Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

I'm gonna take #1 off the list as Musk is predicting a China/Taiwan conflict to be inevitable and speculates that once that happens, Giga Shanghai can no longer be an export hub but only allowed to service China only. So unless that situation de-escalate, I doubt Musk will be building a new factory in China.Rumour: good chance that there is an announcement from Tesla China tomorrow, how significant and what it might be I refuse to speculate.

There are lots of suggestions in the thread and comments, but they just seem to be guesses/hopes/fears and not based on any information.

As for the price cut, it seems historically all China price cuts were announced either the 1st of the month or the last day of the month. So I will put that possibility to be low too. Historically I see Jan 3 2020, Jul 30 2021, May 1 2020, Oct 1, 2020.

Source for the Taiwan comment: Subscribe to read | Financial Times

EVDRVN

Active Member

They are packing it up and moving it to the US?Rumour: good chance that there is an announcement from Tesla China tomorrow, how significant and what it might be I refuse to speculate.

There are lots of suggestions in the thread and comments, but they just seem to be guesses/hopes/fears and not based on any information.

I made the mistake to take a look at TSLAQ again:

They used to wait for 10Q to see whether the profit is “real”(excluding credits).

Now they just need to look at the slides to conclude the book is all cooked.

“Such a fraud you don’t need your last name to be Burry to figure out.”

They used to wait for 10Q to see whether the profit is “real”(excluding credits).

Now they just need to look at the slides to conclude the book is all cooked.

“Such a fraud you don’t need your last name to be Burry to figure out.”

What a bunch of toxic fools.I made the mistake to take a look at TSLAQ again:

They used to wait for 10Q to see whether the profit is “real”(excluding credits).

Now they just need to look at the slides to conclude the book is all cooked.

“Such a fraud you don’t need your last name to be Burry to figure out.”

It was hilarious when someone said to Gordon to back out SBC as high SBC from Elon's compensation package skewed SG&A in 2020/2021 he was using as a comparison. He instead went on this rant about SBC should never be backed out because it's part of Sg&A...uhhh okay. You know I am really considering quitting my day job and become a wall street analyst who gets paid big bucks for being stupid.I made the mistake to take a look at TSLAQ again:

They used to wait for 10Q to see whether the profit is “real”(excluding credits).

Now they just need to look at the slides to conclude the book is all cooked.

“Such a fraud you don’t need your last name to be Burry to figure out.”

Can’t figure out how Tesla is paying for new factories if they haven’t issued new stock or Bonds and the books are cooked…..I made the mistake to take a look at TSLAQ again:

They used to wait for 10Q to see whether the profit is “real”(excluding credits).

Now they just need to look at the slides to conclude the book is all cooked.

“Such a fraud you don’t need your last name to be Burry to figure out.”

FSDtester#1

Craves Electrolytes

They are using all the funds they made $$$$ on using Gordo's recommendations.Can’t figure out how Tesla is paying for new factories if they haven’t issued new stock or Bonds and the books are cooked…..

Geez, that's a no brainer...

Maybe it's just me, but I don't even get the joke. "Overhang" is not the same as "hangover". Can someone explain it to me?

Either way, seems like Gary is following Munro's career progression.

White collar professional

Also interesting they always mock Longs for “losing” 50% since ATH, but never boast how much they made shorting 2022.What a bunch of toxic fools.

Oh right, most longs are still up 10x, even at this level. But they lost all their fund 2 years ago and have no skin in the game anymore, haha the irony.

MC3OZ

Active Member

James was able to easily debunk their claims:-I made the mistake to take a look at TSLAQ again:

They used to wait for 10Q to see whether the profit is “real”(excluding credits).

Now they just need to look at the slides to conclude the book is all cooked.

“Such a fraud you don’t need your last name to be Burry to figure out.”

All good

new model me thinks.Rumour: good chance that there is an announcement from Tesla China tomorrow, how significant and what it might be I refuse to speculate.

There are lots of suggestions in the thread and comments, but they just seem to be guesses/hopes/fears and not based on any information.

Artful Dodger

"Neko no me"

Sure they can. At 650KWh per Semi, that's about 32.5 GWh/yr of 2170s. Did you not notice that Tesla recently began construction of a new section of the building at Giga Nevada? Further, Tesla is moving all powerwall and powerpack production to Lathrop, CA which will free up futher production space in the existing factory sections.Tesla can not produce 50,000 semis a year in 2024 without ramping 4680. They need those cells to either go into semis or free up 2170s.

How does Tesla intends to use multiple ?? gigawatt-hours per year of additional 2710s? Notice that the goal of 50K Semi is for 2024. That's ample time for Panasonic to ramp 2170 production at Giga Nevada.There’s no other source of 50gwh in high energy cells a year. Even if you assume a even split between 300 and 500 miles semis they still need about 38gwh

However, 32.5 GWh of 2170s is enough for 400K LR Models 3/Y. Do you see any possible path for Fremont to increase production by that much (that's a doublling)? Or do you think Tesla would ship those cells to Giga Texas (where again, high volume Semi production may be located).

Either way, Semi is getting 2170s from the start of production, and its clear that there are plans to ramp 2170 cell production to sufficient volume to allow 50K/yr Semi production by 2024.

Gigapress

Trying to be less wrong

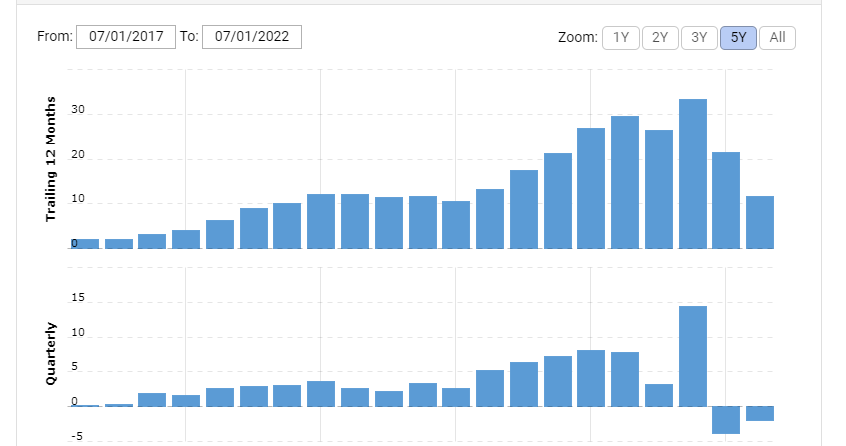

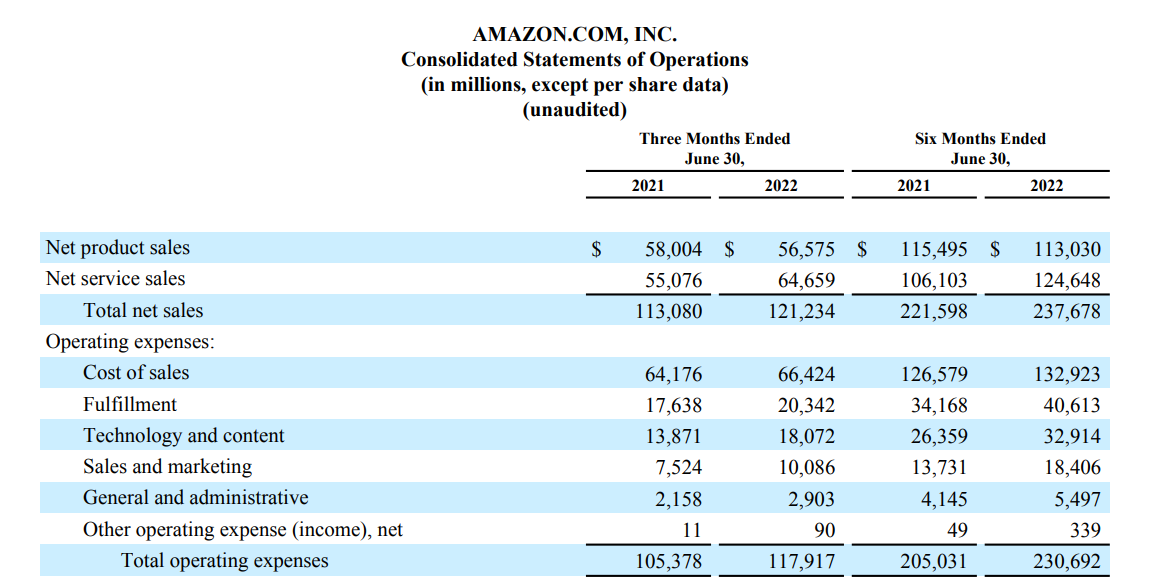

Amazon's having a rough time lately. Trailing twelve month net income is $11.6 billion and the last two quarters have actually had negative income.

In the words of Amazon CFO Brian Olsavsky on the Q2 2022 earnings call, Amazon is getting walloped by uncontrolled cost increases combined with a slowdown in retail sales.

Order fulfillment in particular is costing about $3B extra per quarter compared to last year, despite product sales revenue being slightly down year over year.

Amazon's total revenue including AWS as well as retail grew merely 7.2% year over year. It does not help that their business is cyclical and is currently in the midst of a downswing, but that's still pretty slow growth for a company currently sporting a 100ish P/E ratio. Even if we assume the cost pressures are temporary and instead calculate the P/E ratio based on 2021's $33B net income, the P/E ratio is still 36. Amazon is priced for moderately high earnings growth.

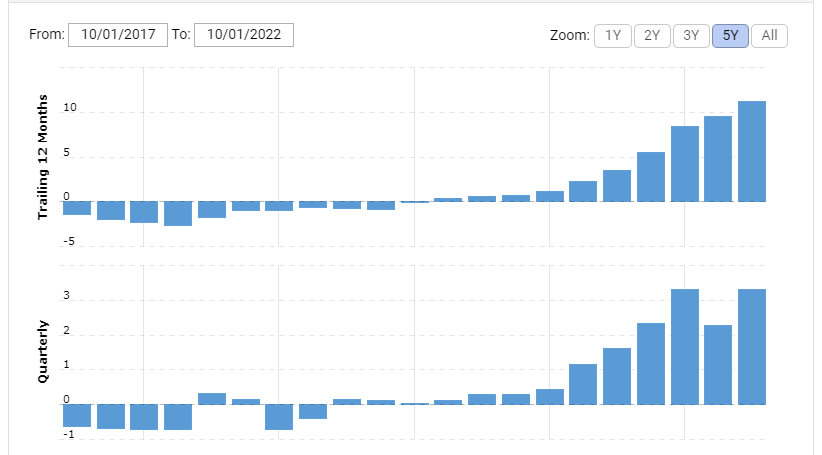

Tesla's TTM net income is $11.2 billion, almost as high as Amazon's $11.6B, but for Tesla the trend is very different.

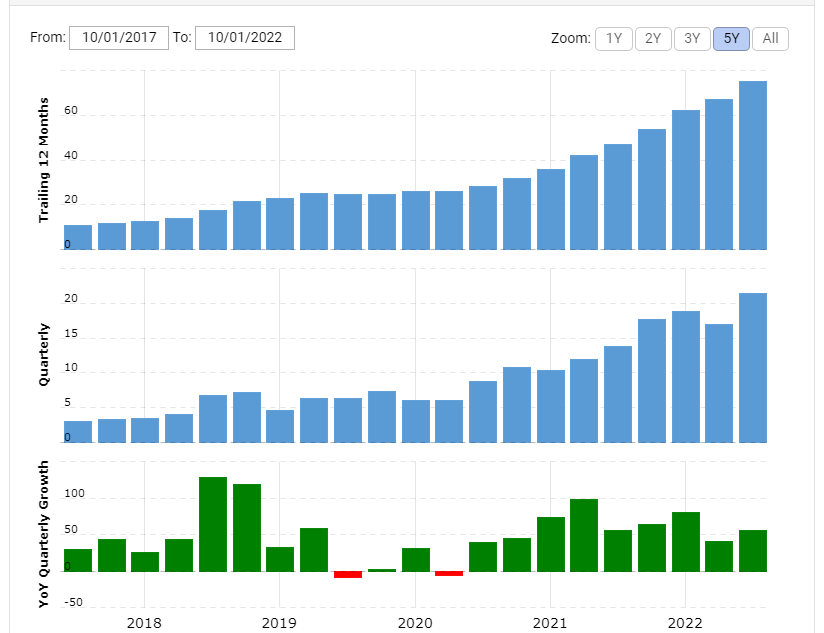

Tesla's revenue has been exploding upwards at more than 50% compound annual growth rate for years, and next year looks likely to see closer to 100% YoY growth while costs are looking to improve substantially, and there is ample reason to expect substantial improvements in gross margin for automotive, solar, and stationary storage, as we've discussed ad nauseam.

(All charts sourced from macrotrends.com)

Amazon market cap: $1.21T

Tesla market cap: $0.74T

Difference: 64%

Hypothetical TSLA price if $1.2T mkt cap: $346

In the words of Amazon CFO Brian Olsavsky on the Q2 2022 earnings call, Amazon is getting walloped by uncontrolled cost increases combined with a slowdown in retail sales.

Last quarter, I discussed several cost pressures facing our worldwide stores business, inflationary costs, fulfillment network productivity, and fixed cost deleverage. Recall that these amounted to approximately $6 billion of incremental costs in Q1 when compared to Q1 2021.

Order fulfillment in particular is costing about $3B extra per quarter compared to last year, despite product sales revenue being slightly down year over year.

Amazon's total revenue including AWS as well as retail grew merely 7.2% year over year. It does not help that their business is cyclical and is currently in the midst of a downswing, but that's still pretty slow growth for a company currently sporting a 100ish P/E ratio. Even if we assume the cost pressures are temporary and instead calculate the P/E ratio based on 2021's $33B net income, the P/E ratio is still 36. Amazon is priced for moderately high earnings growth.

Tesla's TTM net income is $11.2 billion, almost as high as Amazon's $11.6B, but for Tesla the trend is very different.

Tesla's revenue has been exploding upwards at more than 50% compound annual growth rate for years, and next year looks likely to see closer to 100% YoY growth while costs are looking to improve substantially, and there is ample reason to expect substantial improvements in gross margin for automotive, solar, and stationary storage, as we've discussed ad nauseam.

(All charts sourced from macrotrends.com)

Amazon market cap: $1.21T

Tesla market cap: $0.74T

Difference: 64%

Hypothetical TSLA price if $1.2T mkt cap: $346

RobDickinson

Active Member

Price cuts.All good

new model me thinks.

JusRelax

Active Member

What were the prices previously?

EDIT: Nvm, answered my own question (about 5% cut for base MY, about 4% cut for base M3) -

Last edited:

RobDickinson

Active Member

Our (nz) base model Y price post subsidy excluding sales tax is about $35k usd..

TSLA Pilot

Active Member

Just for full disclosure, I believe the NZ base Model Y would be a rear wheel drive model, with a smaller battery? If so, it's not really an apple-to-apples comparison.Our (nz) base model Y price post subsidy excluding sales tax is about $35k usd..

That said, since we're at around $65k for a "base" Model Y, that $30k is a huge difference . . . .

MC3OZ

Active Member

The base NZ model would be rear wheel drive with an LFP battery.Just for full disclosure, I believe the NZ base Model Y would be a rear wheel drive model, with a smaller battery? If so, it's not really an apple-to-apples comparison.

That said, since we're at around $65k for a "base" Model Y, that $30k is a huge difference . . . .

One difference might be import duties on LFP batteries from China.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K