I make my living off the market and, even before I retired over 20 years ago, I made more money from the market than my earnings from working for around a decade before that. I don't blame the market for being disconnected from reality, I credit it for that. Because if the market reflected reality, I would have no particular advantage, I could only achieve market average returns and I would not have been able to retire early so easily. But the market's irrational focus on the short-term, and it's strong tendency to be affected by fake narratives driven by interests that are threatened by disrupters, turns the market into a reliable money-printing machine. All that's required is an ability to spot the fake narratives, some investment capital, and some time.

The financial press will always minimize the chances of success of the disruptors, in favor of the incumbents. For example, in the early 1990's Microsoft was recognized as a strong growth company with ever increasing revenues, and yet IBM was continually expected to take back their rightful throne from the scrappy upstart. Therefore, MSFT was "over-valued" (when, in fact, it's share price did not properly account for the size of expected future revenues or the degree of certainty those revenues had).

Other examples include Qualcomm in the mid-1990's (with a superior new, more efficient, method of encoding cellular data), and Apple (with a sleeker and more versatile form factor for a smart phone). The financial press said Motorola and Nokia, not Qualcomm, had the superior cellular technology (now all wireless uses Qualcomm's spread spectrum technology) and that Apple's device was novel but too expensive, had no physical buttons, and no one needed a computer in their pocket anyway. To profit from these disconnects from reality, one did not need to be early, they simply needed to see the disconnect between reality and the media stories that protected and championed the entrenched interests. This is exactly what is still going on today with Tesla. Even the Federal Government is in on it, trying to help out the entrenched interests at the expense of Tesla. EV subsidies had a place in the twenty-teens, no longer in the twenty-twenties.

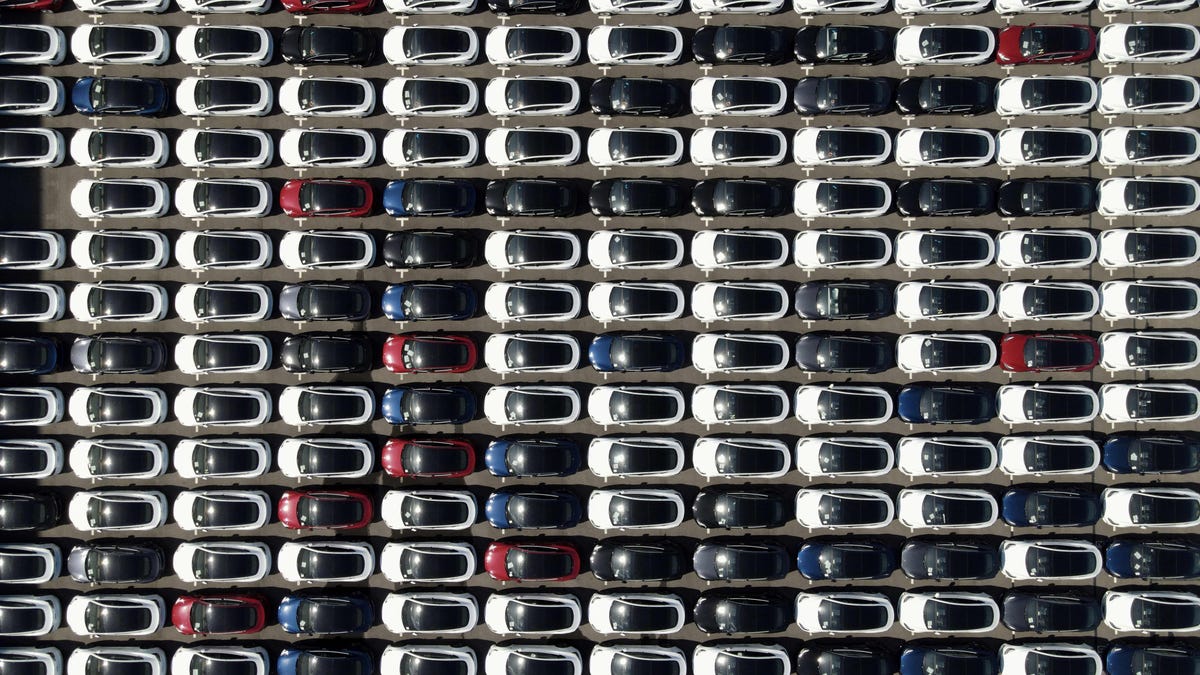

This is why the press cannot drop their narrative that "the competition is coming" while simultaneously chiding Tesla for always being late. Anyone with their eye's half-open can see it's the competition that's late, not Tesla. There was supposed to be a steady stream of superior, high-volume EV's displacing Tesla by 2019 and 2020, but they never arrived. Instead, it was Tesla that continually increased production beyond that of the incumbents. This was 100% foreseeable, it was not a lucky guess. The competition will continue to show up with too little, too late. They cannot show up with high volume production until they figure out how to make EV's for less. Sure, eventually there will be meaningful competition but it's still a long way off and it will not be the incumbents who figure it out, it will be new disruptors. The incumbents only chance is massive Government life support.

People who trust and listen to the financial press and the MSM, deserve exactly what they have coming to them. Because the financial press/MSM is not owned by the disruptors but is beholden to both Wall Street and, even more importantly in the long-term, businesses that will become disrupted, the incumbents. Once that is understood, the media no longer holds a spell over you and the distorted reality they propagate, once identified, can be used to easily print large sums of money over time. The key ingredient to make this stream of profits reliable, is time. Those who view the market as a short-term casino will have results all over the board, with some losing everything, while others make out like a bandit. Others will break even with great relief. Luck plays a large roll so it's unwise to commit large sums to the casino, it's much better to play the long game which makes it possible for the odds to be strongly in your favor over a lifetime. Because luck can run out while disconnects from reality always trend back toward reality. One is reliable, one is not.

Who wins the race, the tortoise or the hare? Consistency is key, compounding returns over time wins the game.

No one knows when the markets will be riding high again but it's likely quite some time, many years, until the next market peak and not too terribly far from the market bottom. Those who invest in TSLA now, or are already invested, will have outsized returns over the next 5 years (and likely far beyond). Those who are taken in by the MSM's fear, uncertainty and doubt cannot properly assign risk/reward. Because fear. People imagine fear and let it grow into a monster they cannot escape from. By the time they tame the fear they will be paying $260 for a stock they could have had for $180-$190. There will be many right here that keep buying between $300-$600/share, because then the fear will be gone. That's not how you maximize returns.