Yeah, still cheaper than a 30 year mortgage though...OT: Unfortunately, interest rates have increased considerably in recent months.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

larmor

Active Member

This is huge bull flag: single man risk eliminated. Teams continue to produce results without Elon’s hand holding or managing.

ZeApelido

Active Member

Wifey, is that you??

That reminds me, when I told my wife how much money we've lost in the last year, she responded with "well if you can spend that much money, I'm going to spend that much money too."

Someone save me...

Raisin45567

Member

No. I’m sorry. But this is called justification after the fact. I invested in a company headed up by Elon Musk.This is huge bull flag: single man risk eliminated. Teams continue to produce results without Elon’s hand holding or managing.

I tell my wife my TSLA holding is like a piece of real estates. I'm collecting rent on it every week via selling CC's. That's all fine and dandy except now the kitchen and half the roof are gone.That reminds me, when I told my wife how much money we've lost in the last year, she responded with "well if you can spend that much money, I'm going to spend that much money too."

Someone save me...

insaneoctane

Well-Known Member

The only thing you're missing is the SP build up to such an event...I've been away from this thread for a few days. But I just had this thought to share.

Is the 4th quarter going to be "Epic" like Elon said?

Let's see. Production is way-way up. Price cuts have been rather puny and mostly limited to "in stock" vehicles. It's possible that ASP could be even higher than Q3. "Epic" might be an understatement.

What am I missing here?

Thekiwi

Active Member

It would appear Elon is aware of the situation.

Is this the first time Elon has called out specifics for what are current headwinds in Q4? He is talking about MACRO conditions to be clear.

Now that he owns Twitter, Elon is likely far more aware of Macro economy given the vast bulk of twitter’s revenue is from advertising - spending on which closely follows economic activity.

Gigapress

Trying to be less wrong

Except that demand fell off a cliff last Friday and Tesla is getting a trickle of orders now. Giga Shanghai will be cutting back to a three-day weekly schedule with all Wednesday-made cars being donated to the dolphins in the East China Sea. I've reduced my Q4 global delivery estimates to 420k with a 69k QoQ increase in inventory.So we have the Nov production number now - 88,564.

If you do some back of the napkin math with what wholesale for Nov was + ballpark of what inventory was going into Q4......yeah Tesla doesn't have a big amount of inventory in China right now. Situation not nearly as dire as it's being portrayed.

That will be $8; please pay on my Patreon page.

Thanks!Welcome back... here is the 3 day summary.

Constant FUD (as expected)

@Gigapress has had to check some people (as expected)

TSLA moving in a direction not consistent with their fundamentals (as expected)

OT discussion that the mods had to smack down (as expected)

The Technoking was declared to give CEO status of Tesla to Tom the boss at MIC

and this news was delivered by the company Tesla just won a lawsuit against for them lying (not surprising but not expected)

MIC had their best October and November in history (happily expected) All the talented, wise, and astute followers in this forum decided TSLA is still the best risk adjusted opportunity for long term investors in the market (as expected)

Oh, and to HODL ... (as expected)

There you go, saved you 500 posts!

The only one of those that shocked me was that an OT discussion was smacked down by the mods. You guys really should behave better when I'm not around.

People have no idea what Tesla's performance is for Q4 and the numbers coming out of China/EU are all record breaking. So he is referring to why stocks are down and not headwinds specifically to Tesla. If this tweet was after Q4 P&D then it's more relevant to Tesla.Is this the first time Elon has called out specifics for what are current headwinds in Q4? He is talking about MACRO conditions to be clear.

Remember he tweeted that Tesla is well positioned for major headwinds next year.

zach_

Member

I get what you're trying to say, but I think it's misplaced. At this point in almost every important way the entire company is a reflection of him and his ideas, philosophies, motivations etc. If he were to depart today, yes I suspect the outcome many many years into the future might trend differently, but as far as we can reasonably forecast, the company is fine. His influence will live on long after his tenure.No. I’m sorry. But this is called justification after the fact. I invested in a company headed up by Elon Musk.

Drumheller

Active Member

After TSLA rises above $400 again, ask your wife how she is going to make that much money to match.That reminds me, when I told my wife how much money we've lost in the last year, she responded with "well if you can spend that much money, I'm going to spend that much money too."

Someone save me...

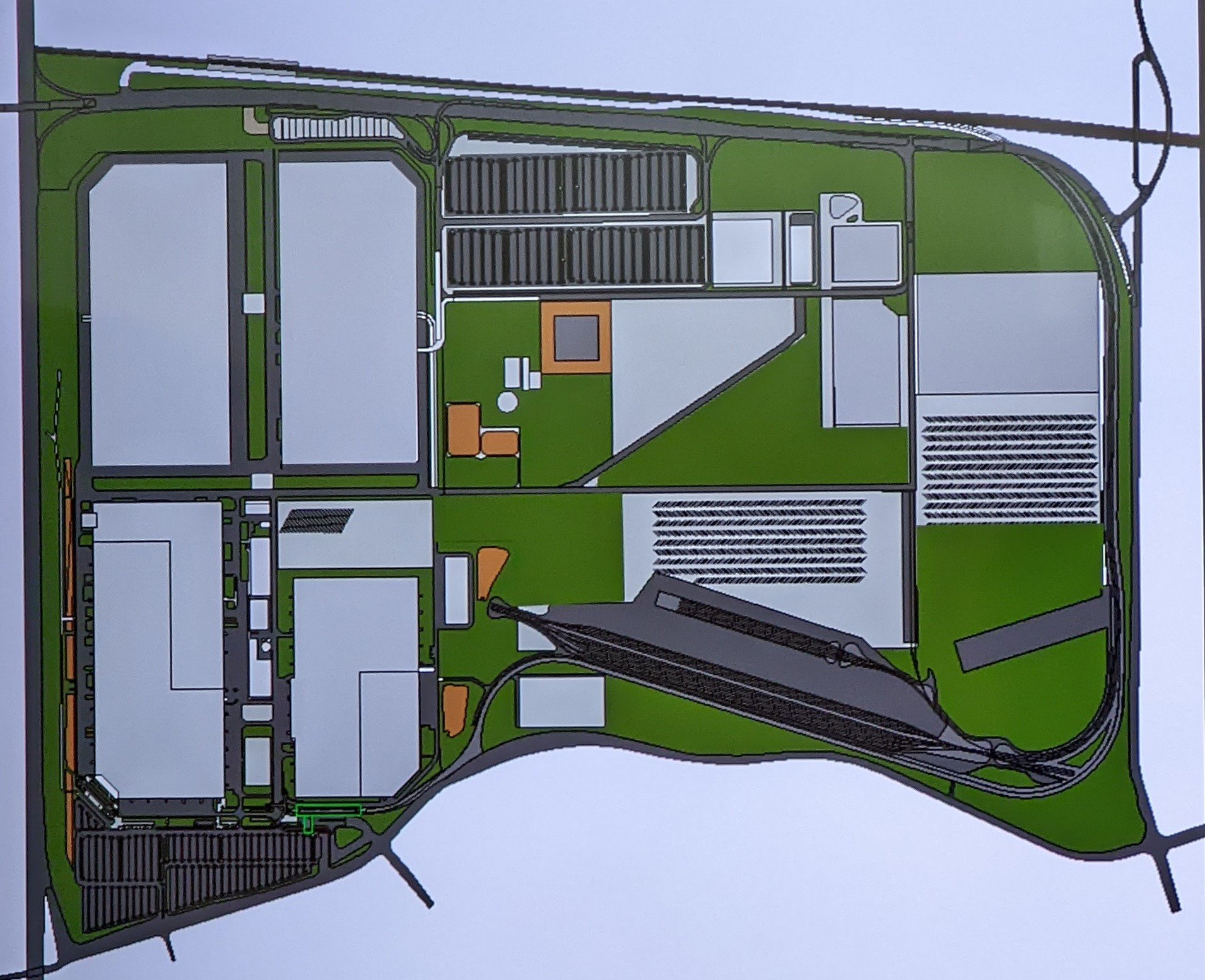

Giga Berlin can expand 100 hectar for logistics lots and other stuff. This land was not part of the initial deal and has to be re-zoned.

The right 1/3 of this map

Will take some years for all permits though.

The right 1/3 of this map

Will take some years for all permits though.

Last edited:

This should be good for Powerwall sales.Hey @bkp_duke , my fears have come true:

PSE substations attacked in November

At least six attacks at electricity substations in Washington and Oregon, including two at Puget Sound Energy substations, have been reported to the FBI in recent weeks.www.seattletimes.com

Cult Member

Born on the 4th of July

She will answer: If you made so much money, you should know that 50% are mine. We are married!After TSLA rises above $400 again, ask your wife how she is going to make that much money to match.

I think it has little plastic wheelchair wheels.Ah, incorrect. You use nickel batteries for high-performance EVs, for the same reason you would choose an iron battery for an economy EV: suitability for the task.

View attachment 882786

*Hint: Performance and high-nickel is all about the power/weight ratio. Bloat won't win.

I like it. It's cute.

MC3OZ

Active Member

Shipping form China to Thailand by rail seems possible there are 3 trains per day form Shanghai to Bangkok.

A high speed link will hopefully be completed by 2028:-

Thailand Sets 2028 Target to Finish High-Speed Rail Link with China

Putting some cars for Thailand and Singapore on a RORO destined for Australia is another obvious strategy.

There are around 4,000 orders so far in Thailand which will probably be delivered in Q1 2023.

Malaysia is probably the next cab off the rank.

Vietnam also a possible market even though Tesla would be competing with the local Vinfast EV range.

Any softening of demand in China can be partially filled by shipping cars to other locations including nearby SE Asian locations.

Model S/X Plaid are finally shipping to Europe, Australia is one location that hasn't had Model S/X deliveries for a while and I suspect there are many others.

The US IRA bill kicks in early next year.

So why all the song and dance about slightly reduced production at Shanghai for a few weeks, which may or may not be actually happening?

A high speed link will hopefully be completed by 2028:-

Thailand Sets 2028 Target to Finish High-Speed Rail Link with China

Putting some cars for Thailand and Singapore on a RORO destined for Australia is another obvious strategy.

There are around 4,000 orders so far in Thailand which will probably be delivered in Q1 2023.

Malaysia is probably the next cab off the rank.

Vietnam also a possible market even though Tesla would be competing with the local Vinfast EV range.

Any softening of demand in China can be partially filled by shipping cars to other locations including nearby SE Asian locations.

Model S/X Plaid are finally shipping to Europe, Australia is one location that hasn't had Model S/X deliveries for a while and I suspect there are many others.

The US IRA bill kicks in early next year.

So why all the song and dance about slightly reduced production at Shanghai for a few weeks, which may or may not be actually happening?

Last edited:

Elon has been ringing various alarm bells for months now, I don’t know if we need to pull in all the tweets etc but could.Is this the first time Elon has called out specifics for what are current headwinds in Q4? He is talking about MACRO conditions to be clear.

Now that he owns Twitter, Elon is likely far more aware of Macro economy given the vast bulk of twitter’s revenue is from advertising - spending on which closely follows economic activity.

He has warned about deflation coming and echoed Cathie Woods’ comments about it. He has said a looming recession could last until spring 2024, just the other day this thread was talking about his stating that interest rates need to be cut immediately. Before that he was saying they need to stop hiking, and he has talked about a dire economic situation in emails etc.

North America is far better off than most of the world right now

Tomorrow could be another fine example of the farce the stock market really is. Even if PPI comes down substantially, if it’s just 0.1% stronger than analists predict we’ll fall off a clif again. Inflation doesn’t matter, the only thing that matters is the ability of analists to throw a dart in the bullseye wearing a blindfold.

Have you sold any stock? If not you haven't lost anything...That reminds me, when I told my wife how much money we've lost in the last year, she responded with "well if you can spend that much money, I'm going to spend that much money too."

Someone save me...

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M