). Thus, I expect much of the benefit to flow through to Tesla via pricing much higher than $180k. Since Tesla has more power in this relationship due to having the best truck on the market by a pretty big margin, I guess that probably around $30k of the subsidy will come to Tesla via higher pricing. That's fine anyway, because $180k is a freaking steal because of the savings on fuel, maintenance, inspection, insurance and longer vehicle longevity. Tesla could easily charge $250k+ and customers would still want it.

I don't have details on Tesla's material costs for high-nickel 4680s going into the Semi, but I guess it's around $50/kWh or so, meaning that the 10% government rebate is worth $5/kWh in addition to the $45/kWh for $50/kWh total. If someone knows of a good way to estimate I'd like to know. I didn't try hard on this because it's a minor impact of a couple bucks per kWh either way. Tesla hasn't said the battery size but it's rated for 500 miles and "<2 kWh/mile" so that is around 1 MWh. $50/kWh = $50k/MWh = $50k/Semi

$30k + $50k = $80k total subsidy benefit estimate.

If we hoped Tesla would start close to maybe 15% gross margin on the Semi in the next couple years with the $180k price (or maybe $200k with inflation adjustment since 2017 when price estimates originally published, then it's now going to be about 60% gross margin after adding in the subsidies.

$80k total subsidy.

60% gross margin.

$80 BILLION cumulative subsidy if Tesla can sell 1 million Semis in USA by 2032

Tesla's entire market cap was a bit less than $80 billion this time in 2019. Only about 150 companies in the world have market caps greater than this. This is the financial equivalent of Tesla acquiring Siemens for free. $80B obviously isn't a precise estimate but it's gigantic by any measure so I don't care much about the accuracy. This equates to about $20 of direct Semi subsidy impact per share of TSLA.

The subsidy will be approximately $20k less for the 300-mile range semi due to the smaller battery, but the manufacturing cost is lower in the first place and Tesla can make about 69% more of them with a finite battery supply (500/300= 1.67 plus a bit for better efficiency due to reduced weight). Any way I look at this, I like the numbers a lot.

Is it a coincidence that Tesla has announced preliminary deliveries to PepsiCo starting in December? I'm starting to think it isn't, because the credits come into effect on January 1st.

Last edited: